Nov 20

/

Lívea Coda

Sugar and Ethanol Weekly Report - 2023 11 20

Back to main blog page

"Between macro developments and white's delivery, raw sugar prices didn’t show much of a change during the week. The idea that sugar might start flowing a little bit faster to the international market opposed to the macroeconomic sentiment shift enabled the recent stability seen in raw prices."

Dry weather, shipping improvements

- Last week, the main highlight was the delivery of white sugar, with the December contract reaching its highest settlement in over 12 years at 746.6 USd/t

- Raw sugar showed weakness despite a substantial 1.5% decline in the Dollar Index.

- Weather improvements in Center-South and the International Sugar Organization global sugar deficit revision may explain why sugar did not respond positively to macro events.

- Port congestion and mill crushing were affected by a rainier-than-average October, but November shows signs of improvement.

- Dry weather is expected to persist, indicating a potential improvement in shipping pace

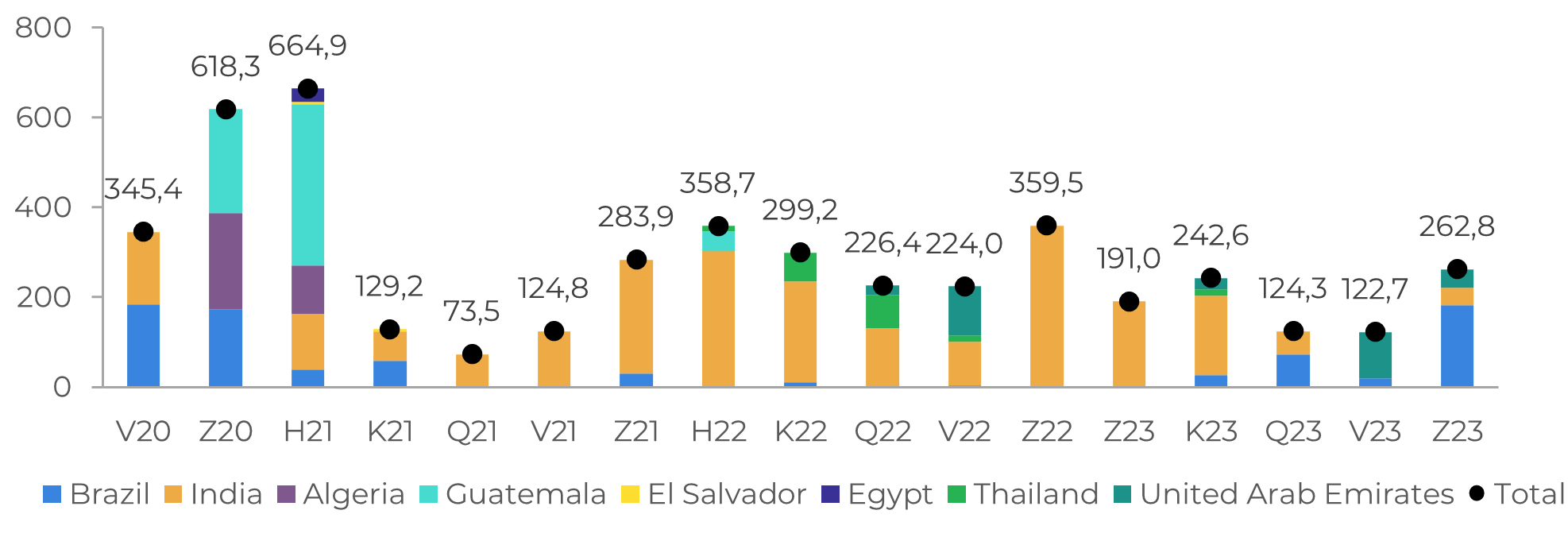

Last week’s main event was the white’s delivery. Expiring on Wednesday, the December contract ended at its highest settlement in over 12 years, at 746.6 USd/t. The Z/H spread suffered volatility during its last session before settling at a 12 Usd/t inverse. Nearly 263kt were delivered, below 2022’s 360kt. Brazil was the main deliverer, followed by India and United Arab Emirates’ tolling volume. The latter indicates that current white premium level – about 140 USd/t – might be enough incentive for coastline refineries in the short term, at least while Brazil is pumping sugar into the international market.

Image 1: White sugar delivery (‘000t)

Source: ICE, hEDGEpoint

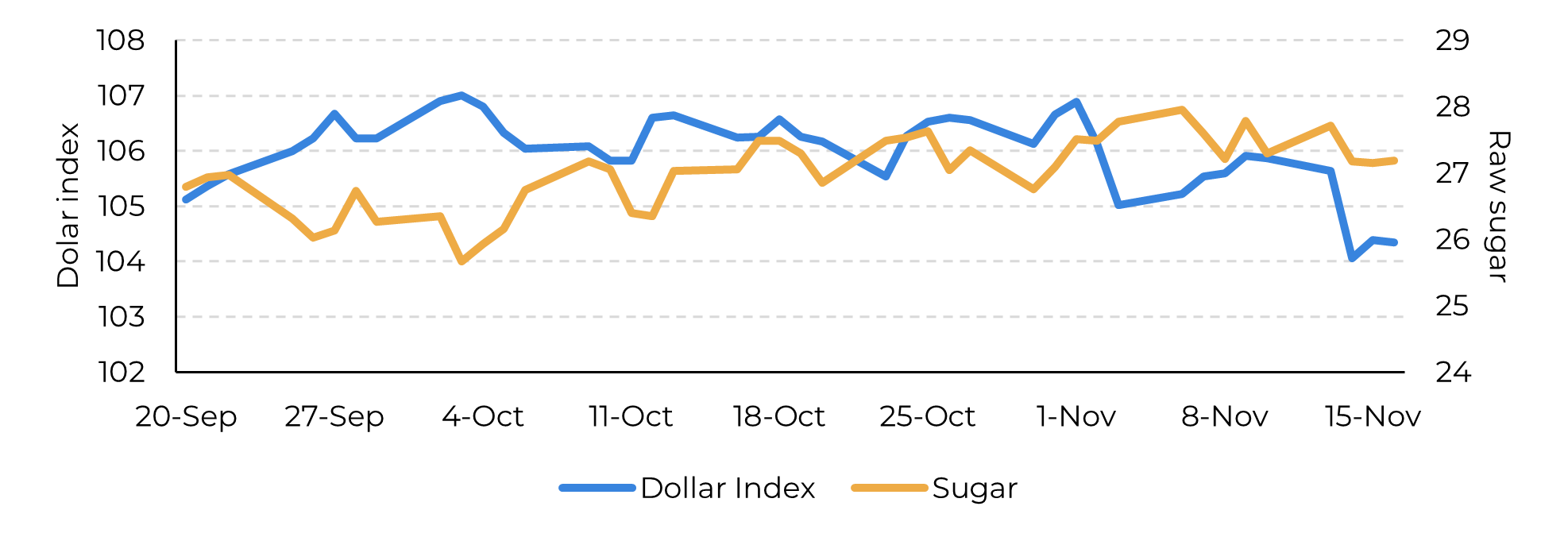

Talking about raws, the week was marked by a certain weakness. While the Dollar Index experienced a substantial 1.5% decline, triggered by investors' selloffs in response to a more subdued than anticipated US inflation rate for October, the sweetener failed to register gains.

Image 2: Sugar failed to register gains amid macro sentiment shift

Source: hEDGEpoint, Refinitiv

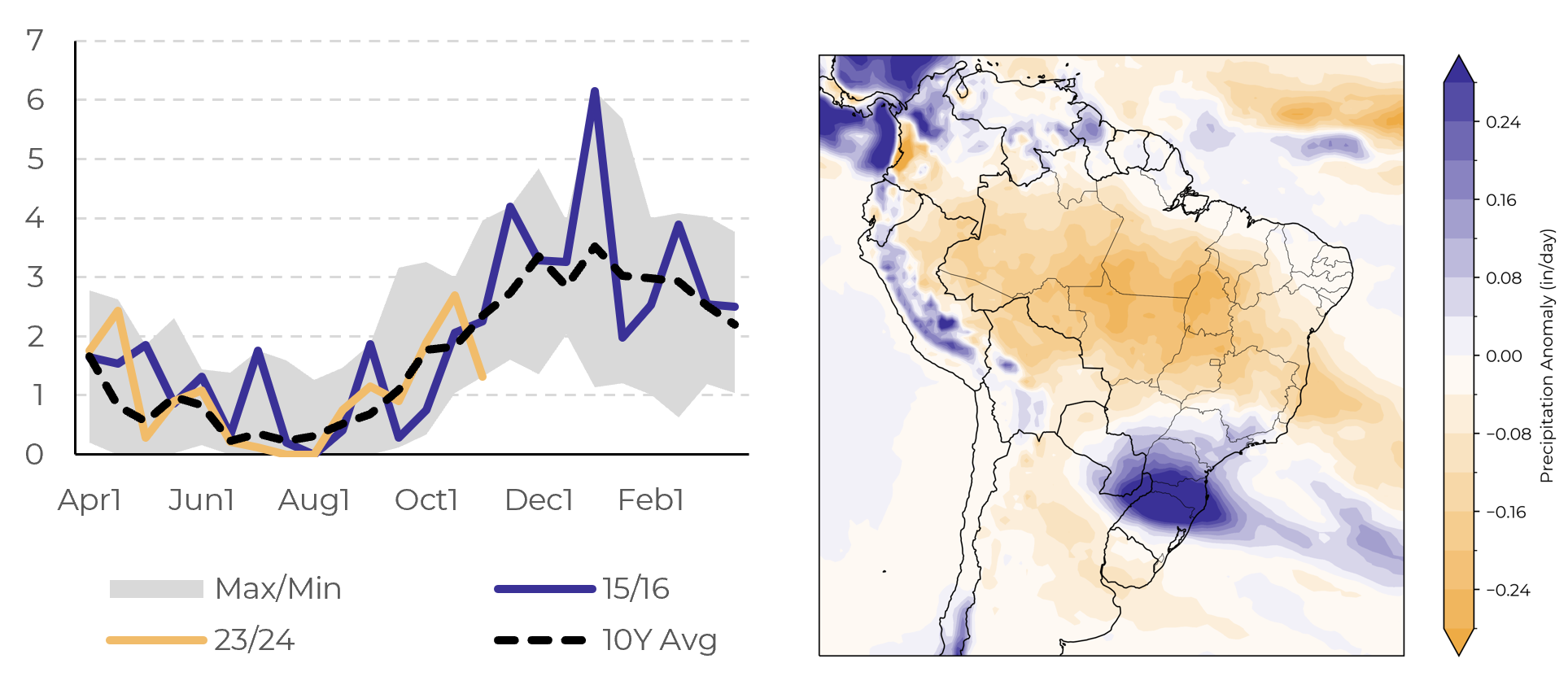

Besides the International Sugar Organization significantly lowering its global sugar deficit projection for 2023/24 to 0.33Mt, down from the previous estimate of 2.11Mt, weather forecast improvement in Center-South might be one of the main reasons why sugar failed to respond to macro events.

Port congestion and mills’ crushing pace were penalized by a rainier-than-average October. However, November is showing improvements. In terms of lost days, November’s first fortnight registered a sharp decline, finishing below the 10-year average, at about 1.3 days. Weather forecasts show that this dryness is expected to linger, despite some rains predicted for this week. Although we might still see some repercussions from previous disruptions in loading operations, we can expect some improvement in the shipping pace.

Image 3: Lost days estimate per fortnight (No. days)/left and lost days estimate per fortnight (No. days)/right

Source: Bloomberg, NOAA, hEDGEpoint

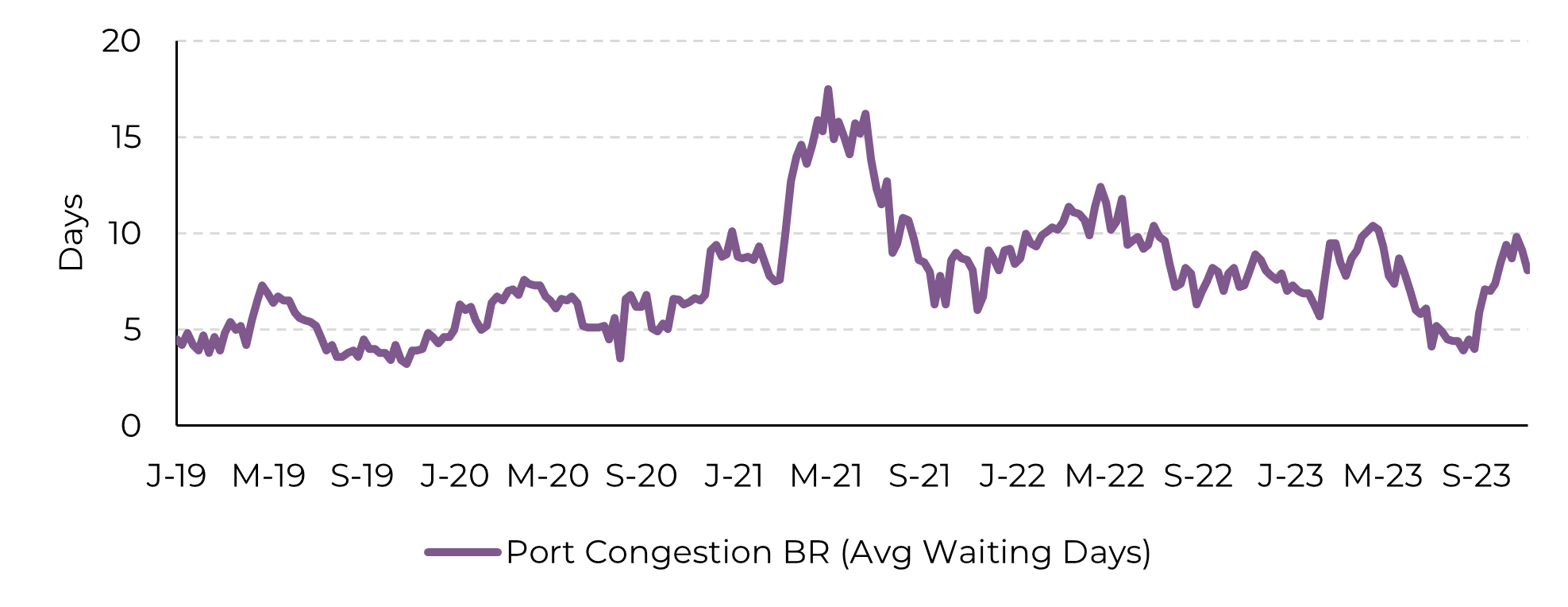

As a matter of fact, Refinitiv Port Congestion Index for Brazil already shows a fastest loading pace with a monthly reduction of nearly 14% or a drop of 1.3 days.

This dryness is somewhat welcome strictly thinking about sugar trade flows. However, if long-lived, it might start to raise concerns over 24/25 crop development conditions, making it extremely important to watch it closely.

Image 4: Port congestion is starting to correct

Source: Refinitiv, hEDGEpoint

In Summary

Brazil is back in the game, with yields above the recent history average, area expansion, and investments in crystallization. Of course, that infrastructure might impose some restraints, but its difficult to imagine that the sector would let the opportunity slide, especially considering the recent price disparity between the sweetener and ethanol. We can expect that given favorable cane development; Brazil is set to maximize its participation in the international market also in 24/25.

Weekly Report — Sugar

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.