Sugar and Ethanol Weekly Report - 2024 03 04

"The market is tilting to the bearish side of the equation with improving prospects in the Northern Hemisphere current crop and Brazil’s capacity to supply the global market. However, as we transition from the March contract to the May one, the next season starts to steal the spotlight and many risks are still on the table. Although we believe it is still too soon to peg a major revision to CS 24/25 cane availability, December and January’s dryness cannot be unaccounted for."

Brazil holds the bearish tone

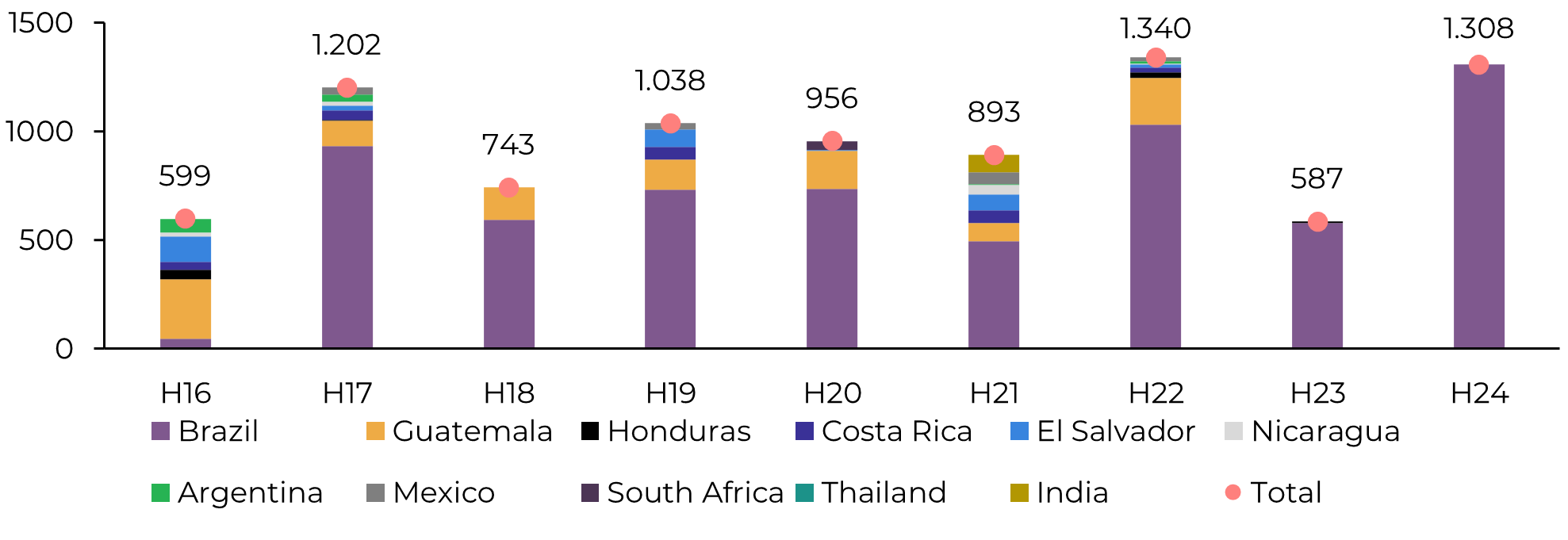

- March sugar delivery surged, matching 2022 levels, with Brazil contributing 1.3 Mt, mostly loaded in Santos.

- May contract faced downward pressure due to high delivery and favorable sugar crops in India and Thailand.

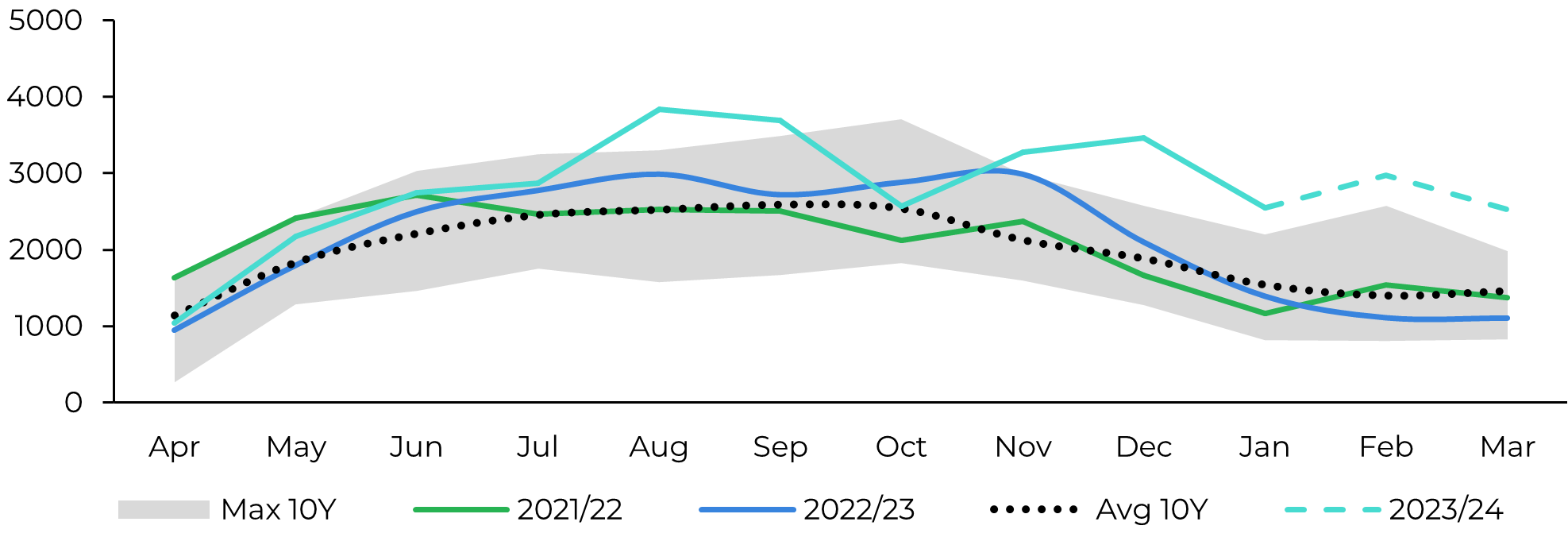

- February 2024 exports from Brazil expected to exceed historical records, potentially reaching over 3 Mt.

- Robust March contract delivery raises expectations for March exports, signaling short-term stability but bearish sentiment.

- Cautious market outlook, with May settling near 21 c/lb, uncertainty over Center-South's 24/25 crop development, and weather conditions remaining crucial.

As anticipated, the March sugar delivery surged significantly, nearly matching levels seen in 2022. Brazil contributed 1.3 Mt on its own. Approximately 980kt are slated for loading in Santos, with the rest distributed between Maceio and Paranaguá. The healthy delivery and a market squeeze led to a final settlement price of 22.58 c/lb – already expected by most market players.

Image 1: Raw Sugar March Deliveries (‘000t)

Source: ICE, hEDGEpoint

The timing of the May contract assuming the forefront proved unfavorable for bullish investors. Not only does a higher delivery underscore the long-debated comfort in the short-term, but recent indicators suggesting that sugar crops in key producers India and Thailand are exceeding initial expectations in the concluding stages of sugarcane harvesting add to the downward pressure.

Additionally, data from Williams indicates that February 2024 is set to remain at the upper range of historical realized data for Brazilian total exports, potentially even surpassing previous records. With approximately 2.75Mt already exported and additional shipments yet to be confirmed, it's conceivable that SECEX could report over 3 Mt in exports for the month.

Image 2: Center-South Exports (‘000t)

Source: Unica, MAPA, SECEX, Williams, hEDGEpoint

The robust March contract delivery performance also heightens expectations for March exports, as Brazil's role as a major contributor underscores both short-term stability and bearish sentiment.

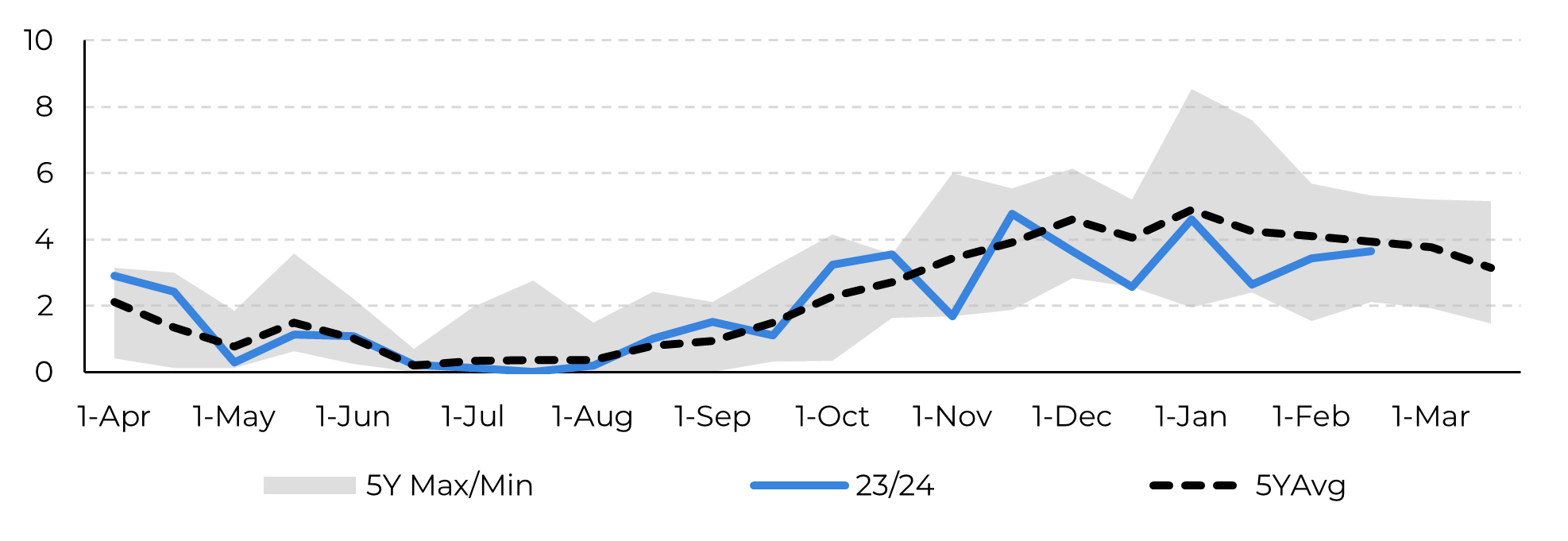

Therefore, it is no wonder why May has not registered gains in its first session, settling close to 21 c/lb, as the market is still cautious, and fundamentals are pointing out a bearish momentum. May/July spread remained rather steady during the week, suggesting there is still no consensus regarding Center-South’s 24/25 crop development, and this is still the main risk that could drive a price reaction. Not having a decent amount of rain could disrupt cane growth, impacting yields directly and resulting in lower raw material availability.

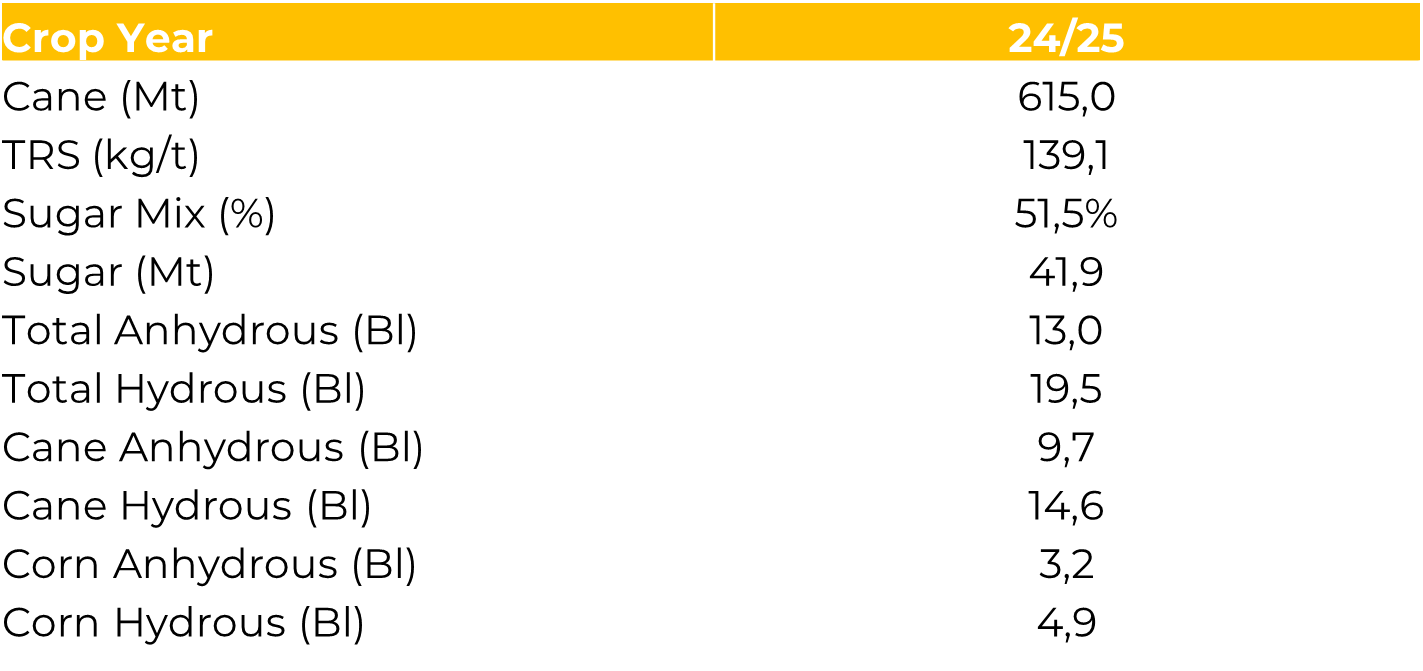

As discussed previously, rains were scattered, but improved during February. Therefore, we believe that it is still premature to peg a major crop reduction, but December and January’s dryness cannot be unaccounted for. In response, we've adjusted our cane expectations down from 620Mt to 615Mt. However, keep in mind that there's still time for cane to mature, especially given that mills still have some volume left from 23/24 to crush before starting the new season, possibly allowing for further development. Not to mention that cane average age is a little bit younger than in previous seasons.

Image 3: Lost Days Considering a 5mm Threshold (No. Days per Fortnight)

Source: Bloomberg, hEDGEpoint

Image 4: Brazilian CS Crop Update

Source: hEDGEpoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.