Sugar and Ethanol Weekly Report - 2023 12 11

Market collapsed and fundamentals are to blame

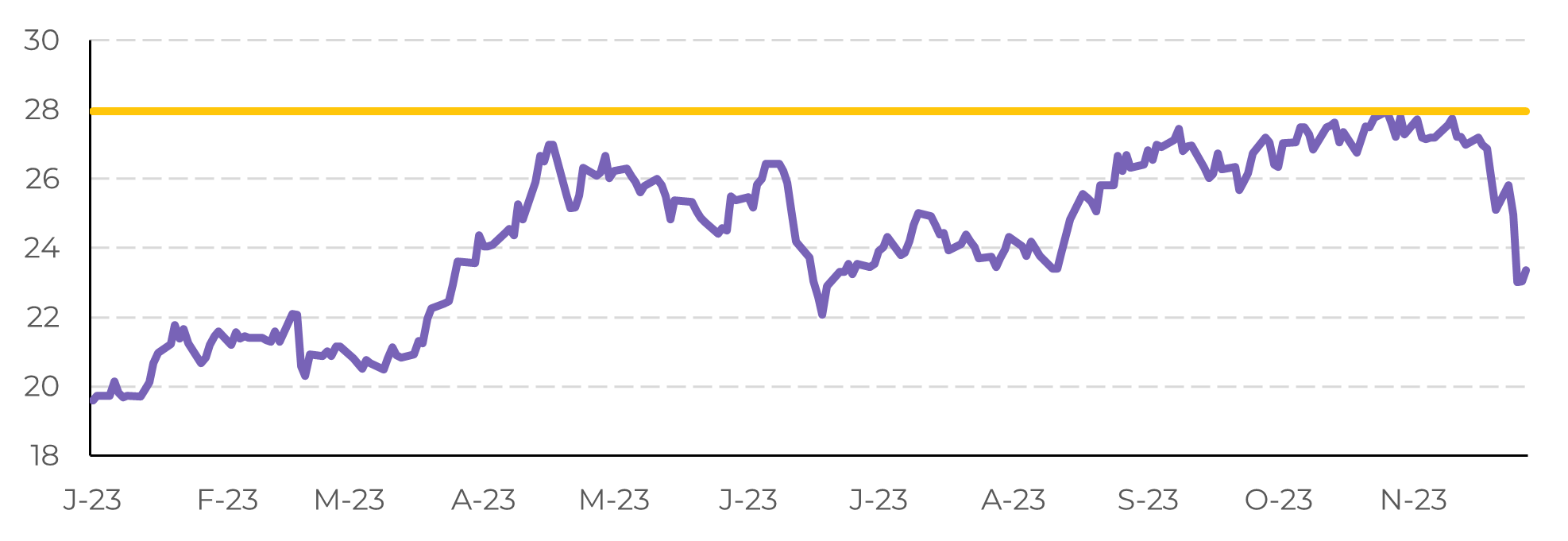

- The market has corrected significantly following oil prices and fundamentals, making its current floor uncertain: at what level will it find support?

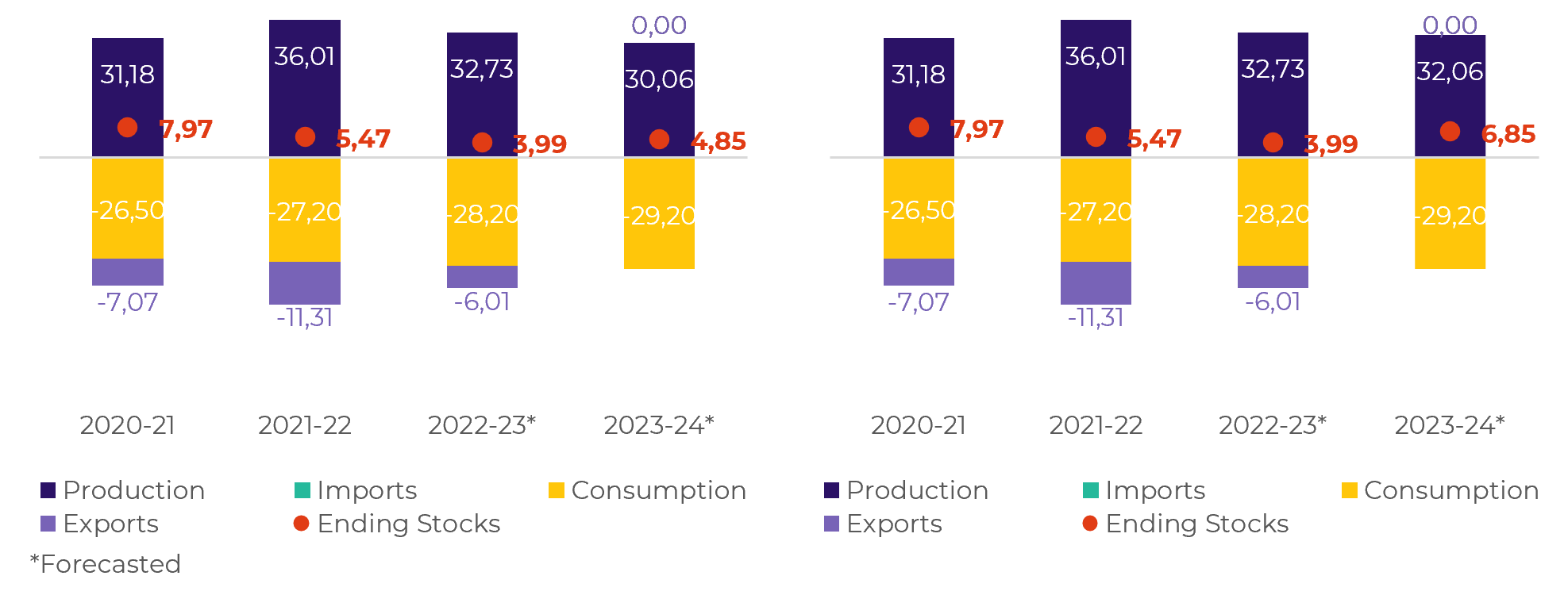

- Brazilian crop updates set a bearish tone for sugar fundamentals. The news that India will prioritize sugar production over ethanol blending further contributed to market bearishness. Proposed measures include restricting the use of sugar cane juice and B-heavy molasses for ethanol, allowing only the use of C-heavy molasses with lower sucrose content.

- The changes in India's sugar production strategy may not significantly affect trade flows, but they could eliminate the global balance deficit.

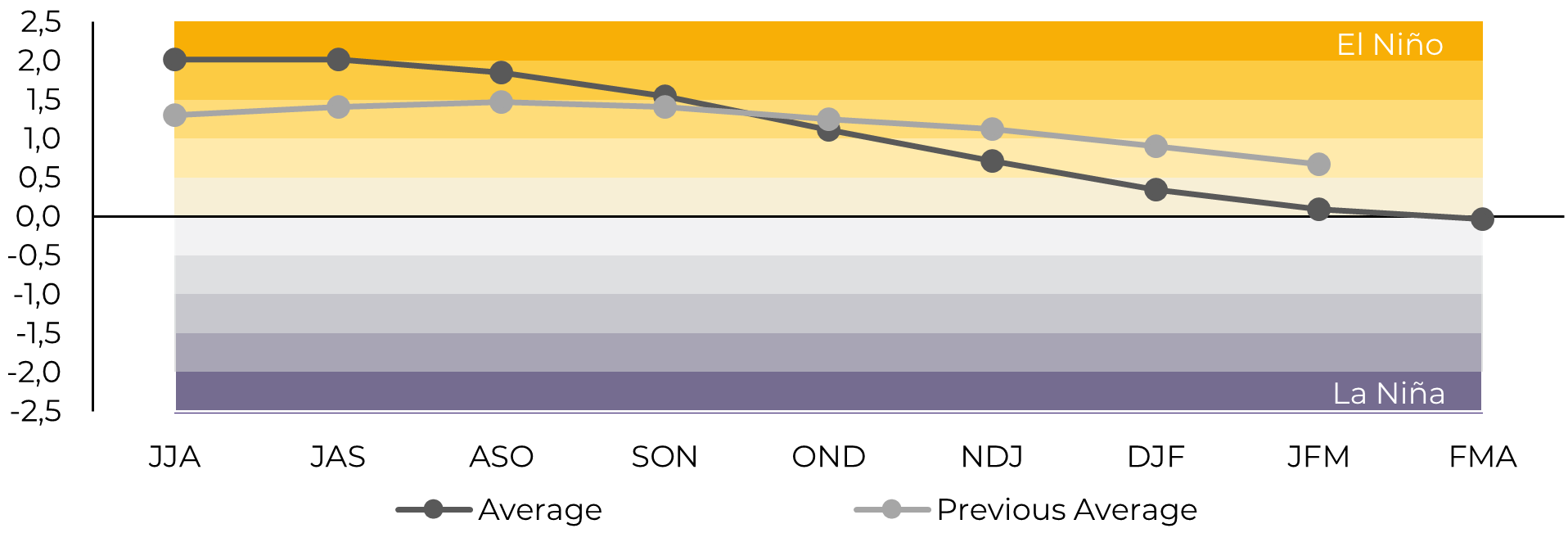

- Weather expectations for 2024 are leaning towards ENSO-neutral conditions, suggesting favorable weather patterns for the upcoming crop development. Short-term hopes for bullish market trends rely on Center-South's export pace and capacity.

Sugar fundamentals were already bearish considering Brazilian crop updates released by many houses in the week prior (ours included), but the headline that India might produce more of the sweetener instead of pursuing its ethanol blending target was all the market needed to melt down.

The Indian government announced last Wednesday (12/06) that it is considering taking some measures to discourage the redirection of sugar for ethanol production, aiming to smooth the sweetener's domestic market tightness and stocks. It would basically consist in restricting the use of sugar cane juice and B-heavy molasses to produce ethanol, allowing only the use of C-heavy molasses, a by-product with lower sucrose content. This measure became official the day after, with prices failing to recover to above 24 c/lb.

Image 1: Sugar Market Turned Bearish: Raw Prices Failed to Breach 28 c/lb

Source: Refinitiv, hEDGEpoint

Image 2: Sugar Balance India Before (left) and After (right - Mt)

Source: ISMA, AISTA, hEDGEpoint

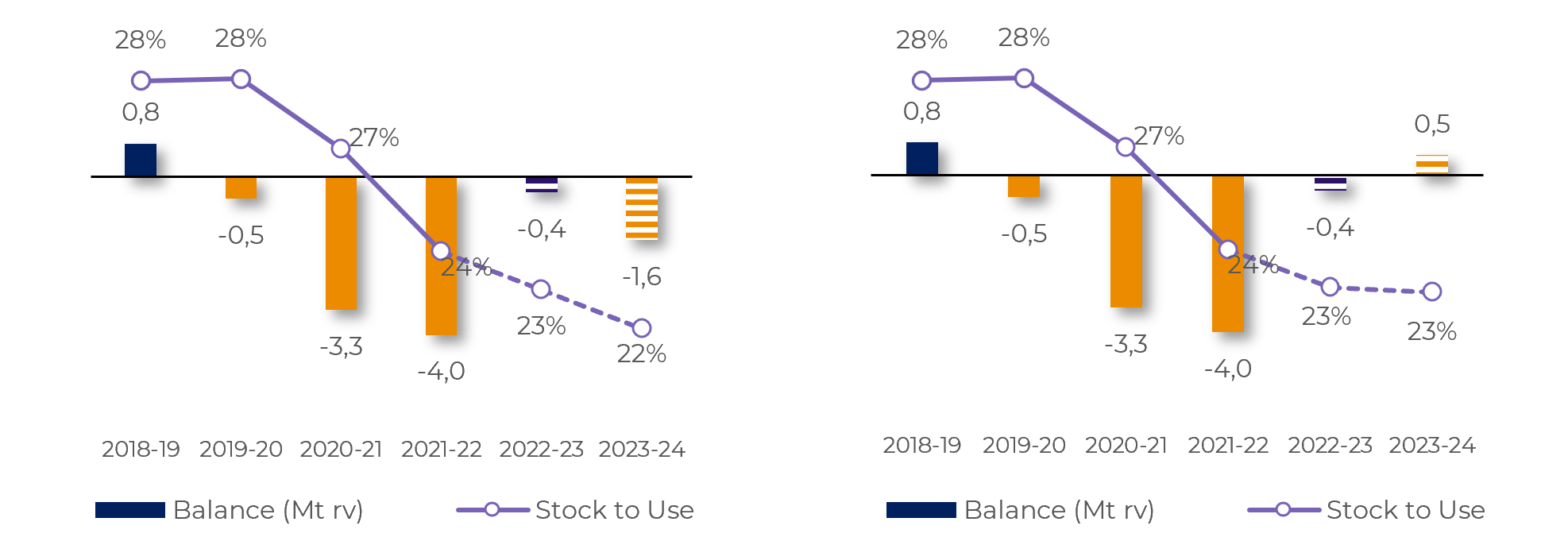

This adds to the view that the market isn’t as tight as once believed to be. Looking at trade flows, as discussed in our previous report, it seems that the deficit can be solved through import seasonality. If destinations hold their ground during the first quarter of 2024, while waiting for Center-South’s 24/25 crop season to pick up, the tightness might simply disappear.

The bearish momentum also draws strength from weather expectations. While 2023 was marked by the El Niño spawning during Northern Hemisphere’s crop development window, 2024 seems to be heading towards a ENSO-neutral ground. This means that weather patterns should be closer to average in both Northern and Southern Hemisphere – allowing us to expect 24/25 crop season to be excellent for Center-South and a recovery year for many Northern countries. Of course, there is still a lot to unravel before we have a clearer view on India’s and others 24/25 crop season.

Image 3: Global Supply and Demand Before (left) and After (right - Mt rv)

Source: hEDGEpoint, Green Pool

Image 4: El Niño/La Niña Forecast–Nino Index3.4

Source: Source: Columbia, hEDGEpoint

Focusing on the short-term, the only grasp of hope the bulls have is Center-South’s export pace and capacity. Although during November’s second fortnight rains were abundant, the country is known to have exported more than in October, +26% according to SECEX – or nearly 3.4Mt.

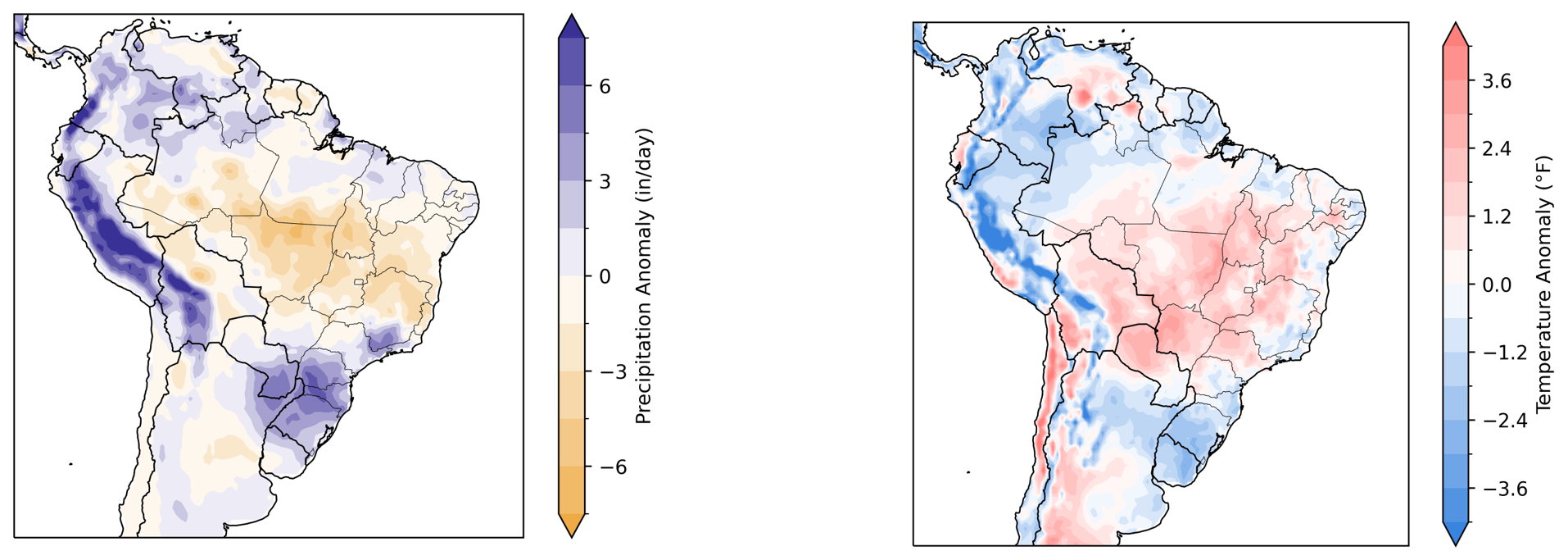

Image 5: Precipitation Anomaly(in/day - left) and Temperature Anomaly (ºF - right) – 14-day Starting December 04

Source: CEPEA, Refinitiv, hEDGEpoint

In Summary

It is getting harder and harder to believe in a 30 c/lb market. Many fundamentals have shifted and are now on the bears' side: Brazilian excellent crop keeps surprising on the upside, as discussed in our previous report, India might induce higher sugar production, and next year's expectations are also improving. El Niño and La Niña might give us a break, offering good conditions for cane development.

Finally, the market corrected massively following oil and with many selling off their long positions. Reaching 23.1 c/lb on Wednesday made us wonder, where is the floor? Would it be China’s import arbitrage, orbiting 20 c/lb? This is a wait-and-see moment, but with a little deficit, maybe sugar can find support above it.

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com