Sugar and Ethanol Weekly Report - 2024 06 17

"Last week, raw sugar prices were driven by speculation, particularly in response to Friday’s Unica report. Despite investments, the sugar mix level was surprisingly lower than last year, and TRS was worse than expected due to immature and leftover cane crushing. However, the fundamentals remain largely unchanged, with Brazil still on track for its second-best year maintaining a tight price range. However, weather remains the biggest source of volatility; any significant deviation from an average-precipitation forecast could disrupt future crop developments and alter the current price range."

Brazil could be lower, what about it?

- Last week's raw sugar prices were influenced by speculation and anticipation of a bullish outlook before Friday's Unica report. The biggest surprise was the lower-than-expected sugar mix level, despite investments in crystallization.

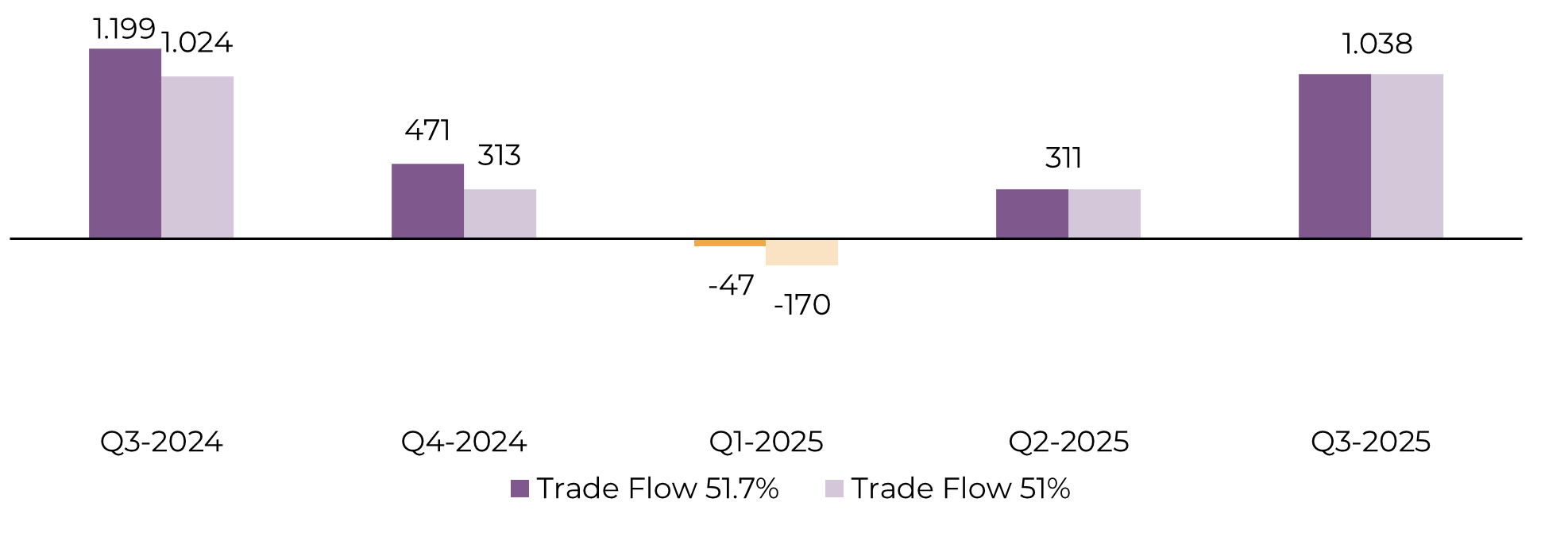

- Even with a sugar mix variation between 51.7% and 51%, total sugar output would only vary slightly (42 to 41.5 million tons), maintaining Brazil's status as a key supplier.

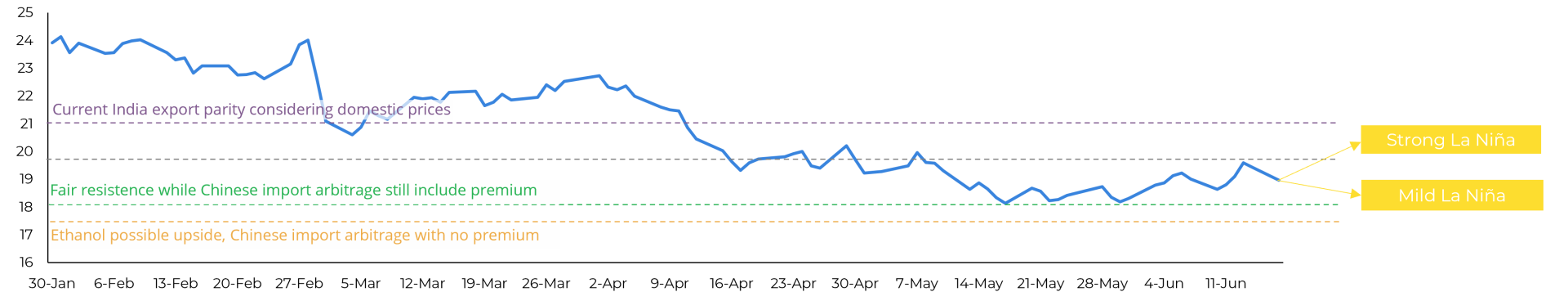

- Prices have remained within the range established in early May, with a perceived price floor around 18 c/lb. Speculation of Chinese buying arises when prices approach this level, but China’s reduced need for imports suggests a closer alignment with ZCE levels (17-17.5 c/lb).

- Key market drivers are weather-related, with short-term weather in Brazil, ENSO developments, and Northern Hemisphere crop conditions playing a crucial role.

Last week, raw prices were influenced by speculation, especially reacting to Friday’s Unica report. The market anticipated a more bullish outlook before the report release, with prices rising from Tuesday to Thursday (19.59 c/lb) but dipping slightly on Friday (19.46 c/lb). The biggest surprise was the sugar mix level, below last year, despite investments in crystallization suggesting it should have been higher. Additionally, the ATR (agricultural yield) was worse than expected, due to the crushing of both bisada (leftover) and immature cane.

Image 1: The difference between a 51.7% and 51% sugar mix has minimal impact on trade flows ('000t tq)

Source: Refinitiv, Hedgepoint

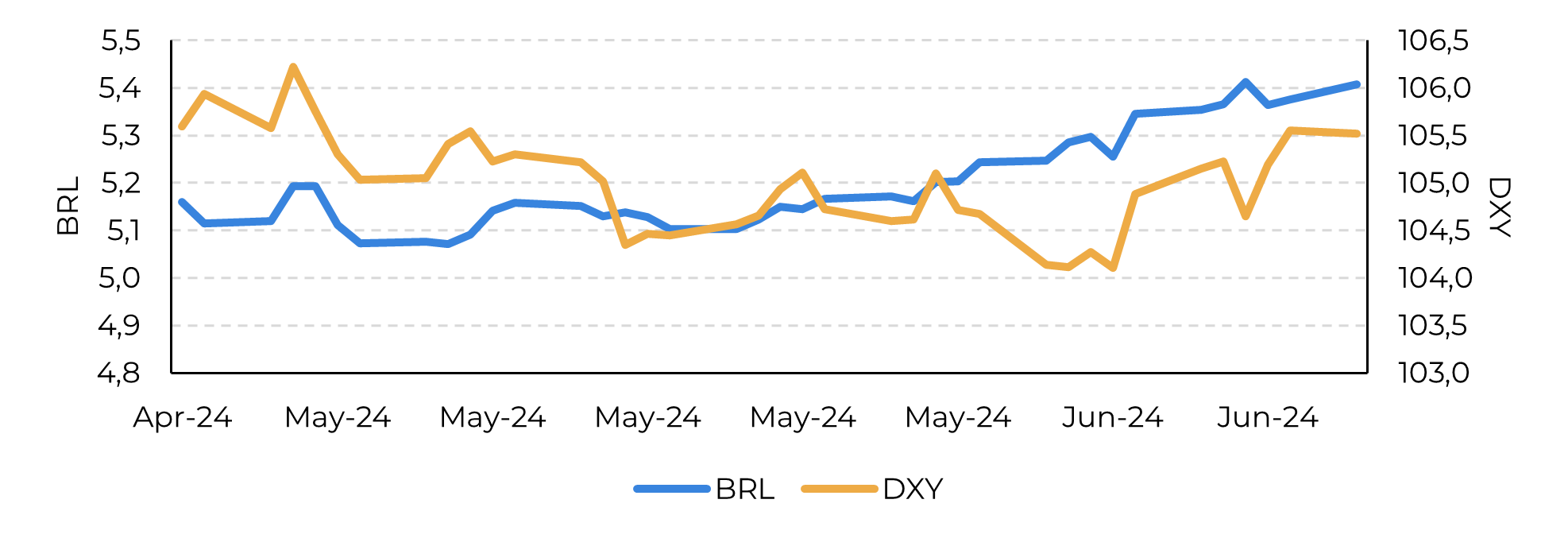

Image 2: IBRL devaluation is another source of incentive to exports

Source: Refinitiv, Hedgepoint

Image 3: Raw Sugar Prices (c/lb)

Source: Refinitiv, Hedgepoint

For prices to stay within these ranges, the weather needs to be "average." We might see some changes as future rainfall trends become clearer. Key points to monitor include:

- Short-term weather in Brazil: Drier conditions could increase sucrose content but damage late-season cane, making it difficult to achieve a higher sugar mix.

- 2ENSO developments: An active La Niña during the Center-South’s summer could impact the 25/26 season, particularly if it is very strong, though this climate event generally has little correlation with precipitation in the region. For more details, refer to our report on La Niña.

- Northern Hemisphere’s crop development: Weather significantly influences this as well, with the current monsoon season affecting India's potential output.

It's important to note that most key drivers are weather-related, suggesting that although rather dull currently, it is an uncertain market going forward.

Therefore, news like a worse-than-expected monsoon in central-northern India tends to have a bullish impact on sugar prices. However, unless there is a tangible effect or at least strong confirmation, these impacts may dissipate in the short term since they do not alter the current fundamentals. Most impacts are likely to be seen in the 2025 contracts, as Brazil is expected to have another excellent result in 2024.

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com