Sugar and Ethanol Weekly Report - 2023 12 04

Where is the deficit?

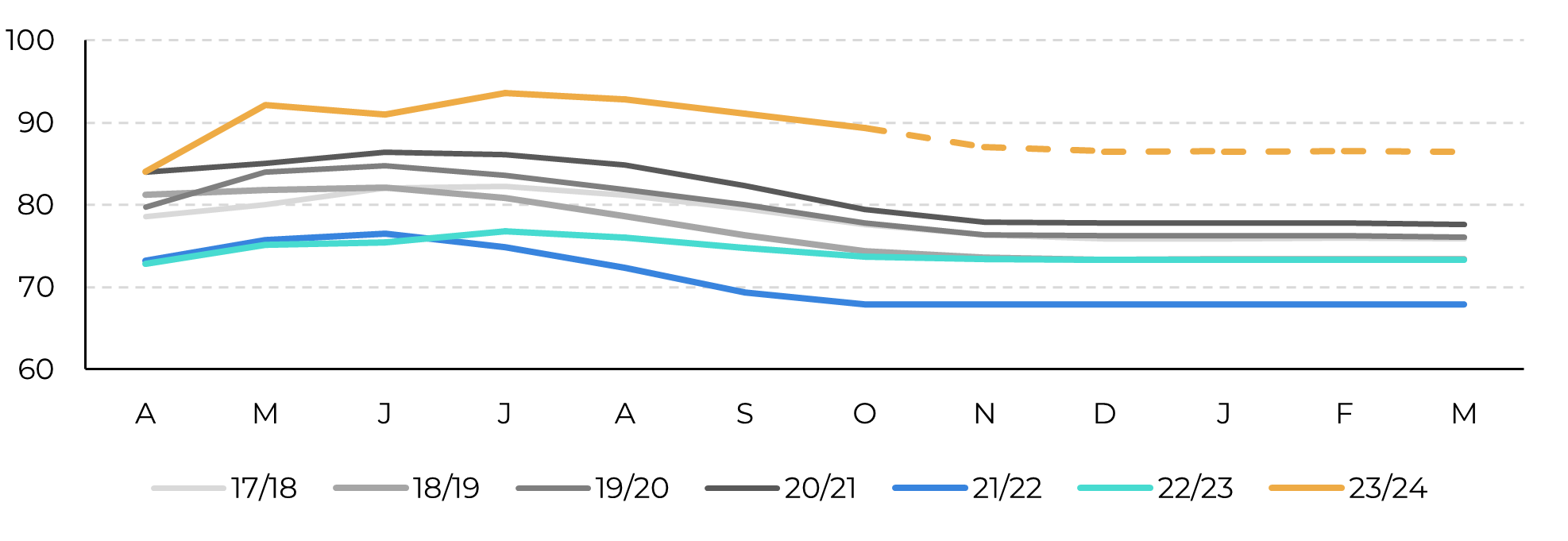

- Driven by cumulative cane yields above 89t/ha in October, we revised total cane availability from Center-South to 655Mt.

- Despite potential challenges from the weather, the region is anticipated to crush around 645Mt by March’s end, leaving 10Mt on the field.

- Center South could produce 41.6Mt of sugar, exceeding previous estimates by 1.1Mt. The higher cane availability this season sets a positive tone for 24/25, with the potential for sugar production to surpass 43Mt if weather conditions cooperate.

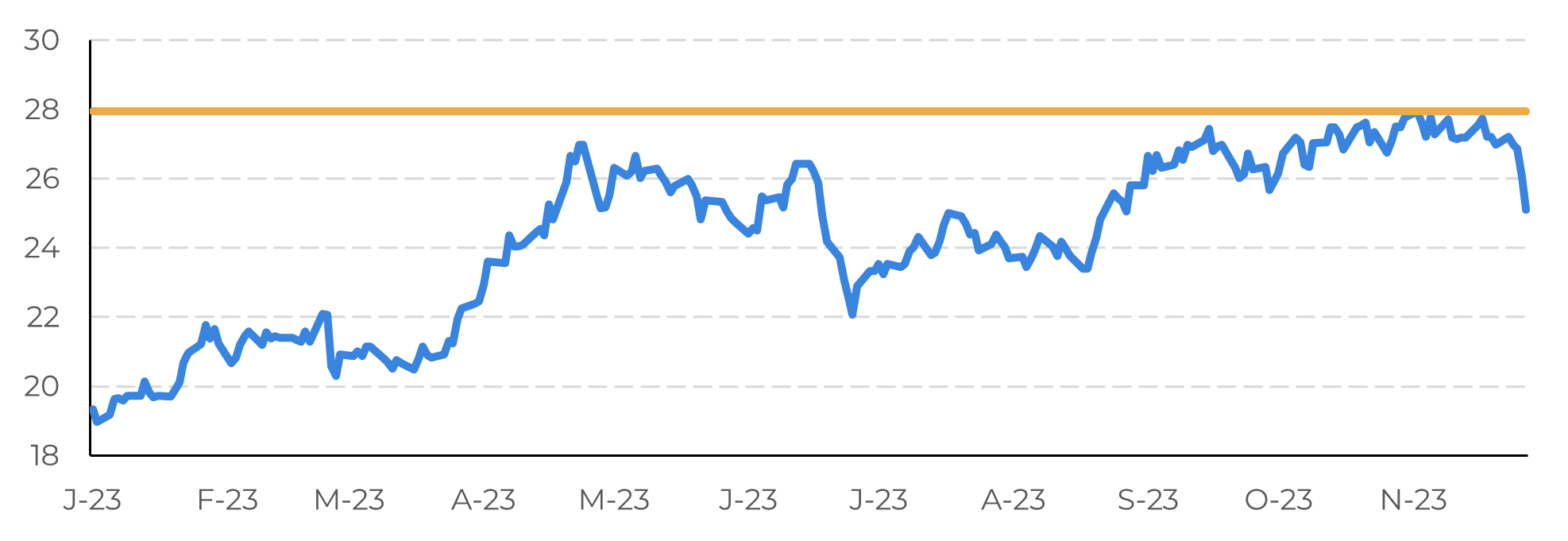

- The positive results in sugar production help mitigate the predicted deficit, keeping its prices below 28c/lb. While the sweetener’s exports from Brazil are expected to improve with favorable weather conditions, the biofuel market, particularly ethanol, faces a bearish trend with a nearly 25% correction in prices since the beginning of the crop.

The latest Unica report brought to light a much higher cane availability than previously anticipated for Center South. With cumulative cane yields above 89t/ha in October, the total raw material can be estimated as high as 655Mt – or even more! The only thing on the millers’ way is the weather: as the region approaches summer, precipitation becomes abundant. Accounting for another two or three good-paced fortnights, the region is set to crush around 645Mt by March’s end.

Image 1: Cumulative Cane Yields Estimate (t/ha)

Source: UNICA, Conab, hEDGEpoint

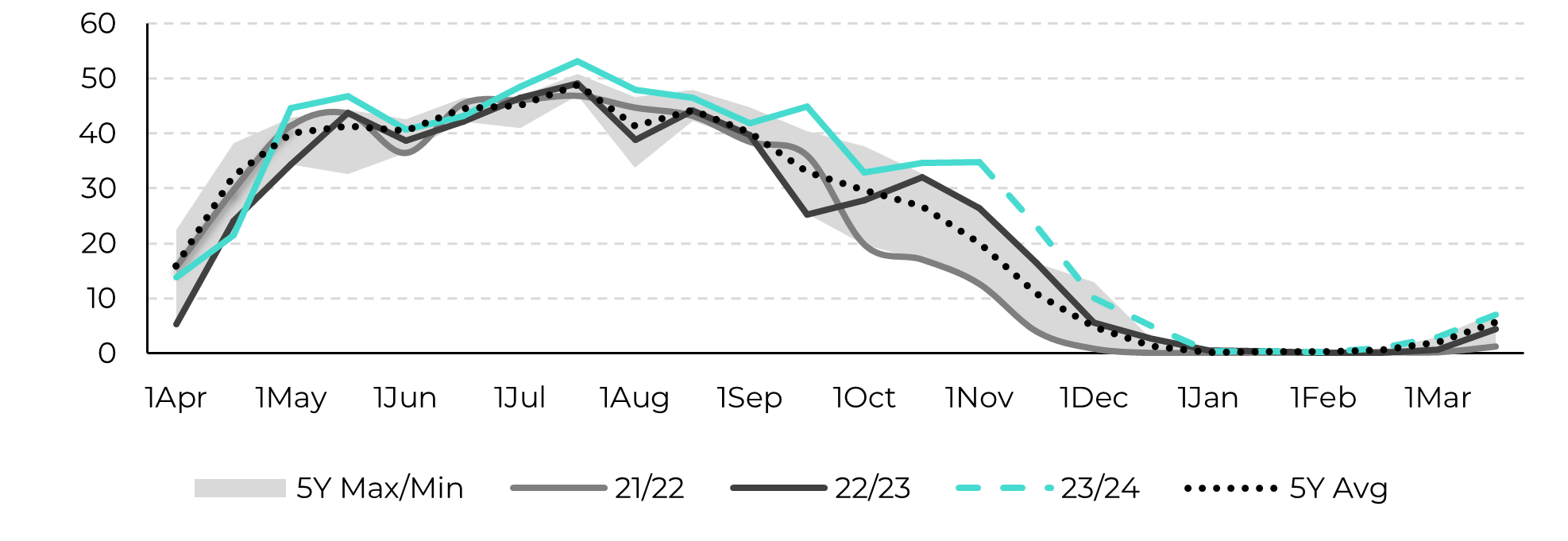

Image 2: Crushing Estimates Per Fortnight (Mt)

Source: UNICA, hEDGEpoint

Having higher cane availability this season and leaving at least 10Mt on the field adds to 24/25 prospects. If weather cooperates, next year could be a re-run, and sugar might be on the verge of a bearish momentum build-up: with increased crystallization capacity, next year’s sweetener production can surpass 43Mt.

This excellent result smooths out a great part of the predicted deficit, leaving some for Q1/24 only. Therefore, it is no wonder that sugar prices have failed to breach important resistance levels, remaining below 28c/lb.

Image 3: Raw Sugar Resistance Level

Source: Refinitiv, hEDGEpoint

The lower availability from the Northern Hemisphere is given, as is this major sugar crop from Brazil. The only question that remains is if the latter will be able to ship the sweetener out to smooth trade flows. Sugar is not competing with other products currently, but with weather. November lost days already improved compared to October, and December is expected to be even more positive. This means that exports should pick up and waiting days reduce.

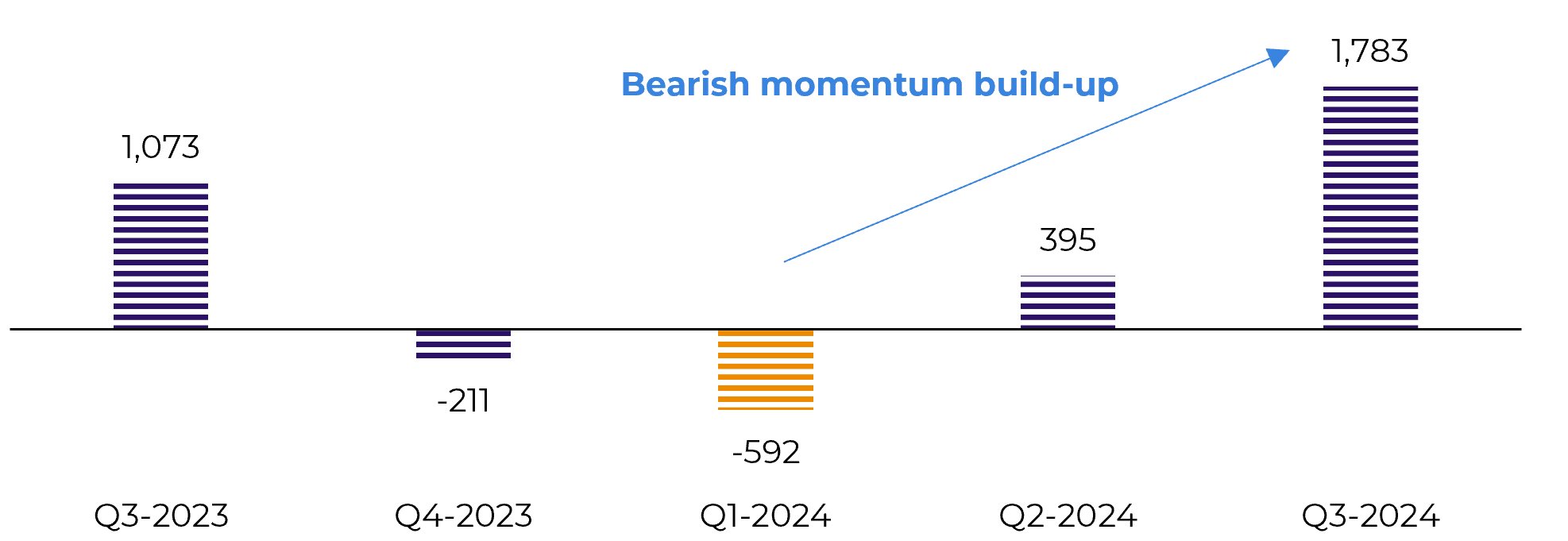

Bearisher than sugar, however, is the biofuel market.

Image 4: Total Trade Flows (‘000t)

Source: Green Pool, hEDGEpoint

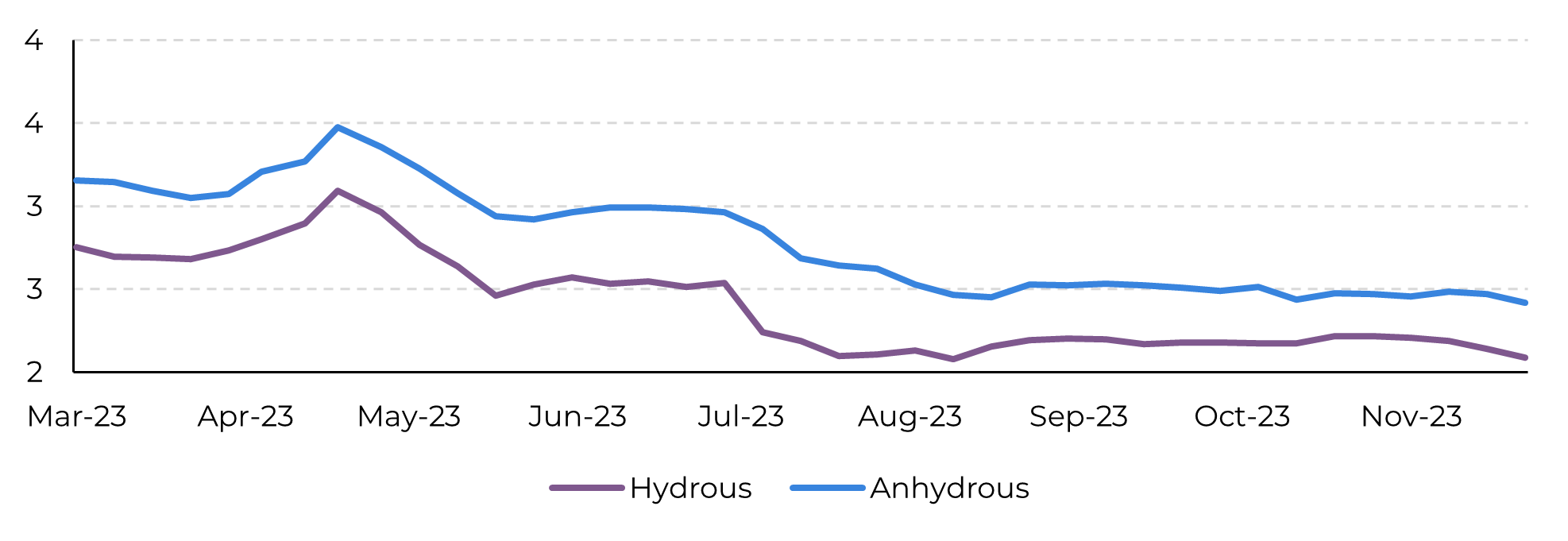

Higher raw material and diminishing sugar mix at the end of the crop, when not met by demand, are the perfect combination for a price meltdown. While both qualities, hydrous and anhydrous, have thrived in terms of production, domestic sales have not kept up. Total output varied by 12.5% and 8.7% respectively. Meanwhile, total sales rose only 5.5% and 2.7%, inducing stockpiling in both hydrous and anhydrous markets.

As a result, CEPEA’s price index shows a correction of nearly 25% since the beginning of the crop for both qualities – and this trend is not expected to be short-lived. The only way prices could react would be if demand were to rise for the challenge. However, even with the holidays approaching, it is difficult to phantom stocks dropping below average. In this sense, ethanol couldn’t be less of a threat to sugar, even with its market turning more bearish.

Image 5: SCEPEA Weekly Index for Anhydrous and Hydrous (BRL/L)

Source: CEPEA, Refinitiv, hEDGEpoint

In Summary

The sugar market seems to be approaching an inflection point: bullish fundamentals are making way for a more bearish view. Of course, Brazil’s export capacity remains the biggest source of volatility as it is highly linked to coming rains.

Currently, the sweetener is not competing with other products for a place in berth, but weather. If December is drier, helping waiting time reduce, we could see some corrections to the sweetener prices, especially if the weather turns out to be favorable for the 24/25 crop development. All in all, breaching the 30c/lb seems to be getting more difficult by the day.

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.