Sugar and Ethanol Weekly Report - 2024 04 22

"Last week started amidst a bearish macroeconomic environment for commodities driven by Middle East conflict escalation and concerns over the US economy, heightening market risk perception. The week was also marked by the white sugar May contract expiry, settling at $615/t with a notable 314kt delivery, mainly from the UAE, India, Brazil, and surprisingly, Poland and China. "

Macro and whites delivery, signs of a bearish market

- The beginning of last week was characterized by bearish macroeconomic conditions, driven by Middle East conflict escalation and concerns over the US economy, increasing market risk perception.

- The delay in Federal Reserve rate cuts strengthened the dollar, creating challenges for commodities, notably markets with weak fundamentals, such as sugar.

- Emerging countries, like Brazil, faced challenges, with a 4% depreciation of the Real in April, boosting export returns despite corrections in sugar prices and, therefore, adding to the bearish trend.

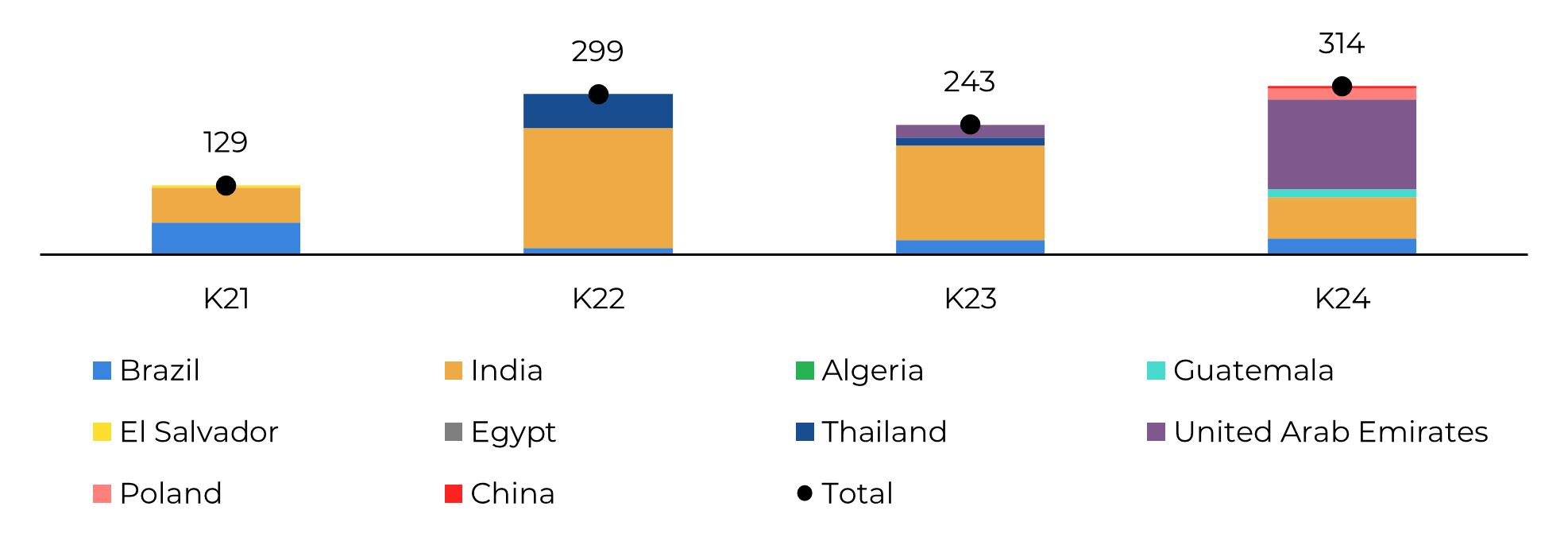

- The week also saw significant activity in the sugar market, marked by the white sugar May contract expiry at $615/t and a notable delivery of 314kt, predominantly from the UAE, India, Brazil, Poland, and China, with the latter two making their first recent appearances as suppliers.

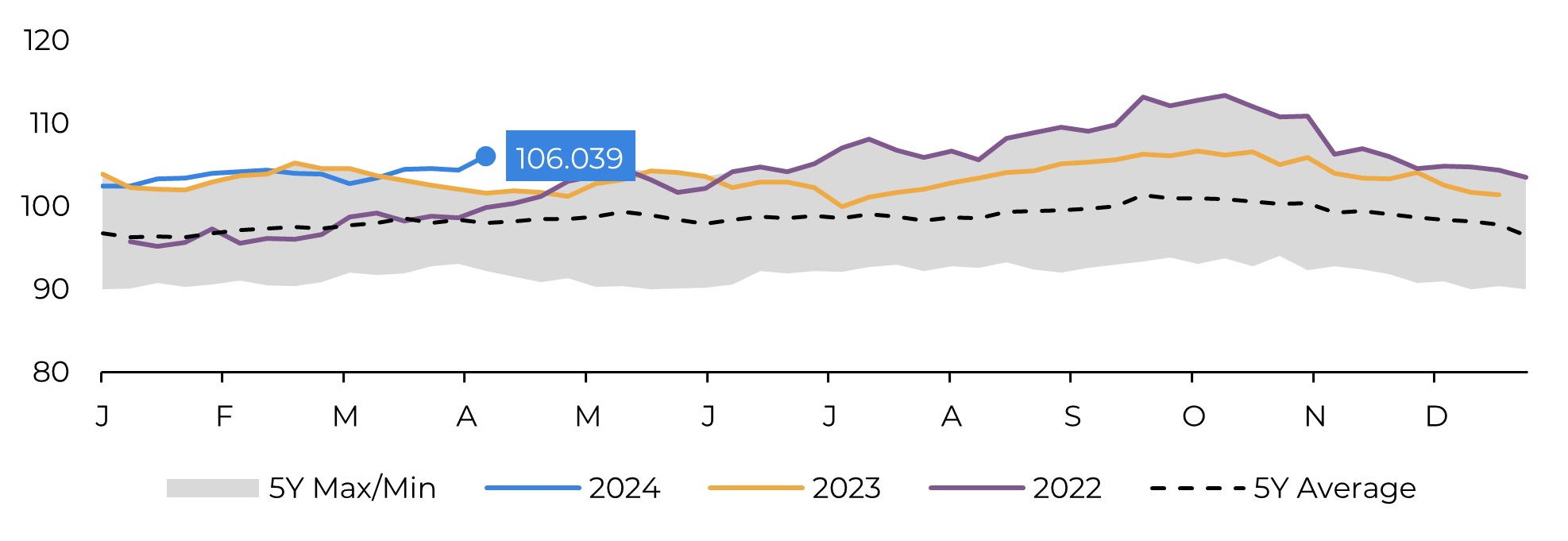

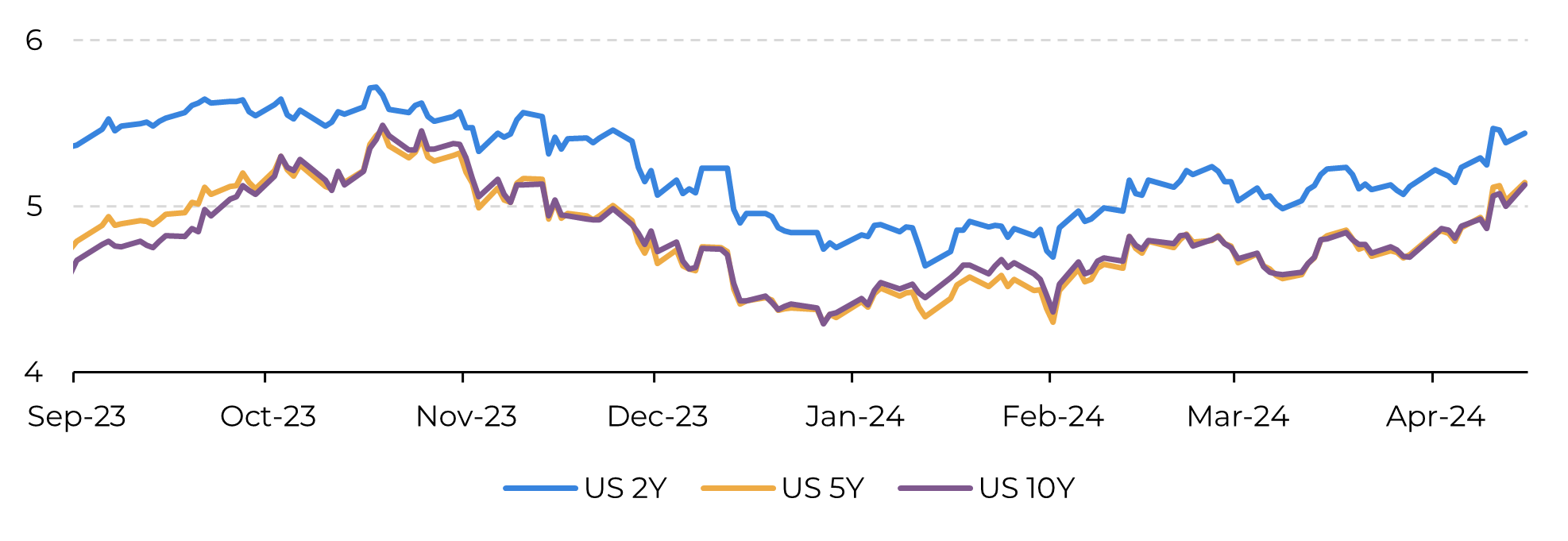

Last week started with a bearish macroeconomic environment. The conflict escalation in the Middle East, coupled with concerns regarding the US CPI results, heightened risk perception in the market, aligning with the trend observed since the beginning of 2024. US Improving US Treasury yields might create further barriers for investors to add riskier assets to their portfolios

The idea that the Federal Reserve will delay rate cuts boosted the dollar's strength, creating a more daunting environment for bullish commodity players, particularly in markets like sugar where fundamentals are not supportive.

Another result of this bearish macro environment is the challenge some emerging countries face. For instance, the Brazilian Real depreciated by approximately 4% in April. This depreciation translates to higher returns for exports, contributing to maintaining a healthy export rhythm even with some corrections to sugar prices.

Image 1: Dollar Index

Source: Refinitiv, hEDGEpoint

Image 2: US - Treasury Yields (%)

Source: Refinitiv, Hedgepoint

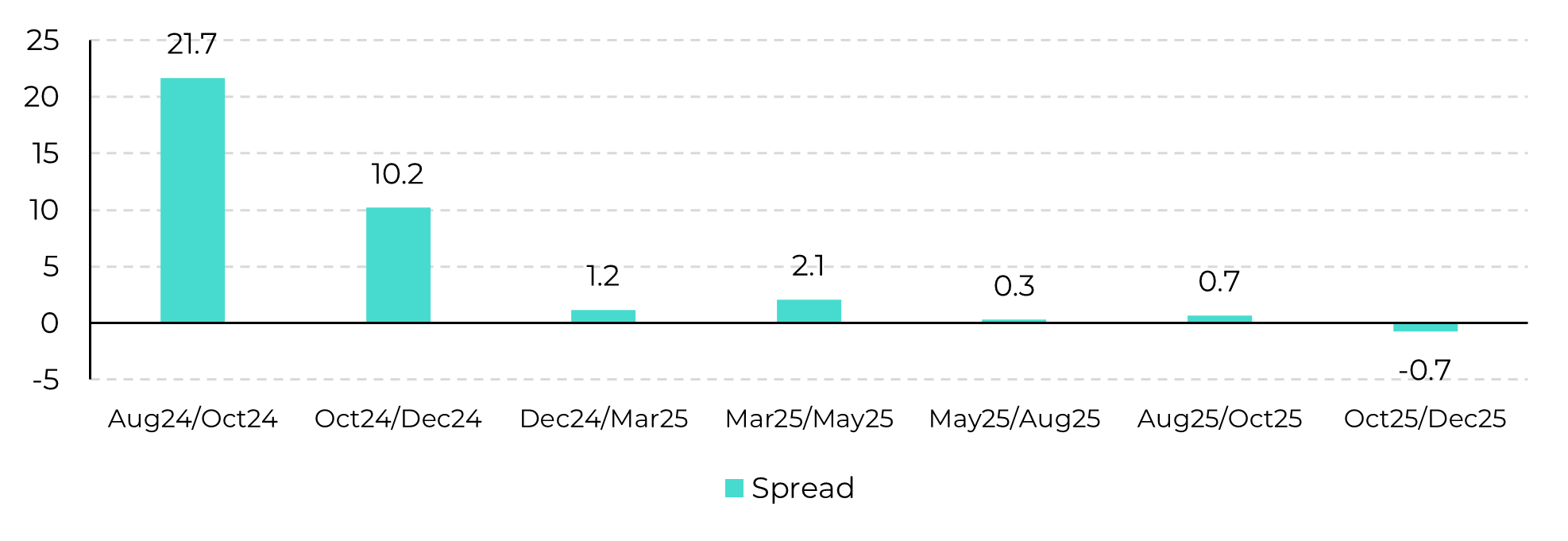

Apart from the macroeconomic backdrop, the week was marked by the white sugar May contract expiry. The final settlement price was 615 USD/t, and the spread between May and August contracts closed at an inverse of 35 USD/t. A total of 314kt was delivered, marking the highest level since at least 2021. Most of the volume was delivered by the UAE, with significant contributions also from India and Brazil. Notably, this expiry was the first appearance of Poland and China among the suppliers in recent years – quite intriguing participation!

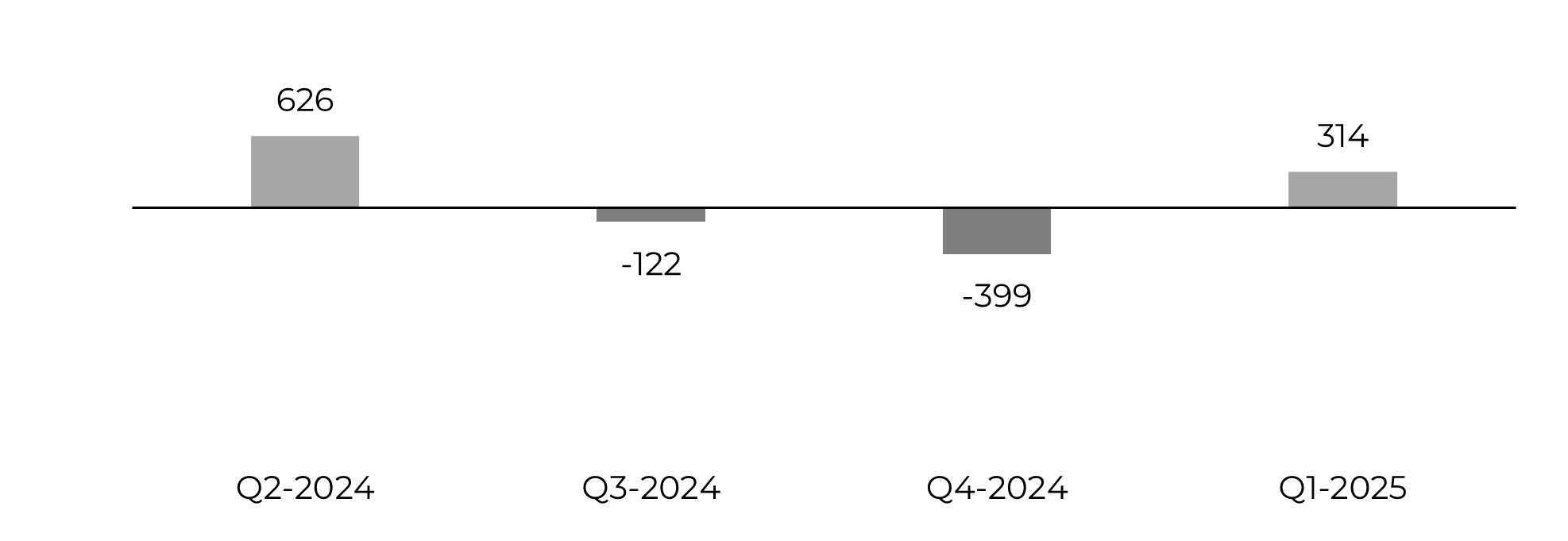

Image 3: White Sugar Delivery – May/K Contract (‘000t)

Source: ICE, Hedgepoint

China did buy raw sugar back in December when prices allowed an open import arbitrage in their non-producing states, estimated at 20.5 c/lb. Consequently, Chinese customs reported the highest volume of imports entering the country during January and February, which provided a floor for raw sugar prices in the market. As China's crop cycle accelerates and considering their refining capacity, it is not surprising that traders may seek to capitalize on current white sugar prices, especially with fundamentals suggesting a potential correction ahead.

Image 4: White Sugar Spread USD/t

Source: Reuters, Hedgepoint

Image 5: White Sugar Trade Flows (‘000t tq)

Source: Green Pool, Hedgepoint

In Summary

The week was also marked by the white sugar May contract expiry, settling at $615/t with a notable 314kt delivery, mainly from the UAE, India, Brazil, and surprisingly, Poland and China. China's earlier raw sugar purchases and expected production increases signal potential market corrections ahead. Optimistic forecasts for Northern Hemisphere sugar production in 2024/25 are reinforcing bearish trends, with a projected modest surplus of 500kt.

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.