Monitoring La Niña

"La Niña's impact on the sugar market is currently expected to be mild, as its intensity was revised down. It will likely be active between September and February. Key suppliers like Brazil, India and Thailand show a low correlation between precipitation patterns and La Niña occurrences, therefore, a less intense event suggests a more neutral outlook, potentially allowing supply recovery and leading to milder prices."

Monitoring La Niña

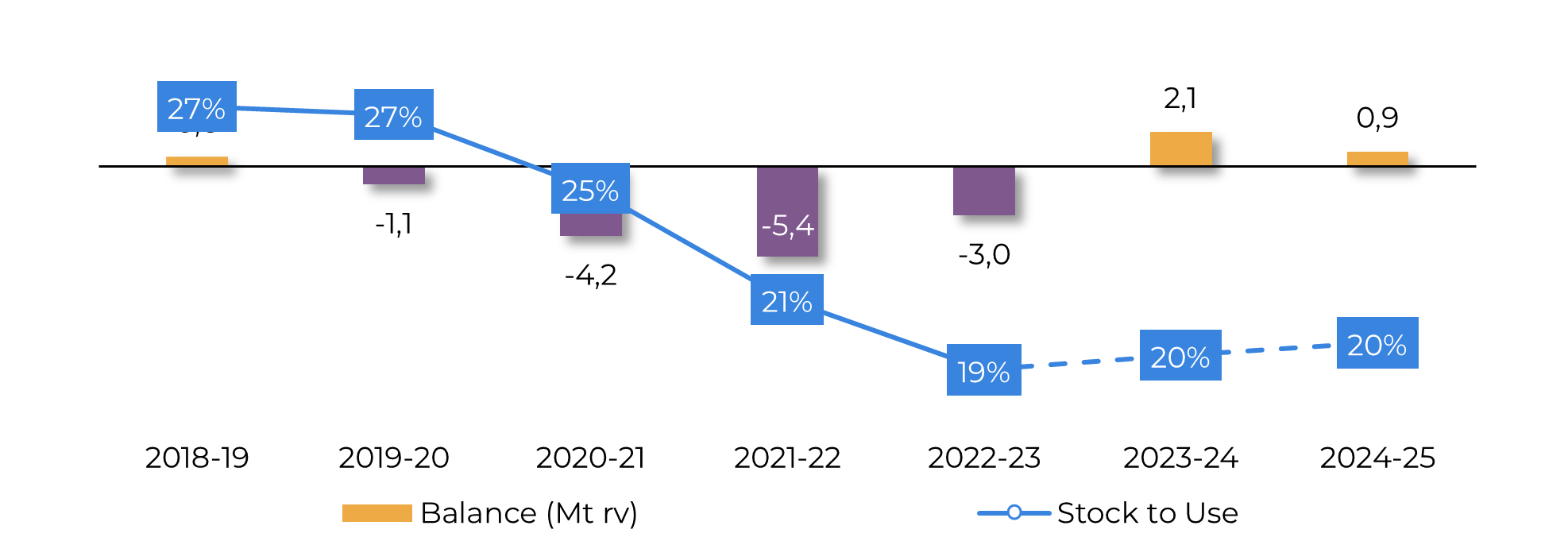

- Despite the rally in sugar prices on the last days, after the release of Unica’s figures, the expectations are still of a slightly surplus in the 24/25 season, especially with improved prospects in the Northern Hemisphere and continued high production in Brazil (albeit lower than 23/24). The current weather patterns also points to a more stable year.

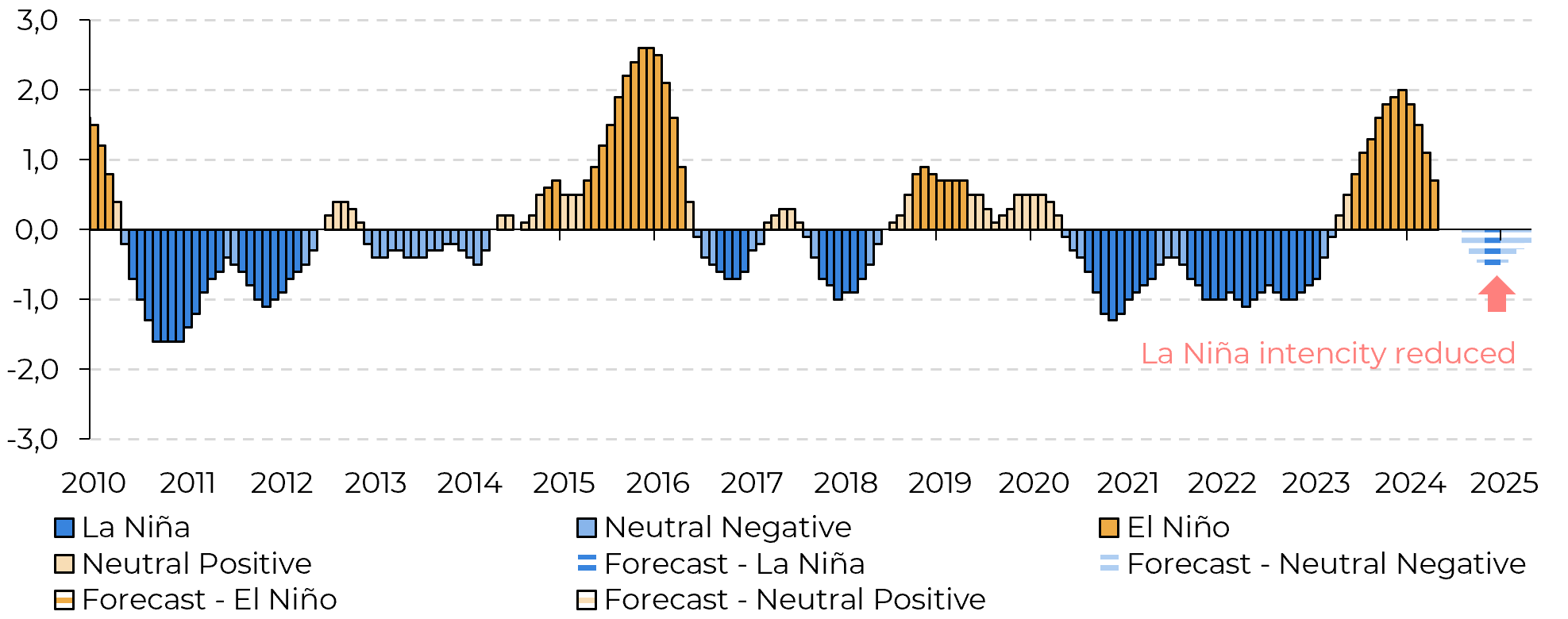

- La Niña's impact on the sugar market is currently expected to be mild, as its intensity was revised down. It will likely be active between September and February.

- Key suppliers like Brazil, India and Thailand show a low correlation between precipitation patterns and La Niña occurrences, therefore, a less intense event suggests a more neutral outlook, potentially allowing supply recovery and leading to milder prices.

- Global sugar demand is expected to grow by around 1%, with a modest surplus anticipated for 2024/25; monitoring Chinese buying behavior is crucial as increased domestic availability could reduce imports and contribute to a bearish market outlook.

After two weeks of falling sugar prices due to a more positive outlook in the Northern Hemisphere, raw and white sugar contracts rebounded last Thursday, approaching 19 c/lb for raw sugar. Prices were boosted by lower-than-expected Brazilian crop numbers, following the release of Unica's figures on the 25th. However, the medium-term scenario remains bearish. The Brazilian Central-South should still achieve a good sugar production in 24/25, and countries such as India and Thailand are expected to have favorable weather this year, which should allow for higher production.

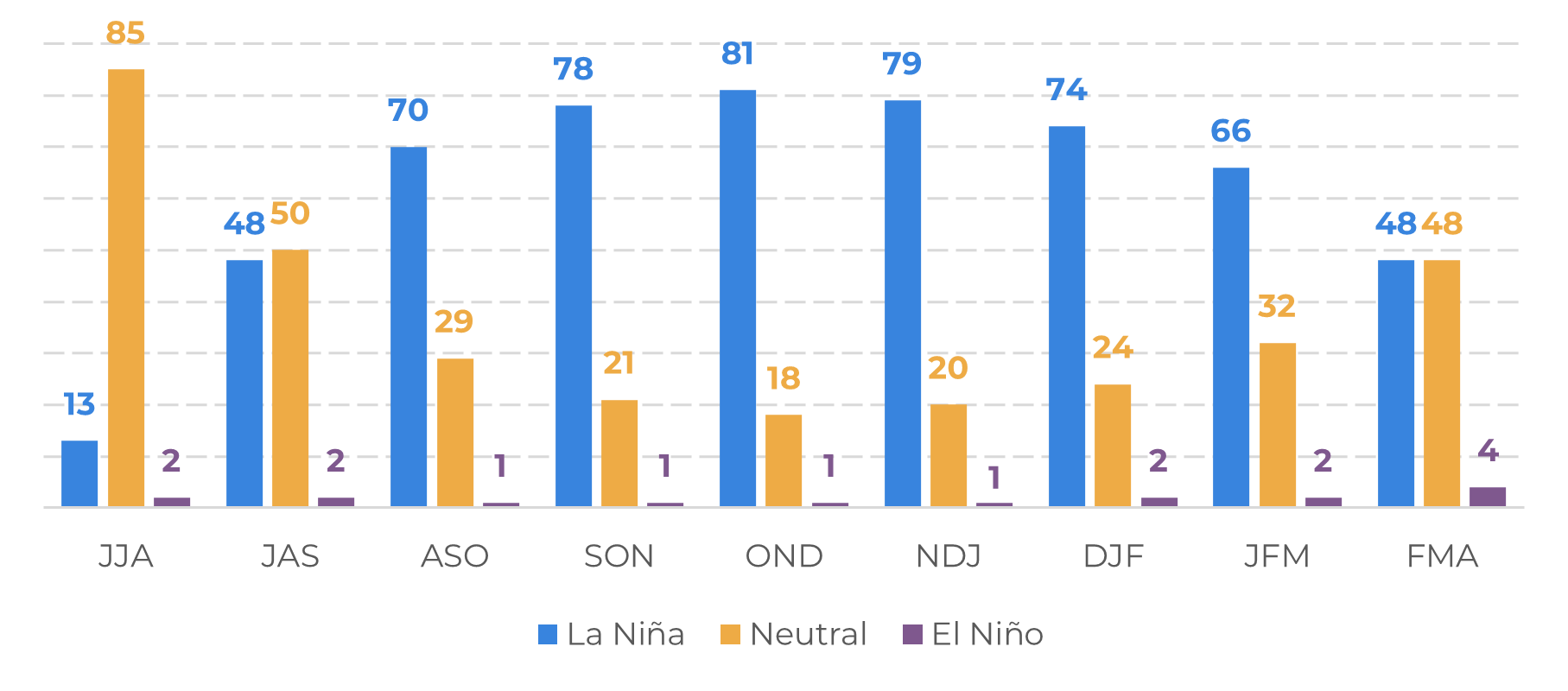

Thus, as interesting as discussing price movements might be, this report aims to recap La Niña's possible effects, which may not be as intense for the sugar market. Recently released data by NOAA indicates the probability of an active La Niña in August (70%), but with highest probability between November and February (78%). This timing puts Brazil's Central-South (CS) region's spring and summer in the spotlight, as it coincides with the cane development window. Additionally, the Northern Hemisphere's winter and crushing would also be at its peak, therefore, also worth monitoring.

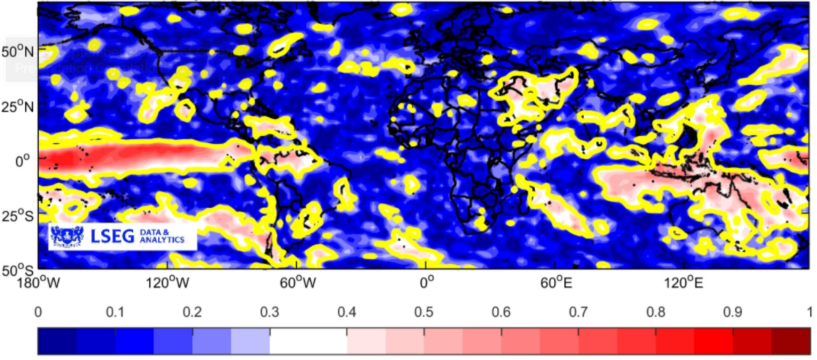

However, analyzing the correlation between precipitation patterns and ENSO occurrences, it appears that La Niña is unlikely to significantly affect Brazil's Central-South region. It would require a particularly strong weather event to cause drier conditions in this area. The same cannot be said about temperature. Since its correlation is stronger, we could expect a cooler summer.

Image 1:Official ENSO Probabilities (June 2024)

Source: NOAA

Image 2: ENSO Correlation to Precipitation (Sep-Nov)

Source: Refinitiv

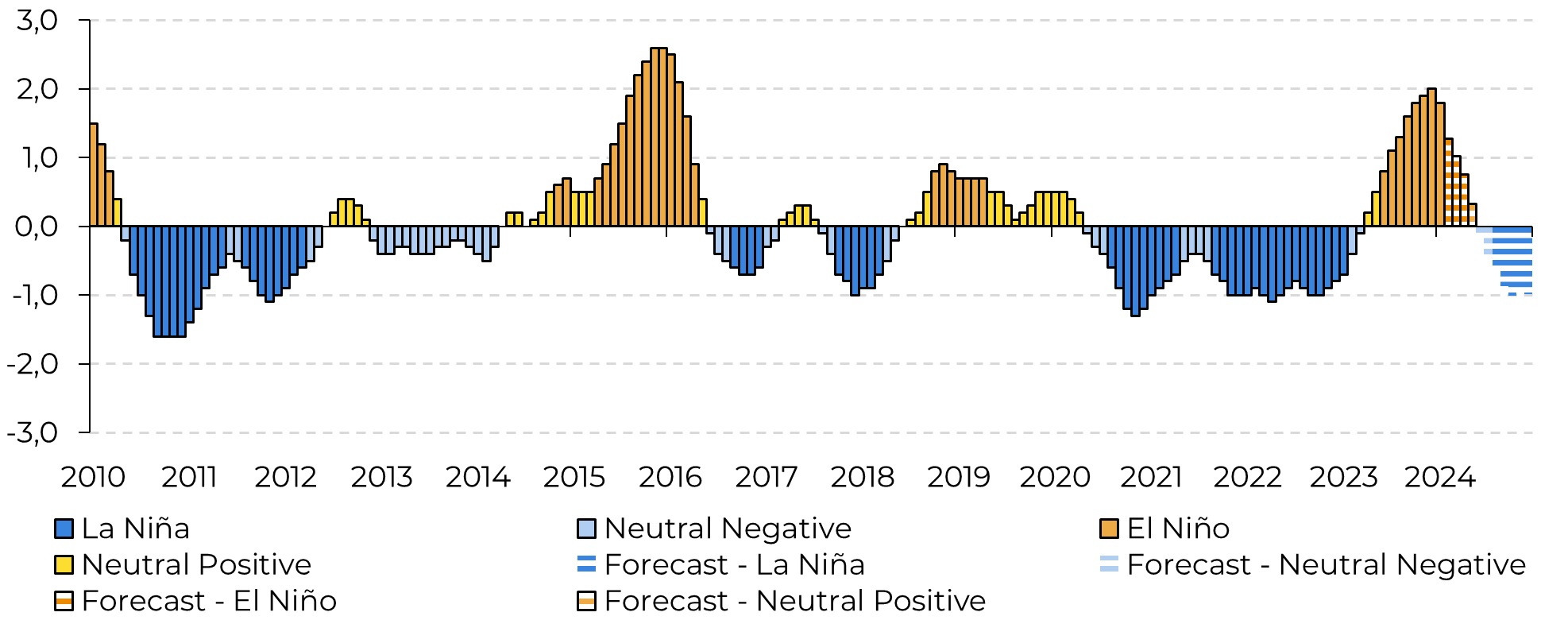

Image 3: ENSO Status – ONI Index (ºC) | March 2024

Source: : IRI, NOAA, Hedgepoint

Image 4: ENSO Status – ONI Index (ºC ) | June 2024

Source: : IRI, NOAA, Hedgepoint

Increased availability could lead to softer prices, making demand the most important potential bullish factor going forward and the most difficult to predict.

Considering that sugar demand tends to be resilient, especially in developing countries, global growth is expected to remain around its 1% average. Although a surplus year is anticipated for 2024/25 (Oct-Sep), it may be modest, with less than 1 Mt.

In terms of trade flows, monitoring Chinese buying behavior is crucial. China is expected to have a better crushing during 2024/25, with the China Sugar Association estimating 11 Mt of domestic availability. This would reduce the country's import needs by at least 500kt, contributing to a more bearish market outlook.

Image 5: Global Supply and Demand Balance (Mt rv | Oct-Sep)

Source: : Green Pool, Hedgepoint

In Summary

Global sugar demand is expected to grow by around 1%, and a modest surplus is anticipated for 2024/25. Monitoring Chinese buying behavior is crucial, as increased domestic availability could reduce imports and contribute to a bearish market outlook.

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.