Nov 13

/

Lívea Coda

Sugar and Ethanol Weekly Report - 2023 11 13

Back to main blog page

"Brazil is back in the game, with yields above the recent history average, area expansion, and investments in crystallization. Of course, that infrastructure might impose some restraints, but its difficult to imagine that the sector would let the opportunity slide, especially considering the recent price disparity between the sweetener and ethanol. "

Brazil is back in the game!

- Touching the 28c/lb level, raw sugar took advantage of the recent shift in macro sentiment and port congestions in Brazil.

- The sugar market is getting more and more dependent on Brazil, the good news is that the country is expected to keep pushing and reaching excellent results.

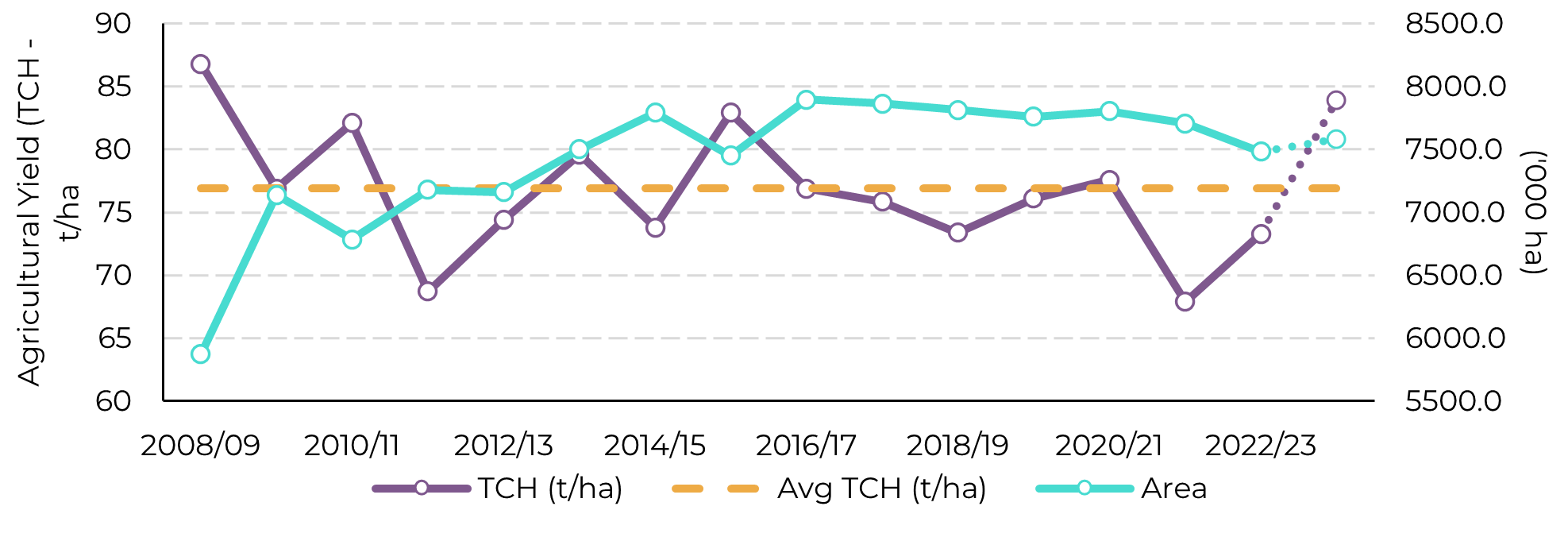

- Cane yields during 23/24 are the main reason behind the region’s excellent results. It breached the recent-history average moving close to 08/09 levels.

- The price disparity between the sweetener and ethanol – currently at 13USc/lb or over 290 USD/t – also endorses mills’ decision and creates incentive for investment in both crystallization and infrastructure.

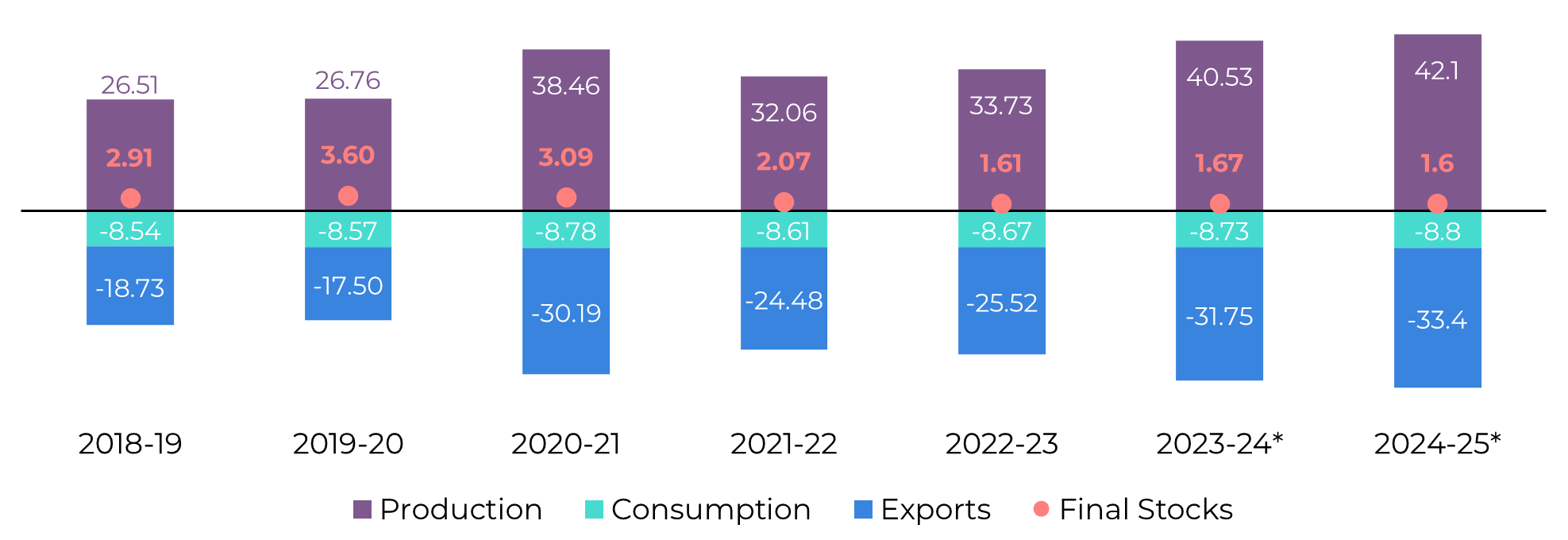

- For 24/25, market consensus suggests excellent results in Center-South, our preliminary view accounts for a production exceeding 42Mt and exports close to 33.5Mt. But there is still a lot to unravel.

The sugar market availability is getting more and more dependent on Brazil, the good news is that the country is expected to keep pushing and reaching excellent results. But before we delve into Brazil numbers and expectations, it is important to discuss last week’s price movements.

The week started with sugar prices reaching 12-years highs, supported by disruptions in Center-South’s (CS) exports caused by port congestion and rainfall. However, Brazil is still trading at a discount – close to flat prices – meaning that origins are not yet fully under the Northern Hemisphere tightness influence. Of course, as we approach Brazil’s summer, and thus, the time of the year when mills are forced to reduce their rhythm and cane becomes scarcer, prices might find further support.

Image 1: Sugar took advantage of both internal and external market support

Source: Refinitiv, hEDGEpoint

Touching the 28c/lb level, raw sugar also took advantage of the recent shift in macro sentiment. The dovish speech made by Powell after Fed’s decision to keep interest rate stable offered further support to the commodity, as it induced a sharp correction in the dollar index. Even with this framework, sugar was unable to sustain its gains, correcting back to 27.2c/lb on Friday.

It was, therefore, a volatile week, and CS remains one of the hottest and bearish topics.

Cane yields during 23/24 are the main reason behind the region’s excellent results. It breached the recent-history average moving close to 08/09 levels. Not only that but area is also expected to recover. Nevertheless, these are well-explored topics, that, together with an excellent cane quality so far – despite closer-to-average precipitation – allow Brazil to be the biggest bearish force in the market.

Cane yields during 23/24 are the main reason behind the region’s excellent results. It breached the recent-history average moving close to 08/09 levels. Not only that but area is also expected to recover. Nevertheless, these are well-explored topics, that, together with an excellent cane quality so far – despite closer-to-average precipitation – allow Brazil to be the biggest bearish force in the market.

Image 2: Brazil is the strongest bearish force: yields are set to moved back above average

Source: UNICA, Conab, hEDGEpoint

Of course, price volatility this week is tight to the country’s ability to ship the sweetener. Port congestion is reported to be up, and cash premium is starting to react, but this doesn’t mean that Brazil doesn’t have products, on the contrary, sugar is waiting to reach the international market. Therefore, the country is expected to postpone the start of Northern Hemisphere tightness effects, by supplying more than 30Mt of exports during 23/24.

The recent rains are known to already be beneficial to the next sugar crop. So far, prospects seem to be in the region’s favor. Even if we assume that there will be some retraction in the TCH, positive weather can work two ways this time: it can boost cane development and induce a higher volume to be left on the field, adding to next year’s cane prospects.

Image 3: Brazilian CS Sugar Balance (Mt tq)

Source: UNICA, SECEX, Williams, MAPA, hEDGEpoint

The price disparity between the sweetener and ethanol – currently at 13USc/lb or over 290 USD/t – also endorses mills’ decision. Not only sugar is expected to remain the more profitable alternative, but 23/24 results induced crystallization capacity investments while it made explicit the need to invest in infrastructure – and the sector won’t let this opportunity slide.

For 24/25, although there is still a lot to unravel, market consensus seems to dwell on excellent results. So far, we expect Center South to be able to produce more than 42Mt and export close to 33.5Mt. This means that a strong bullish trend might be short-lived, especially if El Niño’s impact on the Northern Hemisphere remains restricted to the 23/24 crop season. However, we must remain cautious as global demand is set to continue its expansion path and, any adverse climate might still drive the market to a deficit.

Image 4: Global trade flows (‘000t tq)

Source: Green Pool, hEDGEpoint

In Summary

Brazil is back in the game, with yields above the recent history average, area expansion, and investments in crystallization. Of course, that infrastructure might impose some restraints, but its difficult to imagine that the sector would let the opportunity slide, especially considering the recent price disparity between the sweetener and ethanol. We can expect that given favorable cane development; Brazil is set to maximize its participation in the international market also in 24/25.

Weekly Report — Sugar

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.