Sugar and Ethanol Weekly Report - 2024 01 08

24/25 will be smaller, but not close to a failure

- Disappointing December rains and higher temperatures in Brazil led to a significant drop in soil moisture in key cane-producing regions, raising concerns about achieving another excellent TCH level (tons of cane per hectare) in the upcoming season.

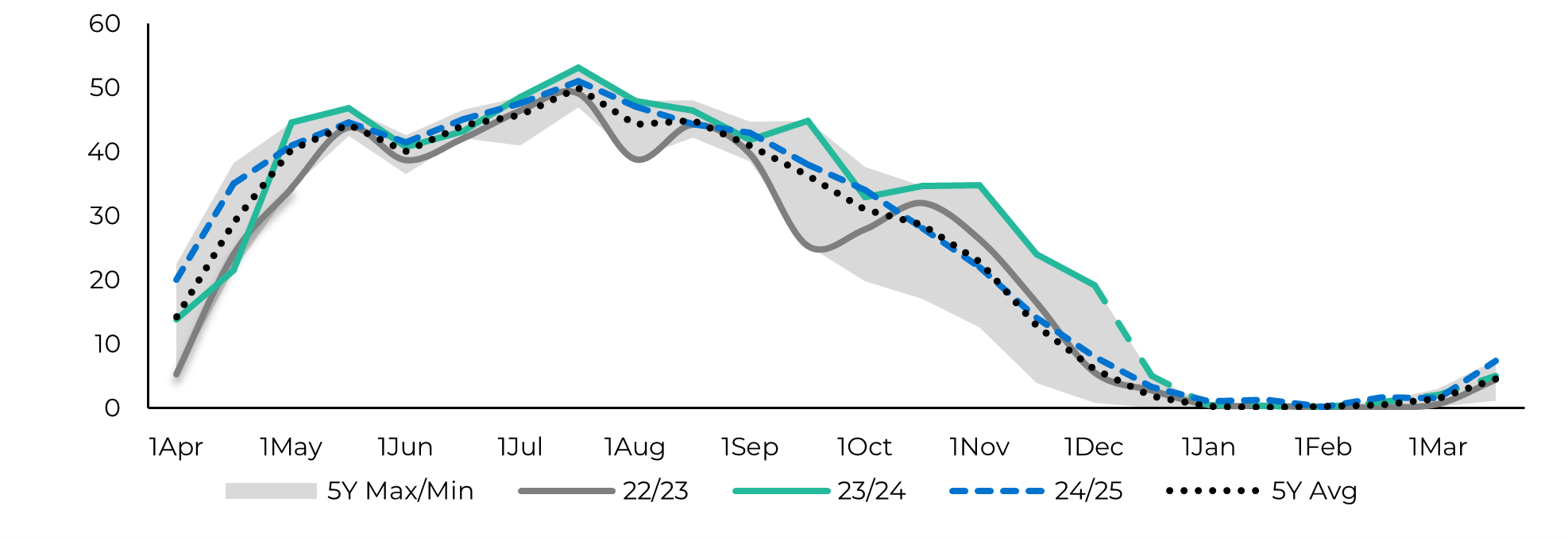

- We revised both our 23/24 and 24/25 crop season estimates. With the recent dryness, it is plausible that millers will end up crushing all its available feedstock still in 23/24, reaching the unprecedented 651.5Mt level.

- Meanwhile, prices recovered some lost ground following the significant decline last month, driven by downward revisions to the 24/25 Center-South crop. Lack of rainfall reduced the cane’s leftovers estimates and accentuated the expected drop to TCH. Therefore, we revised the cane’s availability down from 640Mt to 620Mt. Impacting sugar production directly.

- However, even with a reduction to 24/25 season total output, Brazil remains the main bearish news. The country can solve the trade flows on its own, simply pushing exports during the Northern Hemisphere absence, which has proven to be a reality in the past two months.

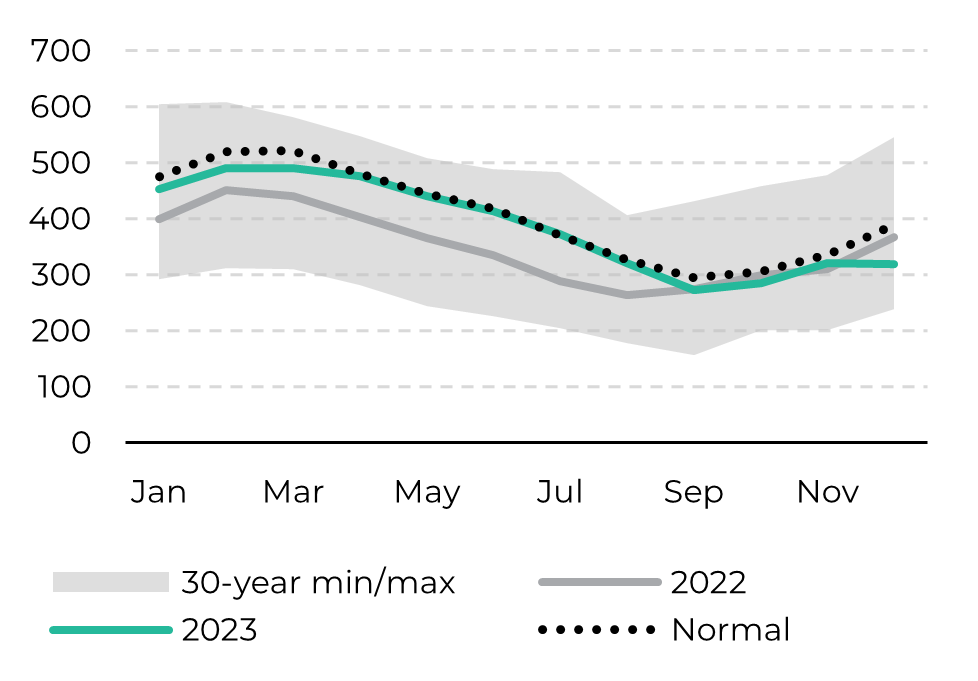

As discussed in our previous report, December’s rains were disappointing throughout the entire Center-South region. Combined with higher temperatures, it induced a major drop in soil moisture in key cane-producing regions, such as the São Paulo state. This contributes to the anticipation that the upcoming season may not witness another year of excellent TCH (tons of cane per hectare), prompting the question: to what extent could it decrease? In this report, our objective is to explore the primary trends we might anticipate and highlight key points to watch out for, acknowledging that it is premature to make definitive predictions at this point.

Image 1: Soil Moisture Average in São Paulo (mm in top 0-1.6m soil)

Source: Refinitiv, hEDGEpoint

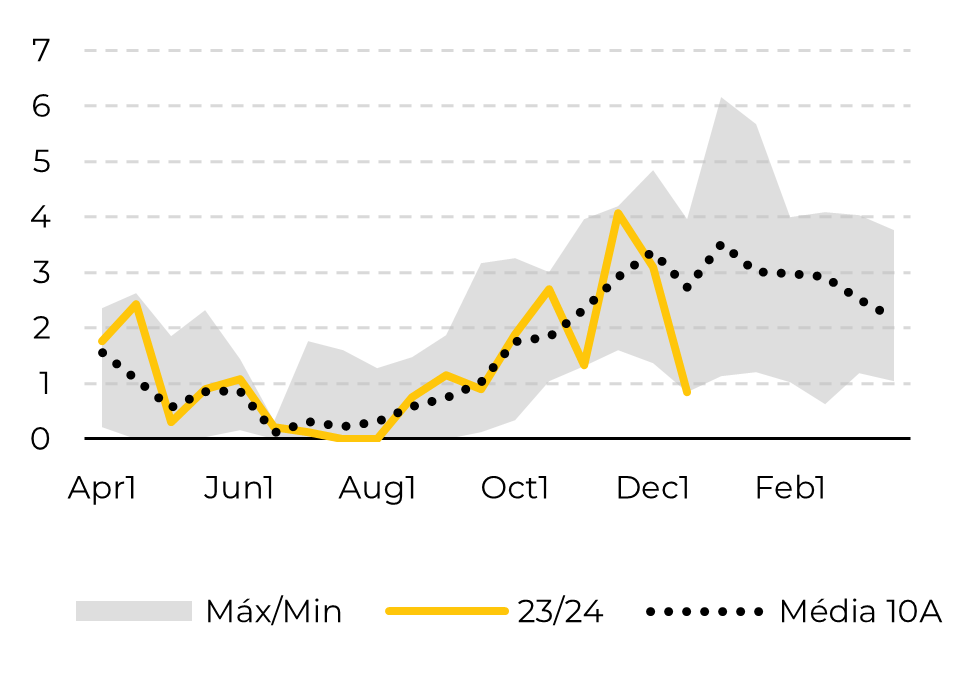

Image 2: Lost Days per Fortnight in CS (No. of days considering a 5mm threshold)

Source: Bloomberg, hEDGEpoint

As a direct result, the previous 640Mt estimated to 24/25 already falls short by 5Mt, to 635Mt. But that was not the only reduction we made

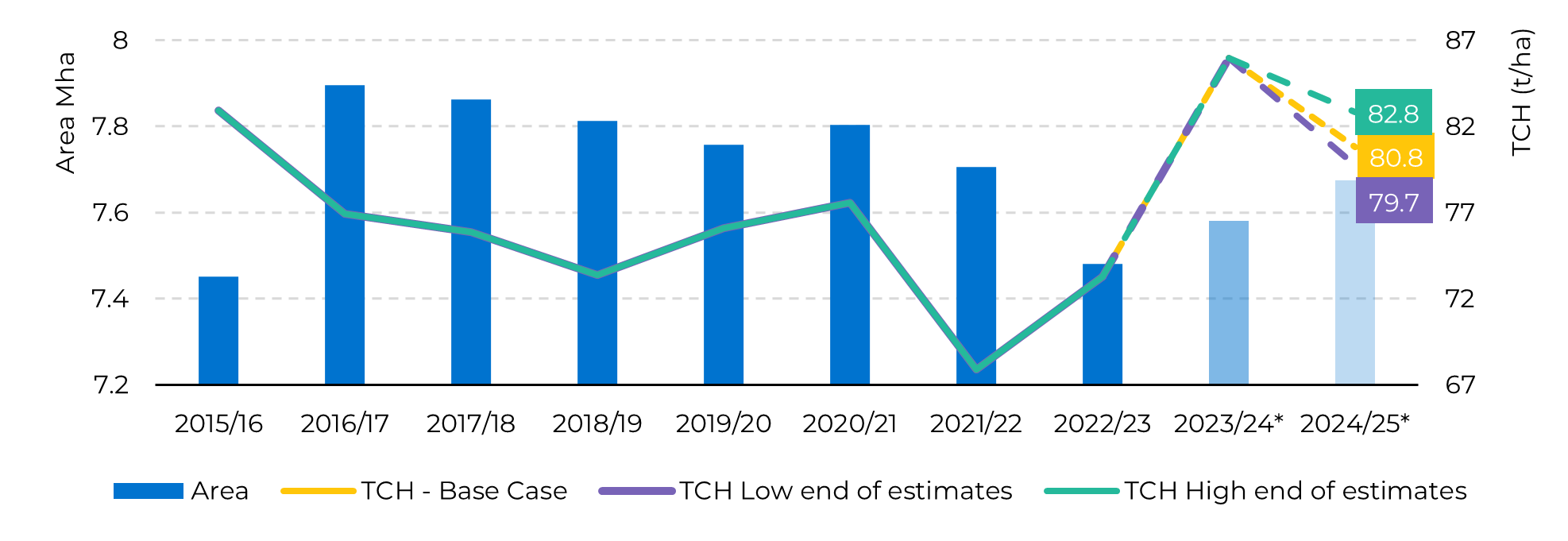

Image 3: Area and TCH Estimates

Source: UNICA, Conab, hEDGEpoint

Considering the adverse weather seen so far and its impact on both soil moisture and NDVI (Normalized Difference Vegetation Index) for the Center-South, our model points out that TCH should decrease by nearly 6%, if weather is not entirely favorable in the coming months. Therefore, our base case considers 80.8t/ha of TCH in 24/25, which coupled with an average area expansion of 1.24%, would lead to 620Mt of cane. Given the recent investments made to the crystallization process, the region would be able to achieve 50.9% sugar mix, which would lead to, at least, 41.7Mt of sugar next season. As a result, although TCH could correct, it doesn’t mean a crop failure, on the contrary, it means the second highest result so far.

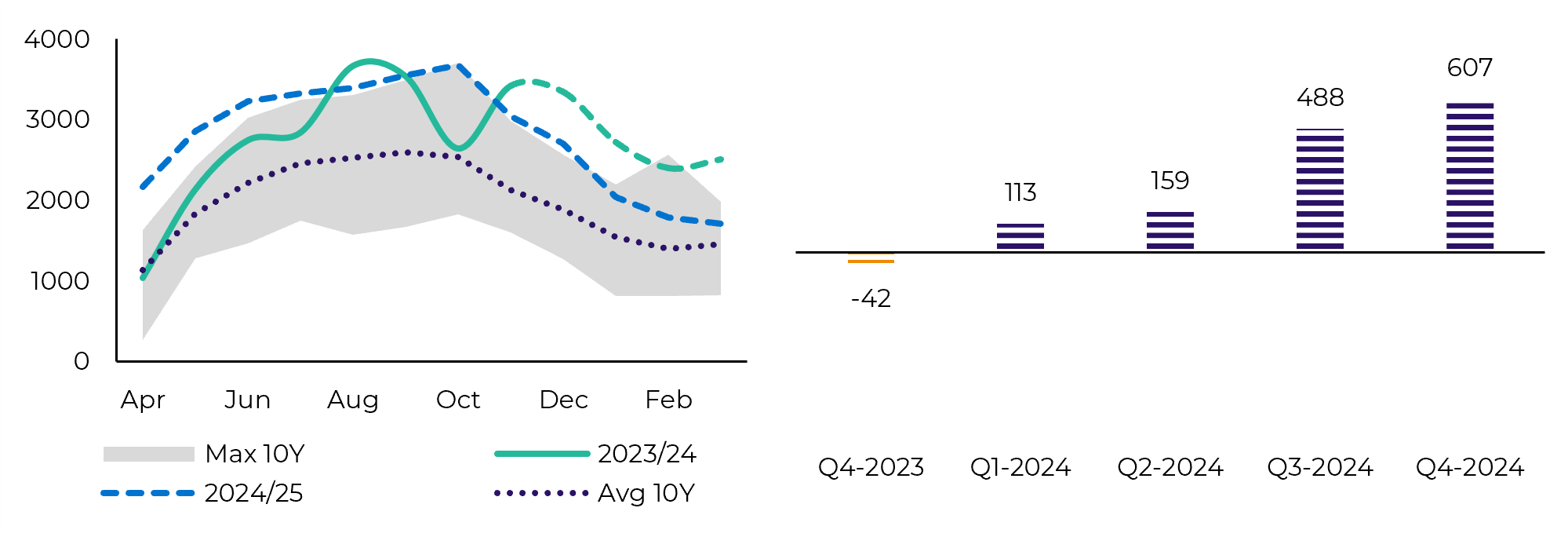

Image 4: Crushing per Fortnight (Mt)

Source: UNICA, hEDGEPoint

Hence, close monitoring of weather conditions is essential, particularly in deciphering price trends. Brazil stands as the primary bearish influence and is likely to continue in that role. Despite potential short-term support for prices due to tightness, it's crucial to recognize that the overall situation is not as dire as previously anticipated. Trade flows suggest a more balanced outlook for Q4/23 and Q1/24, indicating that a 20.5-22.5c/lb range appears to be the new norm. Traders will need to employ creative strategies to uplift prices.

Image 5: CS Total Exports Seasonality vs Total Trade Flows (‘000t)

Source: SECEX, Williams, Green Pool, hEDGEPoint

In Summary

Last week, prices recovered some lost ground following the significant decline last month, driven by downward revisions to the 24/25 Center-South crop. It's important to highlight, however, that this downturn does not signify a crop failure, in fact, it even adds to the short-term availability as December dryness pushed late 23/24 crushing.

Countries such as India and Thailand adds to the bulls, but Brazil may be able to solve trade flows deficit on its own. TCH’s expected drop will be partially offset by crystallization increment, meaning that Center-South may still produce close to 42Mt next season with reduced feedstock availability, 620Mt.

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

pedro.schicchi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.