Sugar and Ethanol Weekly Report - 2024 02 27

"As we approach the expiry date of the March contract, typical price fluctuations have been observed. However, the market continues to be cautious, with funds showing reluctance to buy, evidenced by decreased positioning levels. "

A quick take on sugar

- As we approach the expiry date of the March contract, typical price fluctuations have been observed.

- Prices corrected in response to improved market perceptions regarding India and Thailand's 23/24 availability.

- The market sentiment has been cautious, with funds showing reluctance to buy, evidenced by decreased positioning levels. Furthermore, concerns about a reduced crop in 24/25 prompted a reaction in prices, particularly affecting the March contract, while the May contract has been less responsive, possibly because the latter is not under the "delivery effect“ as is the former.

- Despite these fluctuations, the Center-South region remains supportive of a well-balanced short-term trade flow.

- The region’s 24/25 availability remains contingent upon weather improvements

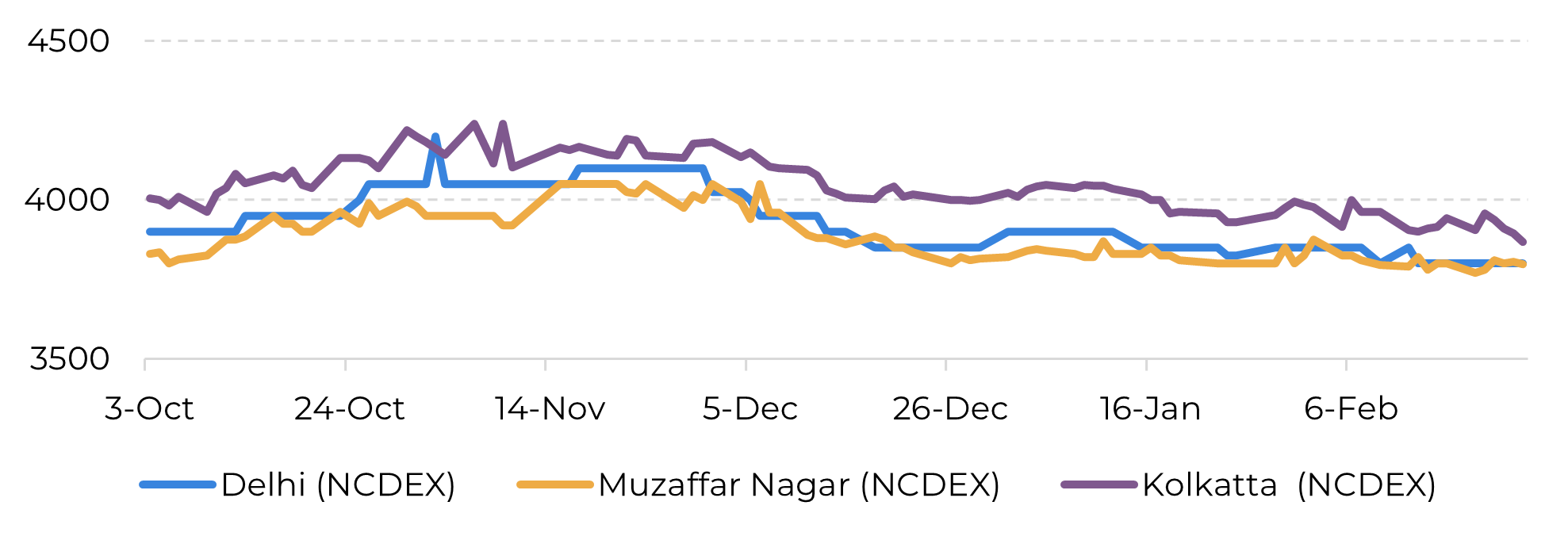

As we approach the March contract expiry date, it is quite common to experience some price action. Last week we saw prices correcting as market perception regarding India and Thailand’s 23/24 availability improved. We kept our estimates unchanged but note that we were already more optimistic than most, with nearly 32Mt for India ( 31.85Mt) and 8.2Mt for Thailand’s output.

Regarding India, crushing figures and diminishing domestic prices suggest that the country will restock a healthy amount this year. Of course, we remain firm that there will be no export allowances during this season. Still, if extremely necessary for preventing price collapse, the only movement we see that the government might feel compelled to take is to allow additional ethanol diversion.

Image 1: Sugar Spor Ptices (M Grade – INR/qtl.)

Source: Bloomberg , hEDGEpoint

In terms of Thailand, the country’s crushing suggests a crop failure compared to the previous year. However, the pace remains strong, with over 1Mt being crushed on a daily basis. Some might argue that this could even suggest a higher production volume than our current estimate, but we should remain cautious – the central region and north-east are already showing end-of-season signs.

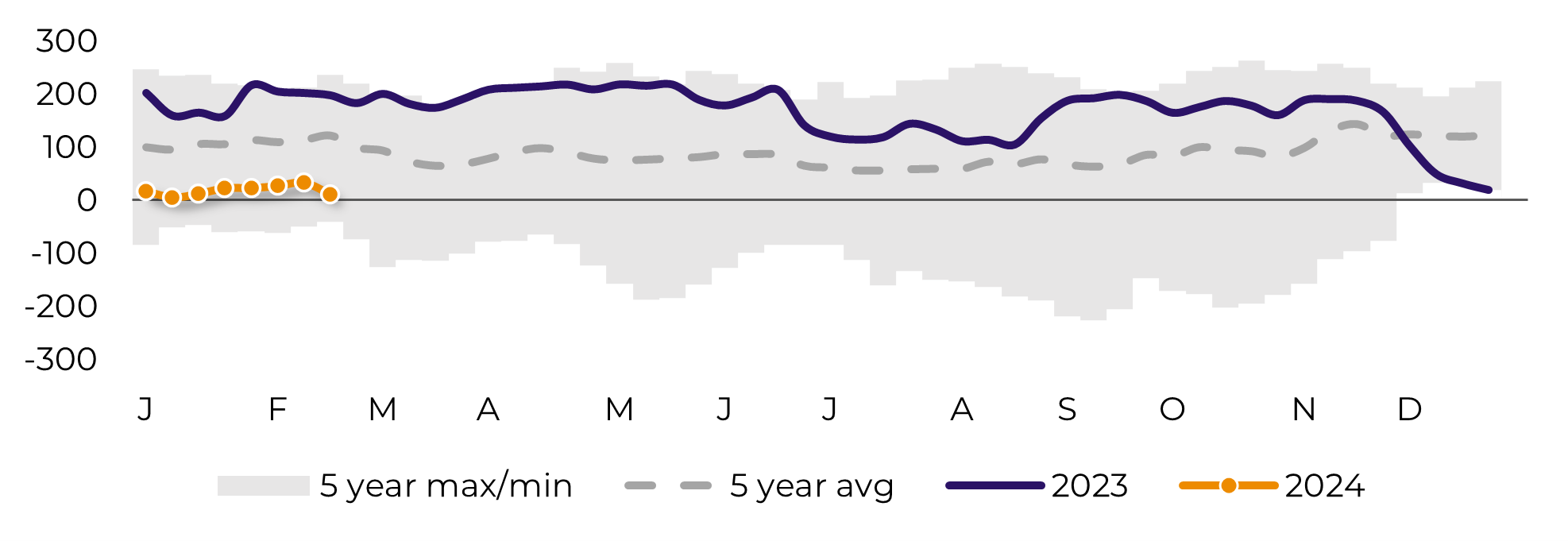

Those news were not exactly encouraging, meaning that funds are not in a good mood for buying. CFTC last data shows a net variation of 22,700 lots, leading total positioning to nearly 11 thousand lots long – the lowest level since January 9th.

Image 2: Speculative Positioning in Raw Sugar Contracts (‘000 lots)

Source: Refinitiv, hEDGEpoint

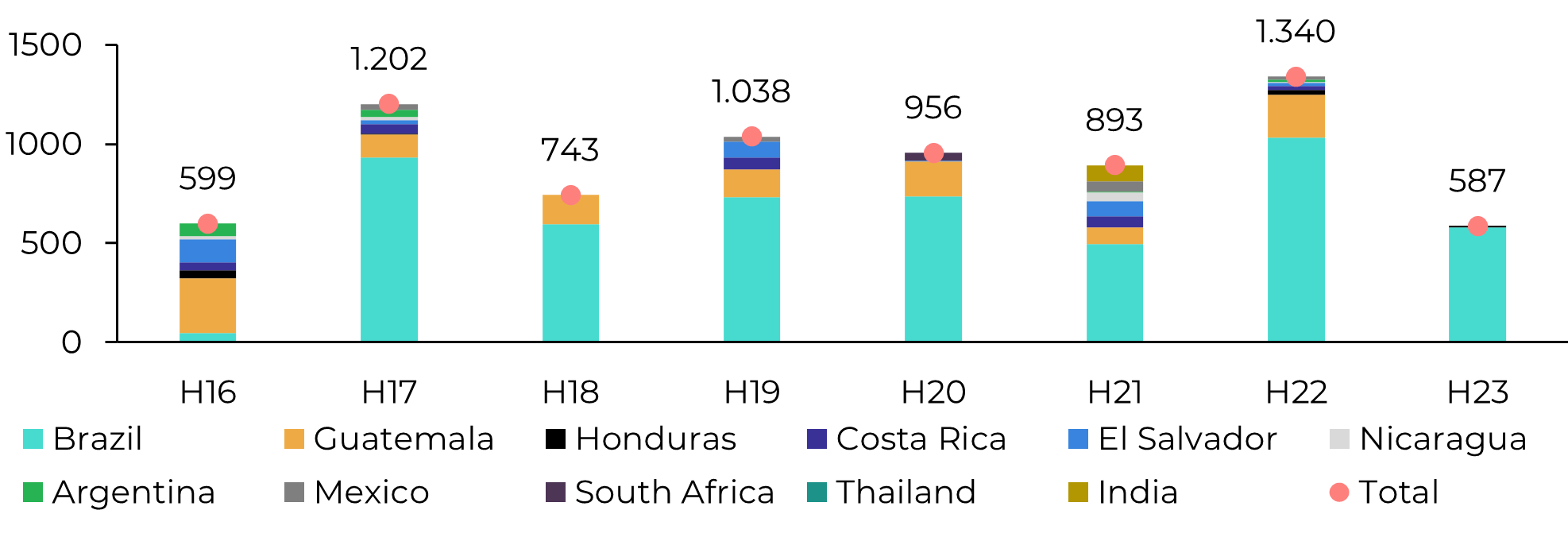

Although there was a reaction in prices yesterday, prompted by some Center-South producers expressing concerns about a reduced crop in 24/25, the market is not so worried about the March contract anymore – and it has little reason to close on a higher note. Open interest is nearly the double compared to a year ago and is 1.14 times higher than the preceding year, when Center-South delivered over 1Mt. The heightened crushing activity during the intercrop period and the record availability suggest the possibility of a substantial delivery occurring this week, which could act as a ceiling on potential gains.

Image 3: March Contract Delivery per Country (‘000t)

Source: ICE, hEDGEpoint

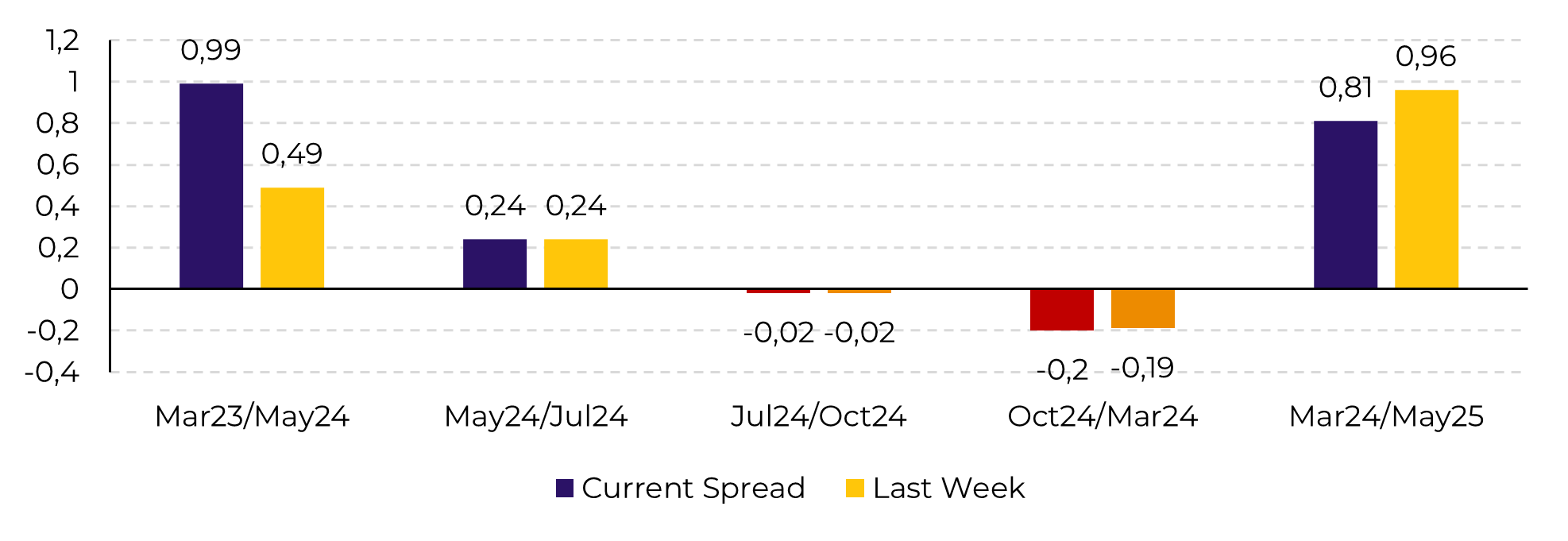

Image 4: Raw Sugar Spreads (c/lb)

Source: Refinitiv, hEDGEpoint

In our prior analysis, we highlighted that even with a potential decrease in cane output to around 611Mt, the Center-South region could still maintain a relatively balanced global scenario. As February nears its conclusion, it seems probable that the May contract will continue trading within a similar range as the March contract did previously.

The primary concern continues to be the weather: will there be improvement? How much of the current dry spell is irreversible? However, we believe that it remains premature to peg a production figure of under 600Mt for the Center-South region.

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.