Jan 22

/

Lívea Coda

Sugar and Ethanol Weekly Report - 2024 01 22

Back to main blog page

"With no changes to fundamentals, market might be performing a technical rebound. This movement might find some support in seasonal demand. "

Sugar’s late reaction and seasonal demand

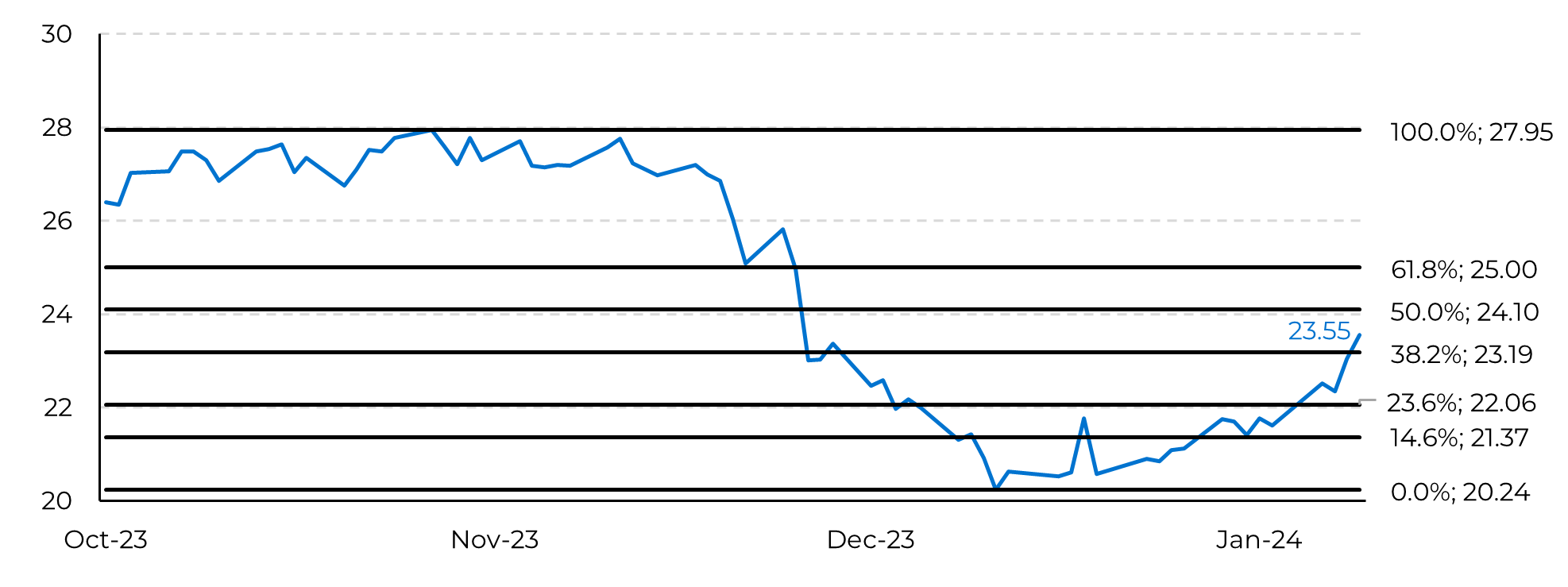

- Raw sugar prices approached the 50% Fibonacci retracement level in the past week, a rebound after a major decline. Although an expected movement, caution is advised as market fundamentals have not significantly changed.

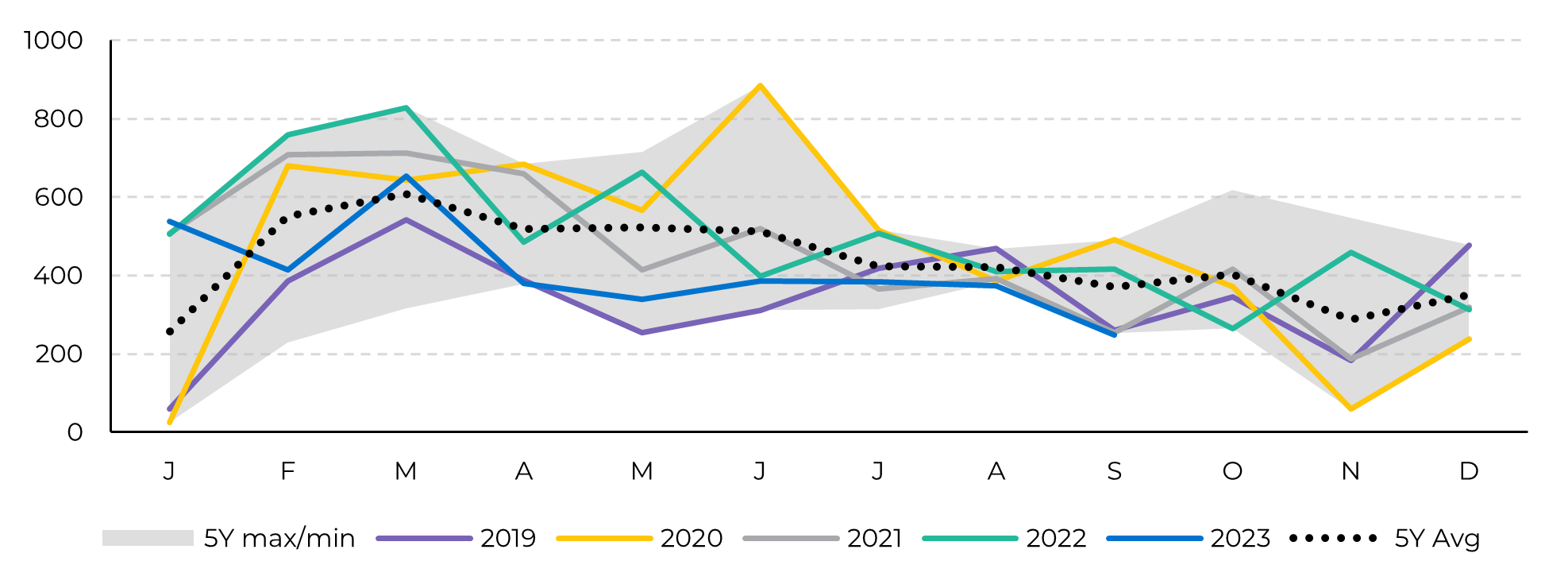

- Seasonally high demand during Ramadan festivities traditionally supports sugar prices this time of the year. Taking Indonesia as an example, a major importer, usually experiences an uptick in its imports during the first quarter.

- Talks on India’s reservoirs are also comforting for the bullish trader, however, it is still too soon to peg what could happen until the next season cane development window.

- Brazil's exceptional sugar production is keeping the market in a tight balance, contributing to limiting the current bullish strike. It may be a short-term reaction to seasonal demand’s movement rather than a reflection of a shift in market fundamentals.

Raw sugar prices reacted in the past week, getting closer to the 50% Fibonacci retracement level. Technically speaking, a rebound after a major meltdown is usually expected, however, we should remain cautious as fundamentals haven’t changed much.

Image 1: Sugar is moving back to 50% retracement

Source: Refinitiv, hEDGEpoint

As discussed in previous reports, market is standing at a tight balance. It is natural for prices to find support in seasonally high demand due to Ramadan festivities. Ramadan, the ninth month of the Islamic lunar calendar, carries profound religious importance for Muslims globally. The conclusion of Ramadan is celebrated with Eid al-Fitr, a joyous day featuring special prayers, feasting, and the exchange of gifts. An illustrative example of its impact on the sugar market is Indonesia, a prominent global sugar importer with an annual average of 5 Mt, which traditionally experiences an uptick during the first quarter. Indonesia key commercial partner, in terms of sugar is Thailand, responsible for around 40% of its total volume, followed by Brazil, with about 22%. This year, the lack of sweetener from its main partner, Thailand, and the disappointing results from other Northern Hemisphere countries will push higher demand for Center-South.

Some destinations that usually present an uptick due to higher demand, though not as relevant in terms of total volume, are Egypt and United Arabs Emirates. Those countries, located at Northeast Africa and the Middle East might face some extra challenges on top of lower availability due to the ongoing conflict at the Red Sea.

Image 2: Indonesia total sugar import seasonality (‘000t)

Source: Trade Map

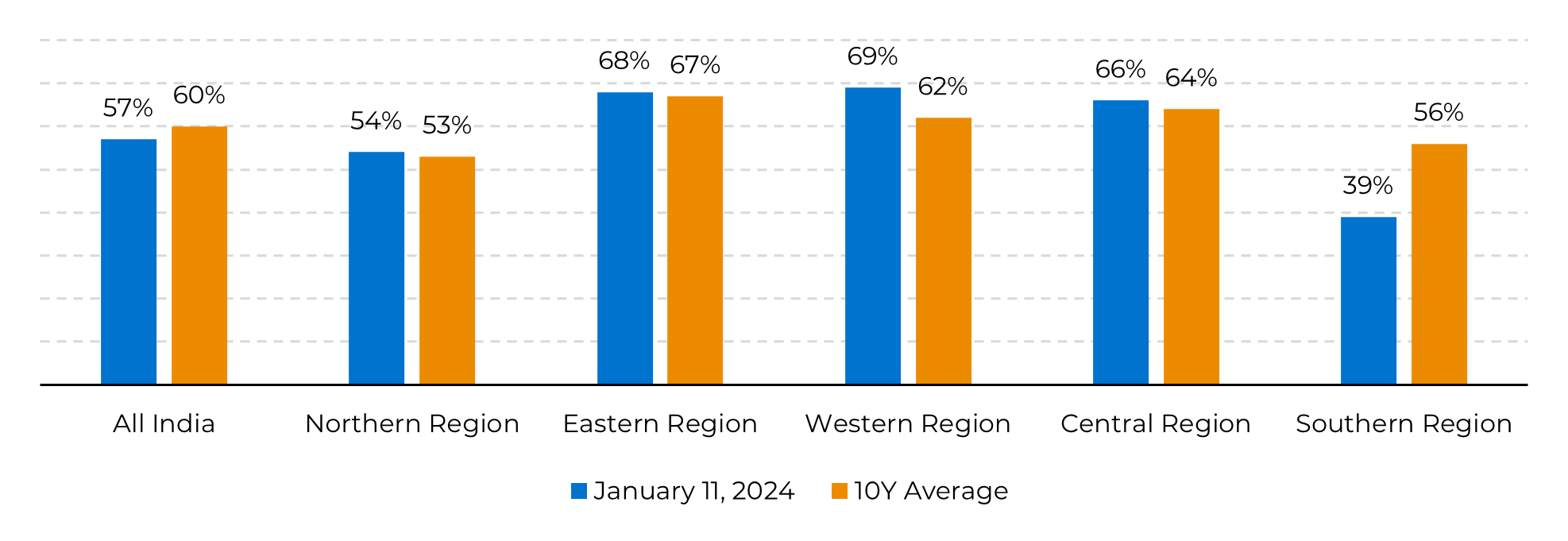

Recent reports highlight concerns about the water levels in Indian reservoirs. The Central Water Commission of India reveals that, as of January 11, the overall levels across the country's 150 reservoirs stand at 57%, a dip from the ten-year average of 60%. Notably, the Southern Region emerges as a significant contributor to this decline, with only 56% of its capacity filled, compared to the ten-year average of 69%. It's worth noting that these figures were widely anticipated, given the particularly dry conditions experienced by Karnataka and Tamil Nadu during the monsoon season, directly impacting reservoir levels. This situation demands close monitoring, particularly as we approach the critical developmental window for crops, especially sugarcane, between June and August, but does not pose any threat to the 23/24 crop season in terms of both production, and exports – the latter being null.

Also about India, the country has produced 14.87Mt until January’s first fortnight, a 7% drop compared to last year. Maharashtra and Karnataka made explicit the adverse conditions cane fields had to withstand last summer, while Uttar Pradesh holds results up with a nearly 15% increase in its output. Nevertheless, Maharashtra farmers have reported better-than-expected cane harvest yields, adding to market production expectations and leaving us comfortable to keep our 31.85Mt estimate.

Image 3: Reservoirs status in India (%)

Source: Central Water Commission

However, let’s not lose sight that Brazil is having the best season it ever had.

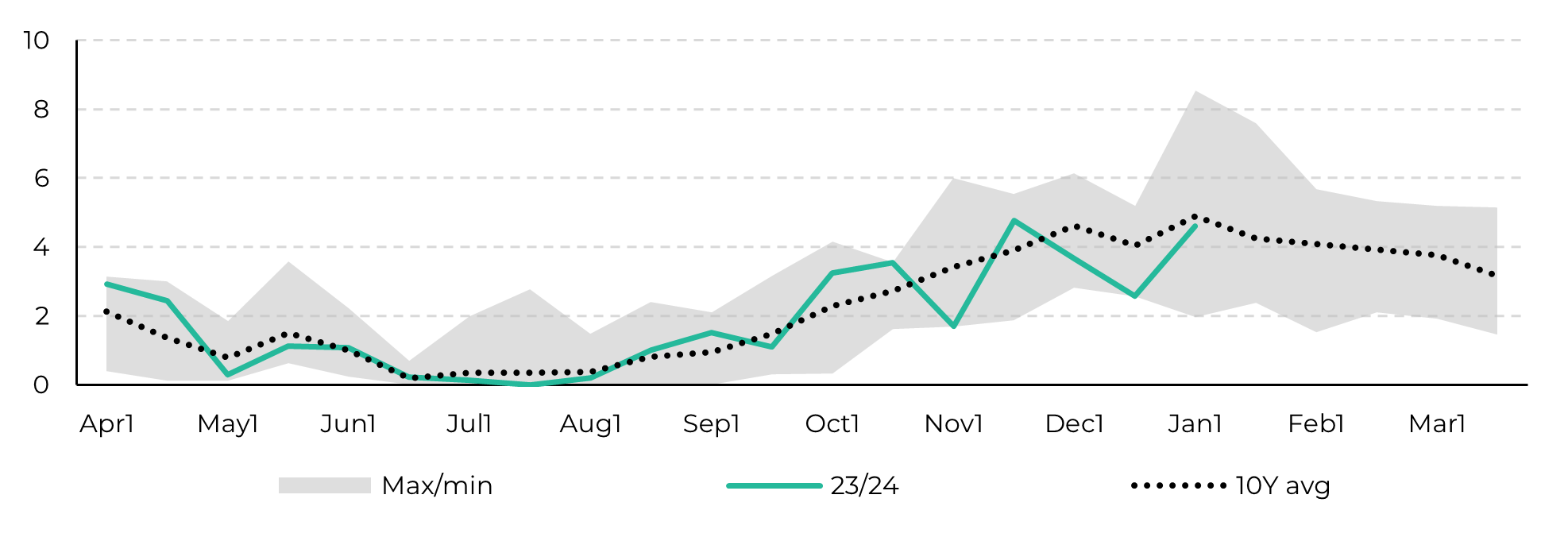

With a record-crushing pace and excellent shipment – registering a record in December – Brazil is single-handedly keeping the market at a tight balance. Rains arrived down center-south and, although scattered, they support another good year in 24/25.

Therefore, the uptick we are seeing in sugar might be a short-term reaction to higher demand in a tight balance scenario, triggering some technical buying, but not reflecting the complete fundamentals. The 24c/lb seems to be a fair high, the 50% Fibonacci retracement.

With a record-crushing pace and excellent shipment – registering a record in December – Brazil is single-handedly keeping the market at a tight balance. Rains arrived down center-south and, although scattered, they support another good year in 24/25.

Therefore, the uptick we are seeing in sugar might be a short-term reaction to higher demand in a tight balance scenario, triggering some technical buying, but not reflecting the complete fundamentals. The 24c/lb seems to be a fair high, the 50% Fibonacci retracement.

Image 4: Brazil’s lost days estimate (nª of days considering a 5mm threshold)

Source: Bloomberg, hEDGEpoint

In Summary

With no changes to fundamentals, market might be performing a technical rebound. This movement might find some support in seasonal demand.

However, we should keep in sight that Brazil seems to be doing more than fine and is in the game supplying through Northern Hemisphere’s absence until its new season.

Weekly Report — Sugar

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.