Sugar and Ethanol Weekly Report - 2024 04 30

"Due to supply improvement, India allowed an extra 800kt of sugar to be diverted to ethanol production in the 23/24 crop, with the expectation of a total of 2.5 Mt being used in the ethanol program.Despite the diversion, sugar availability in the country remains on the positive side. Given the expectation of better weather conditions in the next months, India's sugar production might improve in 24/25. The question is, will the government prioritize the ethanol program in the next season?"

India ehtanol diversion on the rise; Brazil’s harvest adds to the bears

- Due to supply improvement, India allowed an extra 800kt of sugar to be diverted to ethanol production in the 23/24 crop, with the expectation of a total of 2.5 Mt being used in the ethanol program.

- Despite the diversion, sugar availability in the country remains on the positive side.

- Given the expectation of better weather conditions in the next months, India's sugar production might improve in 24/25. The question is, will the government prioritize the ethanol program in the next season?

- Despite a possible higher ethanol diversion, sugar availability in 24/25 remains positive, for both whites and raws, keeping the bearish trend.

- In Brazil, the start of the 24/25 harvest also adds pressure to raws, given the expectation of a high sugar production, specially after Unica’s first outlook on the crop.

Last Wednesday, India’s government allowed the diversion of an extra 800kt of sugar to ethanol production in the 23/24 cycle, after the initial limitations imposed late 2023. This change reflects supply improvements in the Asian country over the last months. Many mills had, in fact, already produced a higher quantity of B-heavy molasses in anticipation for ethanol program and can now use their stocks for the fuel.

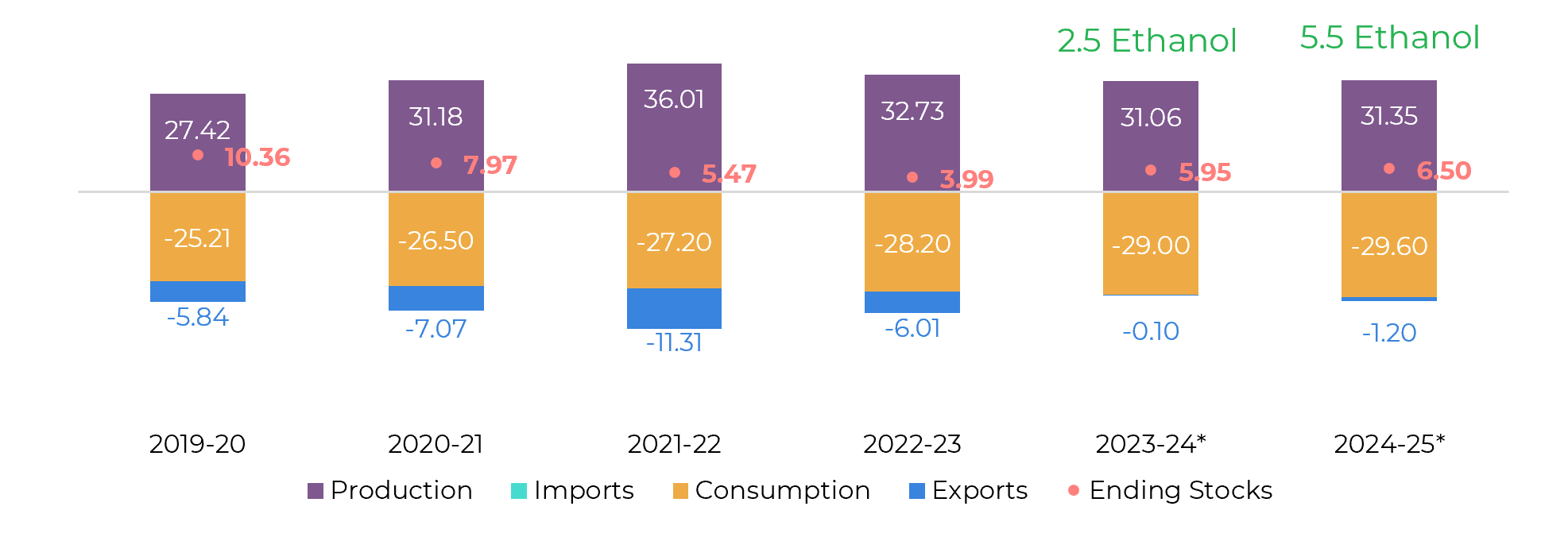

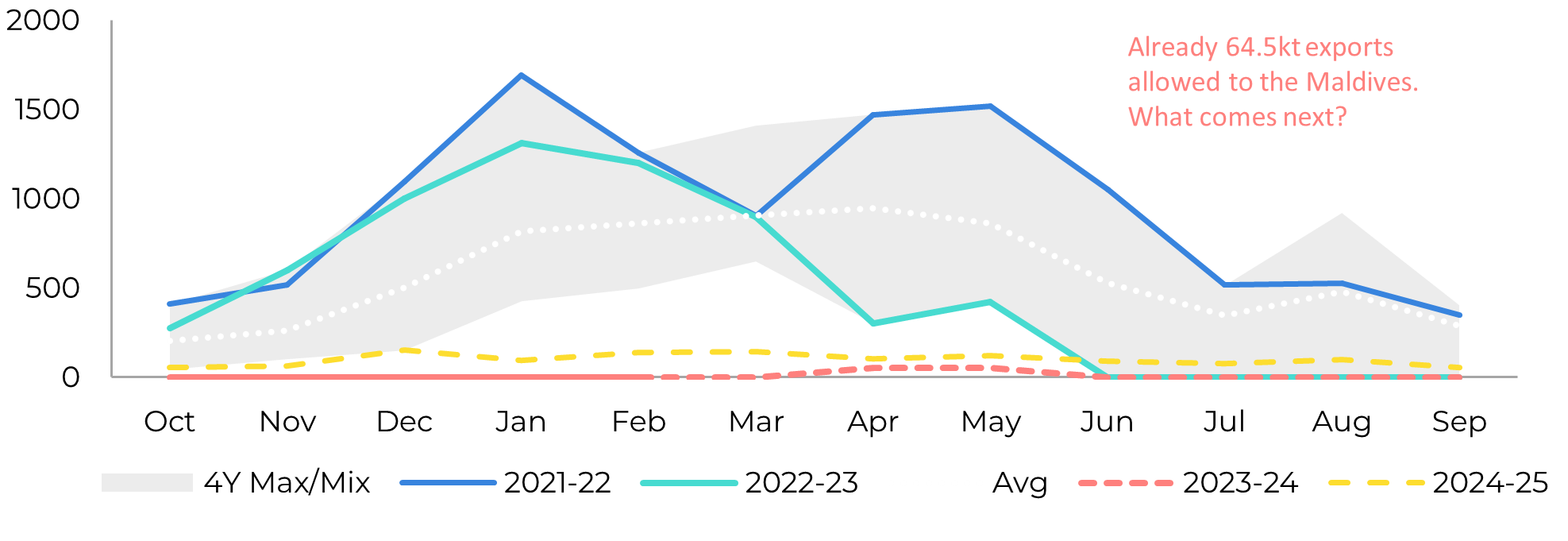

With this additional volume, sugar diversion will go from 1.7M to 2.5 Mt in this season, with total sugar availability expected to change from 31.85 Mt to 31.06 Mt. Despite this decrease, India’s stocks will still reach close to 6 Mt in 23/24, scenery that could support an increase in exports – the government has recently permitted 64.5kt exports to the Maldives!

The outlook for the 24/25 Indian crop is also more favorable weather wise and could positively affect the sweetener's availability. The anticipated change from El Niño to La Niña tends to favor the monsoon period in the country, benefiting cane outputs. The Indian Meteorological Department (IMD) also expects monsoon season to be above average levels in 2024.

With this, we also estimate an increase in sugar availability in 24/25. As a result, the Indian government could allow further sugar diversion to ethanol production. The question is, what India will prioritize?

Image 1: Sugar Balance - India (Mt Oct-Sep)

Source: ISMA, AISTA, Hedgepoint

Image 2: Total Domestic Exports – India ('000t w/o tolling)

Source: ISMA, AISTA, Hedgepoint

Yet, considering the possibility of the Indian government resuming its initial blending target (20%), and, thus, the sugar diversion of approximately 5.5 Mt in 24/25, the country would still reach 31.35Mt of the sweetener in the next season, with ending stocks estimated at 6.5Mt.

In this sense, even if the Indian government increases the sugar diversion to its ethanol program, the outlook for 24/25 is more optimistic. This is also true for other Northern Hemisphere countries and regions, with an expected recovery in the EU, Thailand, and Central America. As a result, the market started to react with the white's August contract showing weakness.

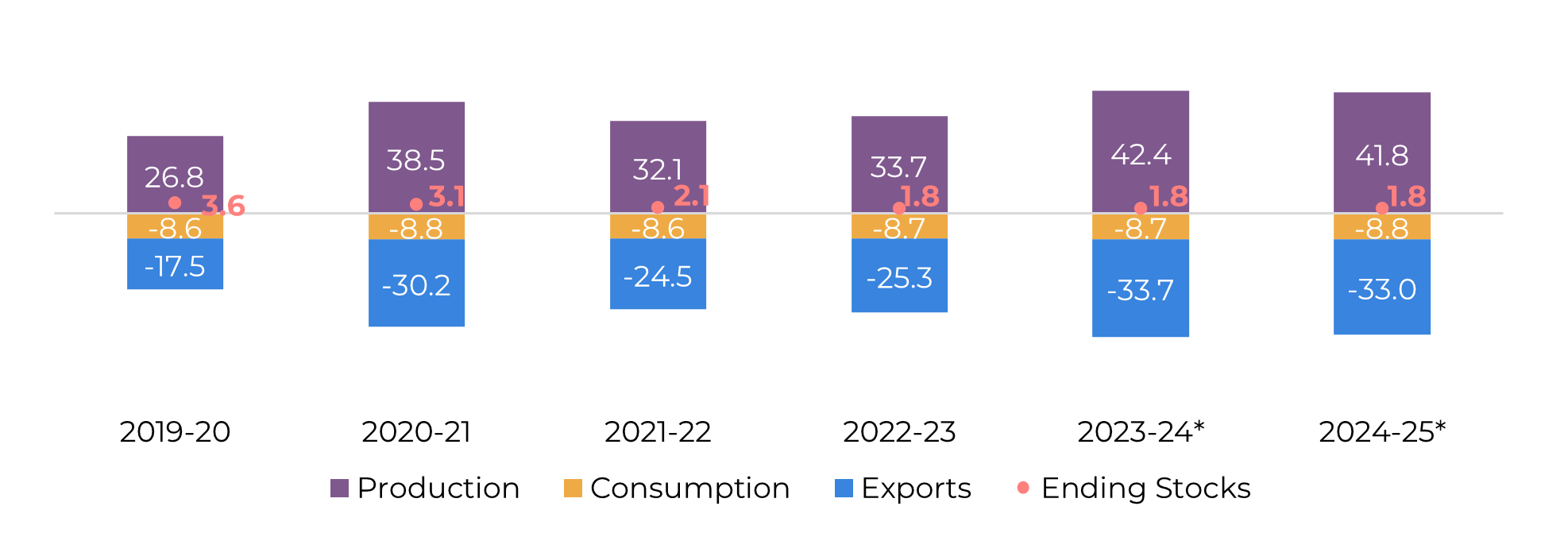

For raw sugar, an abundant supply is also expected. While it’s a consensus that the Brazilian 24/25 season will be lower than the 23/24 – a record crop –, mainly due to poor weather conditions in late 2023, we could still expect a high sugar production. With more favorable prices for sugar, mills have invested the crystallization process and the maximization of sugar mix allowing another year of high availability even with lower raw material.

Image 3: Sugar Balance – Brazil (Mt Oct-Sep)

Source: Unica, MAPA, SECEX, Hedgepoint

On Friday, Unica’s first look on the 24/25 also added to the bears: the group informed that Center-South sugarcane crushing totaled 15.81Mt in the first fortnight of April, with a sugar production of 710kt, an increase of 30.97% year-on-year!

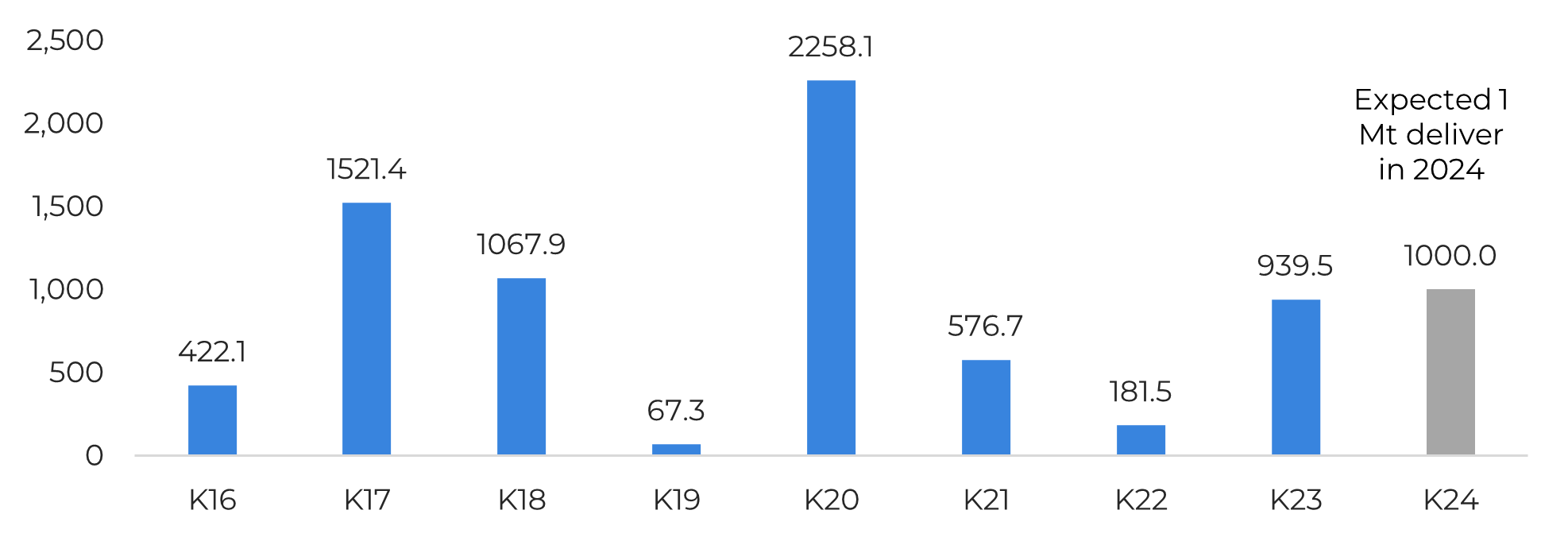

Image 4: Deliver volume for Raw Sugar May Contract (‘000 t)

Source: ICE, Hedgepoint

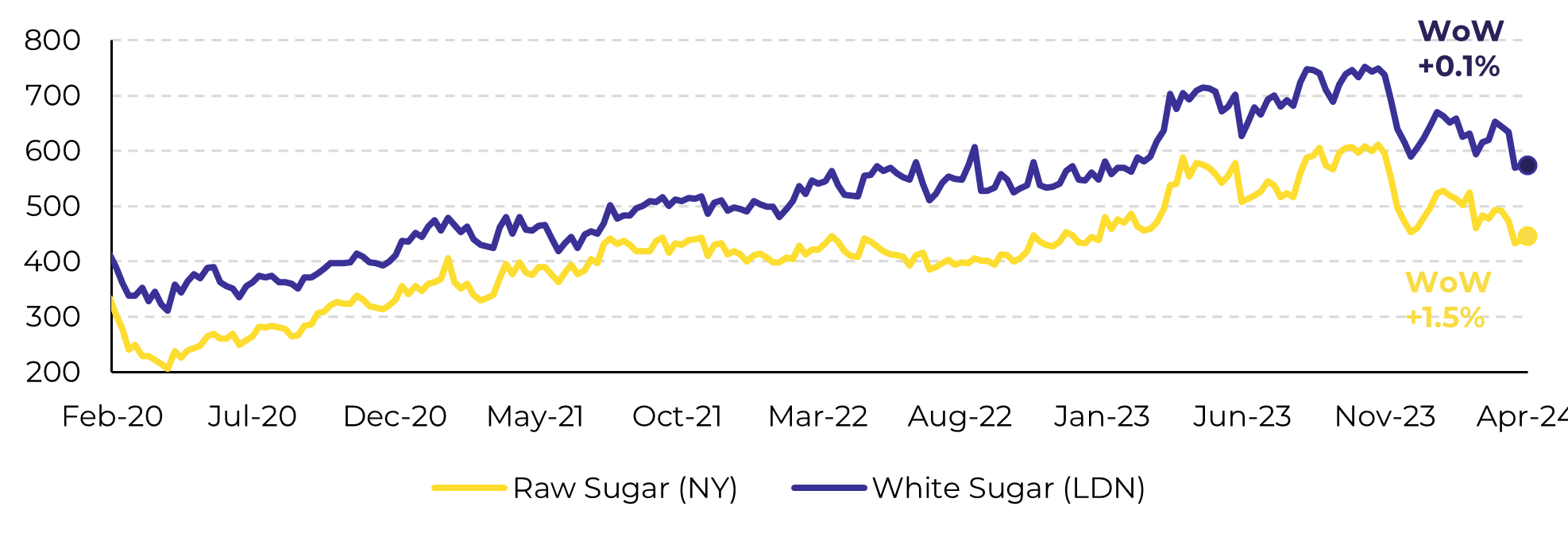

Image 5: Sugar prices in USD/t

Source: Refinitiv, Hedgepoint

In Summary

Weekly Report — Sugar

laleska.moda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.