Sugar and Ethanol Weekly Report - 2024 05 20

"Center-South's robust production outlook, combined with other bearish factors such as Petrobras' leadership change and increased Chinese sugar planting, has pressured sugar prices down to a new range of 17.5-19.5 cents per pound. Despite bullish long-term risks from a potentially stronger La Niña, 2024 prices are unlikely to rise significantly."

Center-South had a strong start and sugar mix is surging!

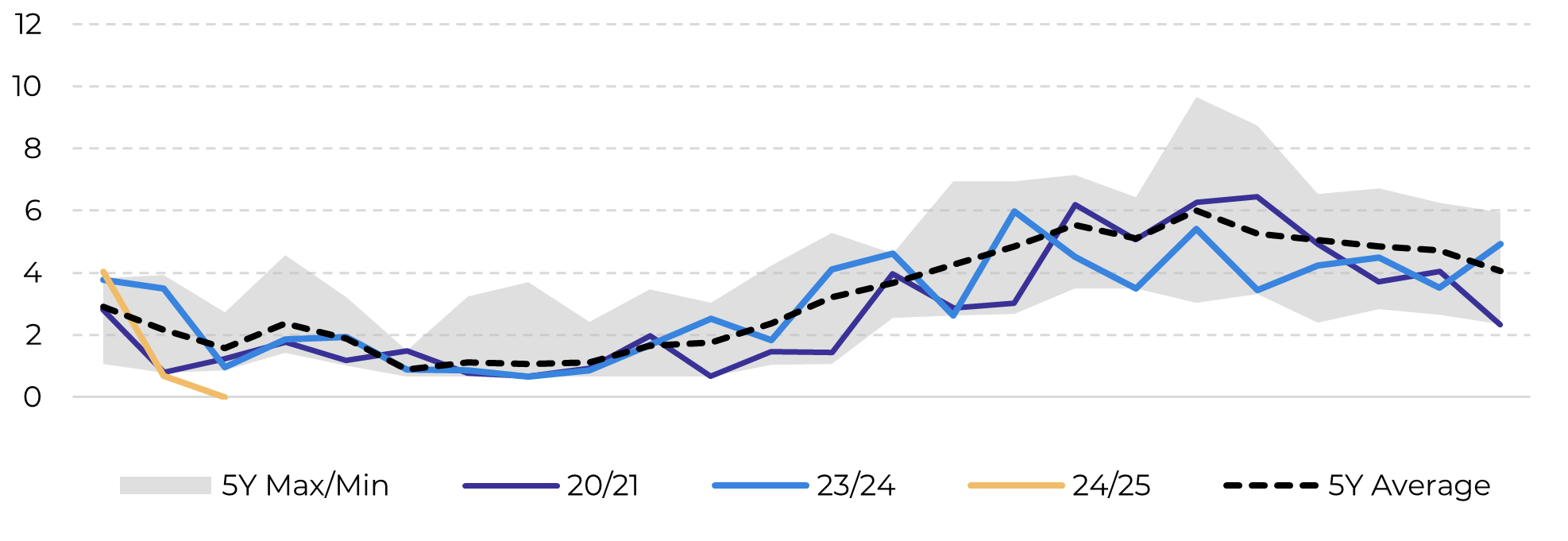

- Dry weather in the Center-South region since mid-April led to a strong start to the 24/25 season, with a 43.41% increase in cane crushing and sugar production rising to 2.6 Mt in April, compared to 23/24.

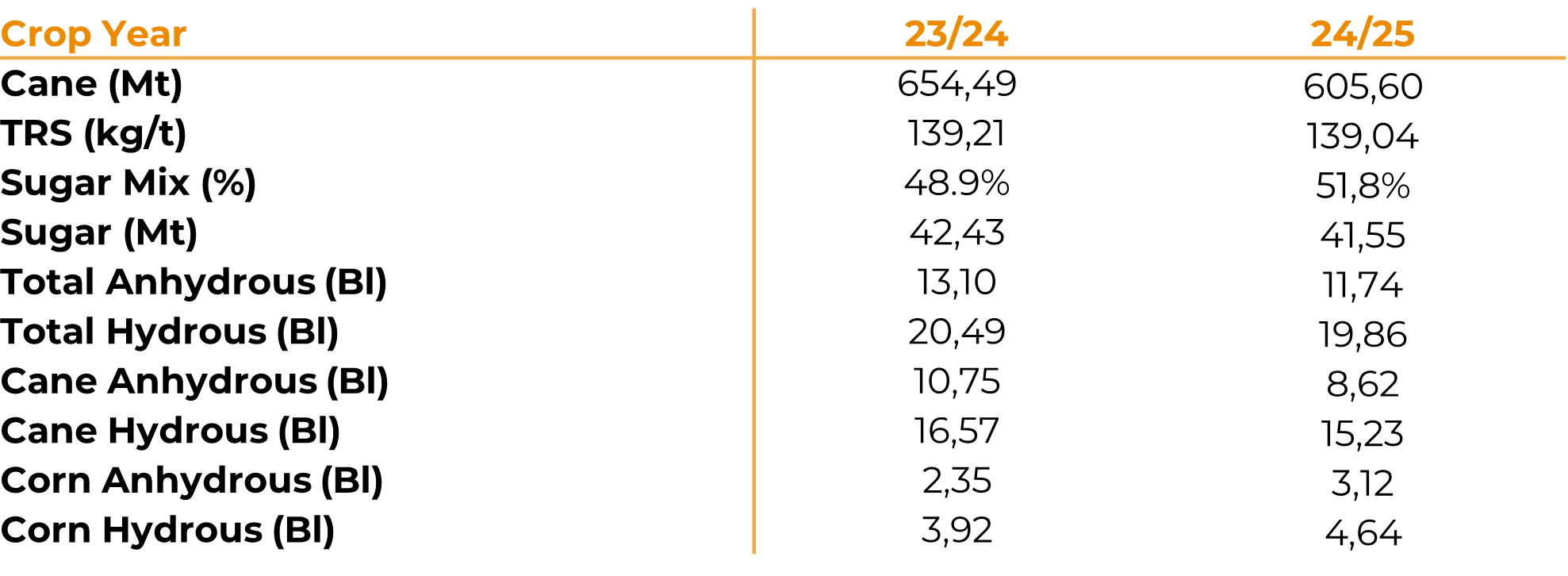

- Compared to the 20/21 season (a crop with similar weather pattern), the 24/25 season achieved a record-high sugar mix despite lower Total Recoverable Sugar (TRS), making it explicit the increased capacity.

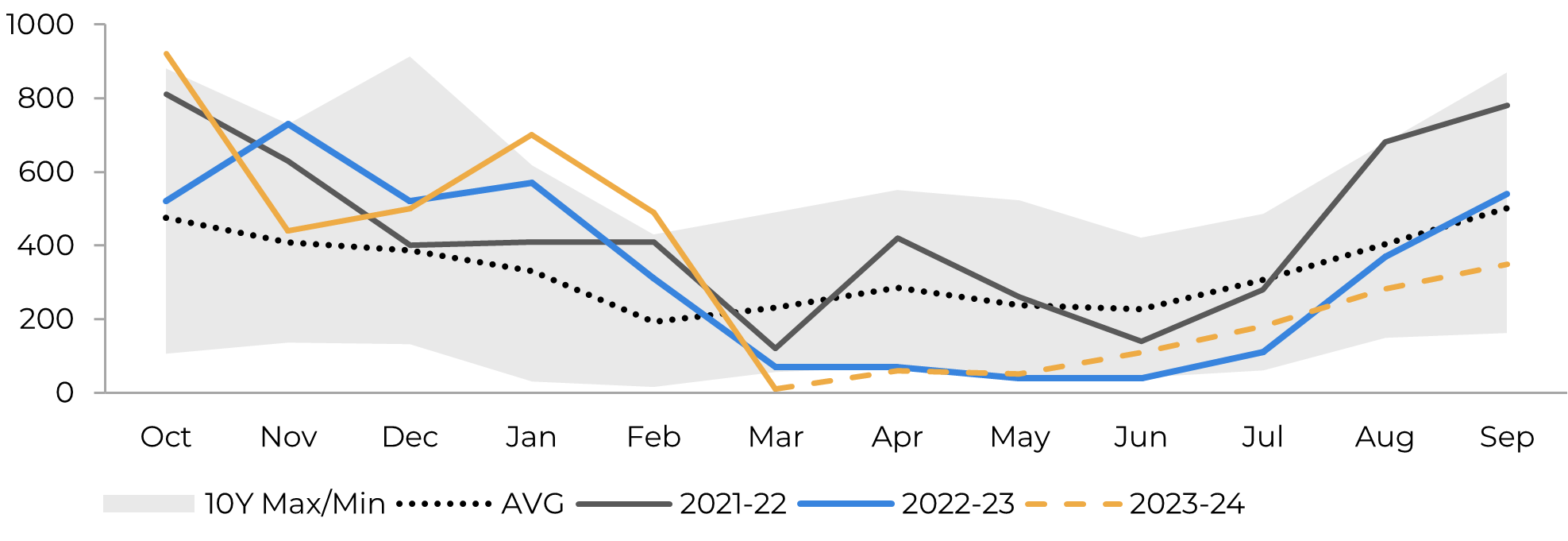

- The bearish trend in sugar prices is reinforced by the change in leadership at Petrobras and its decision not to pass on import costs, as well as increased sugar planting in China, leading to higher expected output.

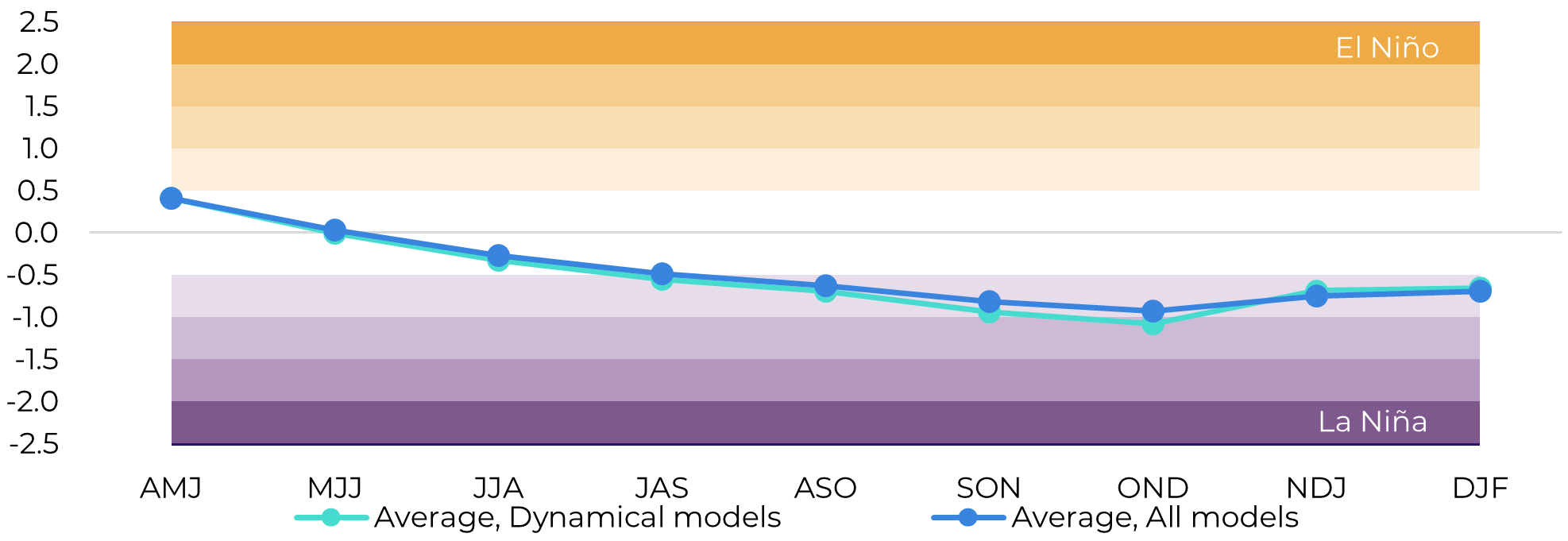

- Going forward, sugar prices are anticipated to remain on a 17.5-19.5c/lb range, with potential long-term bullish risks from a possible strong La Niña affecting the 25/26 cane development in the Center-South region.

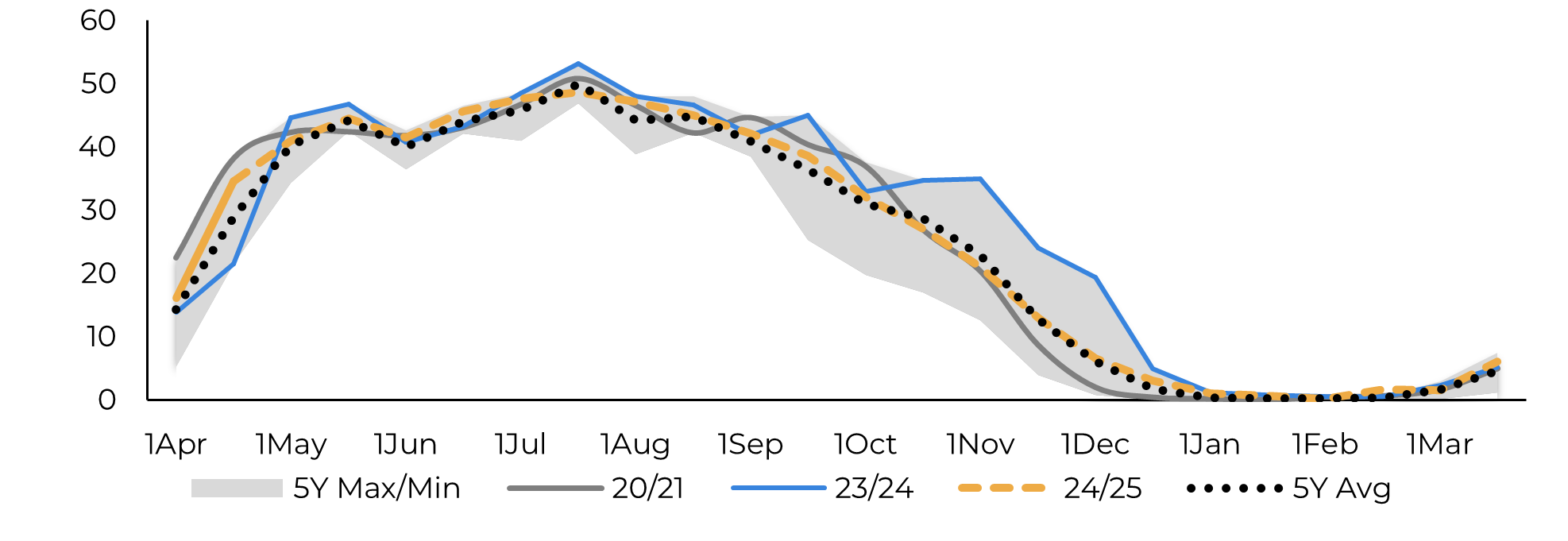

The weather in the Center-South region remains dry, with extremely low precipitation levels in key-producing areas since mid-April. This contributed to 24/25’s strong start, driven by contracted sugar and the need to deliver. Cane crushing increased by 43.41% in April compared to the 23/24 season. Sugar production also rose during the month, reaching 2.6 Mt, up from 1.5 Mt previously.

Interestingly, comparing these results with the 20/21 season, which had similar precipitation patterns, cane, and sugar volumes were higher in 20/21 than in 24/25 so far, as was the Total Recoverable Sugar (TRS). However, a notable trend in the current season is its record-high sugar mix achieved despite lower TRS, indicating that the sugar mix should indeed be higher.

Image 1: Lost Days (No. of Days)

Source: Bloomberg, Somar, Hedgepoint

Image 2: Crushing per Fortnight (Mt)

Source: Unica, Hedgepoint

Despite a slightly lower sugar mix, the Center-South region is still expected to produce over 41 Mt during the 24/25 season, the second-best result in its history. This anticipation contributed to last week's sharp price correction for raw sugar, culminating in the lowest final settlement in over a year at 18.1 cents per pound.

Additional factors reinforced the bearish trend. In Brazil, the government replaced Petrobras CEO Jean Paul Prates with Magda Chambriard, the former head of the Agência Nacional de Petróleo (ANP), Brazil’s oil and gas regulator. A member of the new administration stated that Petrobras does not intend to pass on import costs to consumers, even with oil priced at $80 per barrel, triggering a significant decline in Petrobras shares. For the sugar market, this indicates that ethanol is even less likely to pose a competitive threat.

Image 3: Crop Estimates Summary

Source: Unica, Hedgepoint

Image 4: Total Imports - China ('000t - exc. Syrup and smmugling)

Source: CSA, Refinitiv, Greenpool, GSMM, hEDGEpoint

Image 5: ENSO Nino 3.4 ONI – El Niño, La Niña or Neutral

Source: IRI, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.noda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.