Sugar and Ethanol Weekly Report - 2024 05 13

"Ethanol prices could potentially rise to 16.74 c/lb if fuel demand increases and international oil prices remain bullish, but this trend is only expected to occur later in the season – when stocks are consumed."

Ethanol will fight a lost battle

- Ethanol has struggled to challenge sugar price dominance especially given the record crop, 23/24, that, combined with a slow fuel demand growth, resulted in increased stock levels.

- Despite weakening fundamentals, sugar continues to pay a significant premium over the biofuel.

- Hydrous prices faces challenges including Petrobras' pricing policies, fragile demand recovery, and the necessity of prioritizing sugar production in Brazil.

- Ethanol prices could potentially rise to 16.74 c/lb if fuel demand increases and international oil prices remain bullish, but this trend is only expected to occur later in the season – when stocks are consumed.

- Despite the bullish trends, biofuel is unlikely to threaten sugar production this season due to contracted sugar positions, and international prices.

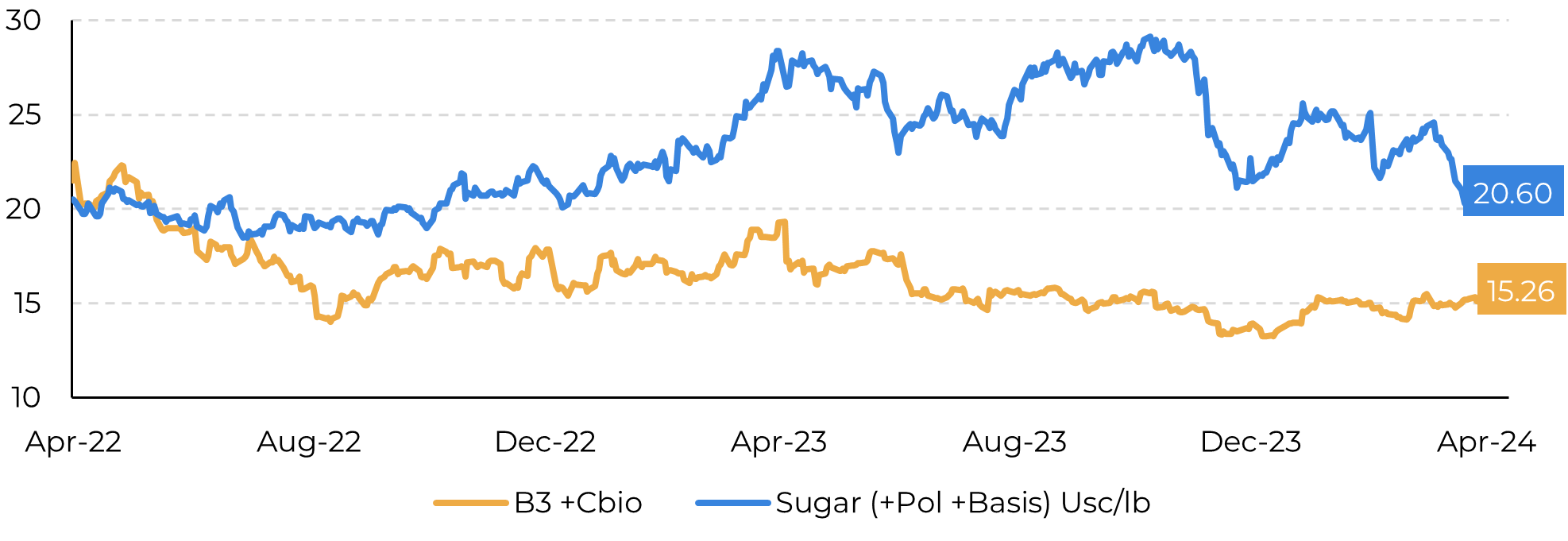

It is a truth universally acknowledged, that ethanol has failed to threaten sugar for a while now. The 23/24 season marked a record crop, which, despite its robust sugar volume, also led to the highest ethanol production to date. Coupled with slower-than-expected growth in fuel demand, last season ended with the highest hydrous and anhydrous stock levels. Consequently, it is no surprise that the sweetener continues to pay a significant premium over biofuel (over 500pts). The recently narrowing gap between these products was not due to shifts in the hydrous market but rather a result of weakening fundamentals in the sugar industry. However, there are some interesting trends to monitor regarding the biofuel.

Image 1: Sugar vs etanol considering premium (c/lb)

Source: Bloomberg, Unica, Hedgepoint

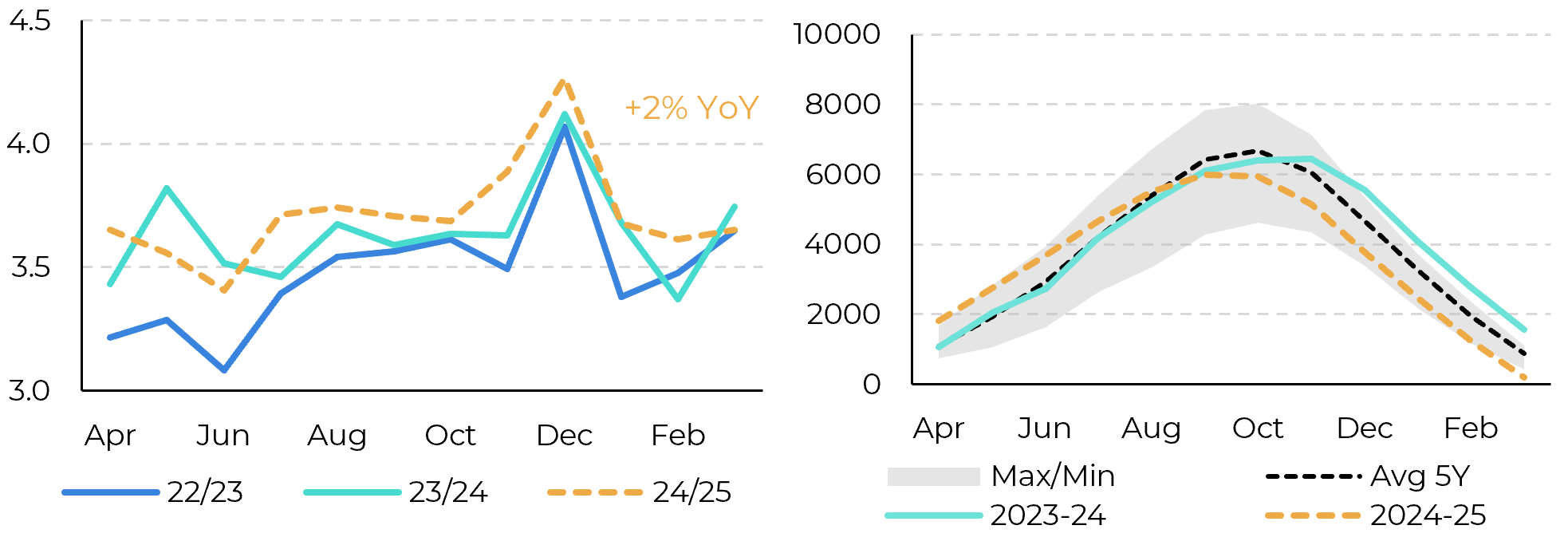

Image 2: Center-South’s Otto Cycle (M m³) and Hydrous expected stocks (‘000 m³)

Source: ANP, SECEX, UNICA, MAPA, Hedgepoint

What prices can ethanol possibly reach going further?

To assess whether prices could rise sufficiently to ensure a more comfortable end-of-season biofuel stock, given a 2% growth in fuel demand, we must start discussing the challenges involved. There are three main challenges:

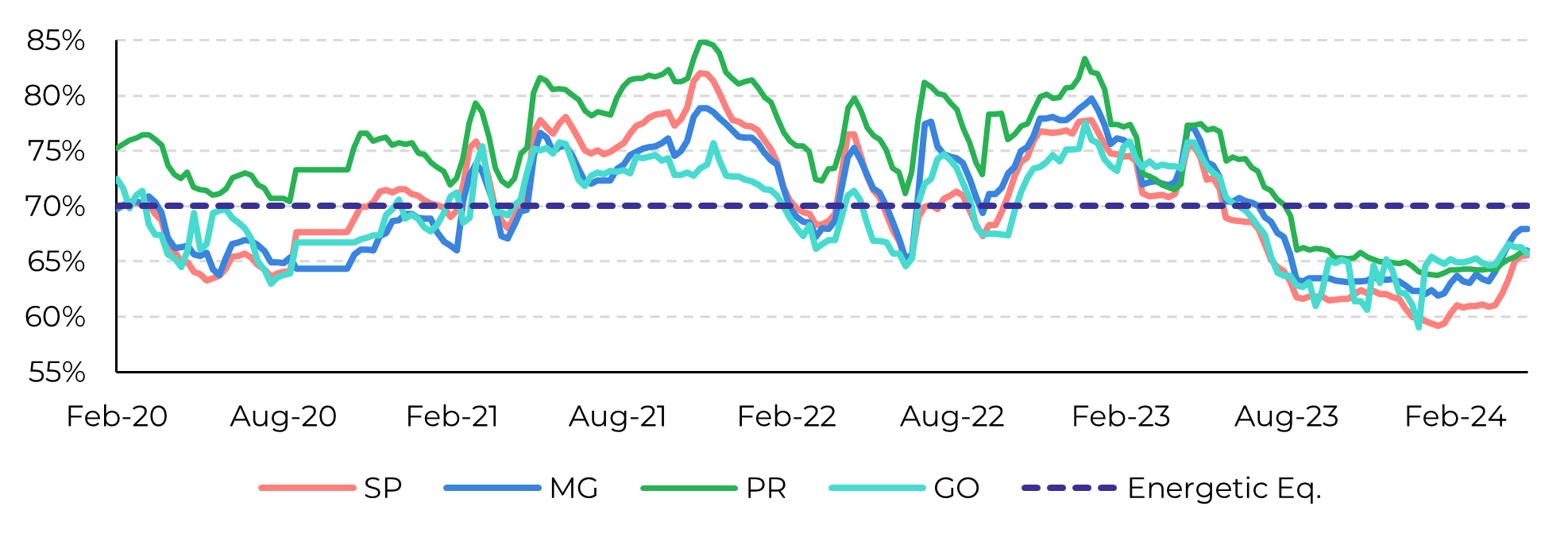

- Gasoline prices are being kept artificially low, with Petrobras holding back on transferring international volatility to the domestic market.

- Ethanol demand recovery is quite recent and fragile.

- Sugar market is getting more comfortable, but it doesn’t mean that Brazilian production is dispensable.

Imagine that Petrobras passes through all the current import arbitrage, estimated at 0.8 BRL/liter. This would mean that hydrous prices in sugar equivalence would go from 14.6c/lb in the current scenario (A) to 16.61 c/lb, in scenario (B). Increasing the sugar’s ethanol so long forgotten floor by nearly 14%. However, assuming higher fuel demand, this could also trigger a correction in pump parity, as consumers would be more inclined to buy hydrous at the current percentage. If pump parity managed to reach the 70% level, prices could rise to 18c/lb, scenario (C). But note that the latter is highly unlikely.

Image 3: Price scenarios: hydrous does not pose a threat to sugar

Source: Bloomberg, Hedgepoint

Image 4: Pump parity in key producing states (%)

Source: ANP, Hedgepoint

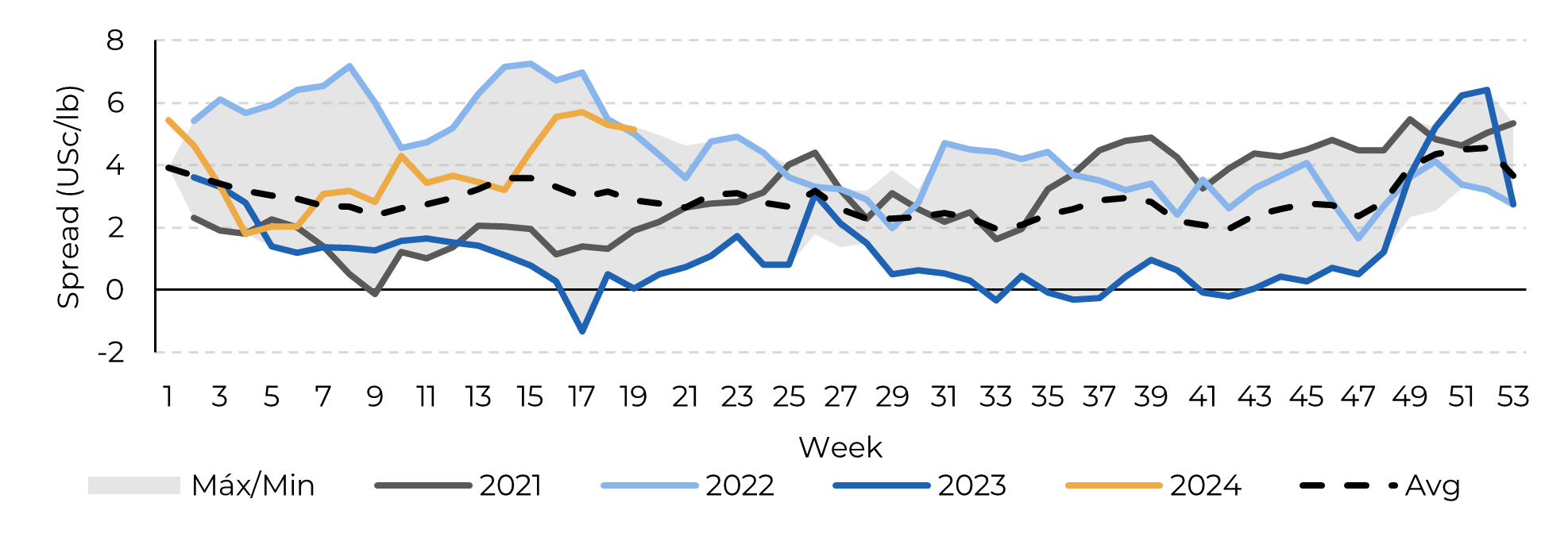

Image 5: Brazilian crystal spread on raw sugar (c/lb)

Source: Refinitiv, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.noda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.