Sugar and Ethanol Weekly Report - 2024 04 08

"ISMA's request for an export quota allowance led to a drop in sugar prices, as India's sugar production for 23/24 is forecasted to reach 32Mt with a surplus of nearly 9Mt by September 30th, 2024 after ethanol diversion. The Pakistan Sugar Mills Association also supported this bearish outlook, seeking export quota allowances due to an anticipated surplus in Pakistan. Raw sugar prices reacted by falling from the 22.7c/lb level, and the market is wary pending government response"

Export requests and we are back at 22c/lb

- Export Quota Request: ISMA's request for an export quota allowance led to a correction in sugar prices. India's projected sugar production for 23/24 is expected to reach 34Mt, with 32Mt available after ethanol diversion. ISMA emphasized that India's sugar stocks could reach nearly 9Mt by September 30th, 2024. They asked for a 1Mt export allowance for 23/24 due to positive prospects for 24/25.

- The Pakistan Sugar Mills Association supported ISMA's bearish outlook, advocating for export quota allowances from the government. Pakistan anticipates a surplus of at least 1.5 million metric tons, which has squeezed margins for sugar mills.

- Raw sugar prices reacted to these export requests, correcting from the 22.7c/lb level. The market is cautious as the government has not responded yet. Allowing both quotas within the 23/24 season would have a bearish impact on prices.

- Allowing exports from India would reverse efforts to stabilize domestic prices, including the ethanol program. The government may focus more on increasing ethanol diversion rather than allowing exports for the current crop season.

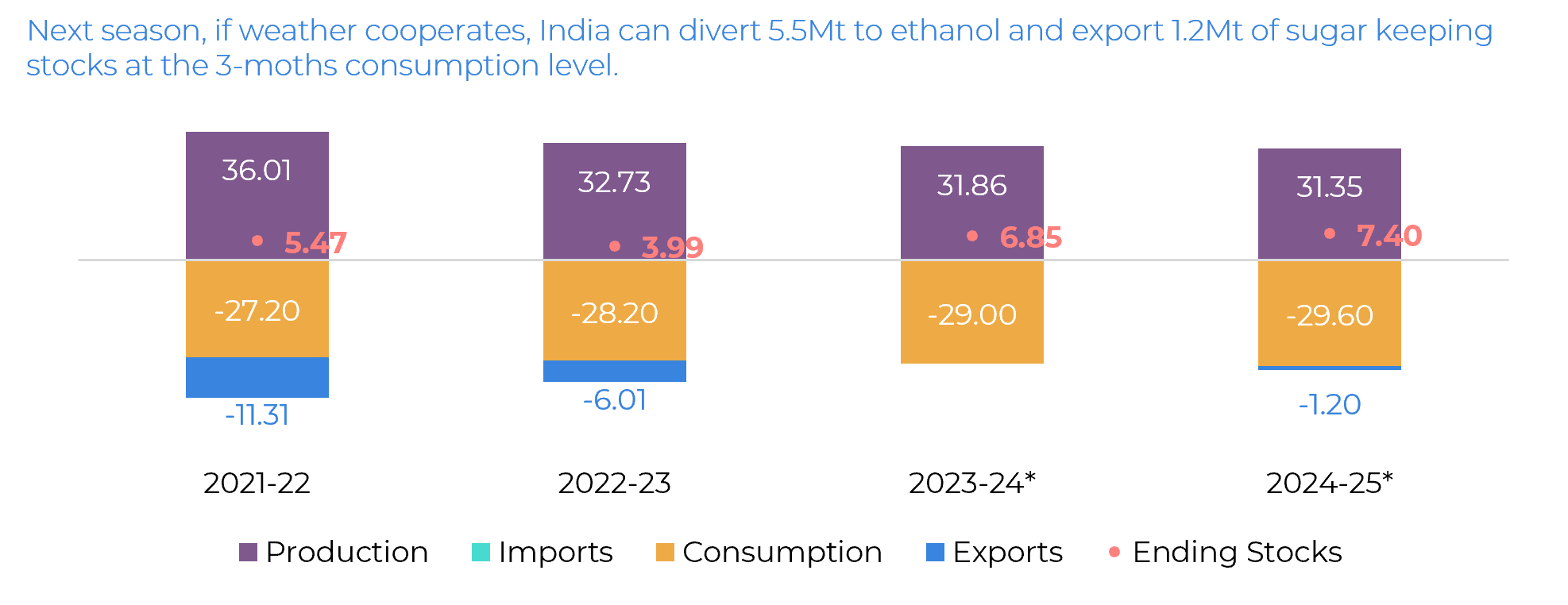

Prices corrected following ISMA's request for export quota allowance becoming public on Tuesday, April 2nd. The agency stated that India’s 23/24 sugar production is going to be higher than anticipated. Considering gross production, the country is now expected to reach 34Mt and, after 2Mt being diverted to ethanol – a marginally higher expectation than the previous 1.7Mt allowed by the government – the country would still manage to reach 32Mt of the sweetener. This volume is astonishingly high compared to the initial estimate which was closer to 29Mt. ISMA highlighted that the country’s stocks would be nearly 9Mt by September 30th, 2024. Contrary to the rumors of the lower area, the agency states that the increase of the Fair and Remunerative Price (FRP) for sugar cane in 24/25 will incentivize cane cultivation ensuring a recovery year – as we have been discussing in previous reports. As a result, having positive prospects for 24/25, and higher stocks predicted for 23/24, the agency asked for the allowance of 1Mt exports yet in 23/24.

The bearish outlook from ISMA was endorsed by the Pakistan Sugar Mills Association, which advocated for export quota allowances from the country's government. Asserting that Pakistan would have a surplus of at least 1.5 million metric tons, owing to consistent record sugar production annually, the association highlighted that increased sugar availability has squeezed margins for sugar mills, making it challenging to compensate cane growers adequately.

Raw sugar prices reacted shortly after these requests became public, correcting from the 22.7c/lb level. However, it didn’t completely meltdown as they were both requests, and the government has not yet answered. Of course, the allowance of both quotas within the 23/24 crop timeframe would represent an extremely bearish outlook, especially for the July contract, as it would mean adding 1.7Mt directly to the trade flows. But we need to keep in mind that there is more at stake.

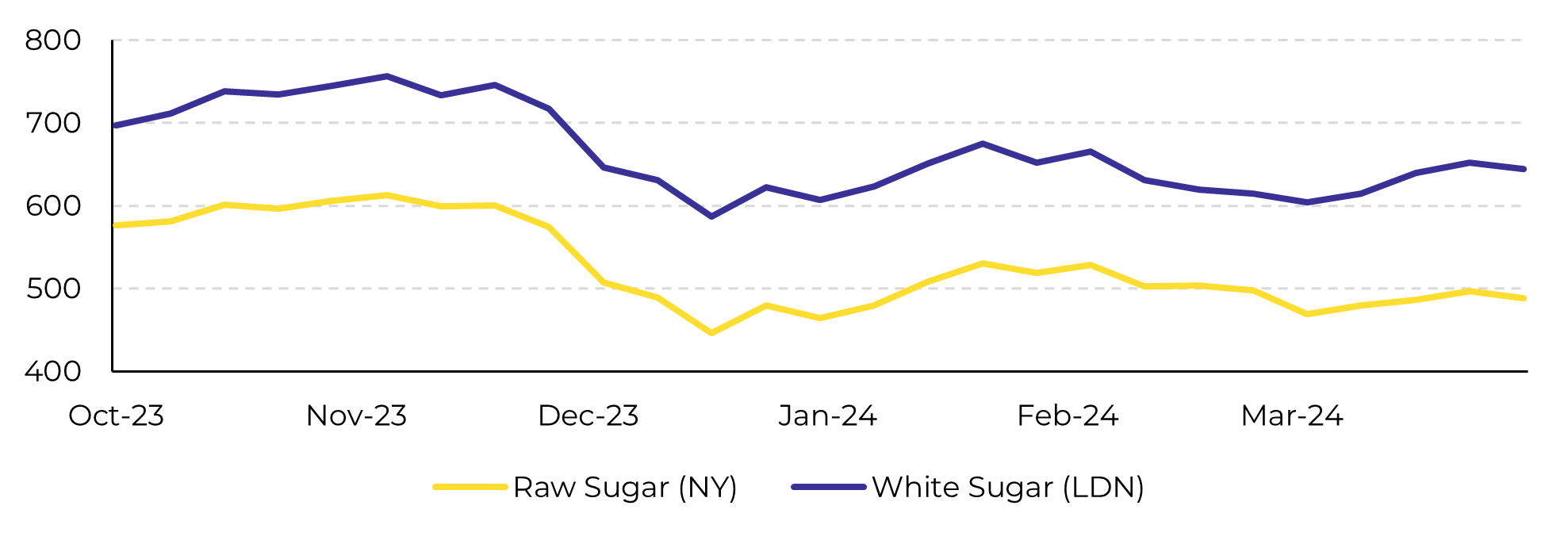

Image 1: Sugar prices in USD/t

Source: Refinitiv, hEDGEpoint

In India, allowing exports would mean a reversal of the government's efforts to ensure domestic supply and stabilize escalating domestic prices, including taking a step back on the ethanol program. In December 2023, the government banned sugar diversion for ethanol production allowing only a 1.7Mt quota, along with the ban on sugar exports. One might imagine that the government might be more inclined to increase ethanol diversion, picking up the program, than allow any exports in this crop season. However, allowing 64.5kt to be exported to the Maldives last Friday made the market even more warry and anxious for the government answer, given more strength to the bearish bias. So far, the letter might be perceived as confirmation that having average weather, we can expect India to return as an exporter on 24/25.

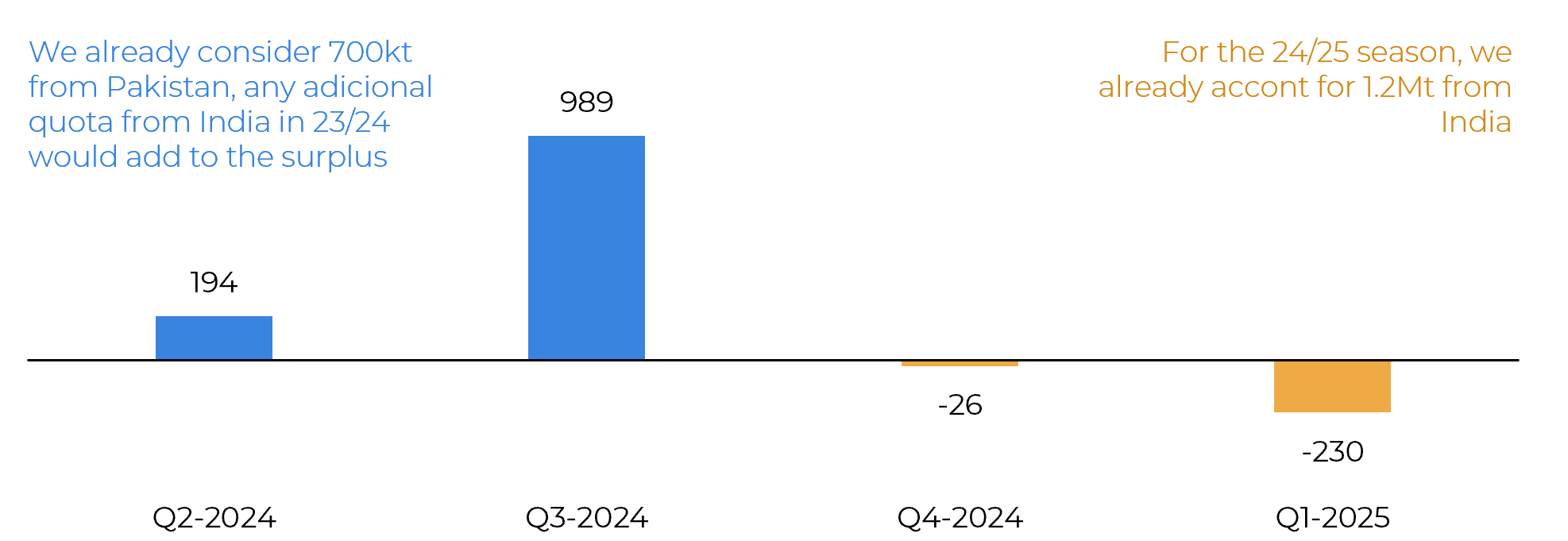

Image 2: Total trade flows (‘000t tq)

Source: Green Pool, hEDGEpoint

The government of Pakistan allowing 750kt of exports still seems more viable in the short term than 1Mt by India. We expected the country to export around 600kt of sugar in 23/24. Any additional volume would ease white sugar trade flows further, allowing for a deeper correction and some bearishness regarding the white premium, as Brazilian CS 24/25 should start in April.

Image 3: India’s sugar supply and demand

Source: ISMA, AISTA, hEDGEpoint

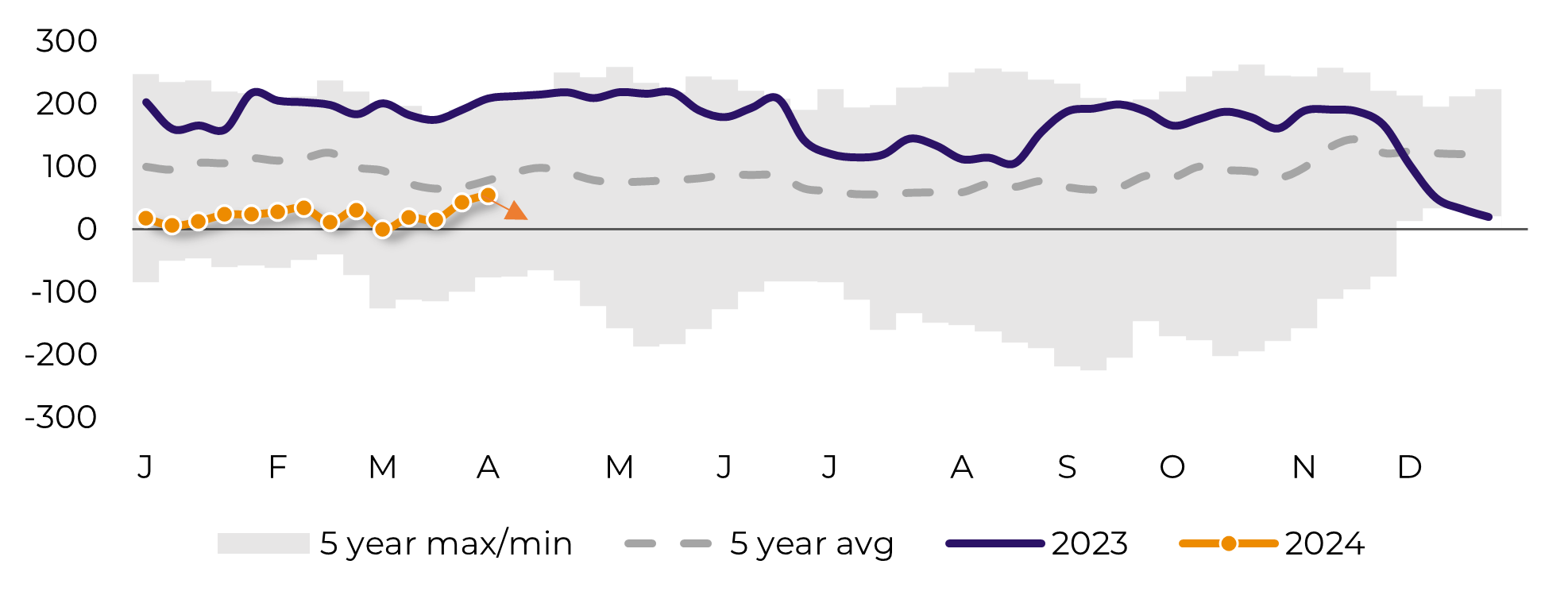

Image 4: Speculative positioning (‘000 lots)

Source: CFTC, hEDGEpoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.