Sugar and Ethanol Weekly Report - 2024 02 12

"We have much to monitor, from a possible La Niña formation to Brazil’s 24/25 crop season cane development. Regarding the latter, it is still rather soon to change our original 6% reduction to cane yields: precipitation was “ok” until November, and December and January dryness were scattered. NDVI levels do not pose a threat, but February and March, if also dryer, might be the spark that the bulls have been waiting for to try to drag prices up a little longer.

How bad is the weather in Center-South?

- Weather remains a key factor in the sugar market, with recent adverse conditions in the Northern Hemisphere contributing to sluggish cane growth and market support.

- Models suggest a potential 6% reduction in cane yields in the Brazilian Center-South region for the 24/25 season, potentially dropping from nearly 655Mt to 620Mt, though historical trends could push this decrease to 7.2%.

- While rainfall improved in the first half of January, the latter half failed to offset December's soil moisture drop, particularly in regions like Ribeirão Preto. However, some areas like São José do Rio Preto, Araçatuba, and Bauru saw more favorable conditions, mitigating concerns to some extent.

- Funds are sitting silently still, only waiting for the next big news, and weather might be just what they've been waiting for. We have much to monitor, from a possible La Niña formation to Brazil’s 24/25 crop season cane development.

Weather always played an important role in the sugar market. Its impact has remained pivotal over the past 2-3 years, especially following Brazil's significant crop disruption in 2021-2022. More recently, adverse weather conditions in the Northern Hemisphere induced sluggish cane growth and bolstered market support. The 23.8 c/lb level seen in early February for the raw sugar is about 40% higher than the 23-year average considering the same period. For Whites, the gap is larger: prices are currently 45% higher. This makes explicit that the market is navigating a much tighter scenario, with more demand and supply disruptions. In this context, understanding weather effects on future availability becomes essential.

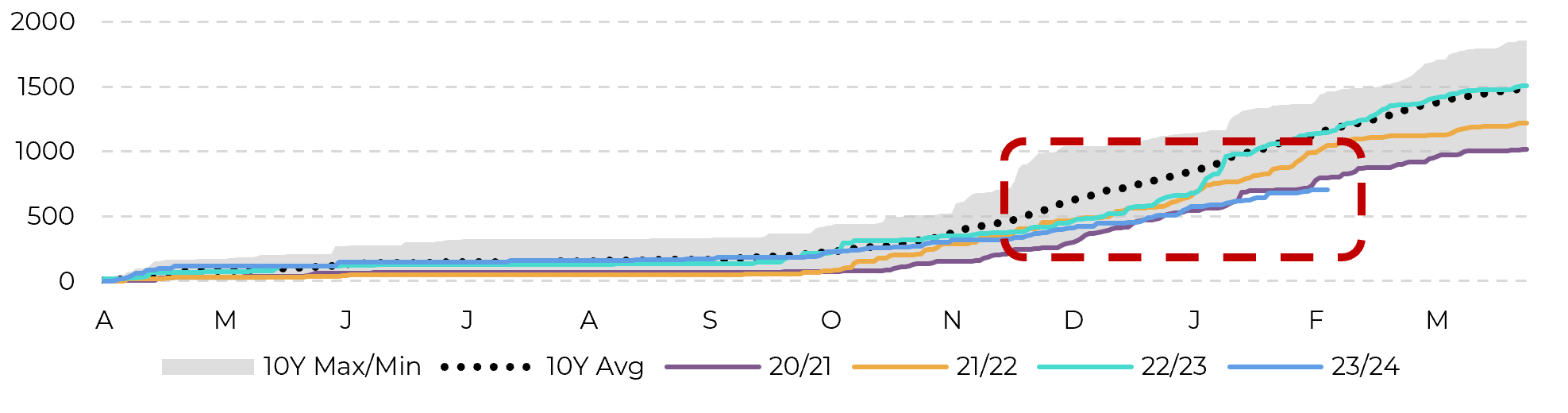

As discussed in previous reports, our models pointed out that cane yields in Center-South can suffer at least a 6% reduction in 24/25, inducing a drop from nearly 655Mt to 620Mt. However, if we also factor in historical trend, this variation becomes 7.2% and leads to 611Mt. Of course, we still think it’s too soon to peg on the recently dry weather, but it is something to watch out closely.

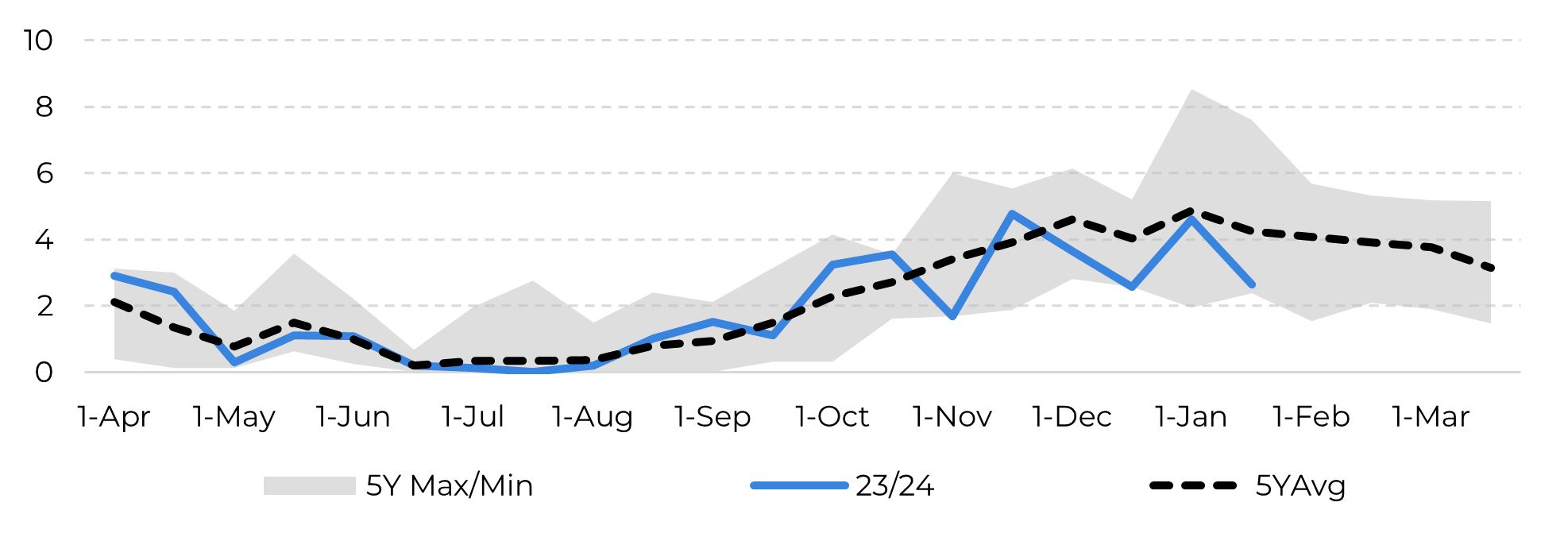

Image 1: Lost Days Estimate (nº of days)

Source: Bloomberg, hEDGEpoint

Although rainfall improved during the first half of January, the latter half presented a contrasting outcome, resulting in insufficient performance for the month to counterbalance the decrease in soil moisture observed in December. At least in some regions.

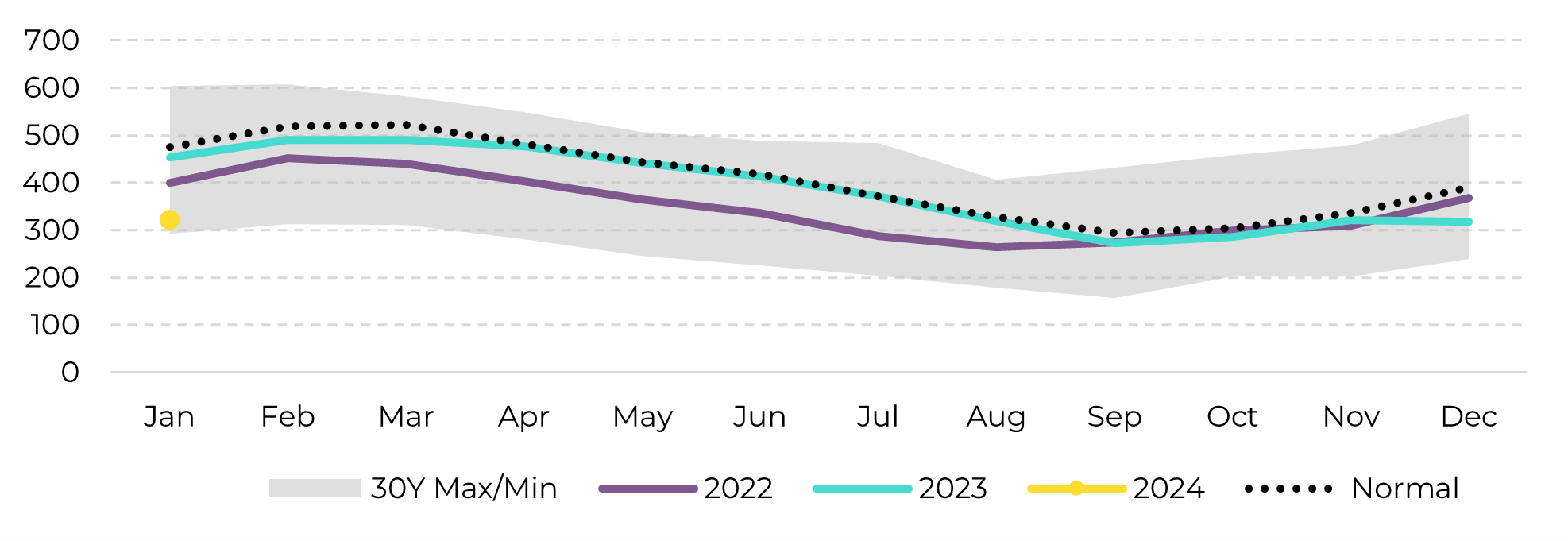

Image 2: São Paulo Average - soil moisture in the cane areas (mm in top 0-1.6m soil)

Source: Refinitiv, hEDGEpoint

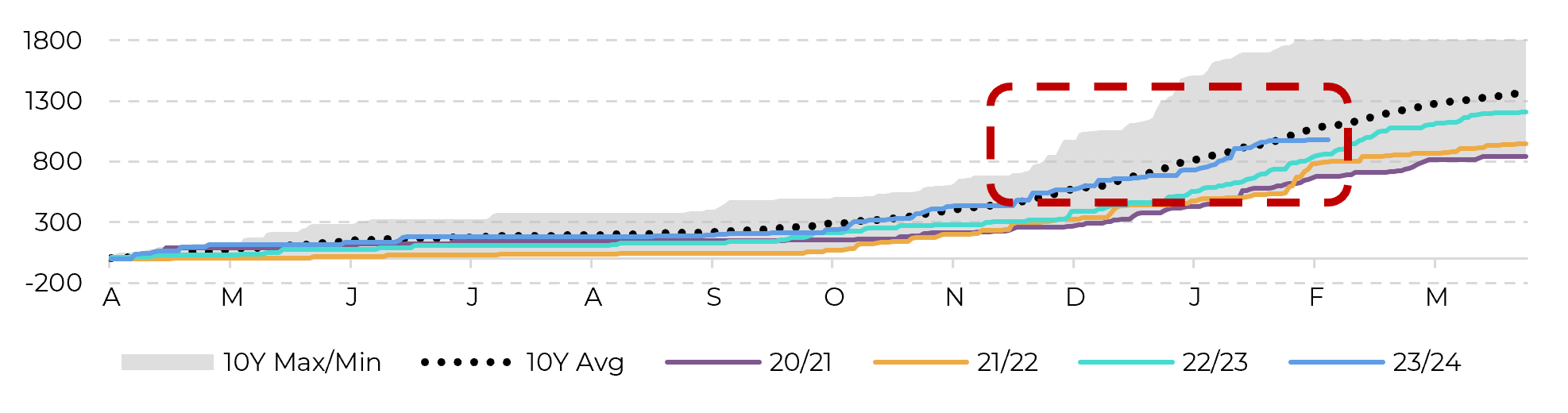

The difficulty in estimating a further reduction to Center-South’s output relies on the fact that rains were quite uneven and scattered throughout the entire region. While Ribeirão Preto, responsible for about 14% of Brazil’s total cane production, received well-below-average precipitation and remains at the lower end of historical values, São José do Rio Preto is close to average. The latter is estimated to account for 10% of Brazil’s total cane availability and, together with Araçatuba and Bauru, which account for 6 and 5% of the total cane volume, ease some of the worries.

Image 3: Cumulative Precipitation Ribeirão Preto (mm)

Source: Bloomberg, hEDGEpoint

Image 4: Cumulative Precipitation São José do Rio Preto (mm)

Source: Bloomberg, hEDGEpoint

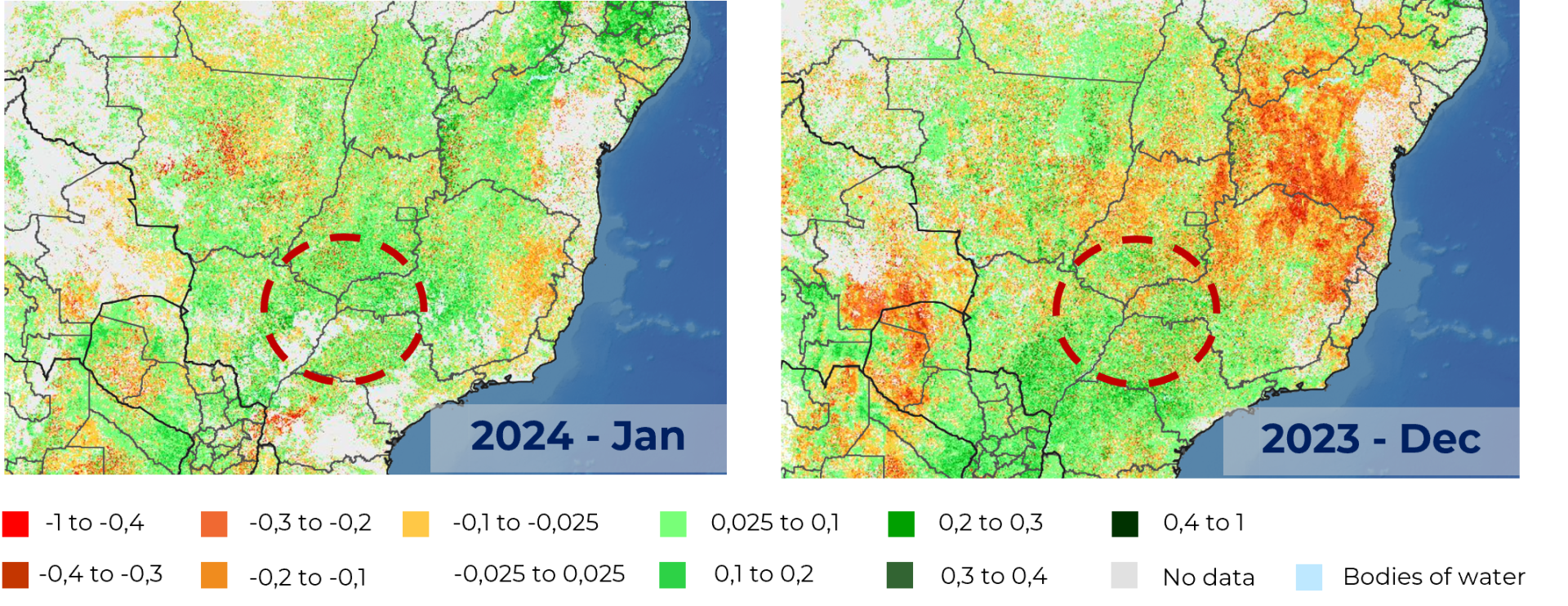

Therefore, some regions were more affected than others – and, overall, soil moisture is not encouraging. However, the region’s NDVI (Normalized Difference Vegetation Index), which measures the plants’ ability to absorb sunlight, improved during the month. This is highly used to measure and monitor plants’ health, as crops that have a better sunlight absorption during its early stages of development can have improvements on yields.

Image 5: NDVI Anomaly

Source: USDA

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.