Sugar and Ethanol Weekly Report - 2024 06 03

"The current state of ENSOS indicates that the transition to La Niña will occur a little later than expected, with the phenomenon becoming more active during the third quarter. In Brazil, the phenomenon tends to benefit cane harvest, due to low rainfall and higher temperatures in winter. However, it also increases the risk of fires and frosts."

La Niña is coming: how can the sugar market be affected?

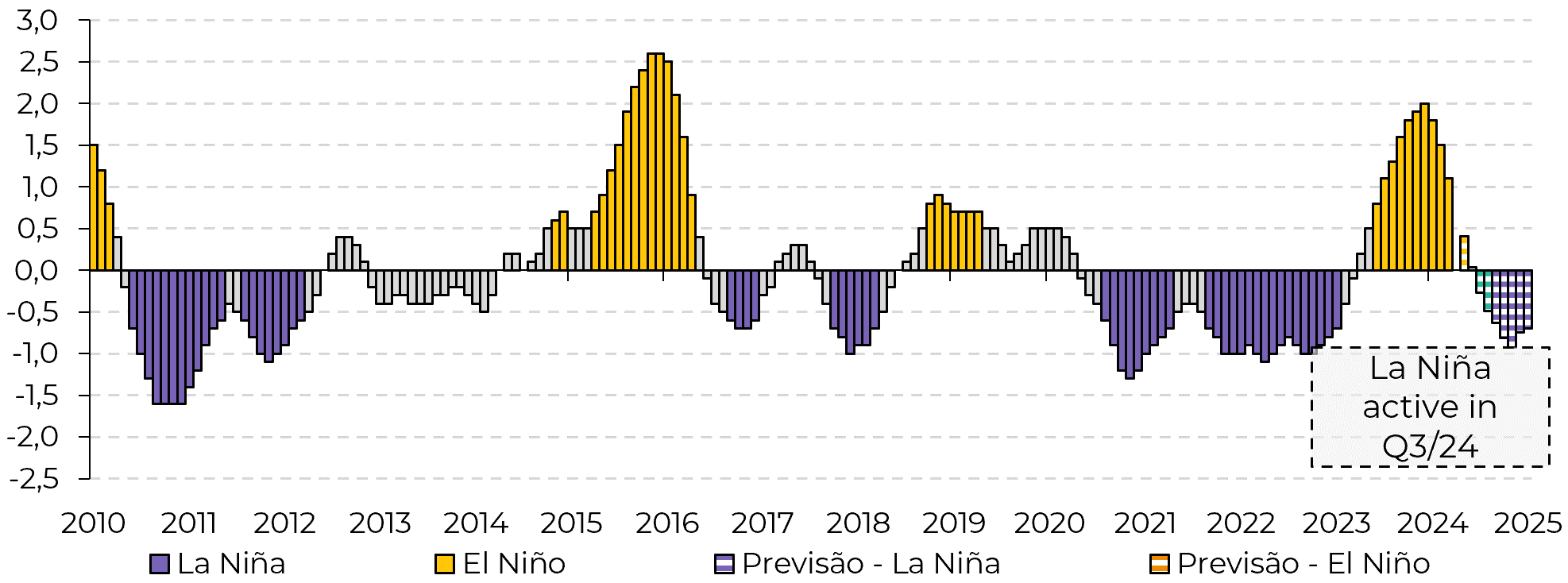

- The current state of ENSOS indicates that the transition to La Niña will occur a little later than expected, with the phenomenon becoming more active during the third quarter.

- In Brazil, the phenomenon tends to benefit cane harvest, due to low rainfall and higher temperatures in winter. However, it also increases the risk of fires and frosts. A more intense La Niña from Q3 onwards raises concerns about the 25/26 development.

- For the Northern Hemisphere, a moderate La Niña could bring benefit for production, especially in India.

- In Central America, the hurricane season may pose a greater risk.

- In Thailand, the event would bring above-average rainfall and affect cane quality.

The agricultural commodities market is closely linked to weather patterns such as La Niña and El Niño as they affect the supply side. Depending on the stage of development of the crop in question, these climatic phenomena can be either beneficial or detrimental to the yield of the agricultural product.

In our previous reports we have already mentioned some of the effects that the transition from El Niño to La Niña can have. In this report, therefore, we have tried to look in more detail at the possible scenarios and risks for the sugar sector as a result of this climate change.

Firstly, it is important to highlight that the initial expectations have changed, with the transition from El Niño to La Niña expected to occur a little later than initially expected, at the end of Q2 to the beginning of Q3. As a result, La Niña is expected to have its greatest impact in the third quarter, which brings some changes to its potential impact on cane and sugar beet harvests.

Image 1: Status ENSO – ONI Index (°C)

Source: IRI, NOAA

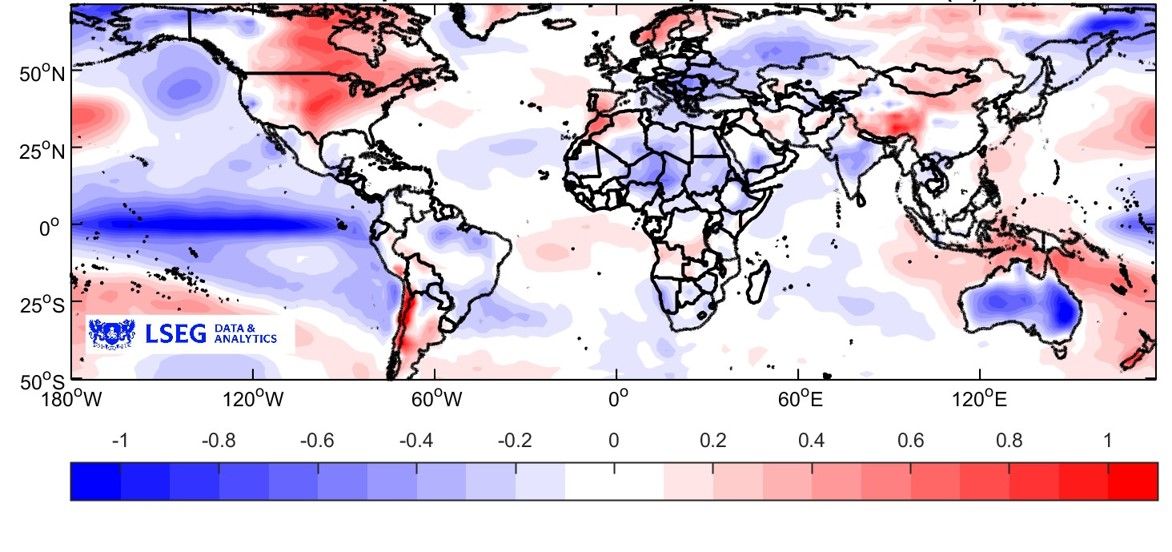

Image 2: La Niña Temperature anomaly (C°) Sep-Nov

Source: Refinitiv

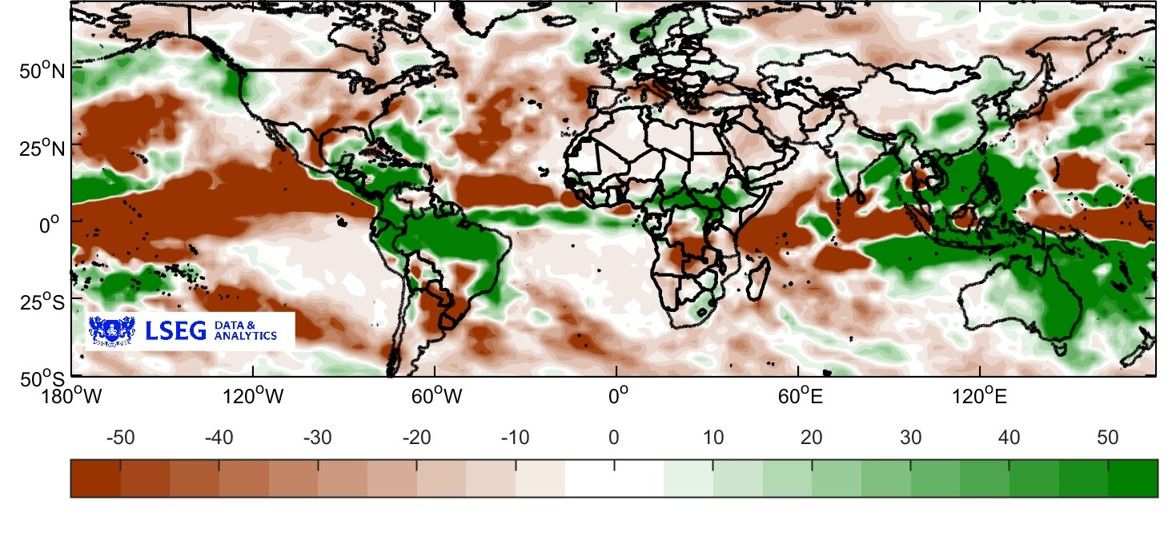

Image 3: La Niña Precipitation anomaly (mm) Sep-Nov

Source: Refinitiv

So how would a La Niña affect sugar production around the world?

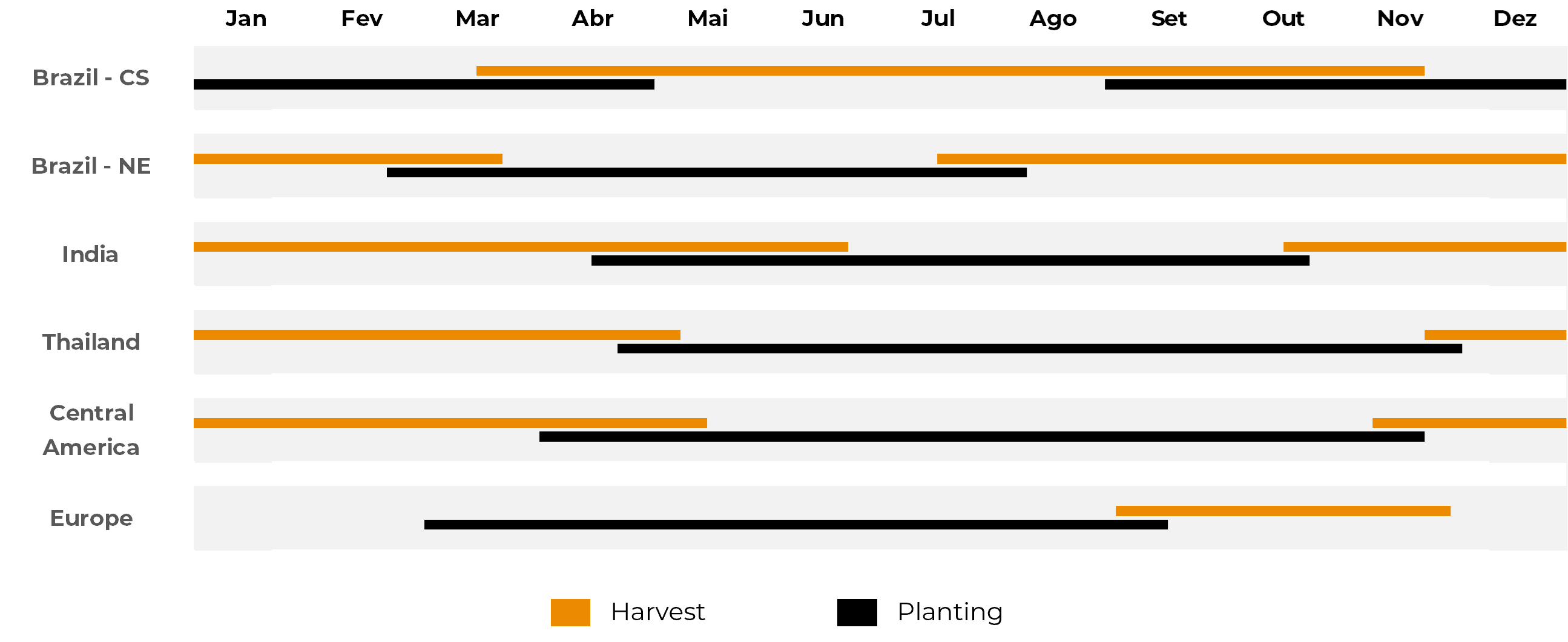

Brazil: In Brazil, a moderate event tends to bring a drier winter in the Centre-South, possibly benefiting the 24/25 harvest. However, a more intense La Niña could lead to frosts and fires, resulting in lower yields and accelerated crushing, also damaging the crop. In addition, if the dry spell extends into the spring - as La Niña is expected to be more intense in Q3 - the development of the 25/26 season could be jeopardized, as was the case in 20/21, when Brazil recorded a crush of only 523 Mt.

India: A moderate La Niña brings the possibility of a good monsoon season. In fact, the Indian government recently indicated that most of the country is likely to receive an above-average monsoon, which should help the development of the 24/25 sugar crop. However, if it is too intense, it could cause flooding.

Europe: In general, weather patterns have little influence and correlation with rainfall and temperatures in the block. A La Niña or an El Niño could be responsible for a slight increase in rainfall between March and August, which could favour the sugar beet development stage. On the other hand, a La Niña event could result in lower rainfall from September to November, the peak of the sugar beet harvest, which could benefit field operations.

Central America: A moderate La Niña tends to increase rainfall during the sugar cane development period (June to September), which can be beneficial to production if it is not excessive. In the latter case, rainfall could delay or hamper the pace of harvesting and reduce sucrose content. In addition, the event could intensify the hurricane season in the region, potentially damaging crops.

Thailand: La Niña has a low climatic correlation with rainfall and temperature in the country between September and November, but if it is very intense it could lead to lower rainfall. However, the event's highest correlation is between March and May, which could bring drought to Thailand during the harvest season, which would benefit activities.

Image 4: Crop Calendar - Main producers

Source: Hedgepoint, CONAB, EC, ICCO, ISMA

In Summary

Weekly Report — Sugar

laleska.moda@hedgepointglobal.com

livea.coda@hedgepointglobal.com