Sugar and Ethanol Weekly Report - 2024 03 11

"Sugar prices experienced a slight rebound after insights from international conferences on the upcoming seasons for the Northern Hemisphere and Brazil. However, this strength didn't hold, with the May contract slipping below 21.5 cents per pound. Bullish sentiment stemmed from concerns over a potential 5% decline in sugar production forecast for Brazil's Center-South region in 24/25, which could impact exports."

A week of intense discussions in the sugar market

- Sugar prices experienced a slight rebound after insights from international conferences on the upcoming seasons for the Northern Hemisphere and Brazil. However, this strength didn't hold, with the May contract slipping below 21.5 cents per pound. Bullish sentiment stemmed from concerns over a potential 5% decline in sugar production forecast for Brazil's Center-South region in 24/25, which could impact exports.

- India's optimistic production outlook of 32 Mt for 23/24 contrasts with initial estimates and may be perceived as bearish. AISTA highlights that sugarcane remains the most profitable crop for the average Indian farmer. Despite challenges, a modest reduction in planting area in India could be offset by higher yields if weather conditions cooperate.

- Thailand surpassed expectations with 8 Mt of sugar production by February, potentially reaching 8.5 Mt in 23/24 and close to 10 Mt in 24/25. Global availability could limit price gains, especially if weather conditions favor production in the Northern Hemisphere. Concerns persist over Brazil's crop forecast due to scattered rains

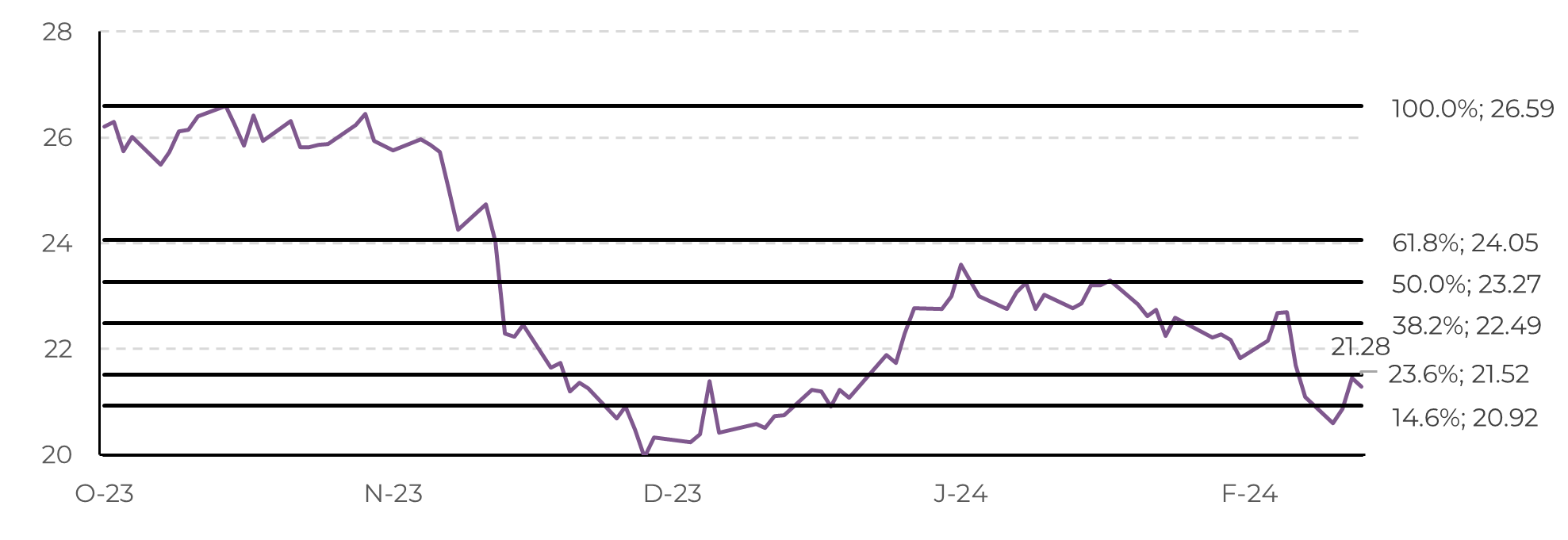

Sugar prices saw a slight rebound as two key international conferences provided insights into the upcoming season for both the Northern Hemisphere and Brazil. However, Wednesday's strength wasn't maintained, and the May contract slipped back below 21.5 cents per pound during Thursday's session.

Image 1: May Contract Retracement Levels (c/lb)

Source: Refinitiv, hEDGEpoint

One of the primary factors driving bullish sentiment in the market was the emergence of a more pessimistic outlook among certain market participants regarding the sugar production forecast for the Center-South region in 24/25, which happens to be the leading global sugar producer. Some analysts projected a 5% decline, suggesting that sweetener's availability could potentially decrease to around 40.5 Mt. This alone could be interpreted as bullish, particularly as it would result in a 1.2 Mt reduction compared to our current estimates, directly impacting exports. This could mean a bullish medium/long term trend as it would intensify an expected deficit for the 24/25 period (October to December) and possibly add strength to the N/V contango. However, the idea of a deficit is not yet a consensus, especially considering the short-term inverse and improvements in Northern Hemisphere crop results: if weather cooperates, further improvements could be expected.

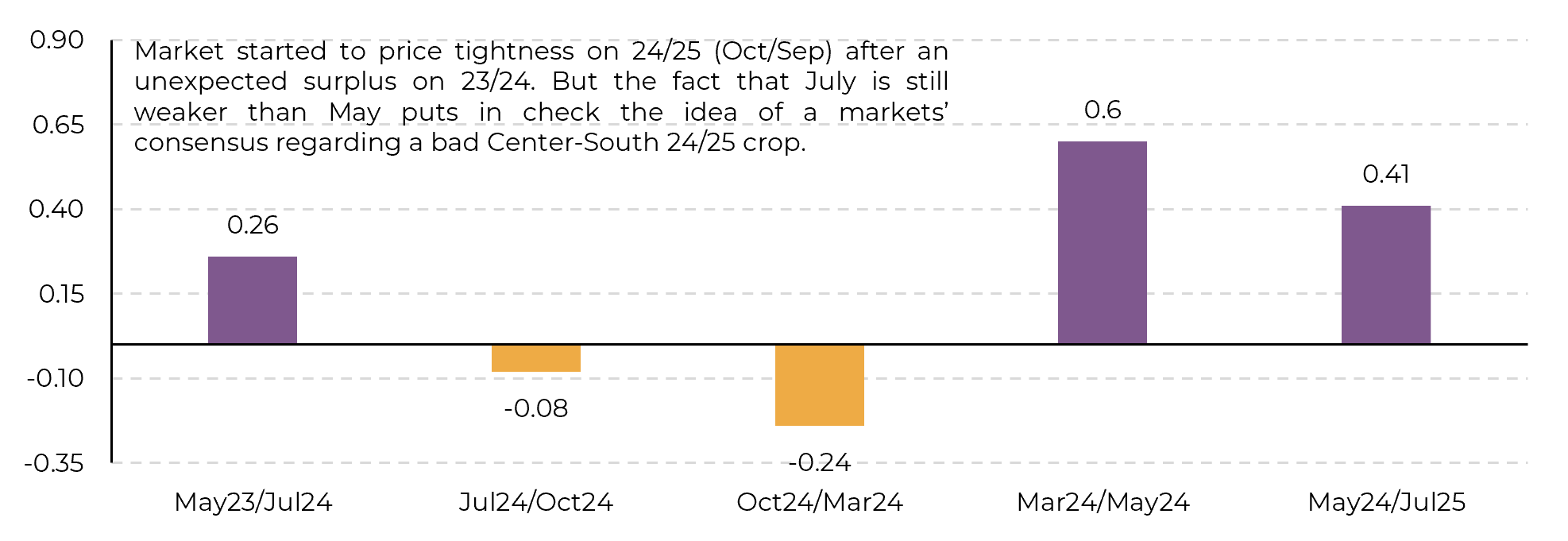

Image 2: Raw Sugar Spread (USc/lb)

Source: : Refinitiv, hEDGEpoint

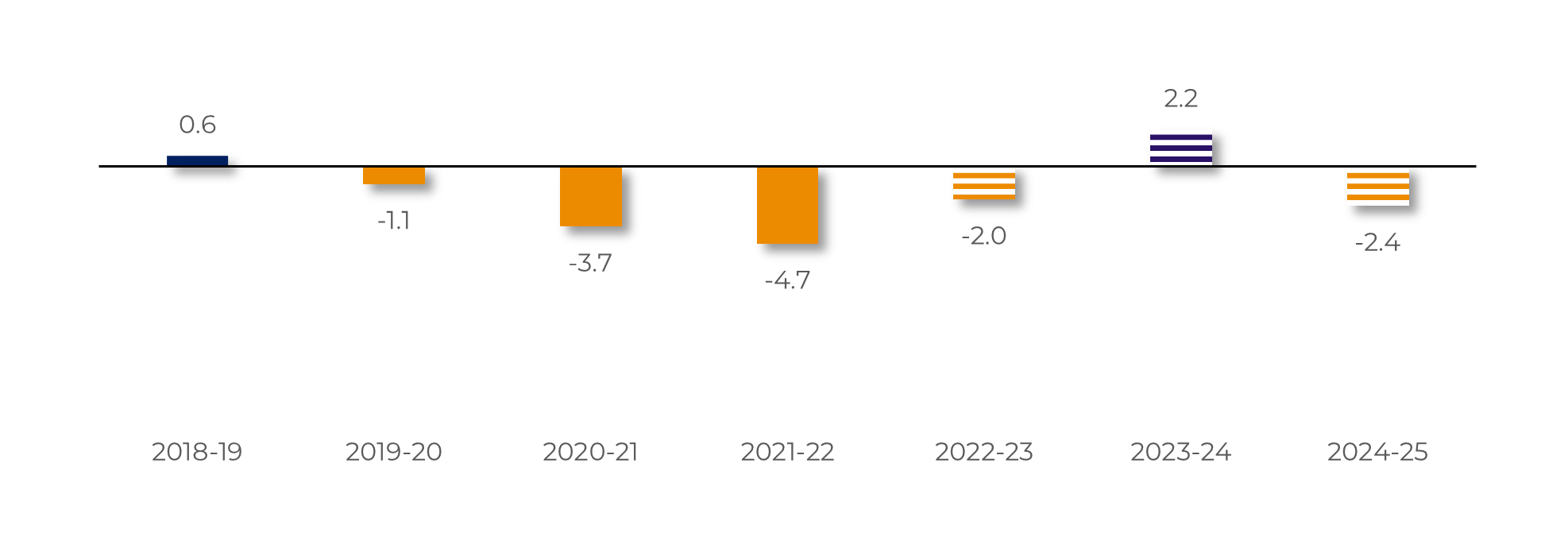

The Northern Hemisphere faced challenges with adverse weather during the 2023 summer, primarily due to the influence of El Niño. However, recent reassessments by Indian officials have painted a more optimistic picture for the upcoming season. According to AISTA's presentation at the Dubai Conference, India is projected to produce approximately 32 Mt of sugar in the 23/24 season, closely aligning with our previous estimates of 31.85 Mt. This upward revision suggests that the country could replenish its sugar stocks by around 3.5Mt.

This forecast contrasts with the initial market expectations, which estimated production to be under 30 Mt at the season's outset. Consequently, this revised outlook may be perceived as bearish for both the 23/24 and 24/25 seasons. Despite reports of reduced planting in the southern Indian states for the 24/25 season due to drought conditions, AISTA highlights that sugarcane remains the most profitable crop for the average Indian farmer. In this sense, why should area drop sharply?

Nevertheless, assuming a decrease in planting area does occur, a modest 2% reduction could be offset by higher yields if weather conditions cooperate, particularly if La Niña's impact proves to be less severe. In such a scenario, India could potentially redirect 5.5Mt of sugar towards its ethanol program without depleting its stock reserves. Subsequently, the decision to export approximately 1Mt or allocate it to domestic stocks would hinge on prevailing domestic and international price dynamics and government policies.

Image 3: Sugar Global Supply and Demand (Oct-Sep MT RV)

Source: Green Pool, hEDGEpoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

Victor Arduin@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.