Oct 30

/

Lívea Coda

Sugar and Ethanol Weekly Report - 2023 10 30

Back to main blog page

"Global reliance on Center-South's sugar production, along with low stocks in key origins and weather challenges, keeps supporting the sweetener’s prices. Brazil’s sugar maximization draws strength in crystallization investments and stagnant ethanol prices. "

Ethanol prices lost correlation to the energy complex

- Bullish market sentiment and rain-related disruptions in Santos contributed to sugar prices remaining supported during the week.

- There is a consensus on Brazil's potential to supply record-high sugar volumes if weather conditions cooperate.

- Ongoing conflict in the Middle East, OPEC+ supply cuts, and reduced US strategic reserves led to a surge in crude oil prices.

- The supportive energy complex has not significantly impacted Brazil's domestic fuel market due to both the government's commitment to keeping pump prices reduced, providing stability against international volatility, and higher feedstock availability.

- Increased feedstock from cane and corn has led to an 11.5% year-on-year increase in anhydrous production, with hydrous not far behind, growing by 9% during the season, despite the max sugar behaviour.

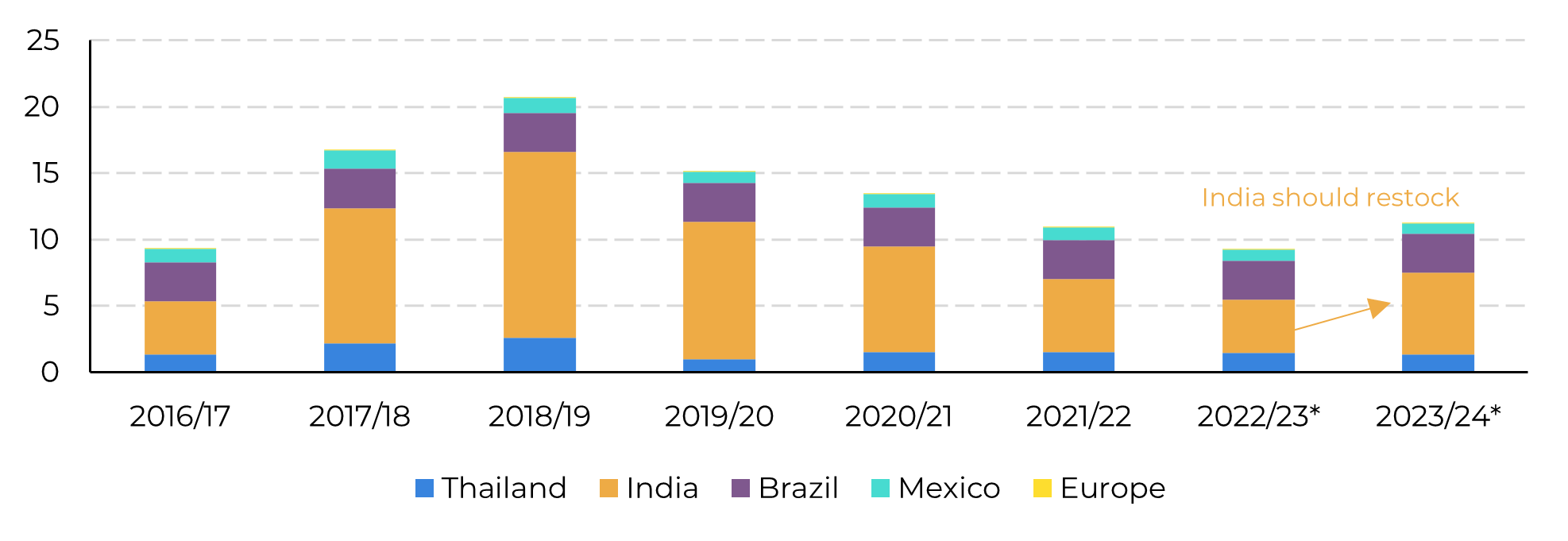

With a rather dull week, sugar prices managed to recover their losses and stay within 27-27.6 USc/lb. The bullish tone set on the sugar week was one of the reasons behind this stability – the other was probably rains disrupting port loading in Santos. Meantime, the market seems to be reaching some consensus. The notion that the world is highly dependent on Center-South’s production, especially given lower origins stocks and weather adversity, is the first one, which keeps adding further support to the sweetener. The second one would be that Brazil does indeed have the potential to continue supplying record-high volumes, of course if the weather cooperates.

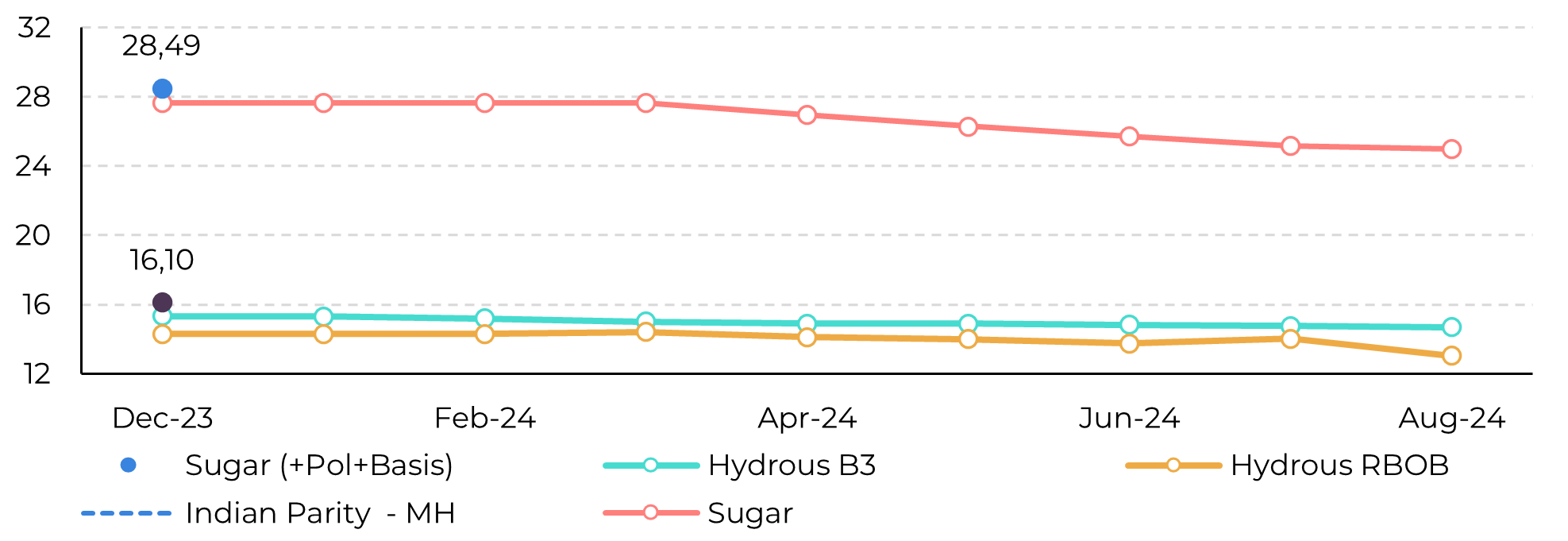

Finally, the market also agrees that Brazil should continue maximizing sugar production. As a matter of fact, many mills have invested in the crystallization process, allowing for optimistic sugar supply forecasts. On the losing side of this notion is ethanol.

Image 1: Key Origins Ending Stock

Source: hEDGEpoint

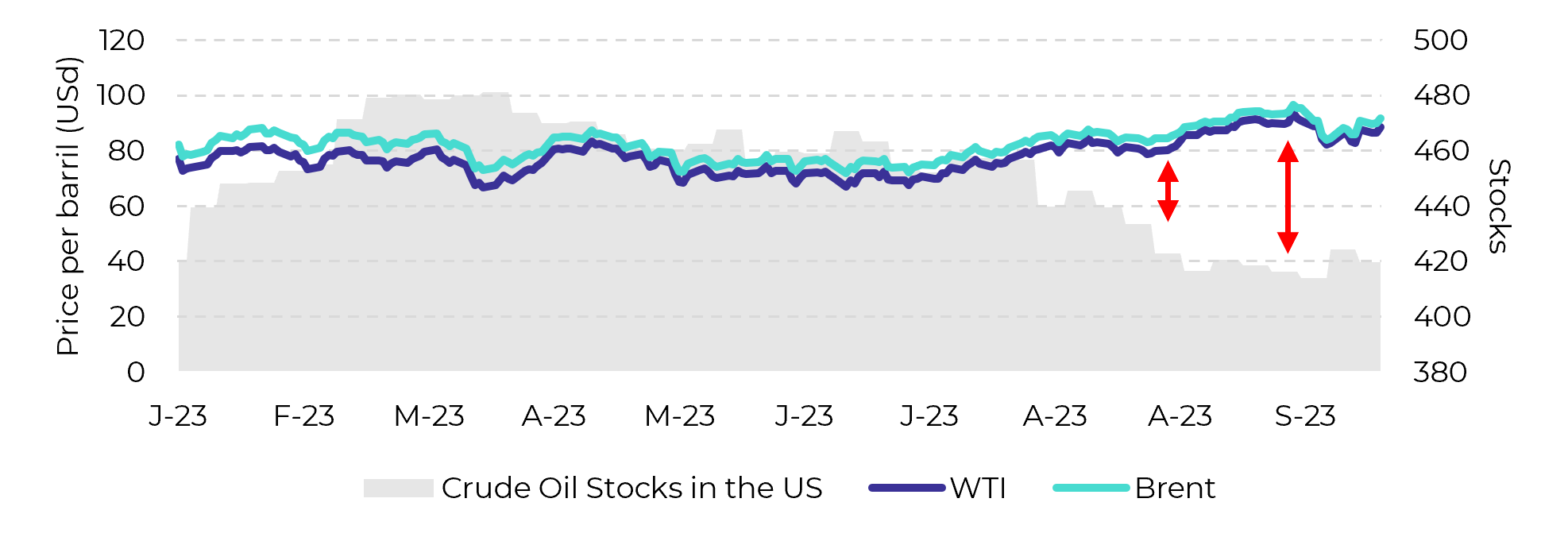

The biofuel prices continues to pay less than the sweetener and should remain doing so. Of course, the ongoing conflict between Israel and Palestine has contributed to the recent surge in the energy complex. Combined with OPEC+ strategy of cutting its supply during 2023 and a decrease in US strategic reserves, the stage was set for an uptick in crude oil and its derivatives prices.

Image 2: Impact of OPEC+ cuts on US crude oil inventories

Source: Refinitiv, hEDGEpoint

Interestingly, this global trend has not impacted the Brazilian fuel domestic market. This can be attributed to the government's commitment to reduced prices at the pump, which prevents international volatility from hitting the country abruptly.

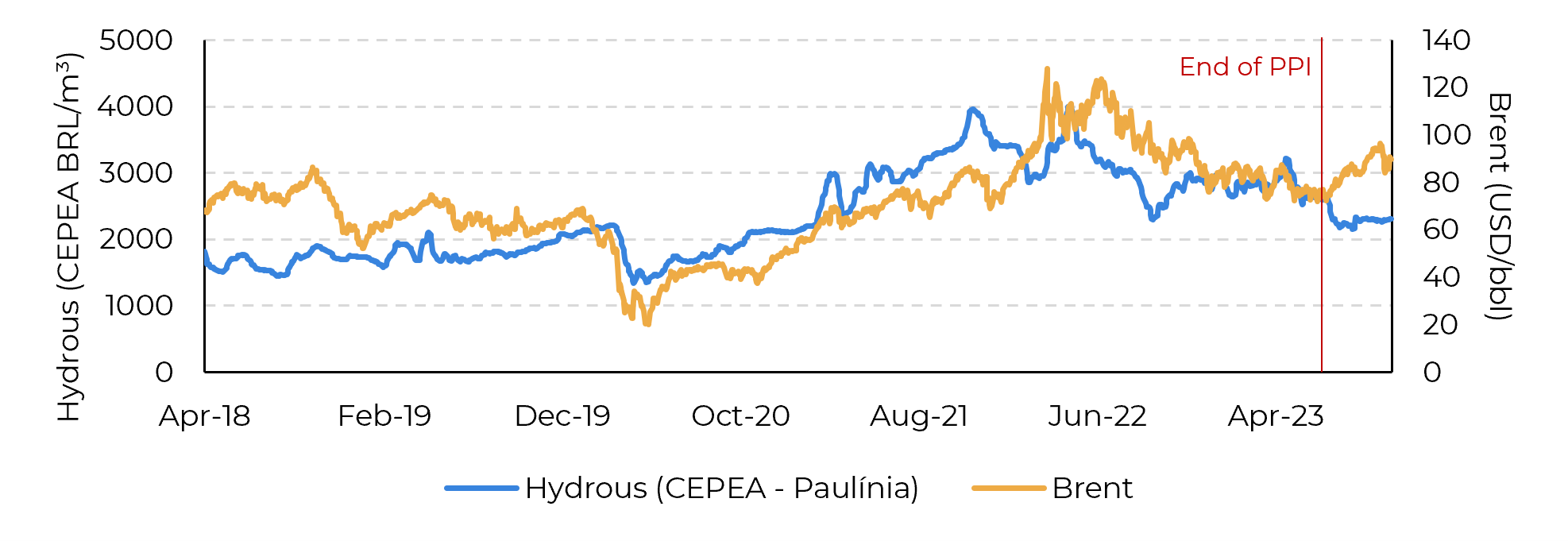

Since the announced “end of PPI” in May 2023, ethanol prices have suffered a decoupling from international oil prices, with import parity closed for most of the period. Note that the correlation between crude oil and hydrous between January 2020 and May 2023 was 80%, while from May 2023 to this date, the relationship has not only decreased but reversed, reaching -67%.

Image 3: End of PPI and the correlation break between hydrous and oil benchmarks

Source: Bloomberg, hEDGEpoint

Therefore, even though it may react to the volatility added by the Middle East conflict, the biofuel should not surpass the sweetener. Another reason for that is the oil spillover effect that triggers an upward trend across the entire commodity board by directly affecting their production chains. Sugar is no different and, added to the availability shortage, the energy complex offers additional support to its price.

Image 4: Sugar and Ethanol Parity (USc/lb)

Source: Bloomberg, hEDGEpoint

Mind that ethanol prices are also not reacting to higher fuel demand: availability is not an issue. Although mills are maximizing sugar, ethanol production is thriving. Increase in both feedstock, cane and corn, allowed for a 11.5% Y/Y increase in anhydrous production so far, with hydrous not far behind, growing 9% during the crop. This higher volume is responsible for keeping stocks stable even with a 5.6% increase in Center South’s Otto Cycle, not giving prices any reason to react.

In Summary

Sugar prices stabilized at 27-27.6 Usc/lb. Global reliance on Center-South's sugar production, along with low stocks in key origins and weather challenges, keeps supporting the sweetener’s prices. Brazil’s sugar maximization draws strength in crystallization investments and stagnant ethanol prices.

Brazil's fuel market remained stable despite recent global crude oil surges, thanks to the government's commitment to lower prices and ample stocks.

Weekly Report — Sugar

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.