Sugar and Ethanol Weekly Report - 2024 05 06

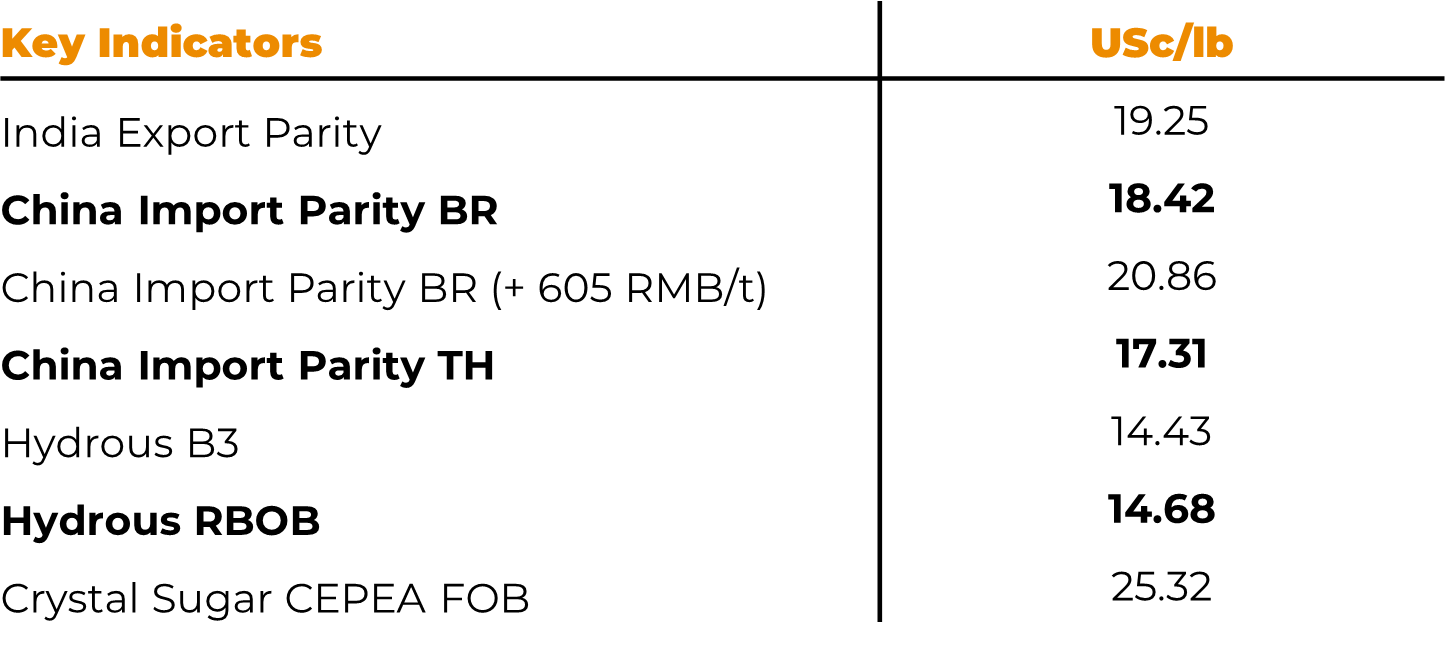

"As prices dropped below key import arbitrage levels, demand waned, affecting sugar price recovery prospects. It is anticipated that import arbitrage levels will shift, potentially signaling a new support and price range for sugar, contingent on global market needs and costs."

Higher supply, weak demand: where is the floor?

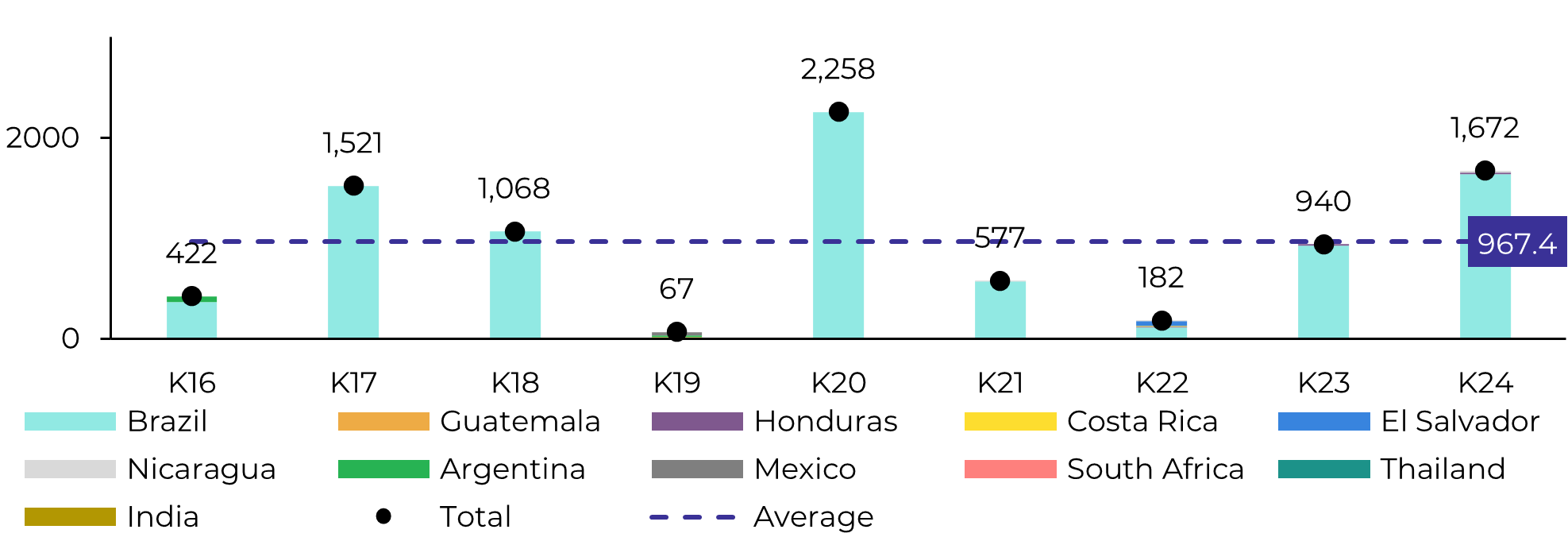

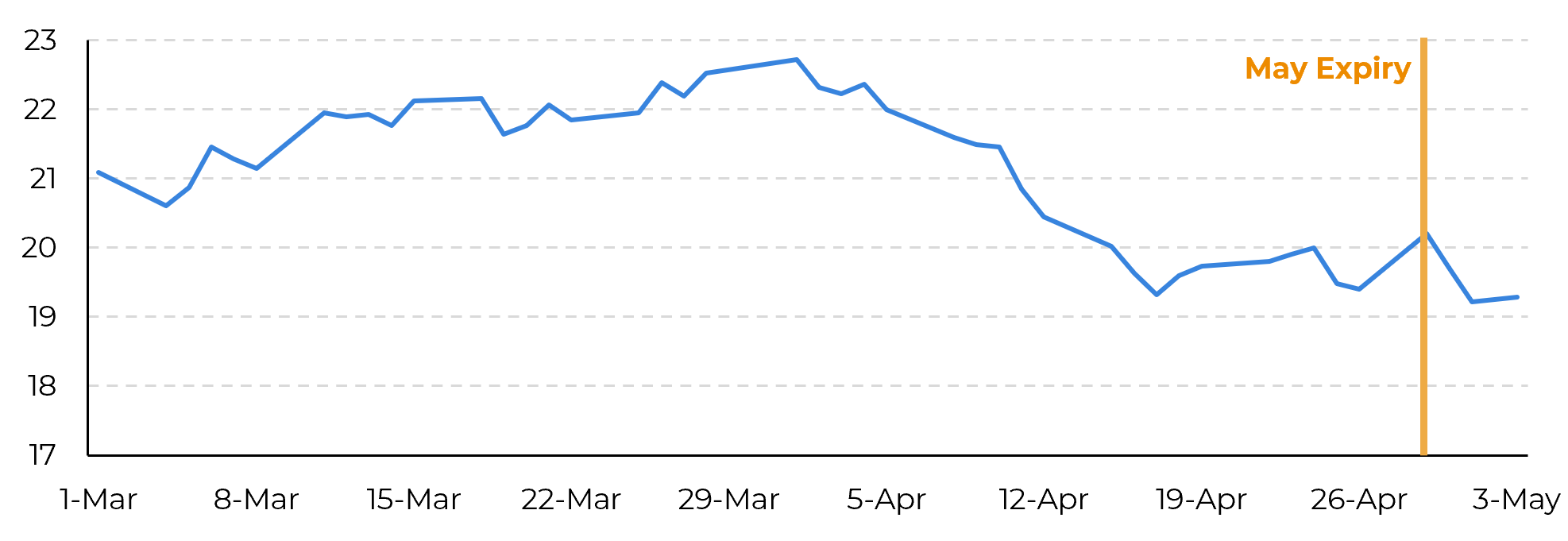

- The May contract settled at 19.72 c/lb on its last trading section. Ultimately, 1.67 Mt were delivered, a 73% increase from the eight-year average, with Brazil being the largest supplier.

- The July contract failed to reach May's price levels due to high delivery volumes and broader macro risk sentiment, with USD strength, equity market declines, and commodity price drops.

- Despite reports of India and Thailand facing challenges in their sugar sectors, market impact was limited due to higher-than-expected supply and weakening demand, notably from major importer China, which has slowed imports amid increasing domestic production.

- As prices dropped below key import arbitrage levels, demand waned, affecting sugar price recovery prospects. It is anticipated that import arbitrage levels will shift, potentially signaling a new support and price range for sugar, contingent on global market needs and costs.

The week started with active trading ahead of the May contract delivery. On Monday, market excitement grew due to rumors surrounding Pakistan's government export quota decision, which added complexity as a possible denial drove prices into a slightly bullish momentum, conflicting with the previous week's observed trend. However, Tuesday saw a sharp price correction after the Pakistan Sugar Mills Association refuted reports of the government's export quota refusal for 23/24. Alongside these rumors, the market anticipated a robust delivery, expecting at least 1 Mt to be delivered. Consequently, raw sugar lacked the bullish support anticipated by some traders. Ultimately, a total of 1.67 Mt were delivered, a 73% increase from the eight-year average, with Brazil being the largest supplier.

Image 1: Raw Sugar May Deliveries (‘000t)

Raw Sugar May Deliveries (‘000t

Image 2: Raw Sugar May Contract Behaviour Since March Expiry (c/lb)

Source: Refinitiv, Hedgepoint

Despite recent reports suggesting that the Indian 23/24 crop season may fall short of the ISMA (Indian Sugar Mills Association) estimate of 34 Mt, especially as crushing activities wind down, and despite Thailand experiencing a strong heat wave, sugar prices failed to recover.

Why didn't these news affect the market as much as expected? One key reason is that supply remains higher than anticipated. While India's sugar production may fall short of ISMA's 34 Mt estimate, the actual production achieved so far represents a significant improvement compared to the market's expectation of under 29 Mt in late August 2023. Looking ahead to the 2024/25 season, increasing ending stocks and anticipated above-average monsoon rainfall could further boost India's sugar availability and allow for exports, adding to the bearish sentiment.

Meanwhile, Thailand's final crushing for the season surpassed expectations, reaching 8.8 Mt. Looking towards the next season, despite reports of exceptionally high temperatures, Thailand's cane is expected to withstand these conditions due to sufficient water supply. The Thai Meteorological Department predicts reduced precipitation in May but foresees a healthy amount of rainfall during June and July, contributing positively to 24/25’s expected recovery.

On the other side of the equation, demand seems to be weaker.

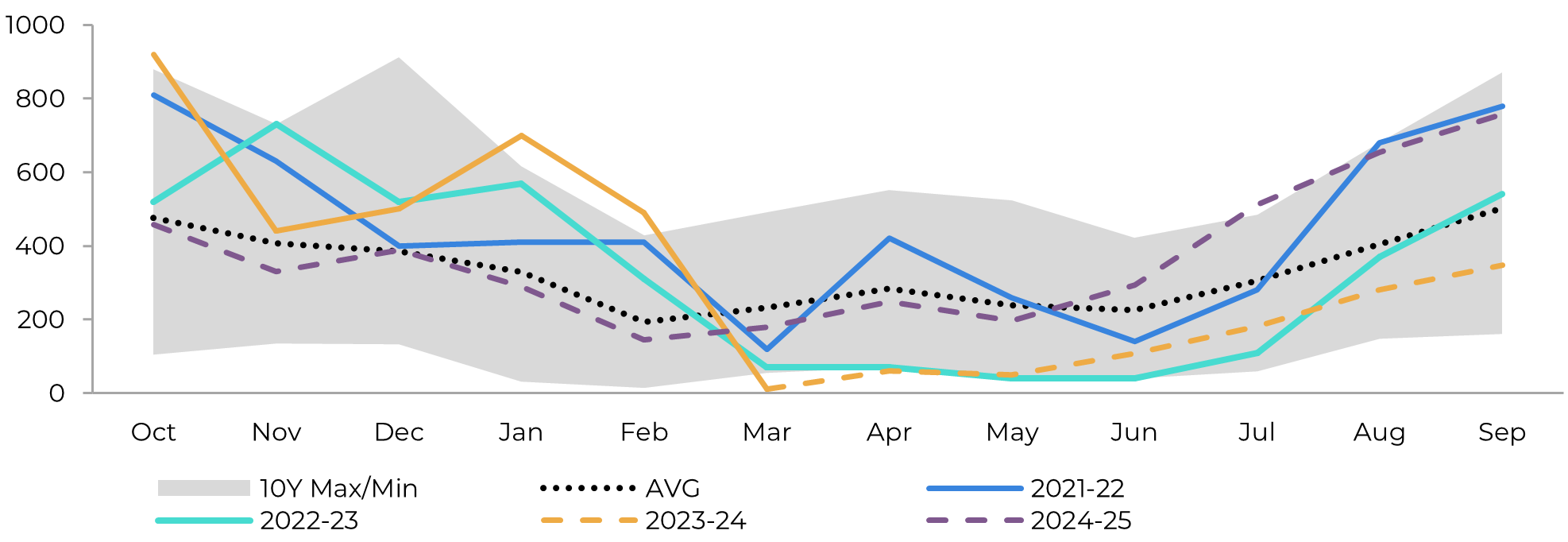

One of the biggest importers, China, was the main reason raw sugar found support during Q1-24. Reducing its prices below the country’s non-producing regions’ import arbitrage level of 20.5 c/lb would trigger buying. However, having imported over 3 Mt since the beginning of its crop season, October 2023, it is only natural that its appetite for imports would diminish as its domestic production increases. For instance, during March, the country's customs reported only 10 kt entering the country, which was not surprising given the seasonality.

Image 3: Total Imports - China ('000t - exc. Syrup and smuggling)

Source: CSA, Refinitiv, Greenpool, GSMM, hEDGEpoint

Image 4: Key Sugar Market Parities (c/lb)

Source: Refinitiv, Bloomberg, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.