Sugar and Ethanol Weekly Report - 2024 04 02

"It is still premature to make a decisive call, but, assuming rather stable weather with a mild La Niña, it is possible to discuss a bearish trend for the white premium. While the main raw producer faces a somewhat smaller crop, the Northern Hemisphere could be entering a recovery year. As the latter contributes mostly with whites to the trade flows, its premium over the lower sugar quality might be entering a bearish momentum. "

A little on the fundamentals behind white premium

- The white premium might be entering a bearisher momentum, with Northern Hemisphere’s possible recovery and Brazilian Center-South availability reduction.

- Sensitive topics like India potentially rejoining trade flows as an exporter could be influenced by favorable weather and government decisions.

- Thailand likely to increase sugar production with milder La Niña, with Mexico and Central America also benefitting from favorable weather.

- European market dynamics, including area growth and increased Ukrainian sugar availability, may contribute to global sugar supply.

- Potential shift towards more comfortable white sugar trade flow in Northern Hemisphere might lead to a correction in higher quality sugar prices compared to raws.

While significant attention has been devoted to the Brazilian Center-South’s 24/25 crop issues and forecast reductions, there has been relatively little analysis regarding the prospects of the Northern Hemisphere. This could be attributed to future developments' uncertainty: it is still early to fix numbers. Nevertheless, we believe it is never too soon to start discussing the potential risks and price actions.

Some topics might be a little more sensitive than others, such as the possibility of India rejoining the trade flows as an exporter. Even with weather acting on the region’s favor, this matter would still need to be decided by the government. However, favorable weather could lead to increased production, and thus, participation in the international market from other countries, such as Thailand.

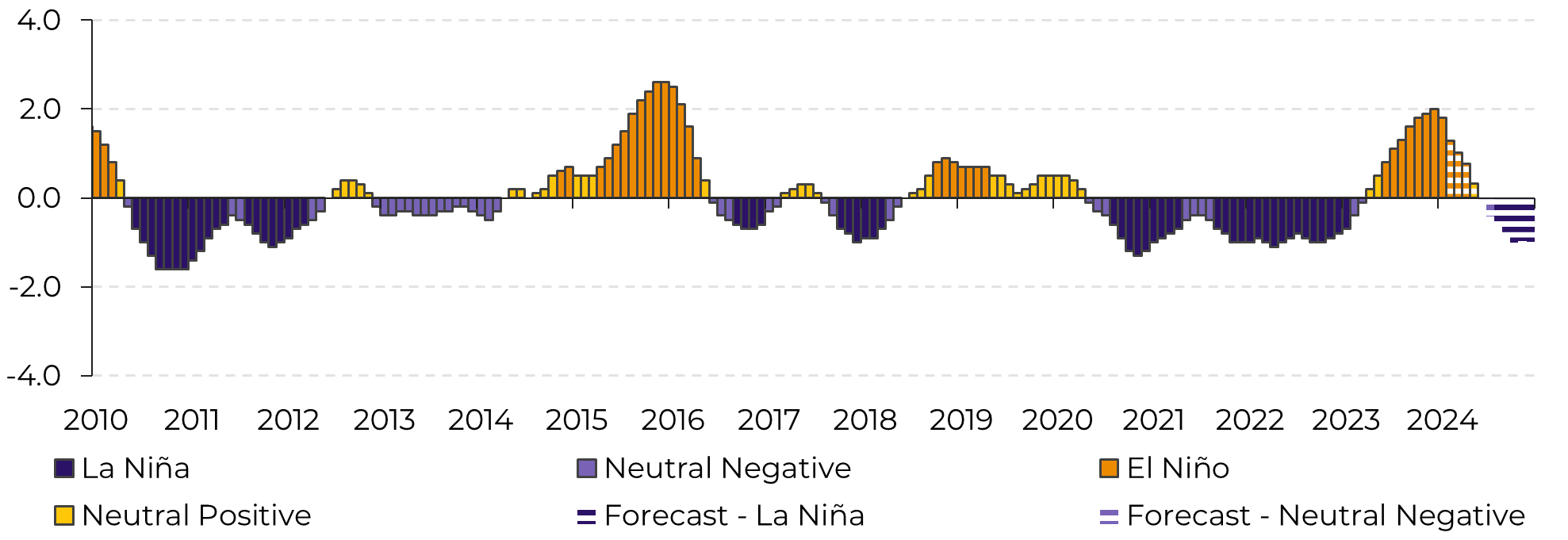

Image 1: ENSO Status – ONI Index (ºC)

Source: IRI, NOAA, hEDGEpoint

As we’ve discussed in previous reports, we wouldn’t be surprised if, with a milder La Niña, Thailand would move closer to 10Mt sugar production in 24/25, as it did over the past two La Niña’s crops, 21/22 and 22/23. But mind that the country wouldn’t be the only one with higher availability.

Mexico and Central American countries could also reap the rewards of these favorable prospects. For example, the 21/22 crop season saw the early formation of the weather event during cane development, yielding excellent results for both Guatemala and Mexico, as well as other players in North and Central America. With the current weather forecasts and the emergence of La Niña a little later in the season, evidence point towards a recovery year, indicating increased regional availability in 24/25.

Furthermore, the European market dynamics adds to this trend. Not only is Europe projected to experience further area growth, ranging between 2 and 3%, but the rise in Ukrainian sugar availability could also enhance the region's involvement in global trade flows. Notably, following the European Commission's removal of tariffs on Ukrainian sugar, imports surged to over 400kt in 22/23 and are anticipated to rise further to 650kt by 23/24, undercutting EU domestic sugar prices. This development has sparked protests across Europe, particularly in France and Poland, from concerned producers. However, the EU has extended its temporary free trade agreement with Ukraine until June 2025. With the potentially higher influx of sugar imports and domestic price corrections, the region could increase its contribution to the global sugar supply.

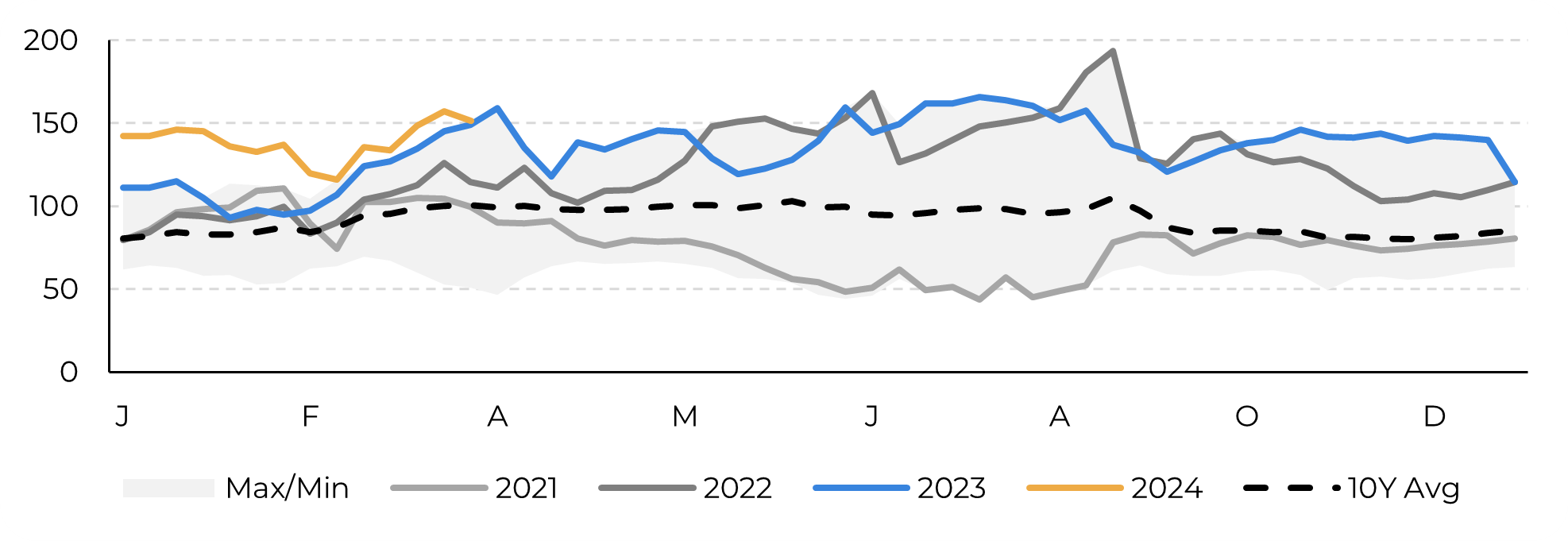

Image 2: White Premium 10Y Weekly Seasonality (USD/t)

Source: Refinitiv, hEDGEpoint

Considering all these factors and recognizing that Northern Hemisphere countries predominantly deal in white sugar, we could be transiting to a more comfortable white's trade flow. Consequently, we could see a more pronounced correction in the higher quality sugar prices compared to raws, which would still find support on the reduced availability from Brazil. Thus, the white premium could be heading towards a bearish momentum.

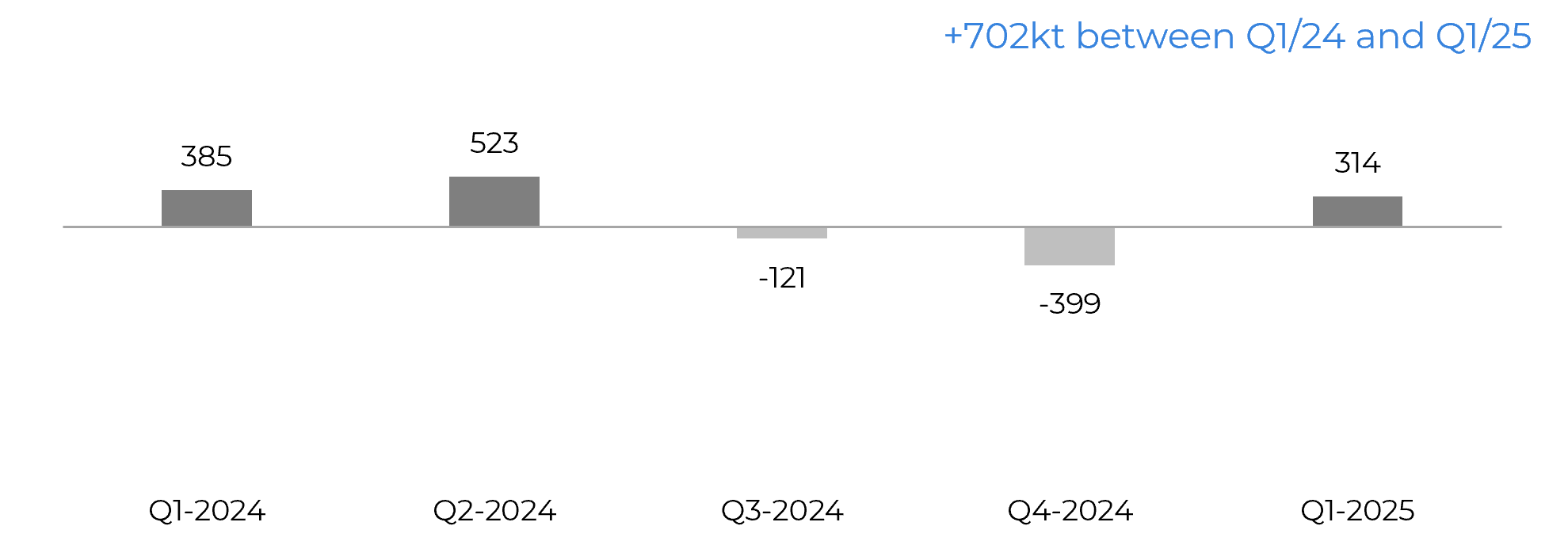

Image 3: Whites Trade Flows (‘000t tq)

Source: Green Pool, hEDGEpoint

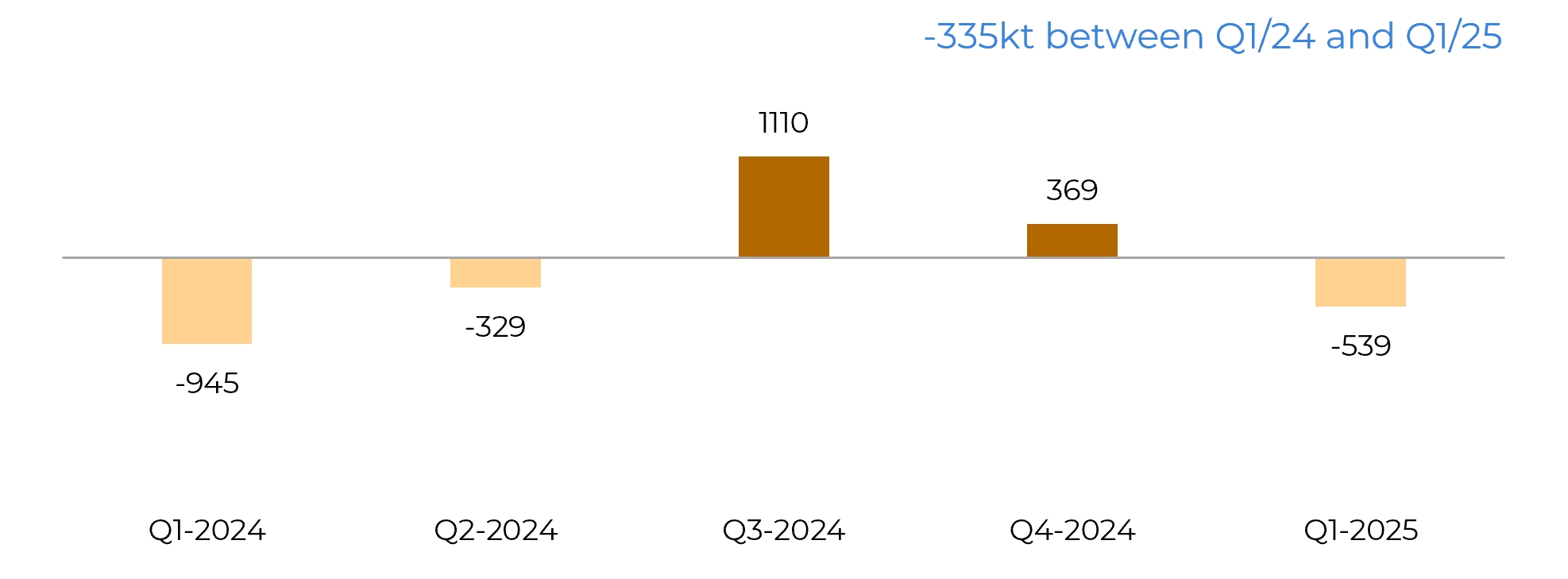

Image 3: Raws Trade Flows (‘000t tq)

Source: Green Pool, hEDGEpoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.