Sugar and Ethanol Weekly Report - 2024 05 27

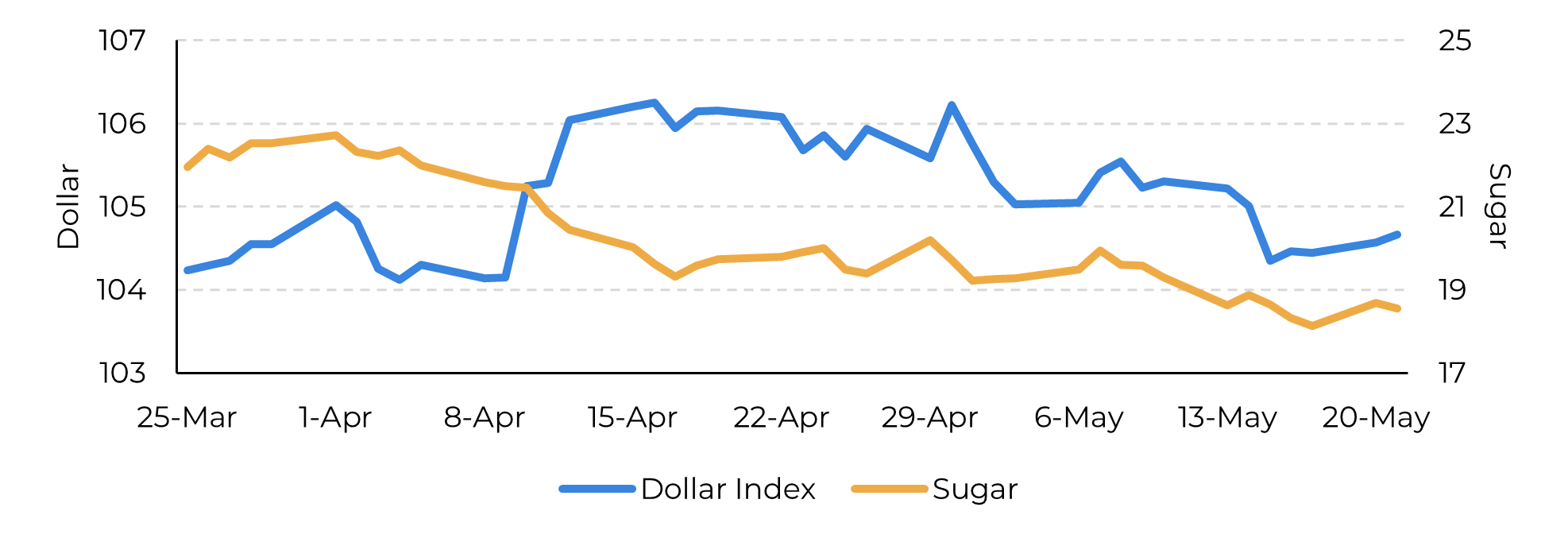

"Sugar attempted recovery early last week, with July settlements reaching 18.68 cents per pound on Monday. The remainder of the week saw unfavorable conditions for bullish traders, with the dollar index strengthening and the market acknowledging unchanged sugar fundamentals, particularly in the short term."

A lower support level

- Sugar attempted recovery early last week, with July settlements reaching 18.68 cents per pound on Monday. The remainder of the week saw unfavorable conditions for bullish traders, with the dollar index strengthening and the market acknowledging unchanged sugar fundamentals, particularly in the short term.

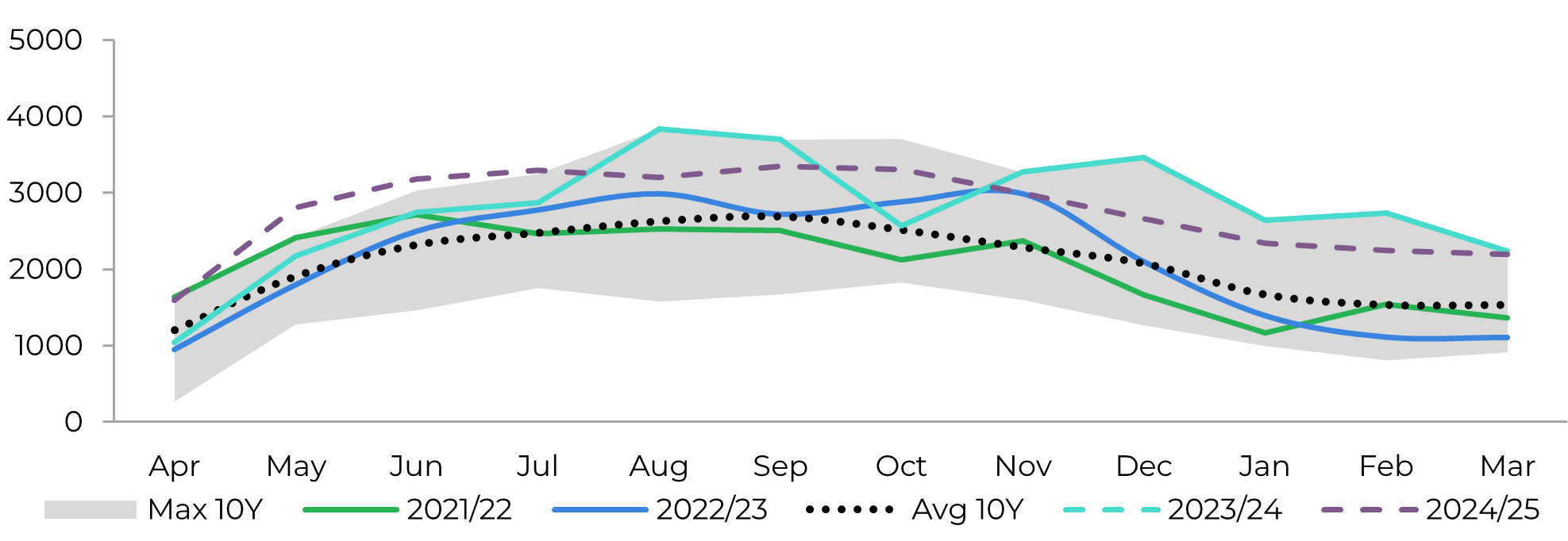

- Strong Brazilian crop and robust exports contributed to a bearish outlook, with April's Center-South region exports surpassing previous records, reaching nearly 1.6 Mt.

- Chinese Customs disclosed April's import figures, showing a decrease of 20 kt compared to the same period last year, reaffirming China’s selective purchasing approach. Rumors of additional purchases and recalibration of import arbitrage suggest lower support.

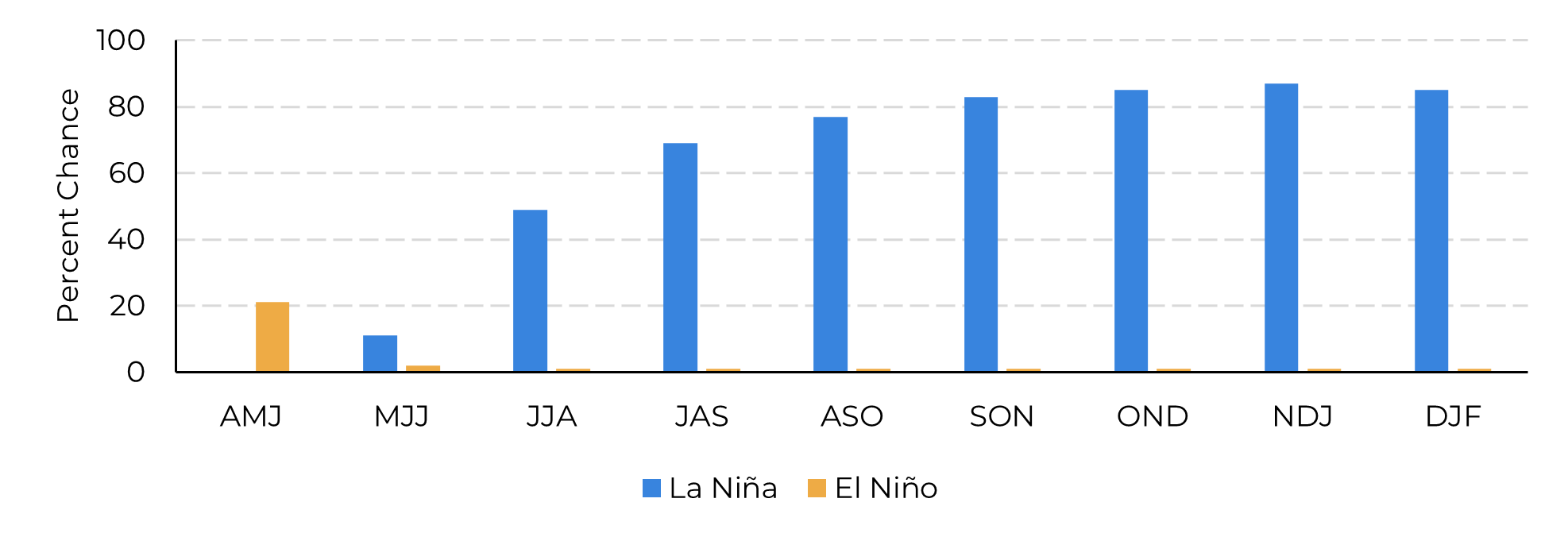

- Additionally, the looming threat of La Niña poses a significant long-term risk, potentially impacting sugar production in 2025, especially in July and October contracts.

Sugar made another attempt to recover at the start of last week after breaching the 18c/lb support level on May 16th. The July settlement reached 18.68c/lb on Monday, also reflecting a relatively dull day in other markets. The dollar index remained stable, while the energy complex experienced corrections.

However, the rest of the week did not favor bullish traders. The dollar index regained strength, and the market recognized that sugar fundamentals didn’t change, at least not in the short term.

Image 1: Dollar Index versus Sugar

Source: Refinitiv, Hedgepoint

Image 2: Total Exports - Brazil CS ('000t)

Source: Unica, MAPA, SECEX, Williams, Hedgepoint

Also regarding current fundamentals, Chinese Customs has disclosed April's import figures, aligning with initial expectations. The nation imported 50kt during the month, reflecting a decrease of 20kt compared to the same period last year. This reaffirms China’s buying calculated approach, with the 3.1 Mt already imported this season providing a cushion for selective purchasing based on price viability.

Recent price fluctuations, dropping below 18 c/lb, have spurred rumors that China acquired an additional 350kt, scheduled for arrival between June and July, in accordance with seasonal patterns. Considering that support was identified around the 18 c/lb mark, it suggests that the Chinese import arbitrage is recalibrating from a 605 RMB/t premium to slowly align with the sole ZCE parity, calculated at 17 c/lb.

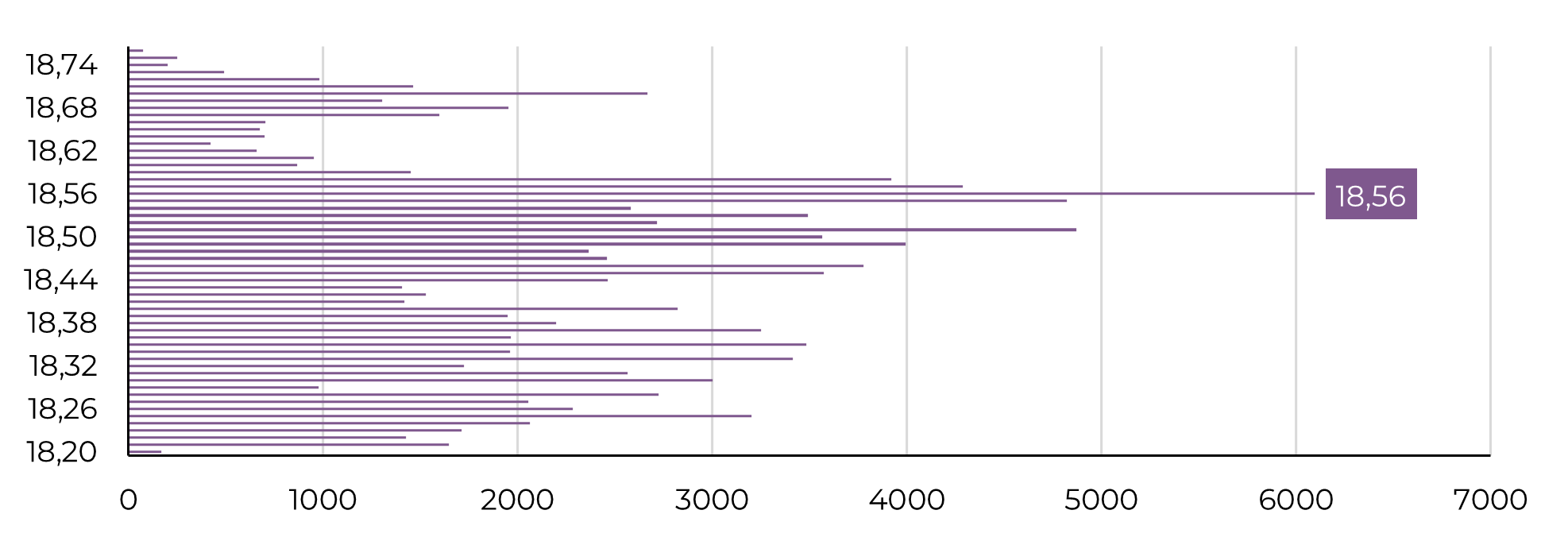

Over the preceding fortnight, the majority of trading activity orbited 18.56 c/lb, with the uppermost trading range falling below this mark. Consequently, the current scenario of sugar prices residing below this threshold, at 18.3 c/lb, isn't unexpected, with notable difficulty encountered in surpassing it. Both fundamental factors and market interest contribute to this challenge.

Image 3: Raw sugar volume at price between May 12 and May 23 (c/lb and No. of lots)

Source: Refinitiv, Hedgepoint

Image 4: NOAA CPC ENSO Probabilities (May 2024)

Source: NOAA

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.