Jan 29

/

Lívea Coda

Sugar and Ethanol Weekly Report - 2024 01 29

Back to main blog page

"The market, seeking reasons to move up, relying on demand’s seasonal support and undefined announcements, while Brazil remains a strong supplier."

Seeking reasons to move up

- The sugar market has seen increased volatility due to a shift in fundamentals towards a more balanced scenario. Navigating in thin ice makes every new piece of information a possible trigger to prices, even when not entirely a fundamental movement.

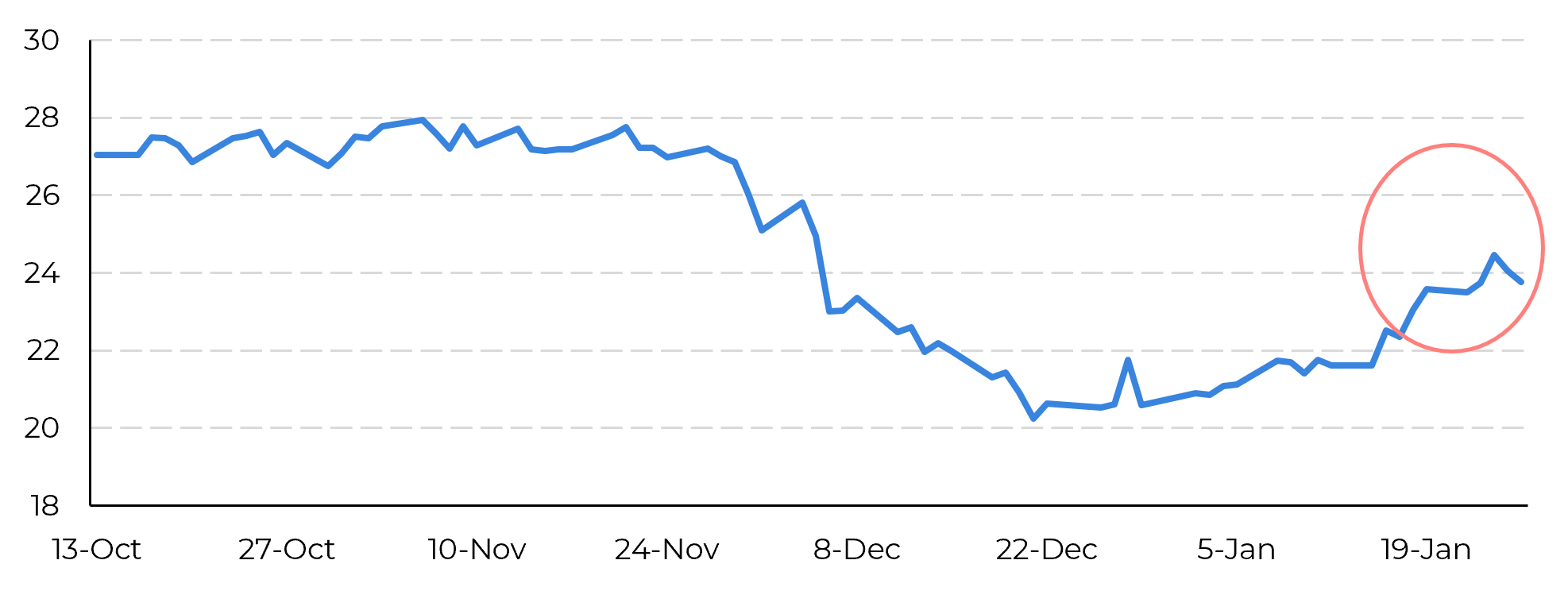

- The bullish took the lead. The announcement by the Indian government contemplating an 8% increase in the minimum price for sugarcane (FRP) for the 2024/25 season influenced prices. This, along with expectations of drier-than-average conditions in the Center-South summer, has contributed to increased prices.

- However, Brazil demonstrated its force with a robust cane crush and a high sugar mix during January’s first fortnight, leading to a decline in prices below 24 cents per pound.

- The market, seeking reasons to move up, relying on demand’s seasonal support and undefined announcements, while Brazil remains a strong supplier.

Sugar market volatility has experienced heightened levels since the shift in fundamentals towards a more balanced scenario. As discussed in previous reports, even a slight surplus or deficit can be likened to navigating "thin ice" in the market, with prices susceptible to movement based on prevailing forces. Last week, bullish sentiments took the forefront.

Although not fundamentally driven, prices tested the 24.6 cents per pound level following the announcement by the Indian government that it is contemplating an 8% increase in the minimum price for sugarcane paid by sugar mills in the 2024/25 season, known as Fair And Remunerative Price (FRP). Typically, the government establishes the FRP a few months before the commencement of the new crop season, but this year, an earlier announcement is under consideration to enhance sugar availability in the country. This development, combined with anticipations of drier-than-average conditions in the Center-South summer, served as a bullish factor.

Image 1: Raw sugar prices (c/lb)

Source: Refinitiv, hEDGEpoint

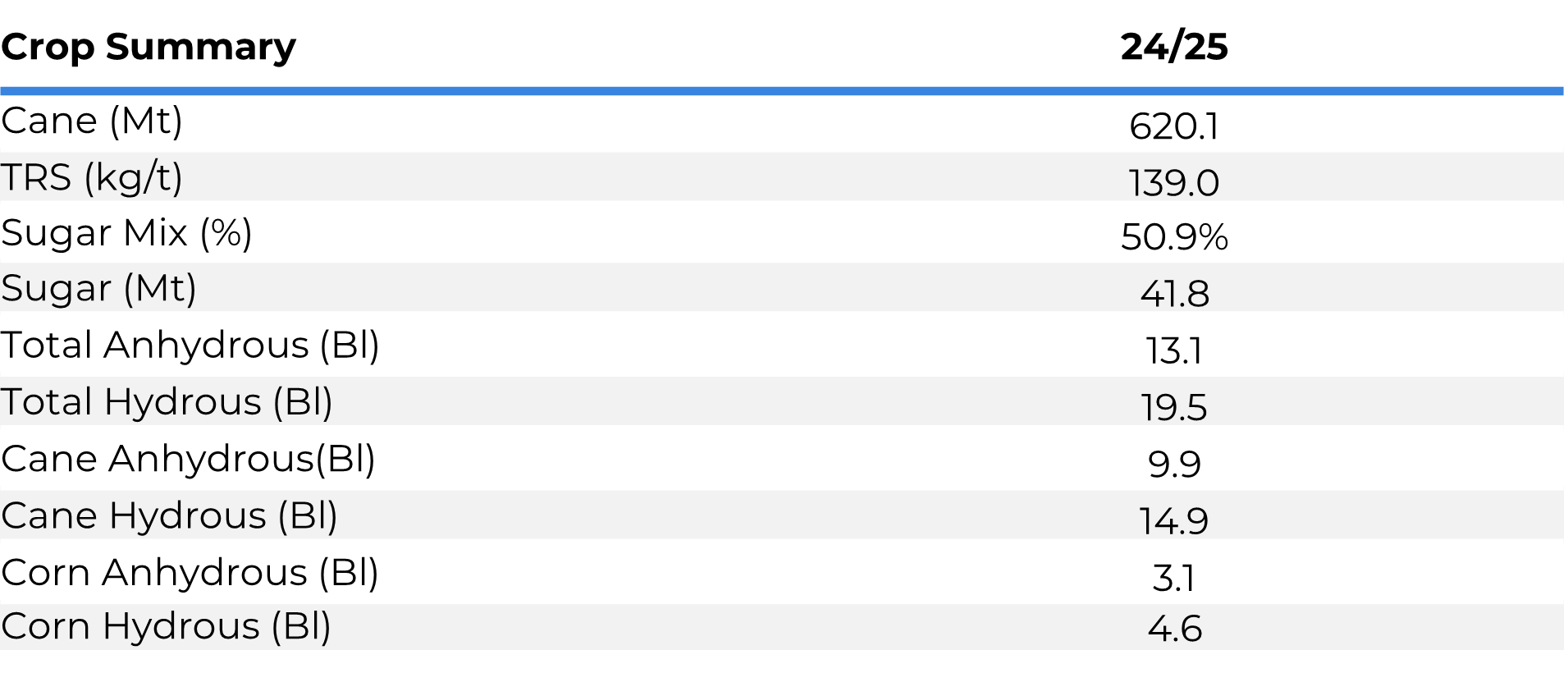

It is important to note that a final decision has not been reached in terms of the FRP, while our estimates for Brazil, 620Mt of cane in 24/25, already factor in second-best results, accounting for less-than-ideal weather conditions inducing a 6% reduction to TCH.

Image 2: 24/25 is far from being a failure

Source: hEDGEpoint

Thursday was the bears turn, and the Unica report reminded the market that Brazil is a force of nature. With a healthy 1.1Mt cane crush during January first fortnight and a 34.2% sugar mix, the region is closer to reaching 651M, especially with some mills announcing a 24/25 early start. Prices moved back below 24c/lb.

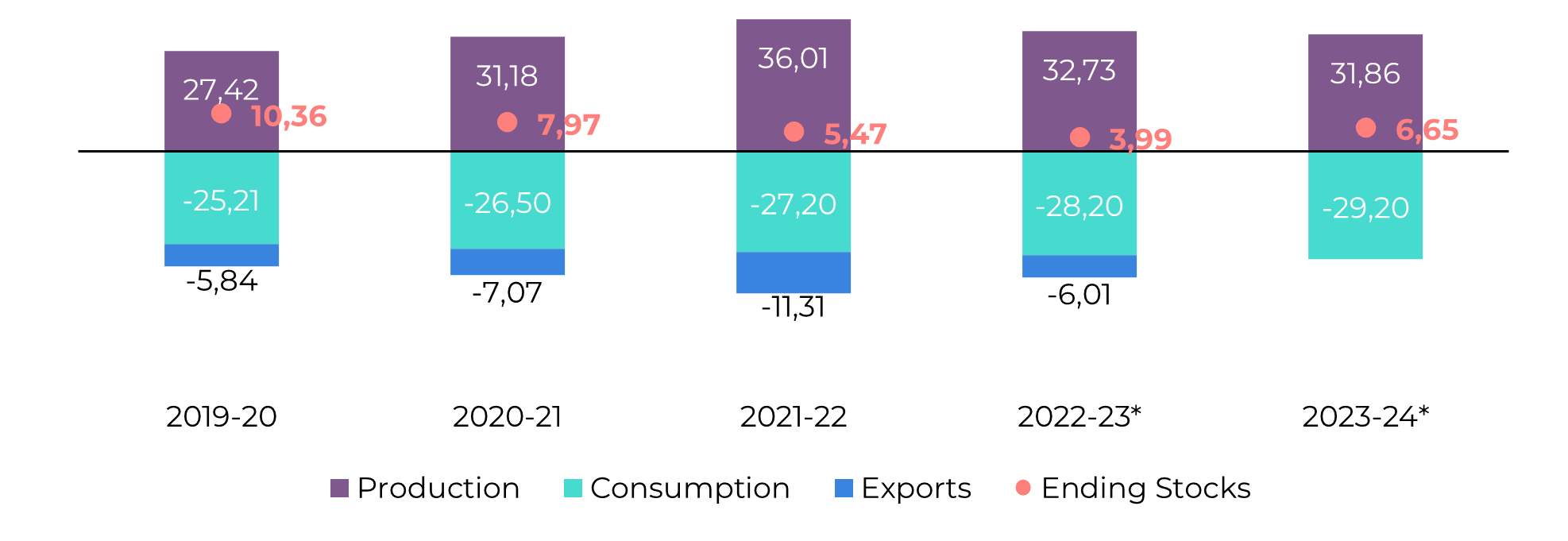

However, this expected increase in availability drove ISMA to request Indian government to additional 1-1.2Mt sugar diversion to ethanol. If allowed, it could impact negatively our estimates, but note that it wouldn’t change the no exports scenario.

Also, last week, although perceived by some as bullish, India’s crushing figures released by ISMA were not only within expectation, but reduced the gap seen until December. By the end of last month, the difference between 23/24 crop season and 22/23 was of 7%. Adding January’s first fortnight, this difference dropped to 5.3%. The association added that the recent weather conditions have been positive for the current crop, prompting cane commissioners in key states such as Uttar Pradesh, Maharashtra, and Karnataka to upwardly revise their sugar production estimates for the 2023-2024 season by 5% to 10% each. This makes us even more comfortable keeping our sugar production estimates unchanged at nearly 32Mt.

However, this expected increase in availability drove ISMA to request Indian government to additional 1-1.2Mt sugar diversion to ethanol. If allowed, it could impact negatively our estimates, but note that it wouldn’t change the no exports scenario.

Image 3: India’s sugar balance (Mt tq – Oct-Sep)

Source: ISMA, AISTA, hEDGEpoint

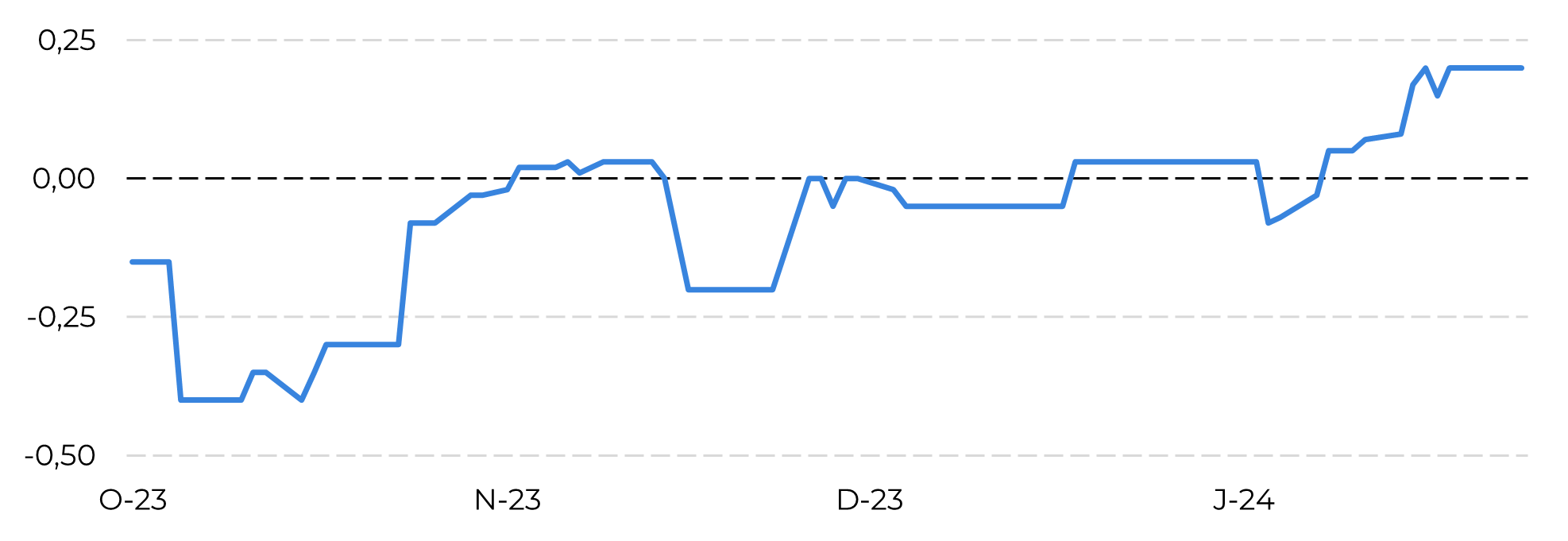

Therefore, little has changed in terms of fundamentals. It seems that the market is looking for a reason to move up, relying on demand seasonal support to cash premiums and undefined announcements. Meanwhile, Brazil remains a strong supplier, with a healthy line up of nearly 3Mt until January 24, increasing port waiting time.

Image 4: Santos Cash Premium – Prompt (Usc/lb)

Source: Refinitiv, Green Pool, hEDGEPoint

In Summary

Last week was marked by a bullish force that peaked on Wednesday, when the Indian government announced that it was considering raising the FRP. However, little has actually changed in terms of fundamentals. In fact, the market remains at a tight balance. While we consider a small surplus, other houses count on a small deficit, but the bottom line is the same: tightness induces volatility. Any news or rumors could trigger short-lived price movements. Understanding the reality behind fundamentals is a must to understand when these movements will last. Right now, Brazil is doing what we expected: loading as fast and as much it can to supply during the Northern Hemisphere’s absence. Nobody said it was going to be easy, cash premium shows that, but it is feasible, and it is happening.

Weekly Report — Sugar

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.