Nov 6

/

Lívea Coda

Sugar and Ethanol Weekly Report - 2023 11 06

Back to main blog page

"The Brazilian CS is the main bearish force. However, its influence remains limited until the expiration of the March contract, which generally reflects availability in the Northern Hemisphere. This year, all evidence points to shortages in the region. There is a bullish trend gaining momentum for this contract."

November is finally here

- Northern Hemisphere's crop prospects for the upcoming season are being closely monitored; forecasts have been updated by some agencies.

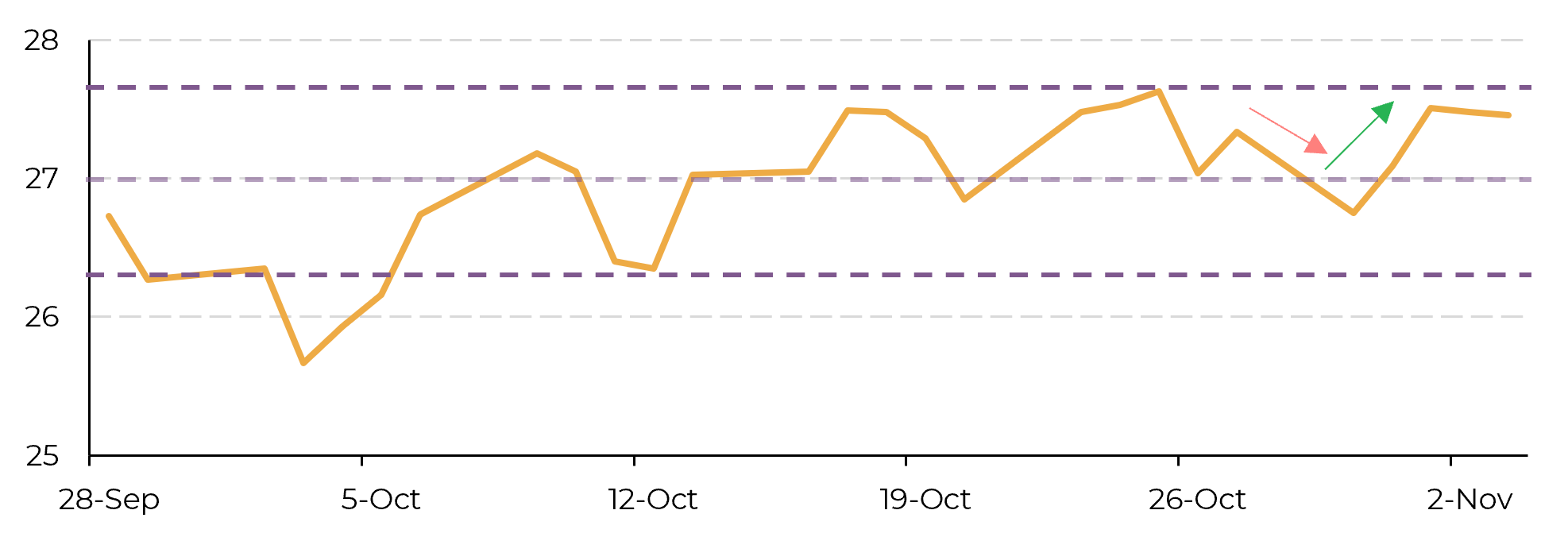

- Raw sugar prices experienced fluctuations but rebounded to above 27.5 USc/lb following ISMA's estimate of 33.7Mt for India's 23/24 crop, indicating a decline from the previous season.

- India could produce around 30Mt of sugar even after considering ethanol diversion, suggesting a positive balance between production and consumption in 23/24.

- Thailand's sugar production is expected to reduce to 7-8Mt in 23/24, leading to concerns about the country's participation in the global market.

- This shortage is not yet entirely felt by the destinations, as Brazil remains quite strong and trading at a discount, forcing a cap over price surges.

With the beginning of November, the Northern Hemisphere’s crop prospects become a little more tangible. Although no realized crushing reports have been released so far, some agencies updated their forecasts for the season.

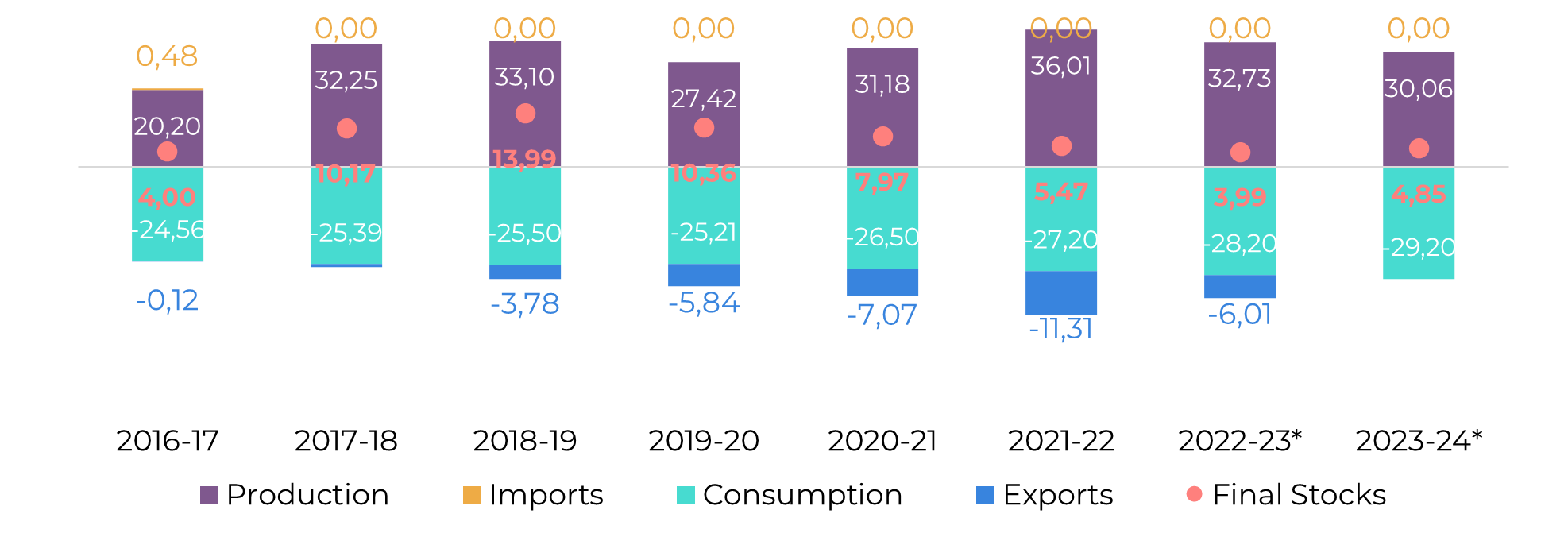

Raw sugar prices started the week correcting only to bounce back to above 27.5 USc/lb on Wednesday, following ISMA estimates of 33.7Mt for the 23/24 crop, a sharp decline compared to 22/23’s 36.6Mt. After considering about 3.5Mt ethanol diversion – given that a short crush window may jeopardize the country’s ability to produce the biofuel – India would still be able to produce around 30Mt of the sweetener.

Image 1: Raw sugar prices bounced back (USc/lb)

Source: Refinitiv, hEDGEpoint

Therefore, we agree with the agency that one should expect a positive balance between production and consumption in 23/24, possibly leading to a stock-building movement as the government is set to prioritize domestic prices. As a result, India’s production update offered no change to our trade flows figures, as no exports were already expected.

Image 2: India’s Sugar Balance (Mt Oct-Sep)

Source: ISMA, AISTA, hEDGEpoint

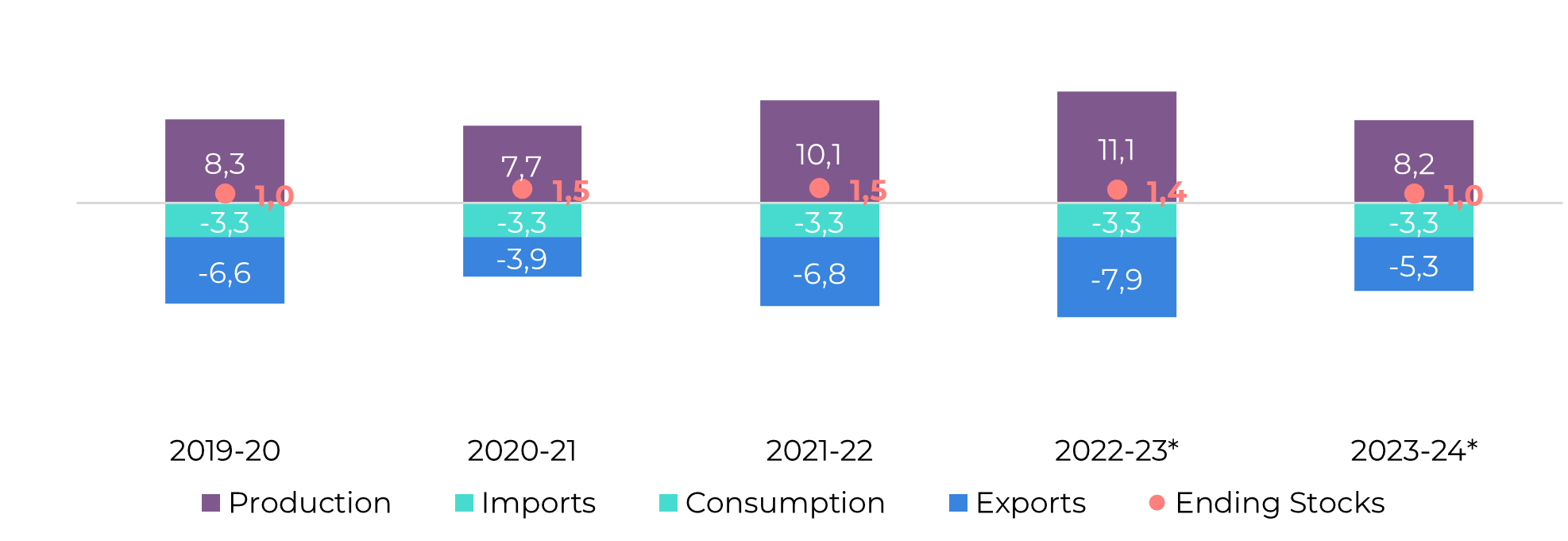

Simultaneously, Thai Sugar Millers Corp. also released a statement regarding Thailand’s 23/24 crop situation and forecasts. According to the agency, the sweetener production is set to reduce to 7-8Mt, or a drop of over 25%, impacting the country's participation in the global market. As discussed in previous reports, we expect Thailand to produce 8.1Mt and export only 5.1Mt, compared to the expected 7.9Mt in 22/23 (Dec-Nov).

However, the bullish developments from Thailand were not limited to that. The recent government decision, made last Tuesday, to categorize sugar as a controlled commodity will significantly affect the sector. Like other controlled goods, this classification implies that any changes in retail prices (or export volumes) will require approval from a regulatory panel. While the authorities' goal is to ensure domestic sugar supplies and manage inflation, millers are apprehensive that this could result in delays when fulfilling delivery contracts.

Image 3: Thailand Sugar Balance (Mt Dec-Nov)

Source: The Tai Tapioca Trade Association, Thai Sugar Millers, Sugarzone, OCSB, hEDGEpoint

These events contribute to a well-known trend: market tightness. But mind, this shortage is not yet entirely felt by the destinations, as Brazil remains quite strong and trading at a discount, forcing a cap over price surges.

The lack of Northern Hemisphere product will be especially felt during Brazil’s offseason. Of course, with more cane, Center-South will be able to provide more than usual, but rains are set to get in the way – as usual. Between November and February, the lost days tend to increase from approximately from 1 during winter to more than 3 days. Combining rains with worn cane, it becomes difficult for mills to maintain a max sugar mix. Still, the region will keep producing as much of the sweetener as possible given price disparity.

Therefore, Q1/24 is when we can expect destinations to start feeling the shortage. But mind, the market’s consensus is that, in the absence of any intense climate event, Brazil is set for another good year in 24/25, making Q1/24 and Q2/24 the only window for the bulls to play.

Therefore, Q1/24 is when we can expect destinations to start feeling the shortage. But mind, the market’s consensus is that, in the absence of any intense climate event, Brazil is set for another good year in 24/25, making Q1/24 and Q2/24 the only window for the bulls to play.

Image 4: Global trade flows (‘000t tq)

Source: Green Pool, hEDGEpoint

In Summary

The Brazilian CS is the main bearish force. However, its influence remains limited until the expiration of the March contract, which generally reflects availability in the Northern Hemisphere. This year, all evidence points to shortages in the region. There is a bullish trend gaining momentum for this contract.

Weekly Report — Sugar

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Pedro Schicchi

pedro.schicchi@hedgepointglobal.com

pedro.schicchi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.