Sugar and Ethanol Weekly Report - 2024 04 15

"The market saw a modest rebound in raw prices as the Indian government is leaning towards resuming the ethanol program over allowing exports, supported by discussions of diverting an additional 800kt of sugar in the 23/24 season. Despite these factors, optimism remains for India's 24/25 crop season due to expected normal monsoon conditions, potentially aiding yield recovery following a challenging 2023 and allowing exports (if the government complies). Brazil's sugar-producing regions are recovering from drought, supporting the market’s current bearish sentiment."

Weather, Government and China

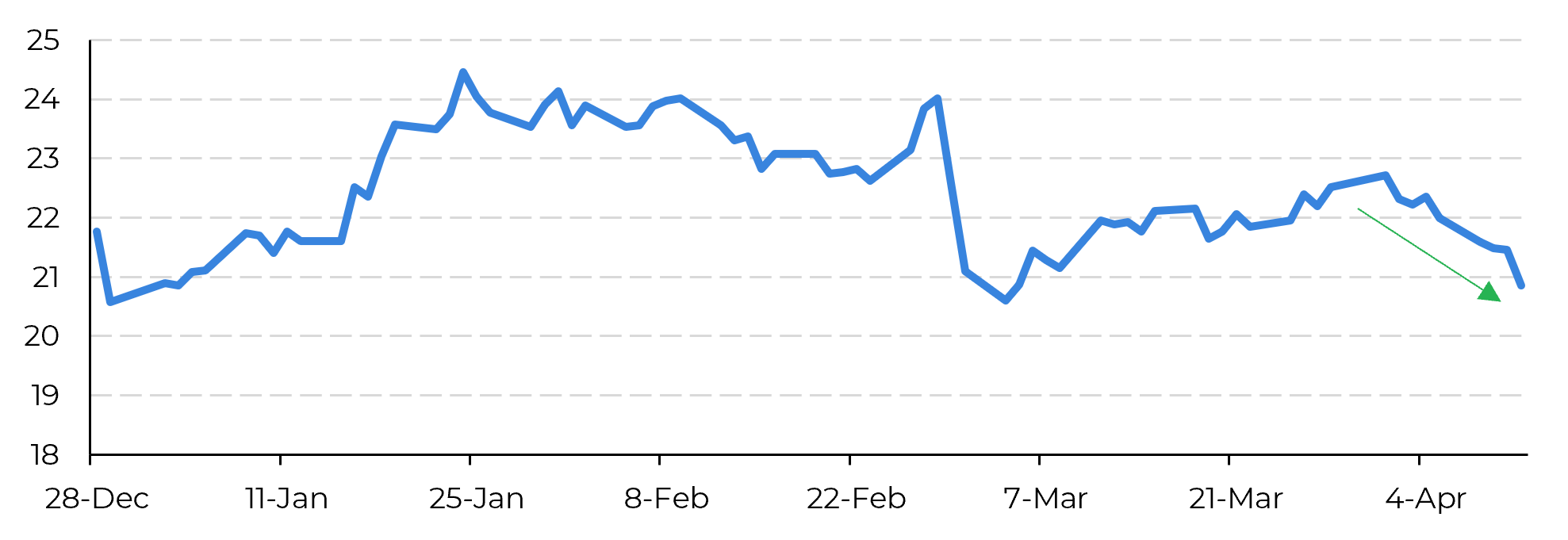

- Raw prices showed a slight recovery due to expectations that the Indian government may prioritize resuming the ethanol program over allowing exports.

- The Indian government is considering diverting an additional 800kt of sugar towards ethanol in the 23/24 season, reducing potential trade flow availability from India.

- Despite potential sugar diversion and lower projected stocks, the outlook for India's 24/25 crop season remains optimistic with typical weather conditions favouring a bearish market.

- Brazil's key sugar-producing regions are showing improved precipitation levels, benefiting mid-end season cane growth and contributing to continued bearish sentiment.

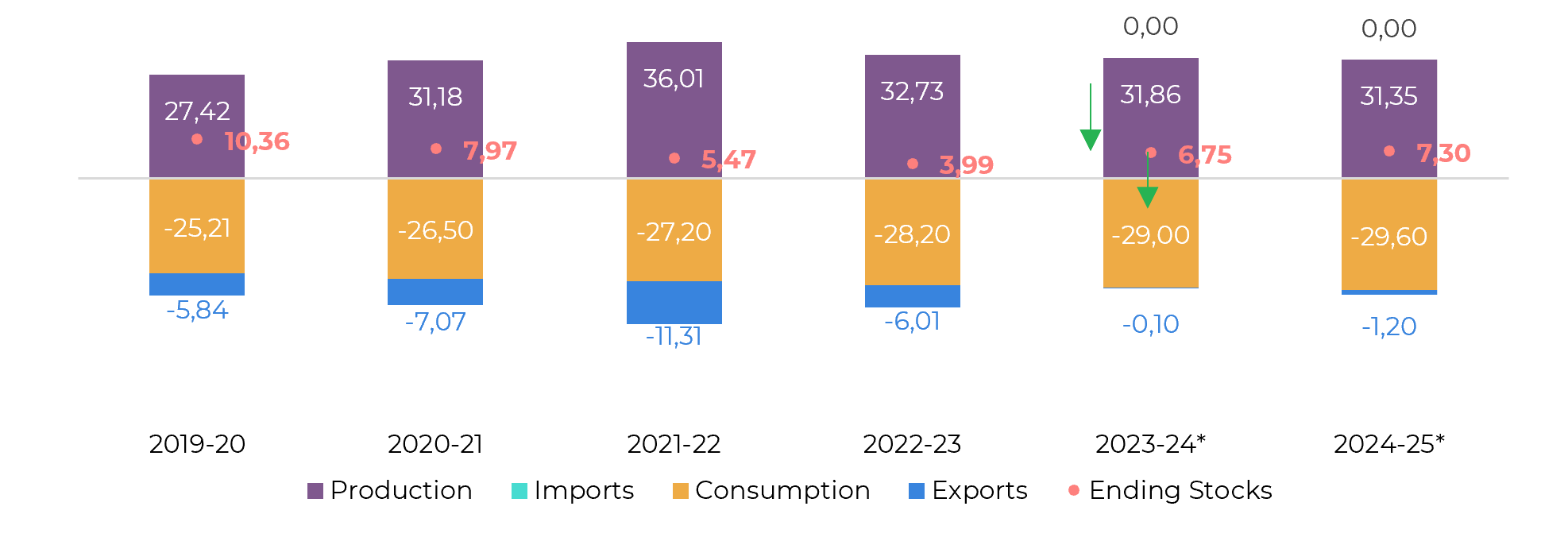

The week was marked by a slight recovery in raw prices after the market realized that Indian government might be more inclined to resume the ethanol program than allow any exports. This notion is in line with what we discussed in our previous report, only now it is backed up by the fact that the government is, indeed, considering an additional 800kt of sugar diversion yet in 23/24. As a result, there shouldn’t be any further trade flow availability coming from the country, at the same time as stocks may end the year at a lower level, but still higher than the two previous season. In our view, diverting 800kt more to sugar would guarantee around 31.1Mt of the sweetener, and thus a nearly 6Mt ending stock. We must remember that the price movement seen because of this rumors did not mean any change to fundamentals, it is only a discussion as to where to place this “extra” availability.

The discussion also doesn’t change the optimism regarding the country’s 24/25 crop season. Despite a possible diversion of 800kt towards ethanol and slightly lower stocks than previously projected, more typical weather conditions favor a bearish outlook.

Image 1: Raw Sugar 1st Contract Behaviour (c/lb)

Source: Refinitiv, hEDGEpoint

Image 2: Sugar Balance - India (Mt Oct-Sep)

Source: ISMA, AISTA, Hedgepoint

India is expected to experience a 'normal' monsoon this year, as per private weather forecaster Skymet shared last Tuesday. This forecast allows us to expect yield improvement following a challenging 2023. During 2023, India received below-normal and scattered rainfall, which adversely affected agricultural production in several regions. According to the agency, rains are expected to be 102% of average between cane’s key development window: June and September. Therefore, India can get back to the export game! But a note of caution, before exporting any volume, the country is most likely to fully resume it’s ethanol program by diverting nearly 5.5Mt of sugar to biofuel production. This would allow India to contribute up to 1.2Mt to the international trade flow in 24/25 – assuming that yields will return to the 3-year average.

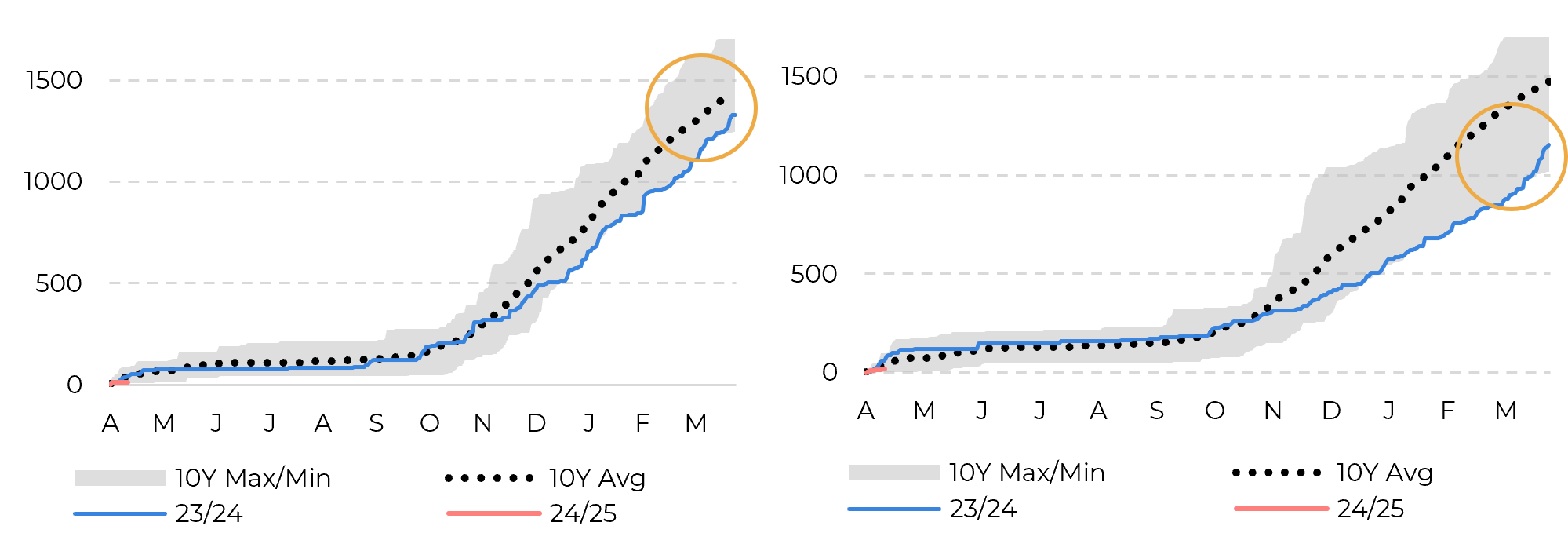

Also on weather, Brazil’s key sugar-producing areas, which received minimal precipitation during December through February, are recovering from the drought. Many moved back to the historical range and others achieved average levels. Although it won’t erase the damage done during the intercrop period, mid-end of season cane will benefit from the weather. Meaning that there is some bearishness left in Brazil as well.

Other than the weather, Brazil’s 23/24 season is officially over! It was a record one with a 654.4Mt vane crushing, generating 42.4Mt of sugar thanks to a higher sugar mix, at 48.87%. Center-South proved to be a spectacular player, with an increasing capacity due to further Investments in the sector. According to SECEX, 34.3Mt were exported in 23/24, easing trade flows and preventing prices from skyrocketing. Established as one of the most relevant suppliers, all eyes are on 24/25.

Image 3: Cummulative Rainfall in Triangulo Mineiro MG (left) and Ribeirão Preto SP (right)

Source: Bloomberg, Somar, Hedgepoint

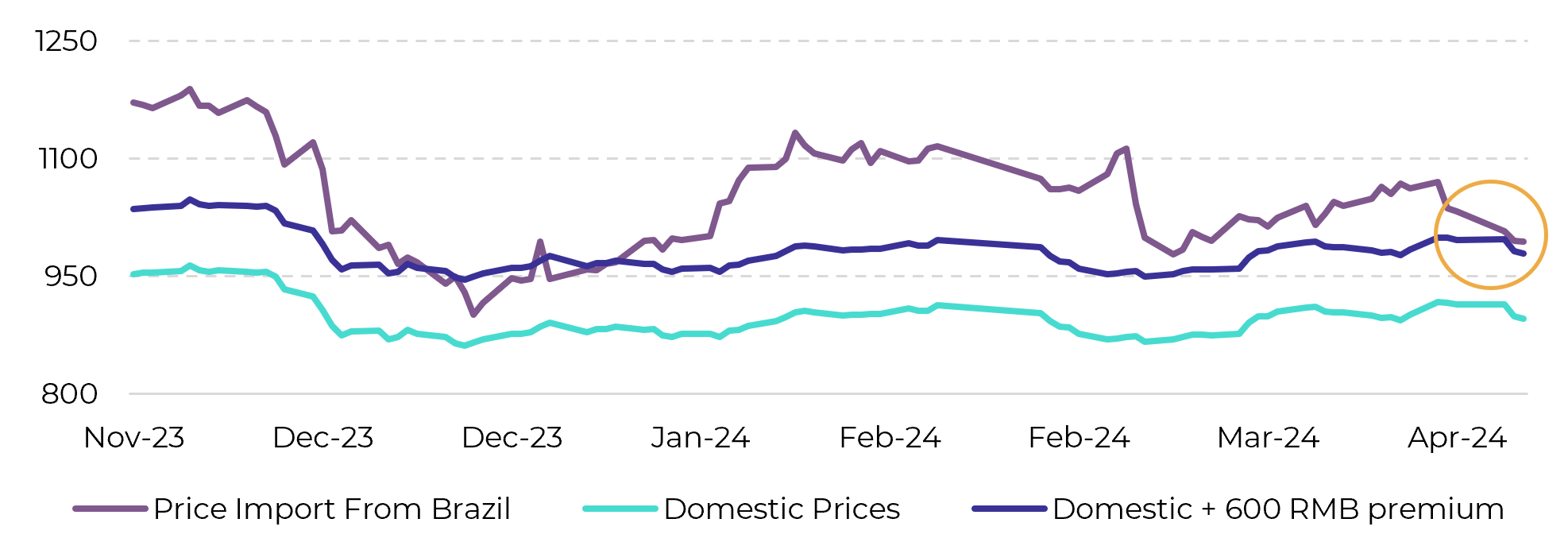

Image 4: Chinese Import Arbitrage – USD/t

Source: Bloomberg, Refinifiv, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.