Sugar and Ethanol Weekly Report - 2024 07 01

"While a milder US dollar and an energy complex price recovery might have contributed to sugar’s performance, the recent surge seems to be mostly driven by its market. Unica report anticipation and Center-South average results created a buzz that has driven traders' eyes from the significant delivery for a July contract. Funds might have lightened their sold positioning, but Brazil might still produce over 41Mt. "

High delivery, higher prices?

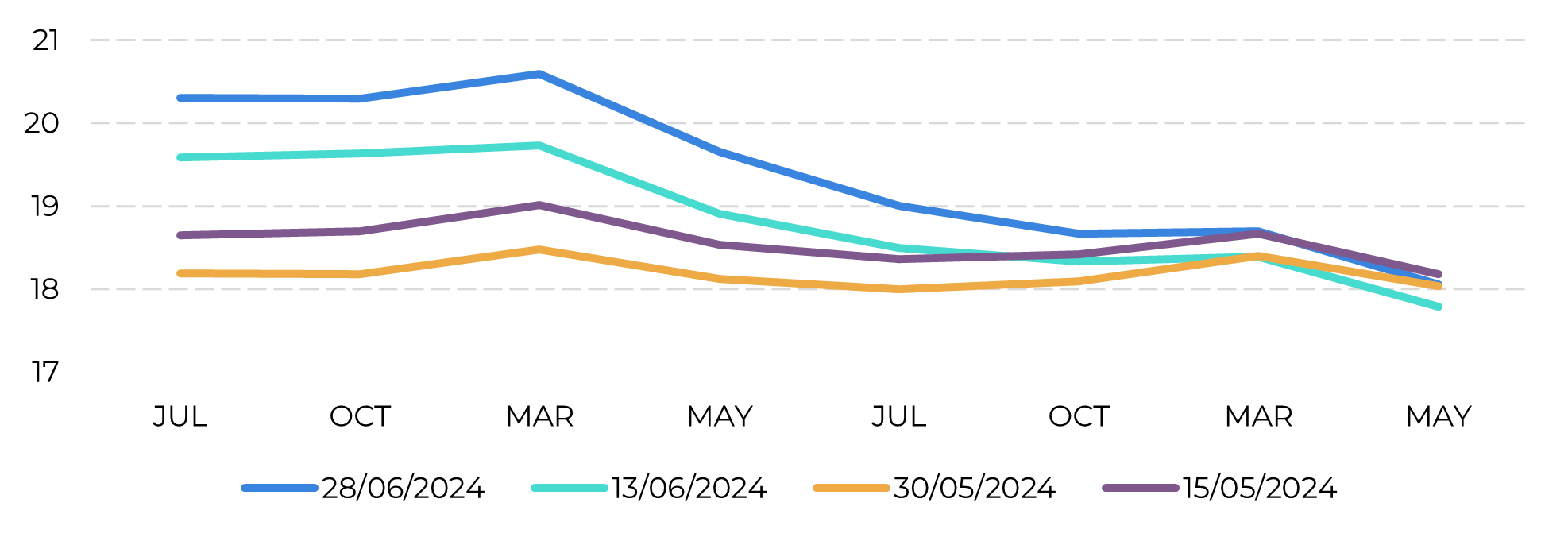

- Last week, the market transitioned from the July to the October contract. Despite a robust July delivery, sugar prices breached resistance and reached an above 20-cent rebound due to anticipated Unica report results.

- The lack of rain led to pessimism about the sugar mix, with an expected 49.5% mix, 48Mt crushing, and TRS between 132 and 135 kg/t. The dry spell and worse cane quality threaten to keep the mix below 51% by season's end.

- The Unica report confirmed a lower mix, at 49.7%, but still higher than market expectations, and a surprising crushing value of nearly 49Mt for June's first fortnight. Sugar prices initially lost momentum but registered gains during July's last trading session.

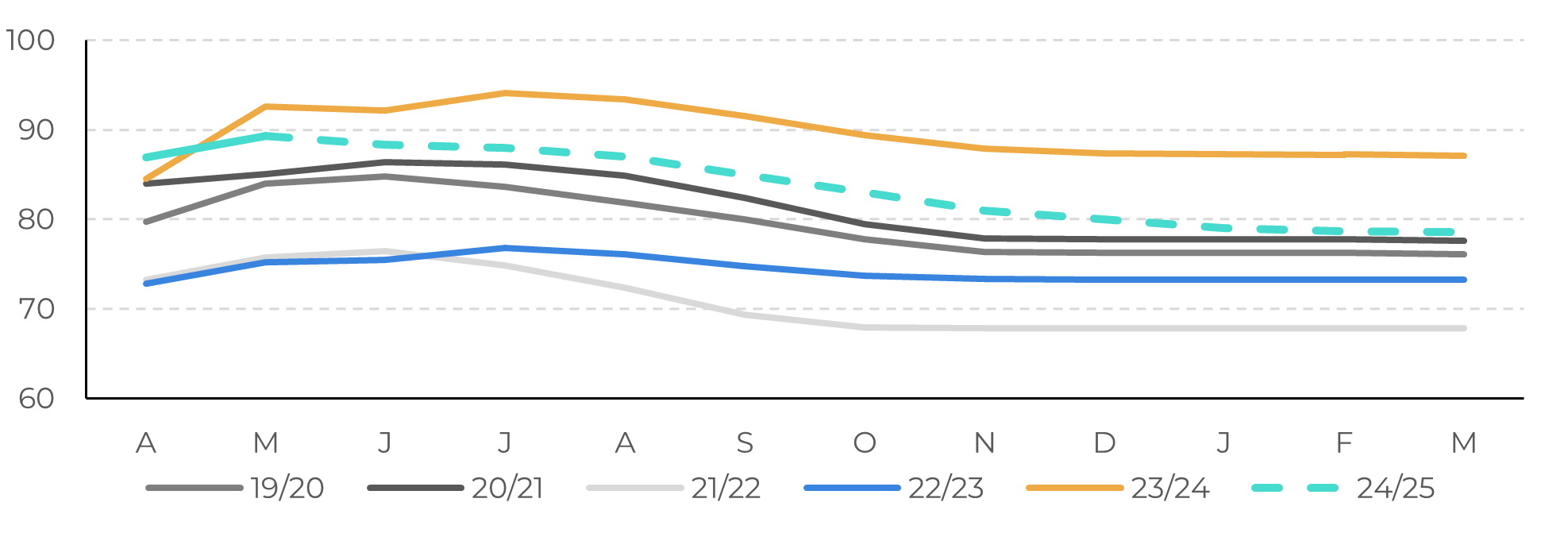

- Market worries that cane quality may prevent an above-51% sugar mix, potentially downgrading sweetener production in Center-South from 41.5Mt to 41Mt. Despite this, Total Cane per Hectare (TCH) remains high at 89.35 t/ha.

Last week, the market shifted its focus from the July to the October contract as options expired and the July delivery approached. During this transition, sugar found the strength to breach past its resistance, driving technical analysis to point to an above 20-cent rebound, which was reached on Thursday. Notably, despite a robust delivery expected for July's expiry, sugar's upside can be attributed to the market's anticipation regarding the release of Unica's report.

Image 1: Raw sugar future curve (c/lb)

Source: Refinitiv, Hedgepoint

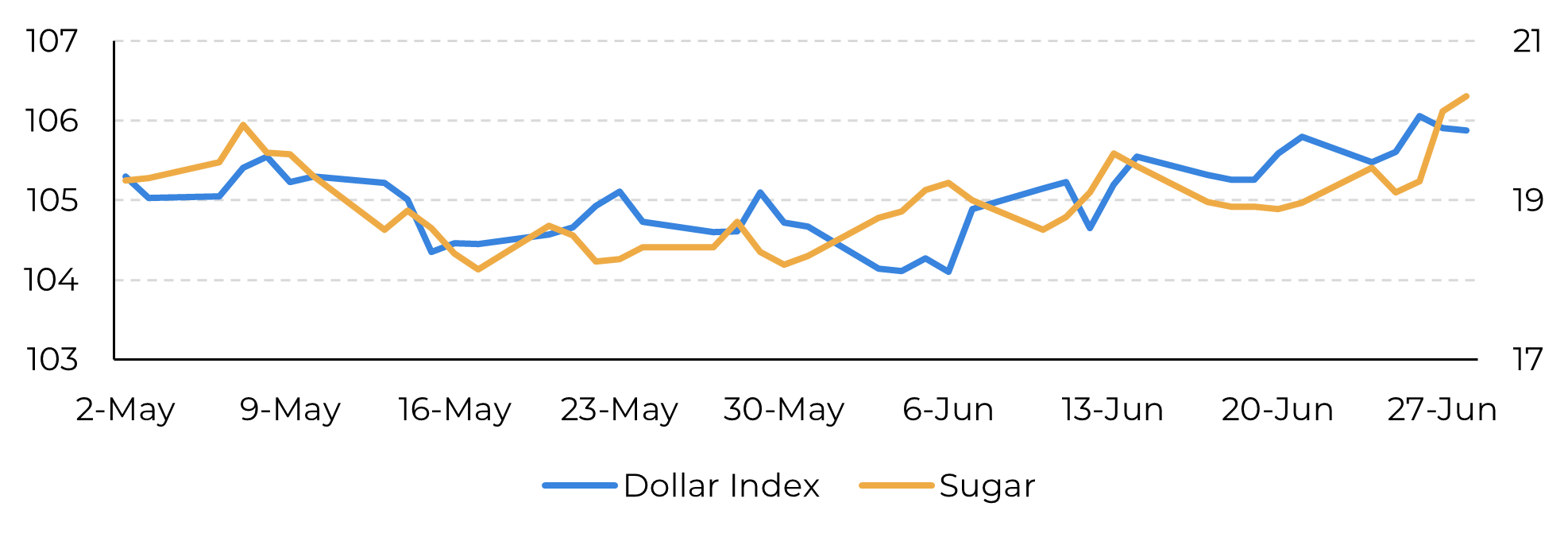

Image 2: July’s behaviour close to its expiry surpassed macro effects

Source: Refinitiv, Hedgepoint

The lack of rains added to a certain pessimism regarding the sugar mix, with an average expectation orbiting around a 49.5% mix, 48Mt crushing, and Total Recoverable Sugar (TRS) between 132 and 135 kg/t. Therefore, although many might argue that a 48Mt crushing is difficult to perceive as supportive, the dry spell and worse cane quality are threatening the sugar mix. If the latter remained below 50% during June’s first fortnight, it might be hard to achieve an above 51% level by the end of the season. And that is more or less what happened. Unica report was out on Friday confirming a lower mix, at 49.7%. However, it was still stronger than the market average. What was surprisingly high were crushing values. Center South reached nearly 49Mt during June’s first fortnight! Straight after Unica’s release sugar prices lost momentum, but managed to turn it around and register gains during July’s last trading session.

Image 3: Brazilian CS Cumulative TCH (t/ha)

Source: Unica, CTC, Hedgepoint

In the end, Unica figures didn’t trigger any revision to our estimates. Although cane crushing was higher than expected, the tail of the crop is expected to be tighter than last year. We kept 613.5Mt of cane and 51.2% sugar mix, but with a warning, if the latter doesn’t react next fortnight, a 51% level might be more likely.

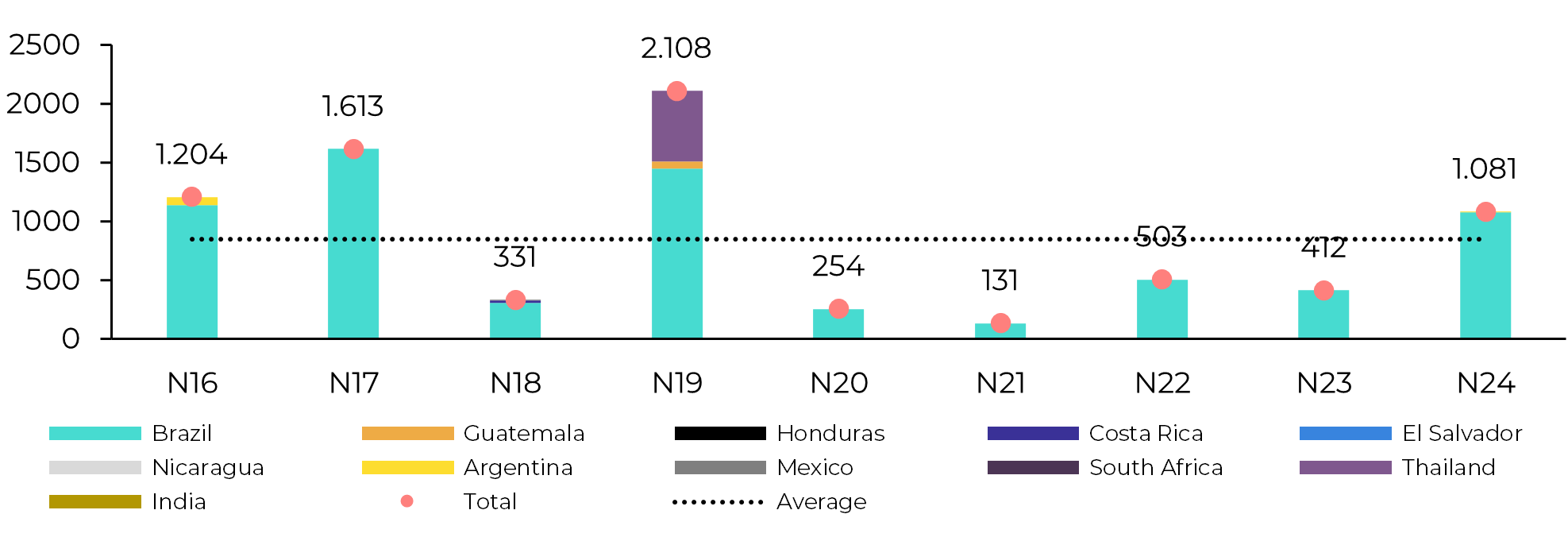

This Center-South buzz ended up stealing the spotlight and July’s last settlement was higher than expected given its delivery anticipation. With over 1Mt delivered, above the 5-year average, prices breached 20c/lb, but kept the carry.

Fundamentally speaking, this carry still points out that the market expects increasing tightness as the trade flow dependency on the Northern Hemisphere rises. News, such as the reported concerns regarding the red hot disease in Uttar Pradesh cane fields, contributes to this trend.

Image 4: Raw sugar July deliveries – preliminar data (‘000t)

Source: ICE, Green Pool

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.