Support on a bearish market

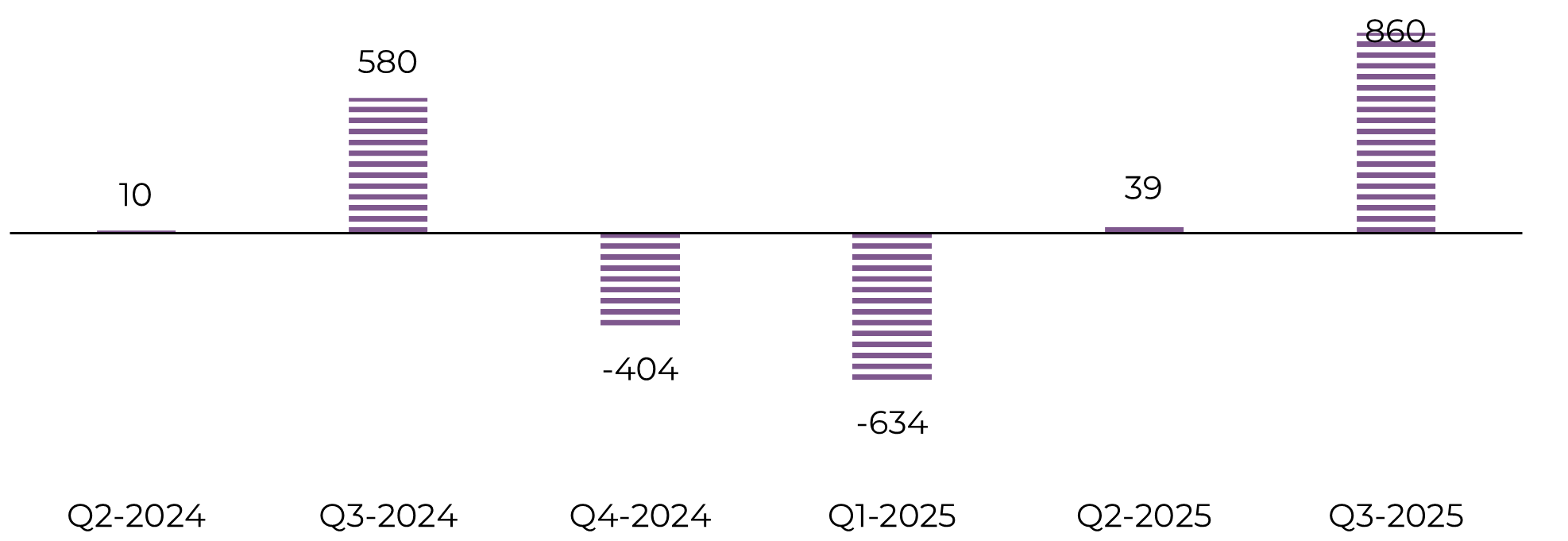

"The upcoming UNICA report is vital for gauging the season's outlook; if the sugar mix stays below 50%, surpassing a 51% cumulative level will be difficult, potentially heightening market concerns. Despite this, it is unlikely the sugar mix will drop to 50%, indicating a worst-case scenario, ceteris paribus."

Support on a bearish market

- Despite robust July contract deliveries, sugar prices rebounded and stayed above 20 c/lb, driven mostly by concerns over Center-South production numbers.

- The lack of rain has led to pessimism about achieving the anticipated sugar mix, prompting analysts to revise projections and making the upcoming UNICA report crucial for understanding price trends.

- While Brazil's reduced rainfall is the main bullish factor, favorable monsoon progress, downgraded La Niña intensity, improving weather in Thailand, and optimistic EU yields are key factors to monitor for 2025 contracts.

- Sugar prices remain favorable, with a significant premium over biofuel, and no anticipated change in mills' prioritization, though cane quality remains a risk.

Despite a robust delivery for the July contract, sugar prices registered an astonishing rebound, keeping its gains and remaining above the 20 c/lb level during last week, a shorter one due to the 4th of July holyday in the US. Driven by technical factors, and a price recovery in the energy sector, sugar’s strength was primarily rooted within its own market, outperforming a US dollar recovery. The recent movement is largely attributed to concerns over Center-South production numbers.

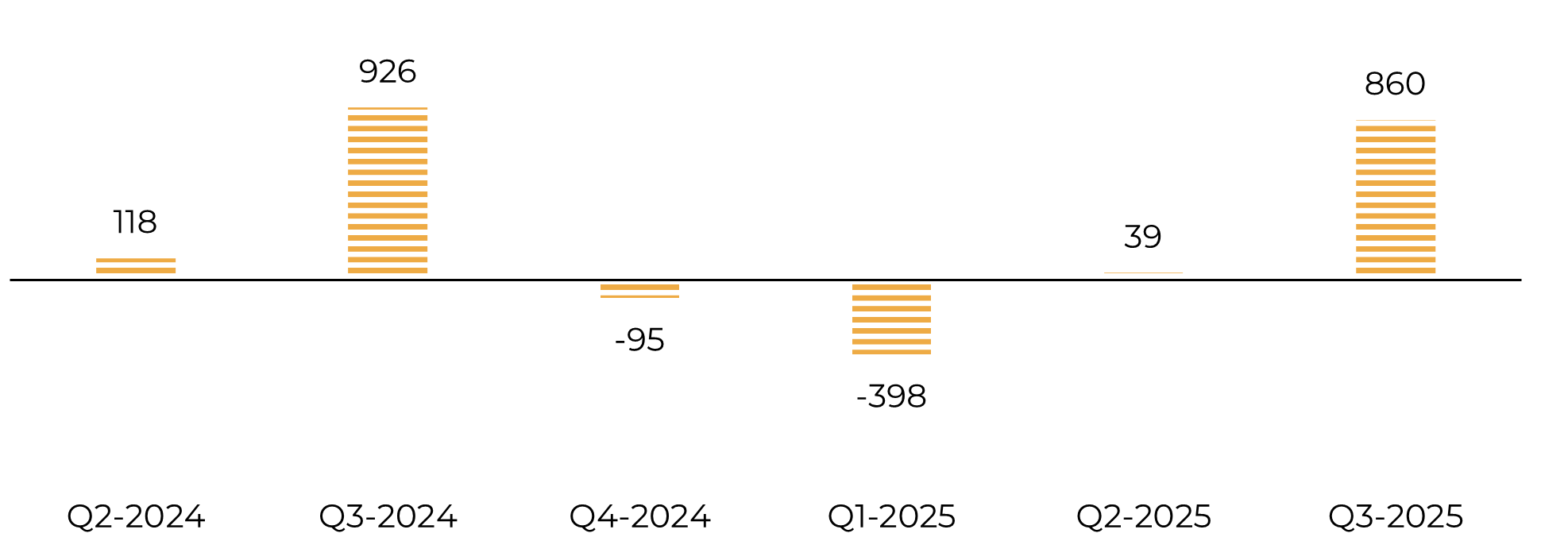

The lack of rain has added to the pessimism regarding the country's ability to achieve the previously anticipated sugar mix. Although the last UNICA report was somewhat in line with market expectations, many analysts felt compelled to revise their mix projections after another fortnight with figures lower than 50%. We revised our figures at the beginning of June to 51.2% and believe that this value is still achievable if, in June’s second fortnight, the regions breaches the 50% sugar mix level, making UNICA’s report monitoring essential to understand price trend movements.

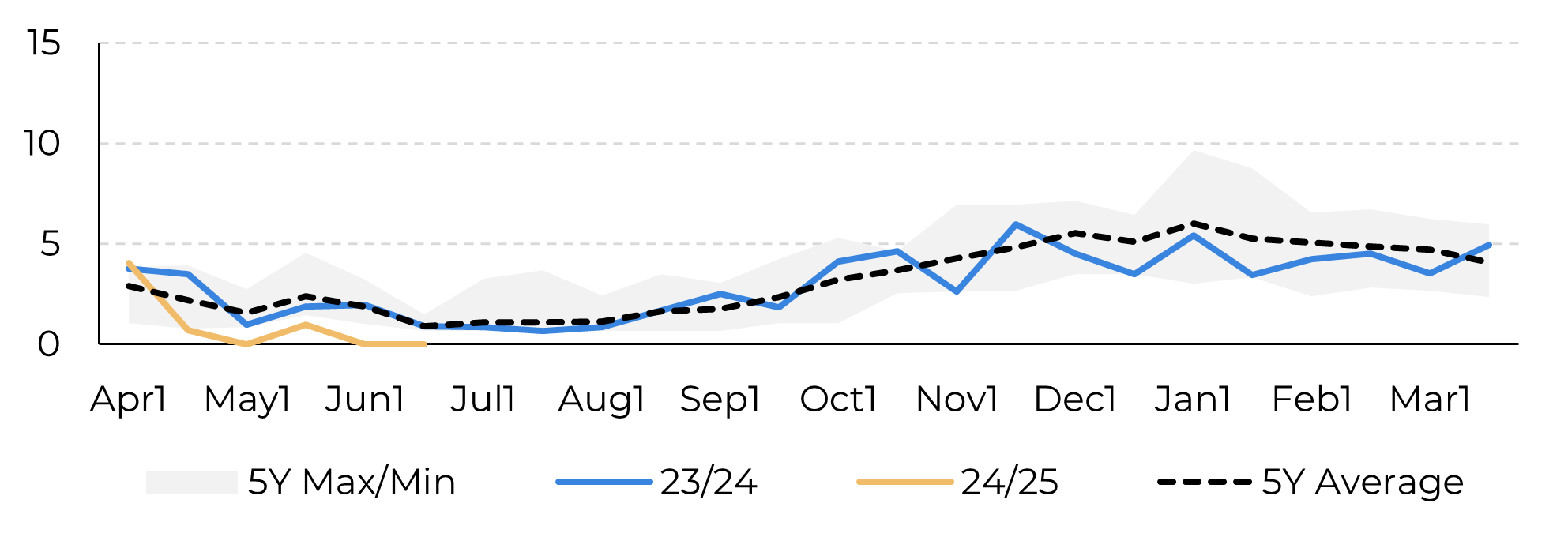

Image 1:Lost days per fortnight estimates (nº of days)

Source: SOMAR, Bloomberg, Hedgepoint

Image 2: Total trade flow considering 51.2% sugar mix, thus 41.5Mt of sugar (‘000 tq)

Source: Green Pool Hedgepoint

Image 3: Total trade flow considering 50% sugar mix, thus 40.6Mt of sugar (‘000 tq)

Source: Green Pool Hedgepoint

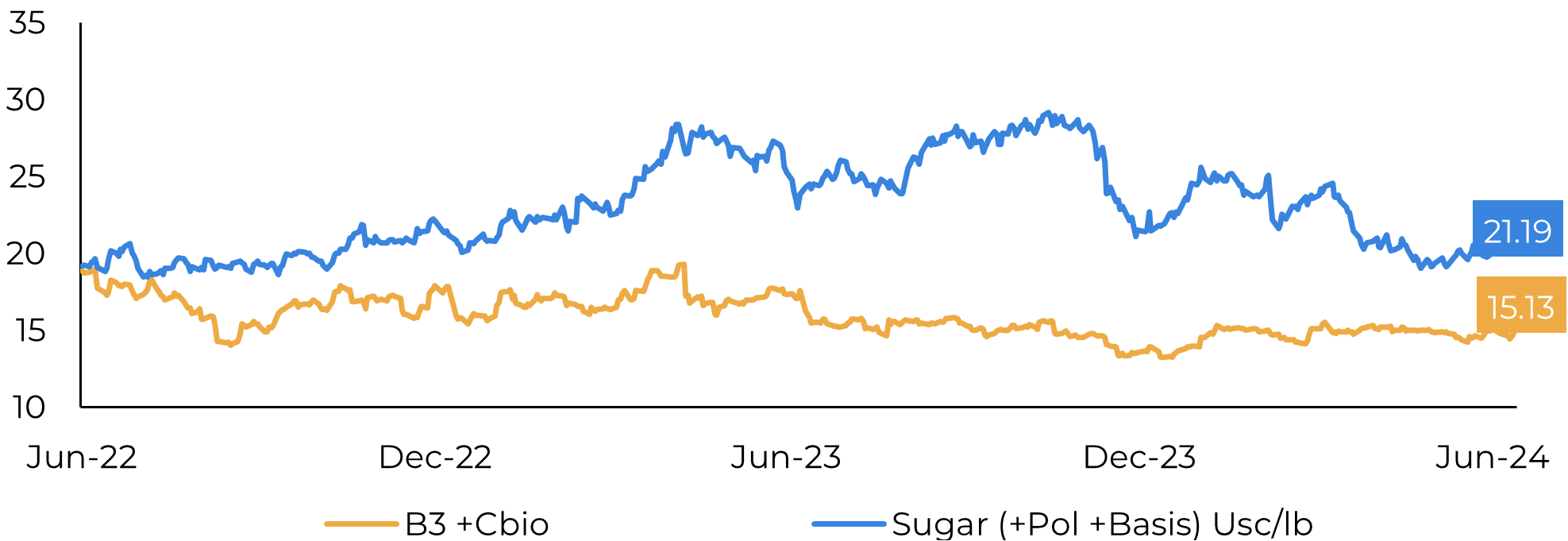

Prices remain favorable for sugar despite higher demand for hydrous ethanol and domestic mills' sales reaching 2020 levels. Currently, sugar prices (20.15c/lb) offer a 540-point premium over the biofuel B3 contract (14.7c/lb). This premium increases to 600 points when polarization and cash premiums are considered (21c/lb vs. 15.1c/lb for the B3 contract plus Cbios). Consequently, there is no anticipated change in mills' prioritization, with cane quality being the only risk to the sugar mix at present.

The lack of rain and poorer cane development have been cited as the main reasons for the lower mix so far. Many in the market are also concerned about end-of-season results. However, cane yields aren't as bad as feared, with April and May results representing the second-best cumulative values on record.

Image 4: Sugar and hydrous parity (c/lb)

Source: Refinitiv, Bloomberg, Hedgepoint

- the monsoon is progressing well,

- La Niña's intensity has been revised down,

- weather conditions in Thailand are expected to improve,

- MARS remains optimistic about EU yields, and

- China is expected to have increased availability.

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.