India adding to the bearish side

"India's optimism is driven by favorable weather, timely monsoons, and, according to the the Department of Agriculture and Farmers’ Welfare, increased cane sowing area, with soil moisture levels supporting crop development and reduced disease risk in key regions."

India adding to the bearish side

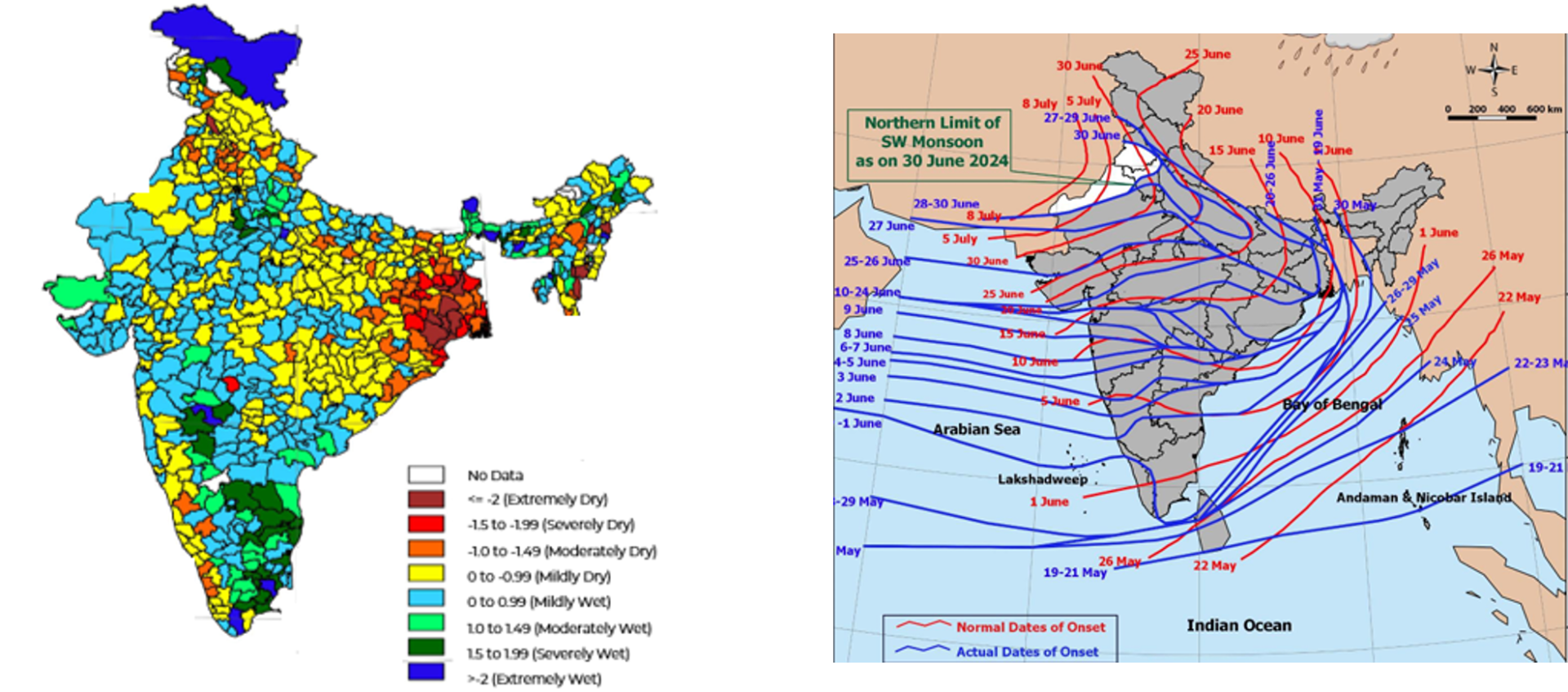

- Key fundamentals such as a progressing monsoon, revised La Niña intensity, improving weather in Thailand, optimistic EU yields from MARS, and increased availability in China are developing, despite market focus on Center-South’s weather issues.

- CNBC Newswire reported ISMA's proposal for export quotas to balance excess stocks, but government approval is unlikely for the 2023/24 season, suggesting possible resumption in 2024/25 if domestic demand and ethanol diversion are met.

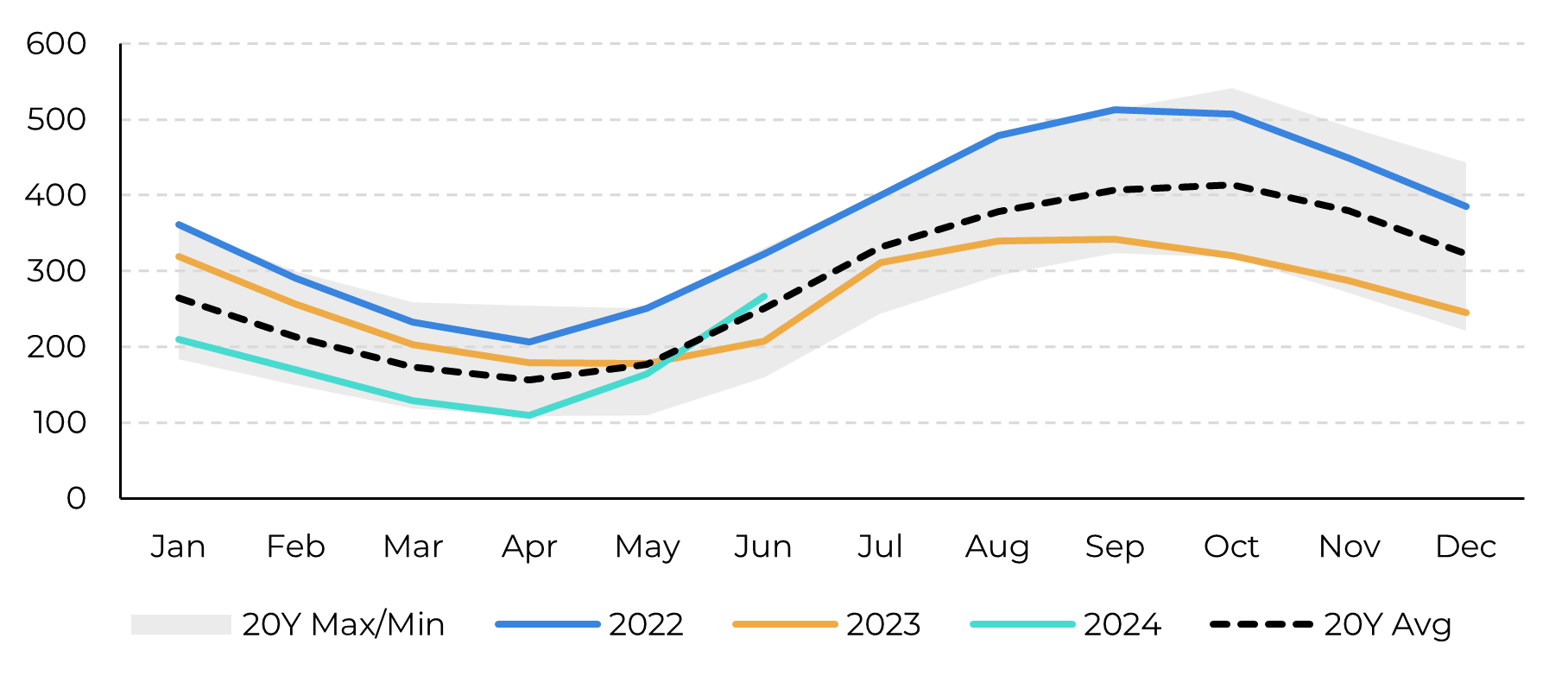

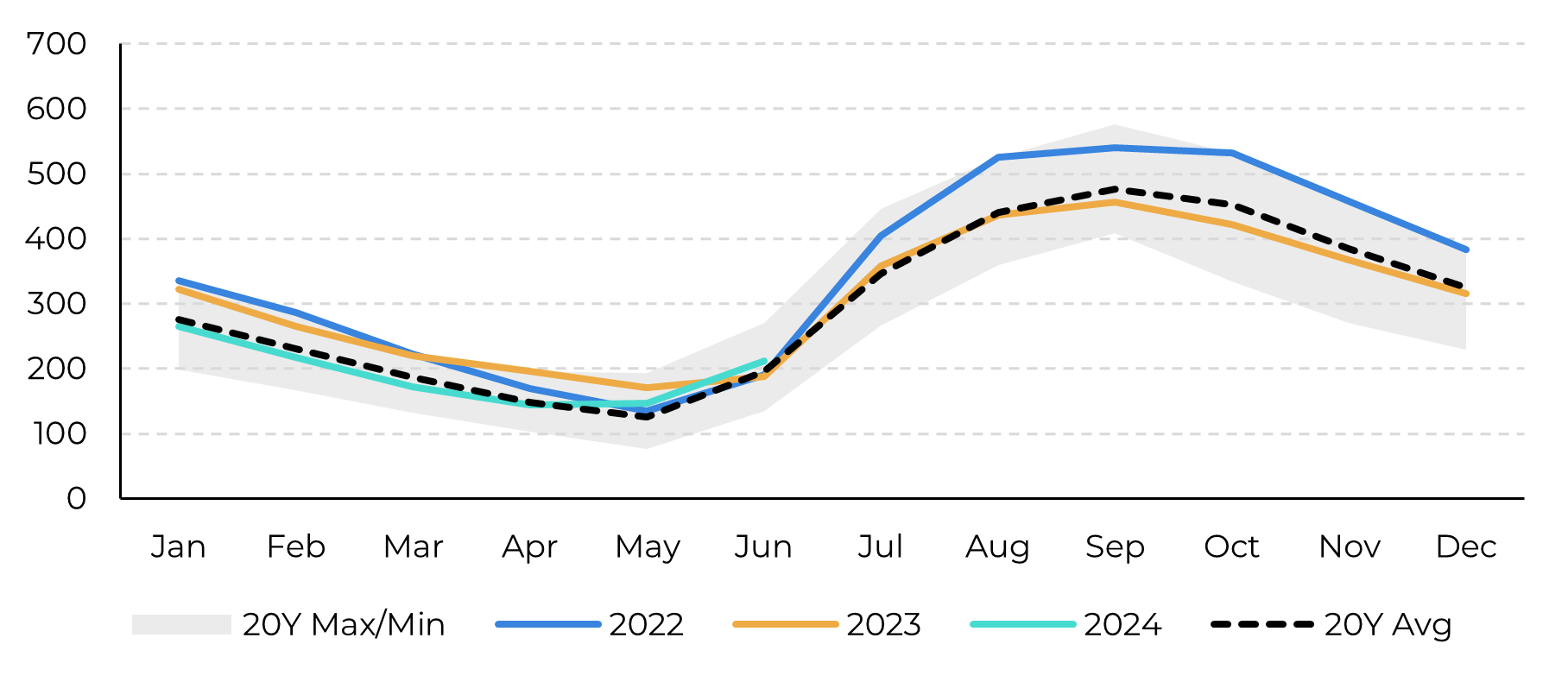

- India's optimism is driven by favorable weather, timely monsoons, and, according to the the Department of Agriculture and Farmers’ Welfare, increased cane sowing area, with soil moisture levels supporting crop development and reduced disease risk in key regions.

- Export allowance views are supported, but prices must cover export parity, estimated between 19-20.15 c/lb, potentially setting the floor price during the Brazilian intercrop season.

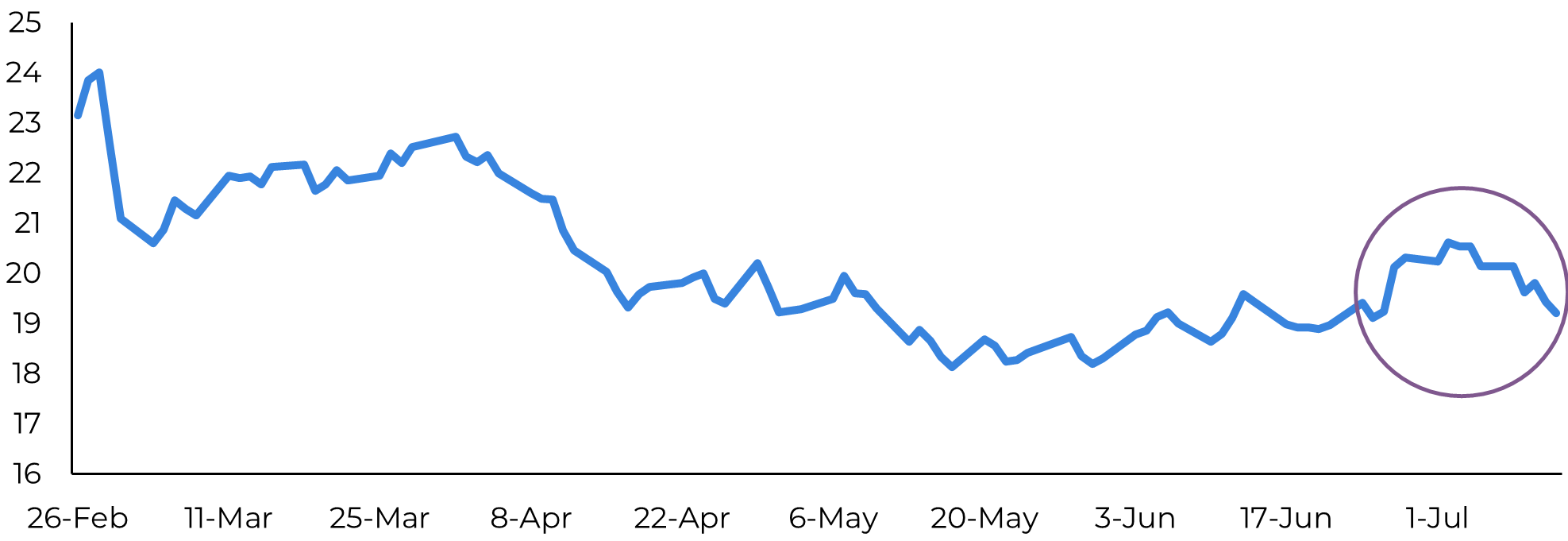

As discussed in our previous report, while market focused in Center-South’s weather issues, some key fundamentals are also developing: the monsoon is progressing well, La Niña's intensity has been revised down, weather conditions in Thailand are expected to improve, MARS remains optimistic about EU yields, and China is expected to have increased availability. Last week, the market has finally realized that India might be a little more bearish than most analysts anticipate.

According to CNBC Newswire, the Indian Sugar Mills Association (ISMA) has proposed allowing export quotas to balance excess stocks. However, it is unlikely that the government will permit any exports in the 2023/24 season. This suggests that India might return to the trade flows in the 2024/25 season, as previously discussed. Once it is confirmed that there is sufficient supply for ethanol diversion and domestic demand, the government could allow 1.5-2 Mt of exports, which aligns with our previous estimates. This interview and the optimism regarding Indian sugar availability were the main reasons for the price correction last Tuesday, along with some rainfall in Brazil's Central-South region.

Image 1:Raw Sugar Prices Small Rolercoster (c/lb)

Source: Refinitiv, Hedgepoint

Image 2: Standardized Precipitation Index June 01 – July 03 and Southweast Monsoon Advance

Source: India Meteorological Department

Image 3: Karnataka Soil Moisture (mm in top 0-1.6m soil)

Source: Refinitiv, Hedgepoint

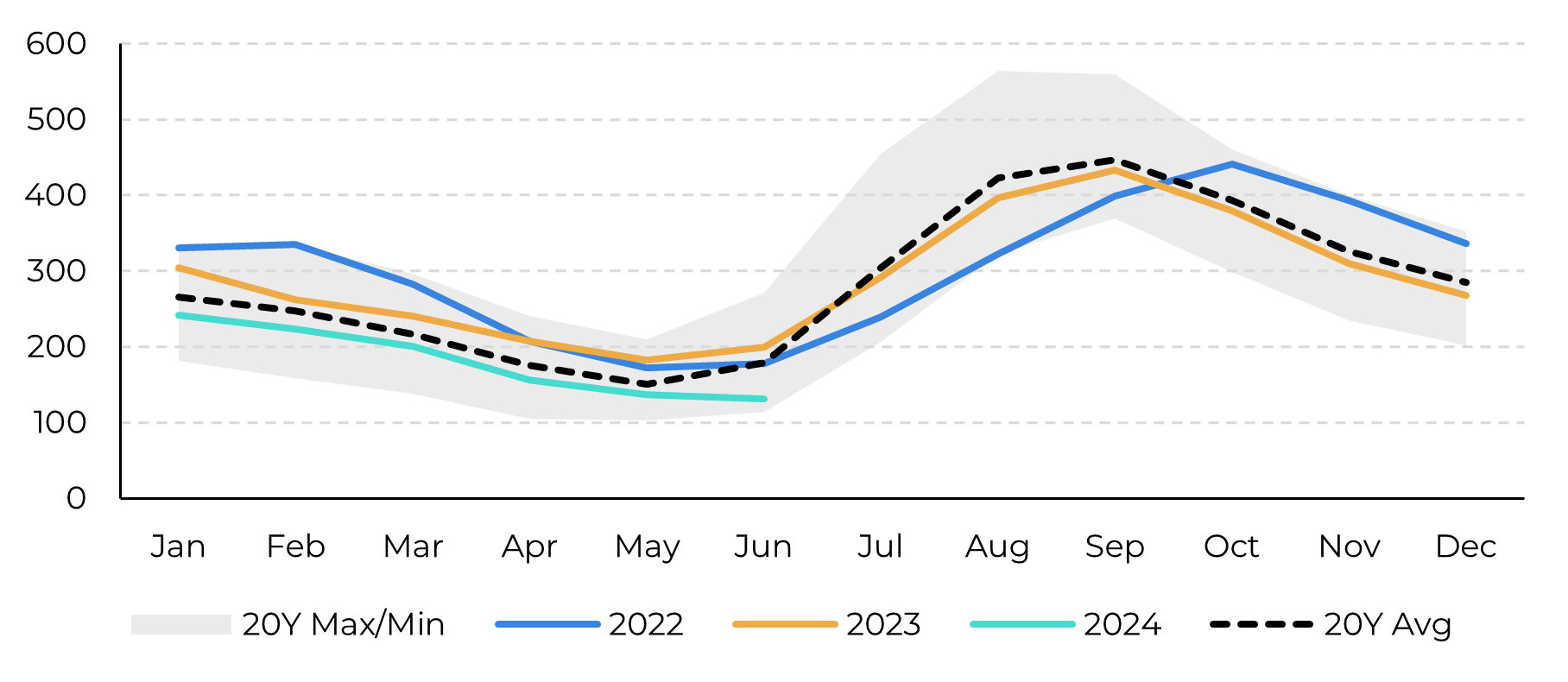

Image 4: Maharashtra Soil Moisture (mm in top 0-1.6m soil)

Source: Refinitiv, Hedgepoint

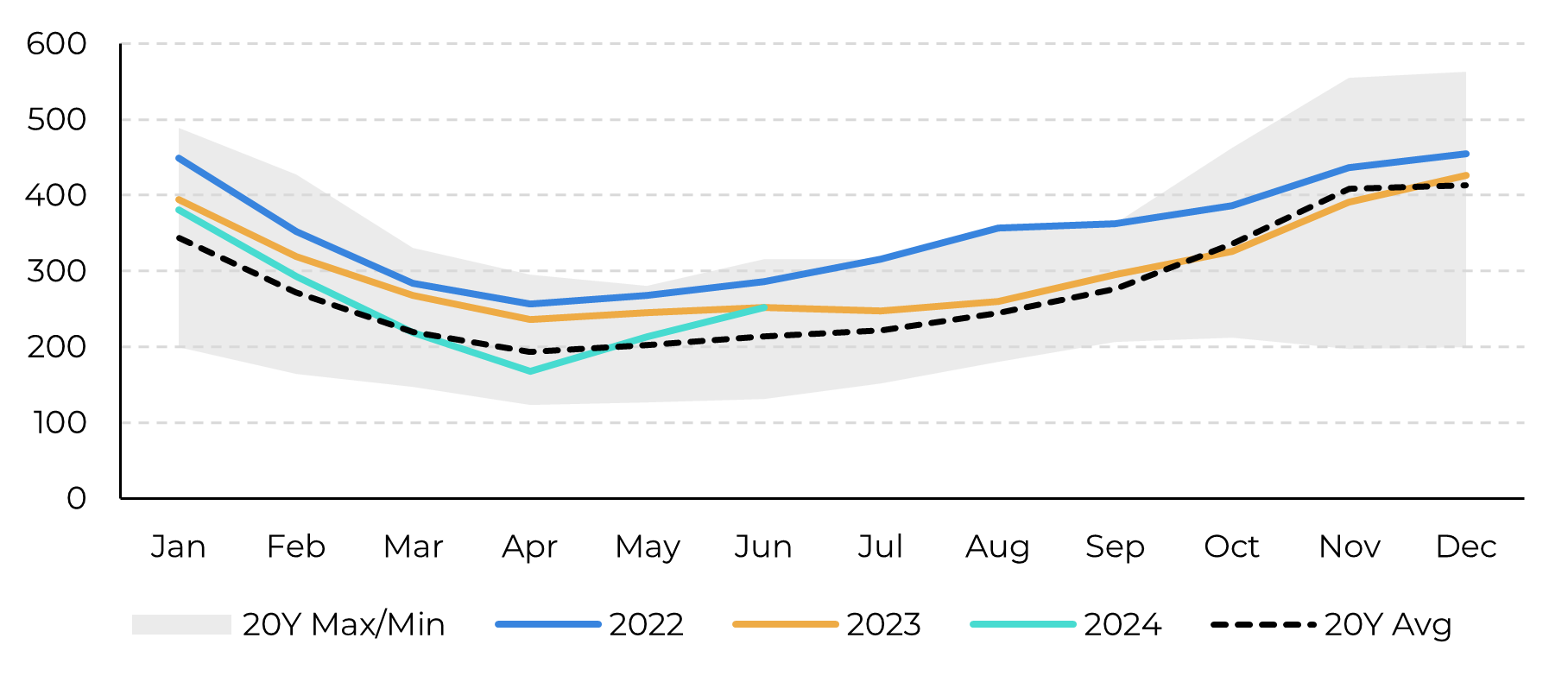

Image 5: Uttar Pradesh Soil Moisture (mm in top 0-1.6m soil)

Source: Refinitiv, Hedgepoint

Image 6: Tamil Nadu Soil Moisture (mm in top 0-1.6m soil)

Source: Refinitiv, Hedgepoint

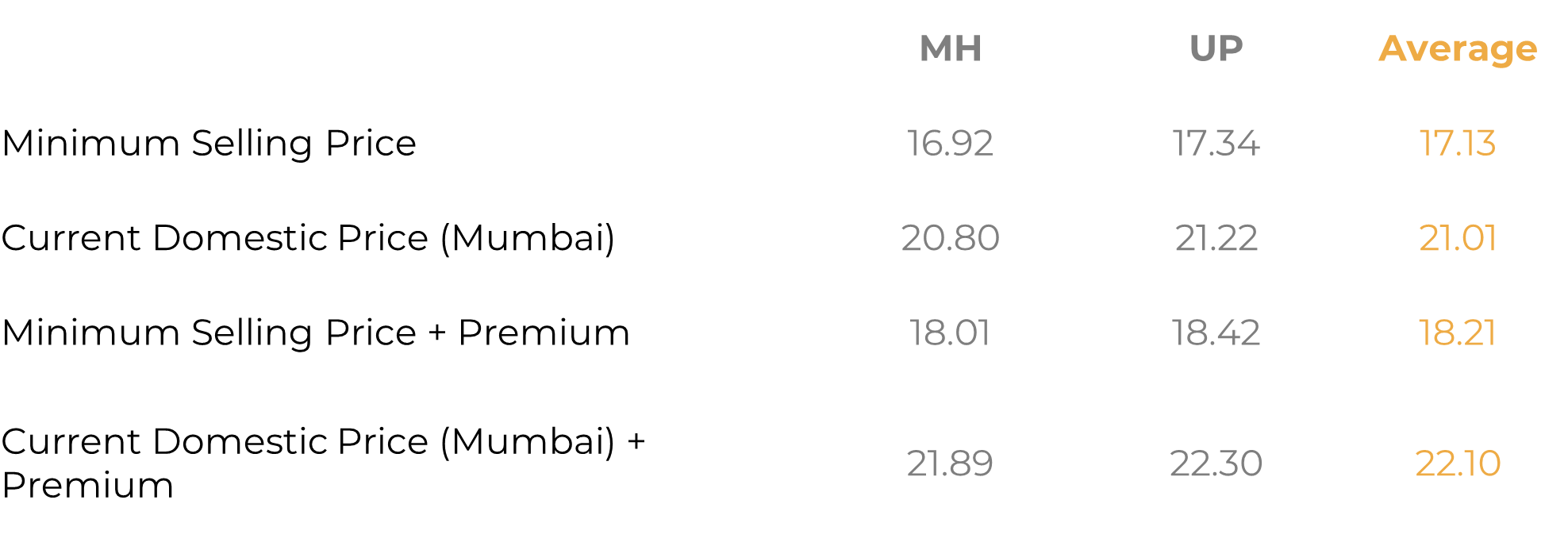

Therefore, everything currently supports the view of allowing exports. However, prices need to be sufficient to cover export parity. We have two different measures to consider: the cost of exports, set by the Minimum Selling Price (MSP) level at 17.13 c/lb, and the Current Domestic Price (CDP) in Mumbai, which is at 21.01 c/lb. The latter represents the price level at which Indian mills would be indifferent between selling domestically or internationally. With strong demand, a premium could be added to both these prices.

Image 7: Total trade flow considering 50% sugar mix, thus 40.6Mt of sugar (‘000 tq)

Source: Green Pool Hedgepoint

As the country builds up stocks and the new season begins, we might see a domestic price correction, adjusting the indifference level. Averaging the MSP and the CDP, one could expect the indifference level to be around 19 c/lb without a premium. If demand remains strong and a premium is added, the level would be 20.15 c/lb.

What does this mean? In our view, this could be the floor price during the upside when trade flows rely more on the Northern Hemisphere, particularly during the Brazilian intercrop season.

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.