Feb 5

/

Lívea Coda

Sugar and Ethanol Weekly Report - 2024 02 05

Back to main blog page

"Sugar market wasn’t exactly surprising this past week, leading to a more stable market activity and funds comfortably waiting for a reason to come back. India’s additional availability would first be diverted to ethanol rather than hitting the international market, meaning little for the current season availability and trade flows. However, it does post some bearish warnings for 24/25. "

Oh look, there is more sugar in India!

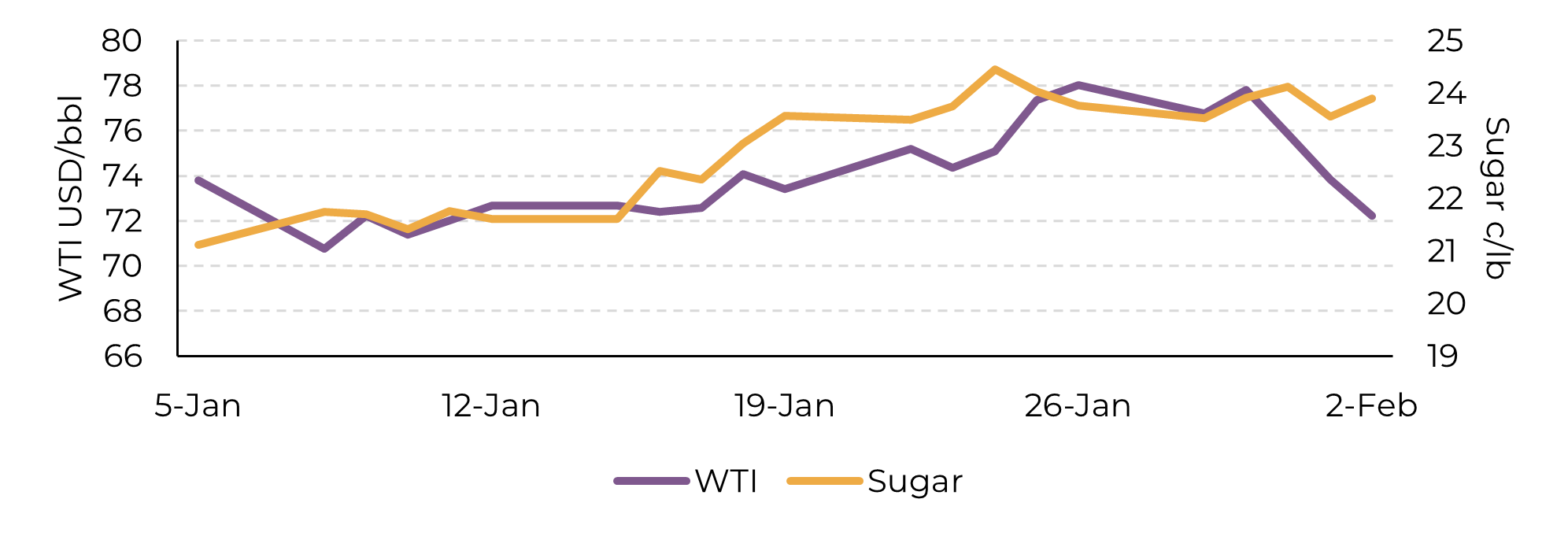

- Last week witnessed macro-driven market movements, with interest rate decisions and geopolitical tensions influencing prices. Sugar prices saw a correction, settling at 23.5 cents per pound on Thursday only to recover some ground on its last session.

- India's sugar production estimates were adjusted upward, sparking conversations about ethanol diversion and potential market effects. However, our projections already accounted for a volume higher than the market average, remaining unchanged.

- Traders are closely monitoring weather conditions in Brazil for both the current and upcoming crop seasons. While cane yields have been great, allowing for even higher sugar production than previously anticipated, current dry weather worries the market as abundant rainfall is crucial for crop development.

- For now, the market just doesn't seem to have enough reasons to have a significant return to the 28 c/lb level seen previously. Although there is demand acting, we may find ourselves confined within a range until key variables provide a clearer indication, with weather being the primary determinant.

Last week saw predominantly macro-driven movements in the market. After the U.S. Fed opted to maintain interest rates unchanged on Wednesday, prices nearly erased all gains registered in the preceding two sessions by Thursday, settling at 23.5 cents per pound. The "risk-off" sentiment gained momentum as Israel contemplated a potential ceasefire. Despite ongoing conflict in the Middle East, the mere mention of a possible agreement prompted a retreat in the energy complex, with both Brent and WTI experiencing approximately a 7% drop each. Nevertheless, it's noteworthy that despite some correction in sugar prices, the sweetener managed to hold its position close to 24c/lb by the end of the week.

Image 1: The energy complex was hit by macro and geopolitical developments

Source: Refinitiv, hEDGEpoint

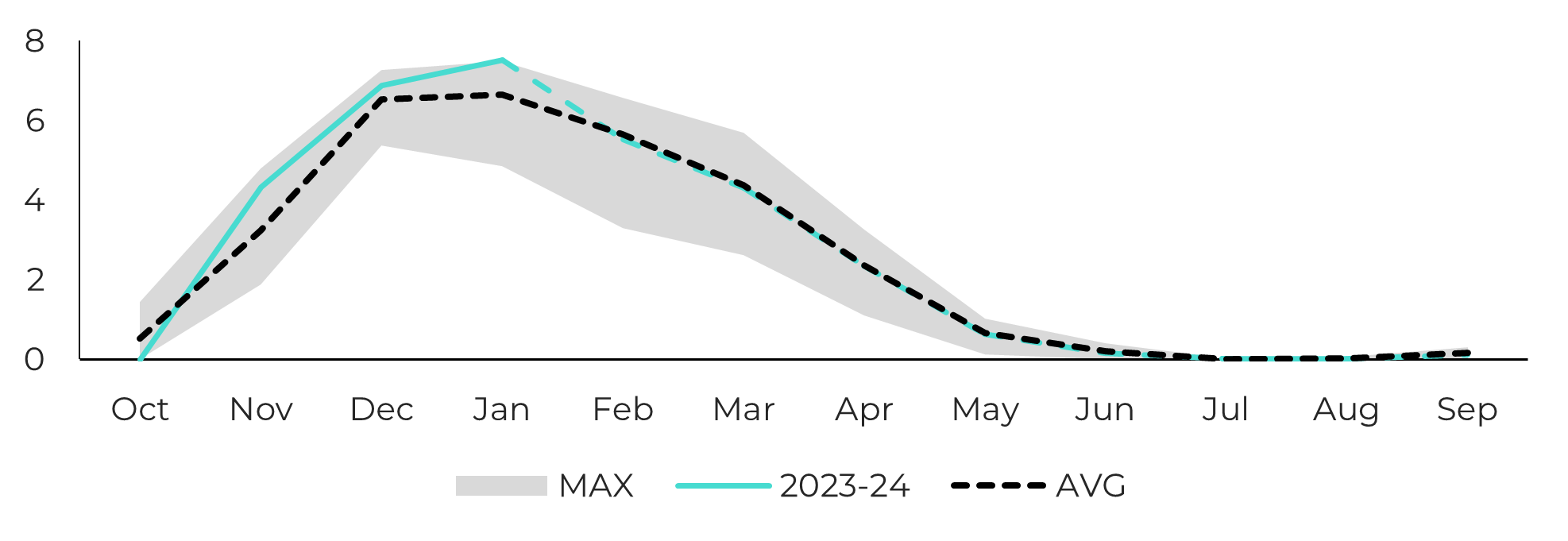

Fundamentally, there have been minimal changes, particularly as we were already more optimistic about India's 23/24 crop compared to the market average. Hence, the upward revision of the country's availability by ISMA and other agencies did not catch us by surprise; in fact, the volumes are now almost in line. While we kept our estimates unchanged at 31.8Mt of sugar production after 1.7Mt diversion, ISMA now considers 31.35Mt, a number that a couple of months ago was tittering towards 29Mt. Pushed by the excellent January results, which closed the gap between 23/24 and 22/23 to -3%, compared to -7% the month prior, these changes in availability also reflected on higher demand for ethanol diversion. Of course, building stocks is a priority, but the second in line is the biofuel program.

Image 2: India’s sugar production (Mt)

Source: ISMA, hEDGEpoint

According to ISMA, the current situation could drive the government to allow another 1.8Mt of sugar to be diverted to ethanol production. The NFCSF agrees, but at a lower volume, stating that it would be possible to divert 1.5Mt more. In any case, a higher ending stock could be a bearish sign for the long term – India could go back to the game if weather cooperates.

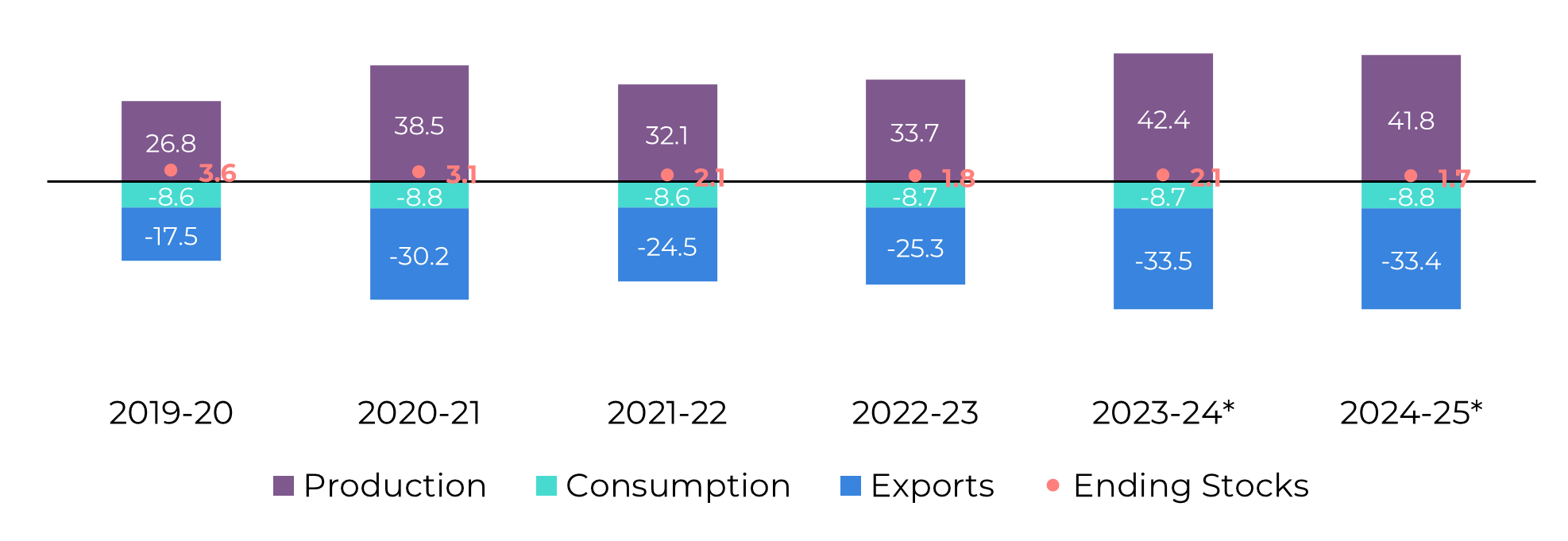

Meanwhile, traders continue to closely monitor the weather conditions in CS Brazil. The development of 24/25 seems to vary across microregions, with some having greater exposure to dryness than others. However, there are still several weeks remaining in the intercrop period, extending through early March, during which rainfall could improve overall conditions. About 23/24, last cumulative yield results reported by Centro de Tecnologia Canavieria (CTC) suggests that the region can achieve over 655Mt of cane and produce 42.4Mt of sugar. The index reached 87.5 t/ha, an impressive growth compared to last season’s 77.2 t/ha. Our 24/25 estimates remain unchanged.

Image 3: Center-South sugar balance (Mt Apr-Mar)

Source: UNICA, MAPA, SECEX, Williams, hEDGEpoint

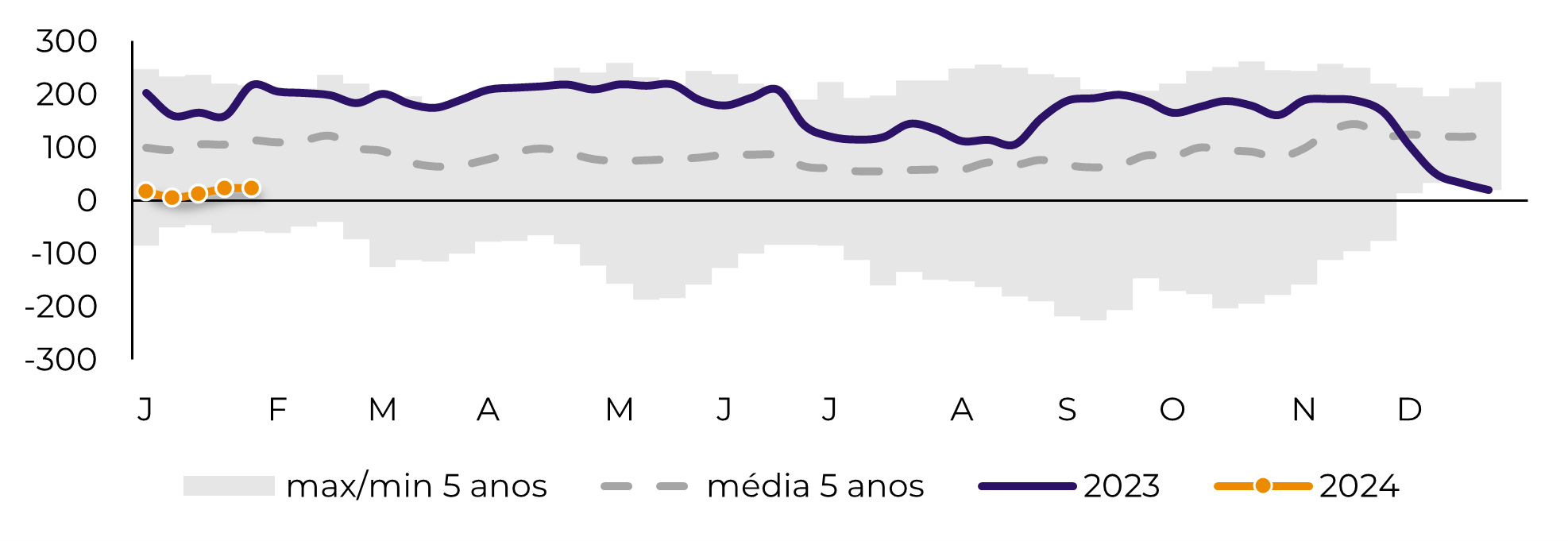

Since none of these developments appear to be particularly surprising to the market, its activity remains subdued, with funds comfortably waiting for a better reason to come back in. This neutral stance aligns with our current globally balanced scenario, where various factors could potentially influence prices. These include deteriorating crop development conditions in the Center South, the outlook for the Northern Hemisphere's 24/25 season, or demand fluctuations either higher or lower than anticipated.

For now, the market just doesn't seem to have enough reasons to have a significant return to the 28 c/lb level seen previously. Although there is demand acting, we may find ourselves confined within a range until key variables provide a clearer indication, with weather being the primary determinant.

For now, the market just doesn't seem to have enough reasons to have a significant return to the 28 c/lb level seen previously. Although there is demand acting, we may find ourselves confined within a range until key variables provide a clearer indication, with weather being the primary determinant.

Image 4: Net speculative positioning (‘000 lots)

Source: ICE, Refinitiv, hEDGEpoint

In Summary

Sugar market wasn’t exactly surprising this past week, leading to a more stable market activity and funds comfortably waiting for a reason to come back. India’s additional availability would first be diverted to ethanol rather than hitting the international market, meaning little for the current season availability and trade flows. However, it does post some bearish warnings for 24/25. Meanwhile, Brazil is still registering excellent 23/24 crushing and yield results.

Going forward, weather is the key variable to monitor to grasp where the market is heading. If it turns positive for cane developing in Center-South’s remaining intercrop weeks, we could have a healthy 24/25 season.

Weekly Report — Sugar

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.