Sugar and Ethanol Weekly Report - 2024 02 19

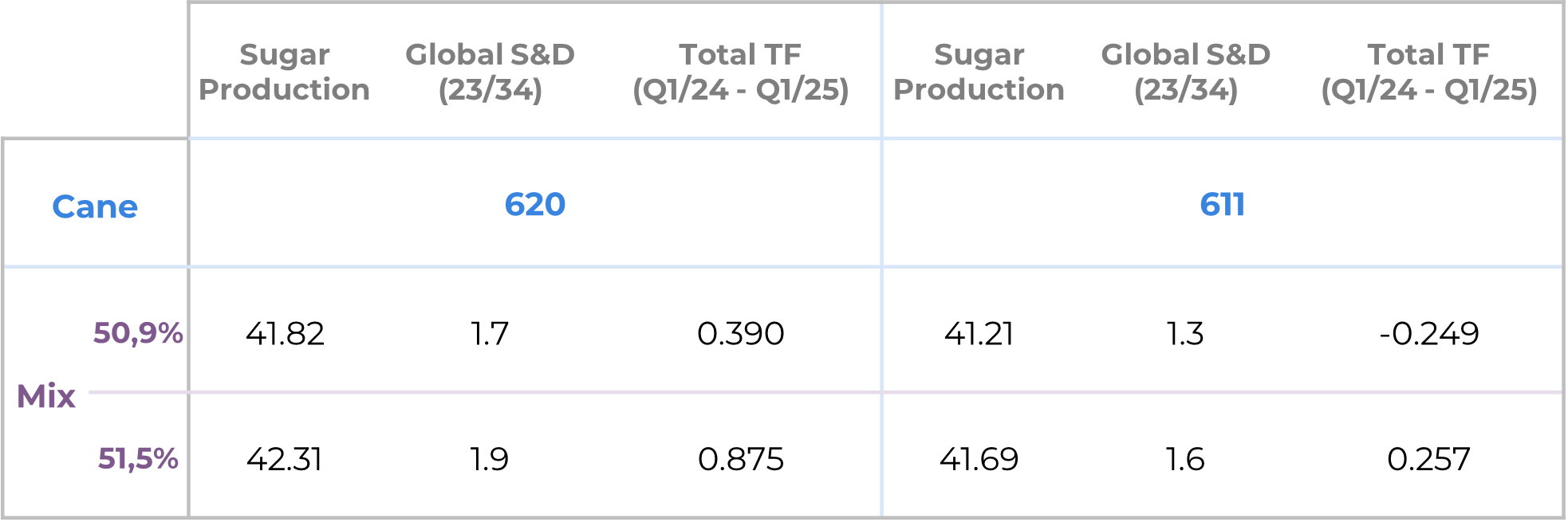

"Since rains haven’t been ideal, the question arises: what would happen if Brazil were to produce less cane, thus sugar? Our simulation shows that potential sugar volume ranges from 41.2 Mt to 42.3 Mt, impacting trade flows – but only switching from a small surplus to a small deficit."

What if Center-South only produces 611Mt of cane in 24/25?

- Forecasting Brazilian CS's cane volume and sugar production is challenging due to uneven precipitation across regions.

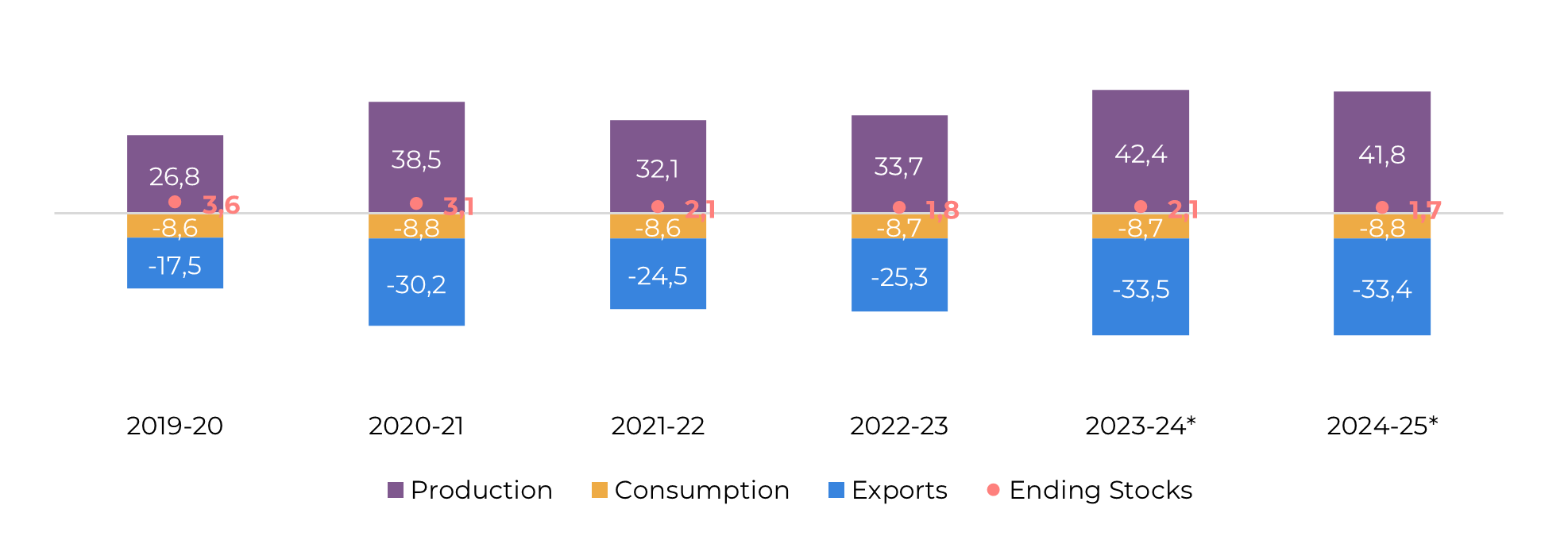

- Assuming stability, Brazil could produce 620 Mt of cane, yielding approximately 41.8 Mt of sugar and 33.3 Mt for export. This base case leads to a well-balanced global trade flow, in line with price action and fund positioning.

- However, since rains haven’t been ideal, the question arises: what would happen if Brazil were to produce less cane, thus sugar? Our simulation shows that potential sugar volume ranges from 41.2 Mt to 42.3 Mt, impacting trade flows – but only switching from a small surplus to a small deficit.

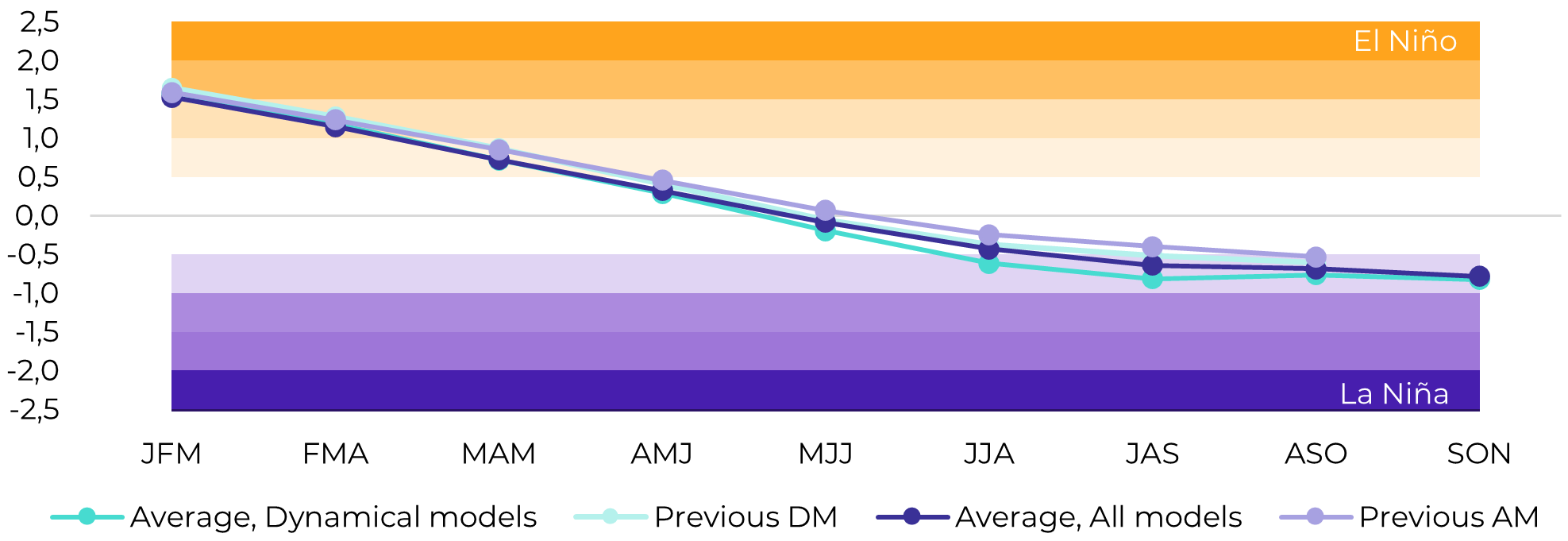

- Risks include sharper yield drops and the influence of the La Niña pattern. Short-term price support is expected during Brazil's intercrop period, but its gains could be capped by lower precipitation boosting late sugar production.

In our previous report, we discussed how challenging it is to forecast Brazilian CS's next season’s cane volume and, thus, sugar. The main reason behind the difficulty is that precipitation was quite uneven and scattered throughout the entire region. While key cane-producing microregions like Ribeirão Preto and Triângulo Mineiro experienced below-average rainfall, others such as São José do Rio Preto and Araçatuba saw more typical precipitation levels. Additionally, we've observed that some entities anticipate a significantly higher expansion in sugar mix compared to our projection. While we acknowledge that substantial investments have been made in crystallization, the exact extent of these investments remains uncertain. As a result, our estimate of 50.9% may be considered conservative by some. Consequently, there are two variables to explore:

- The possibility of lower cane;

- A higher sugar mix.

Image 1: Brazilian Center – South Supply and Demand Estimates (Mt)

Source: Unica, MAPA, SECEX, Williams, hEDGEpoint

Firstly, it's essential to emphasize that the analysis we are about to undertake assumes that everything else remains constant (ceteris paribus). Our current estimate suggests that Brazil could produce 620 Mt of cane. With a 50.9% sugar mix, this would yield approximately 41.8 Mt of sugar and 33.3 Mt for export, ensuring balanced trade flows.

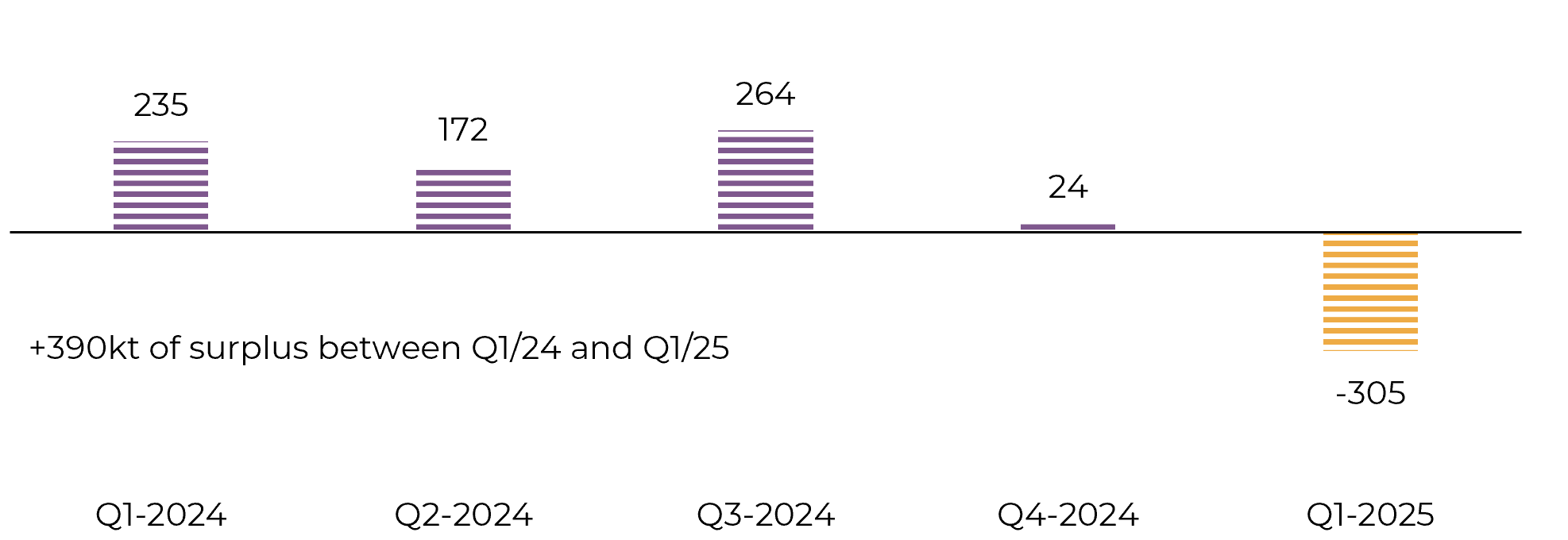

Image 2: Total Trade Flows (‘000t tq)

Source: Green Poll, hEDGEpoint

According to our cane yield model, the potential range goes from 79.7 to 82.8 t/ha, with our base case at 80.8 t/ha. Assuming a yield of 79.7 t/ha and the same small increase in cane acreage, its total volume would amount to 611 Mt. Now, the question arises: How much sugar can be produced from this quantity of cane?

Depending on the sugar mix, sugar volume can vary between 41.2Mt and 42.3Mt. The latter would guarantee a more bearish outlook, with an 875kt surplus in the total trade flows between Q1/24 and Q1/25, while the former is more bullish at -249kt for the same period. It's important to note that regardless of the specific scenario, the market appears to be quite balanced, with Brazil playing a significant role by contributing to this situation with its second-best production year.

Image 3: Brazilian CS Production Simulation (Mt)

Source: Bloomberg, hEDGEpoint

Image 4: ENSO Nino 3.4 ONI – El Niño, La Niña, or Neutral

Source: Columbia, hEDGEpoint

A less severe climate event might positively impact sucrose concentration in the Center South and aid crop development in the Northern Hemisphere. However, should the event be more intense, it could potentially reignite the bullish trend penalizing availability. Currently, the ENSO forecast shows an increase in the probability of the weather pattern starting in June.

In the short-term, as we enter Brazil’s intercrop period, prices might find support, especially given the approach of Ramadan festivities. However, lower precipitation in Center-South keeps boosting 23/24 late sugar production. In total, the region has already crushed 646Mt and produced 42.1Mt of sugar.

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.