Sugar and Ethanol Weekly Report - 2024 01 15

Walking on thin ice: what are the risks?

- Market conditions have shifted to a more balanced state, leading to a decline in prices and nearly neutral speculative positions.

- Both raws and whites are in a delicate balance, with total global trade flows and supply and demand predicting a small surplus. Any disturbances could impact prices and speculative positions.

- The market currently leans towards bearish tendencies, considering factors such as Brazil's positive results and the potential for another strong crop in 24/25.

- Weather patterns, geopolitical conflicts and macroeconomics are crucial factors to monitor during 2024.

The market has shown signs of being well-balanced, instead of the extreme tightness previously anticipated. As a direct result of the more comfortable situation, prices melted while speculative positions nearly netted. A new comfortable range was settled between 20.5 and 22c/lb, and raws have swung among it.

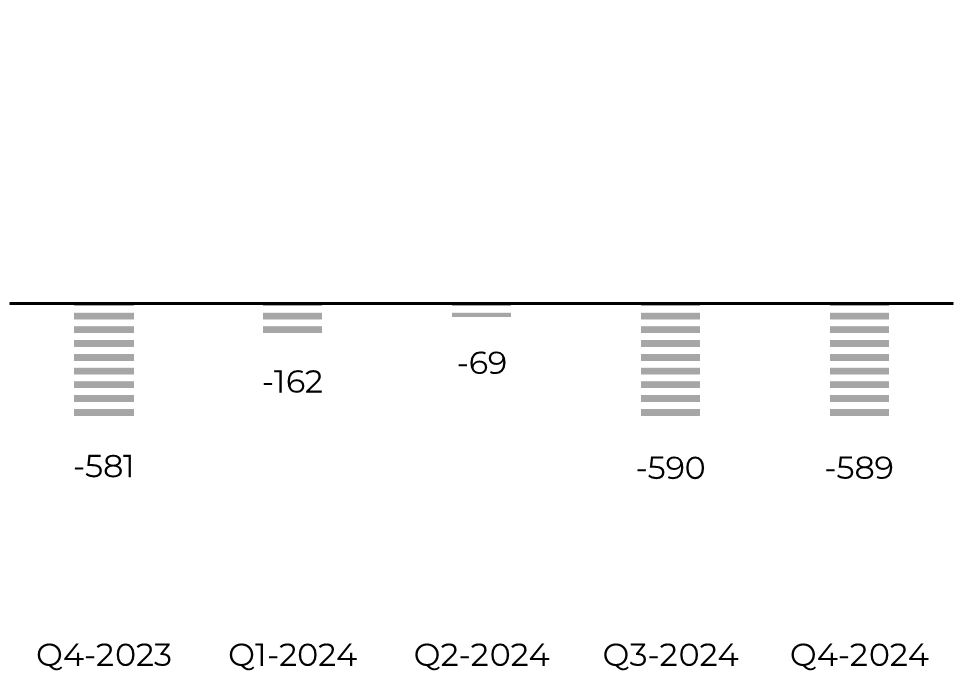

The whites, however, tell a slightly different story. With a small deficit to be solved once the raws are processed, the white premium might find support in the short/medium run. Also, the ongoing conflict in the Red Sea adds to the recent gains. International trade with East Africa and East Asia faces disruption and cost increases.

Image 1: White sugar trade flow ('000t tq)

Source: Green Pool, hEDGEpoint

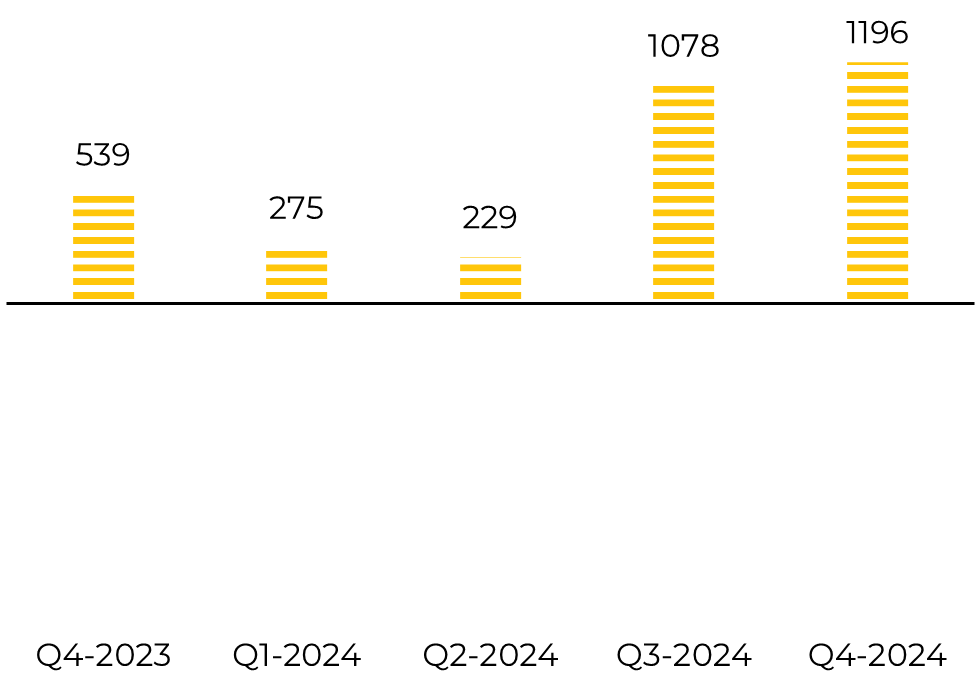

Image 2: Raw sugar trade flow ('000t tq)

Source: Green Pool, hEDGEpoint

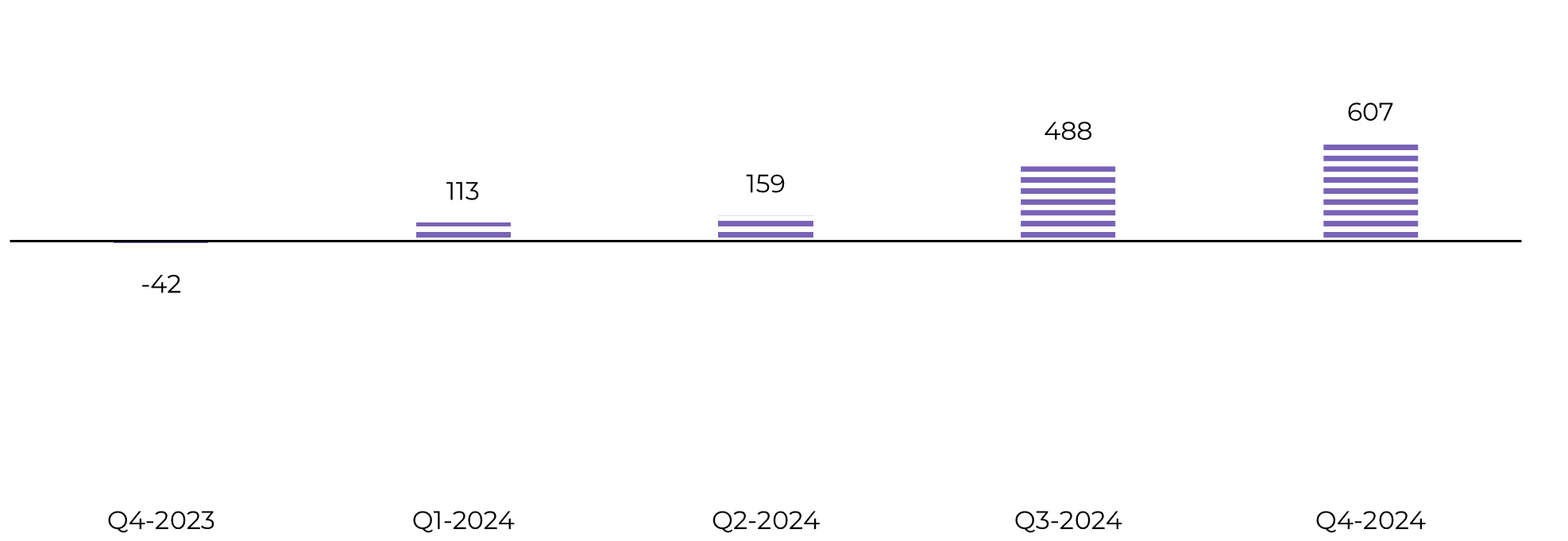

Image 3: Total trade flow ('000t tq)

Source: Source: Green Pool, hEDGEpoint

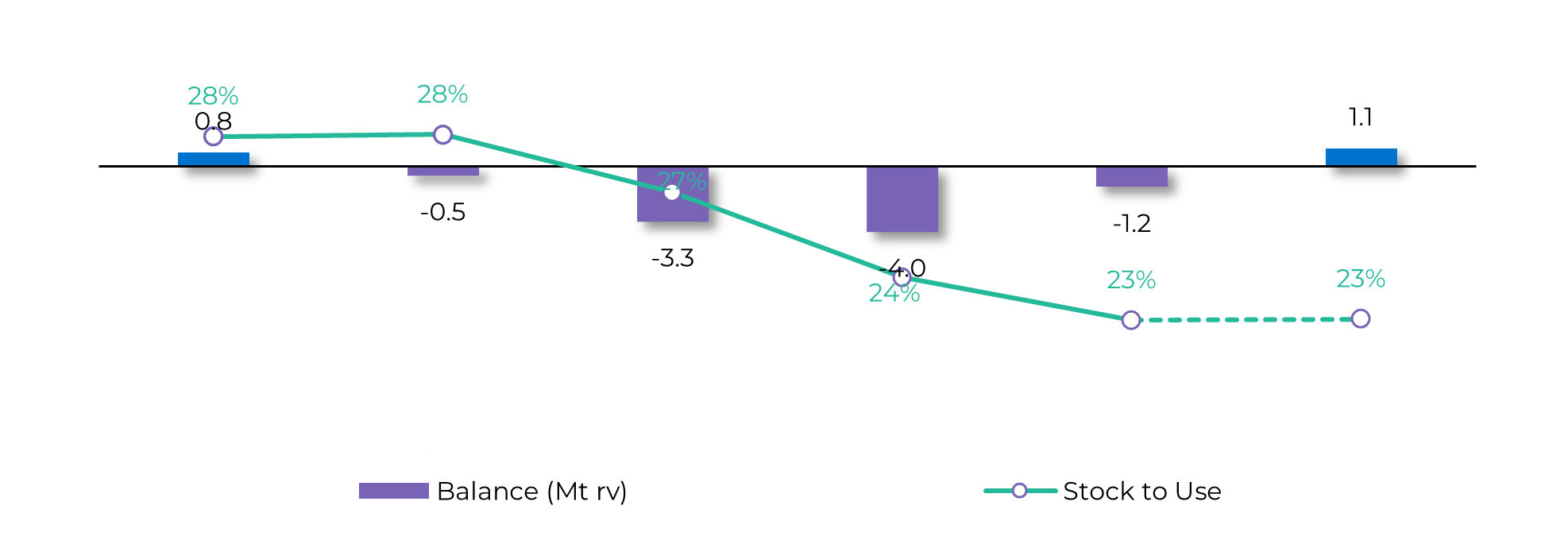

Looking at fundamentals today, market seems to be pending to the bearish side. Of course, prices remain historically high, but with Brazil’s great result so far and the possibility of another great crop in 24/25 coupled with some yield recovery in Maharashtra and Karnataka being reported, market might just stay comfortable for a while. Of course, the announced improvement in yields in some states in India doesn't guarantee a harvest comparable to previous years, preventing exports. It simply suggests that the situation may not be as extreme as initially portrayed.

Poor results in the Northern Hemisphere are already factored into the small surplus, but monitoring its magnitude is still crucial. For instance, sugar production in India between Oct-Dec reached 11.2Mt, 7.2% lower compared to the 22/23 season. In Thailand, the gap is higher, reaching a variation of -33% by December 23rd. However, the reductions remain within expected and we haven’t changed our forecast for both countries. India is expected to reach nearly 32Mt of sugar, with no exports, while Thailand 8.2Mt and reduced participation in global trade flows of a little over 5Mt.

Image 4: Global Supply and Demand – Mt rv

Source: Green Pool, hEDGEPoint

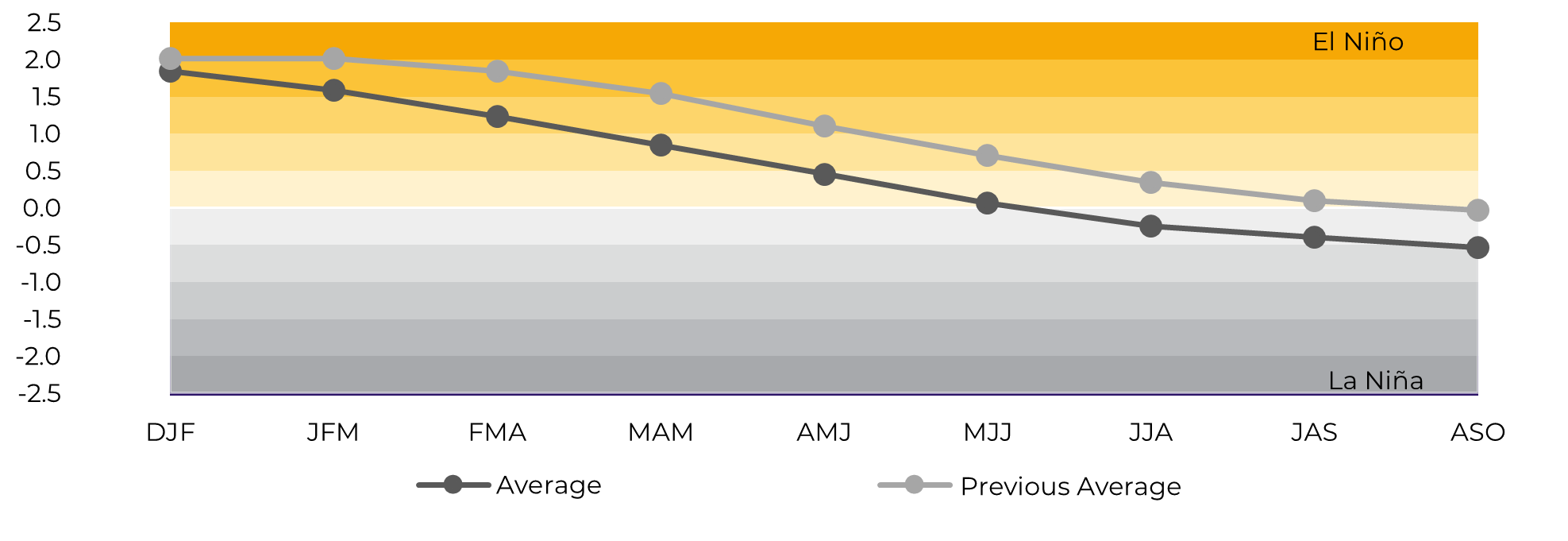

As to weather, we’ve discussed the implications of the recent dryness in Center South on our previous report, and the implications it had and might still have on the region’s sugar availability. On this report we would like to highlight a lurking risk: La Niña. ENSO forecast models started to indicate a possible direct shift from El Niño to La Niña this year. Of course, it is too soon to peg, but we should remember that the impact of these weather patterns on the sugar market depends on the period of its occurrence, duration, and intensity – contributing either to the bulls or the bears. Since the effect can change precipitation regimes, it usually affects yields.

Image 5: El Niño/La Niña Forecast–Nino Index3.4

Source: Columbia, hEDGEpoint

In Summary

The market is currently navigating a delicate balance, teetering on the edge. At present, it appears to be leaning towards bearish tendencies, yet finding some support from the upcoming Ramadan period and disruptions in a crucial trading route.

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.