Sumarizing a volatile week

"The sugar market has slowed recently due to weaker fundamentals making it hard to compete with more volatile assets, such as cocoa and coffee. While recent macroeconomic corrections have stabilized, key monitoring points include potential Chinese sugar purchases, concerns about frosts and fires in Brazil, and India's continued export restrictions. Additionally, improved beet yields in Russia, favorable weather in India and a persistently high TCH in Brazilian CS adds to the potential surplus in 24/25."

Sumarizing a volatile week

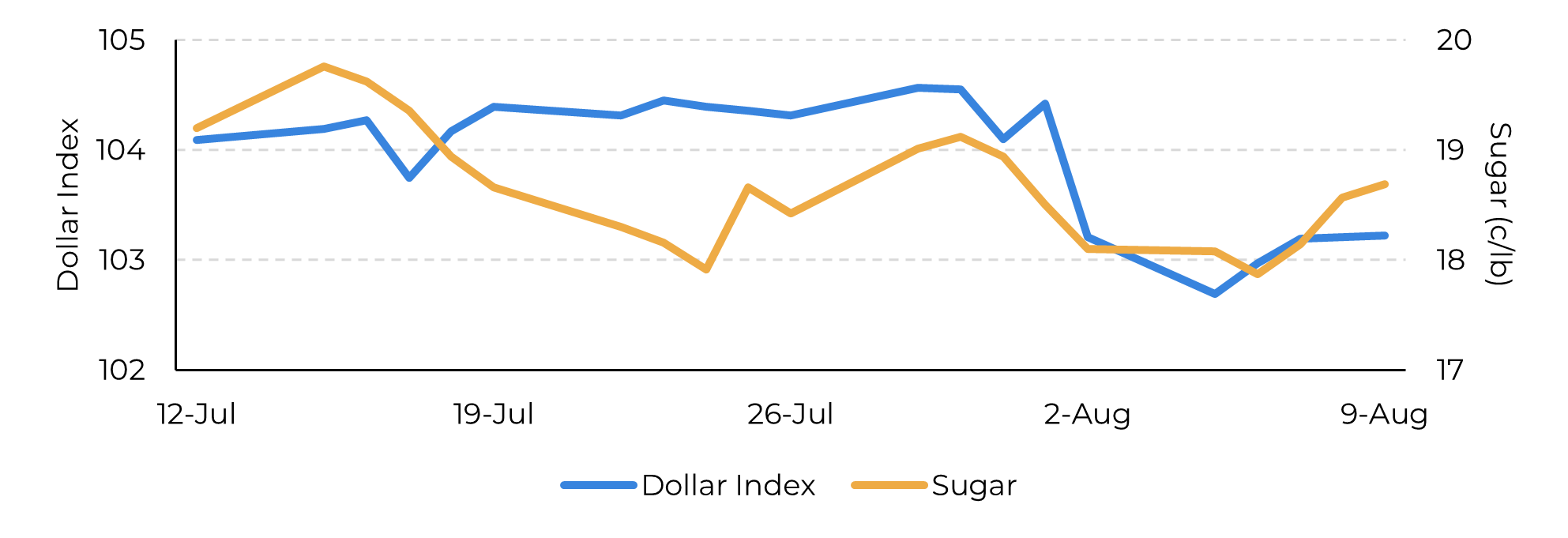

- The sugar market has slowed, leading to milder trader interest, making it more vulnerable to external factors. Weaker BRL has been a major bearish factor, shielding the sweetener from some broader macroeconomic factors like weak U.S. jobs data and the dollar's decline at the beginning of last week.

- However, recent macroeconomic corrections have stabilized by the week’s end, with the BRL and dollar index recovering, easing some selling pressure on commodities.

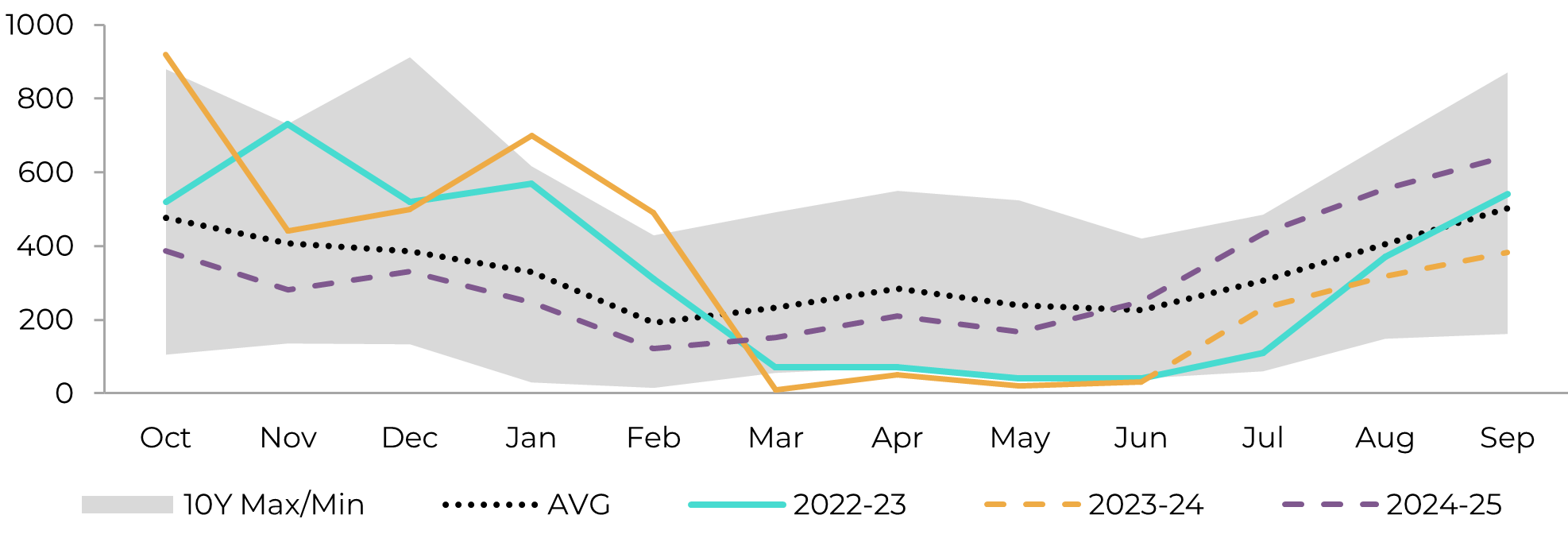

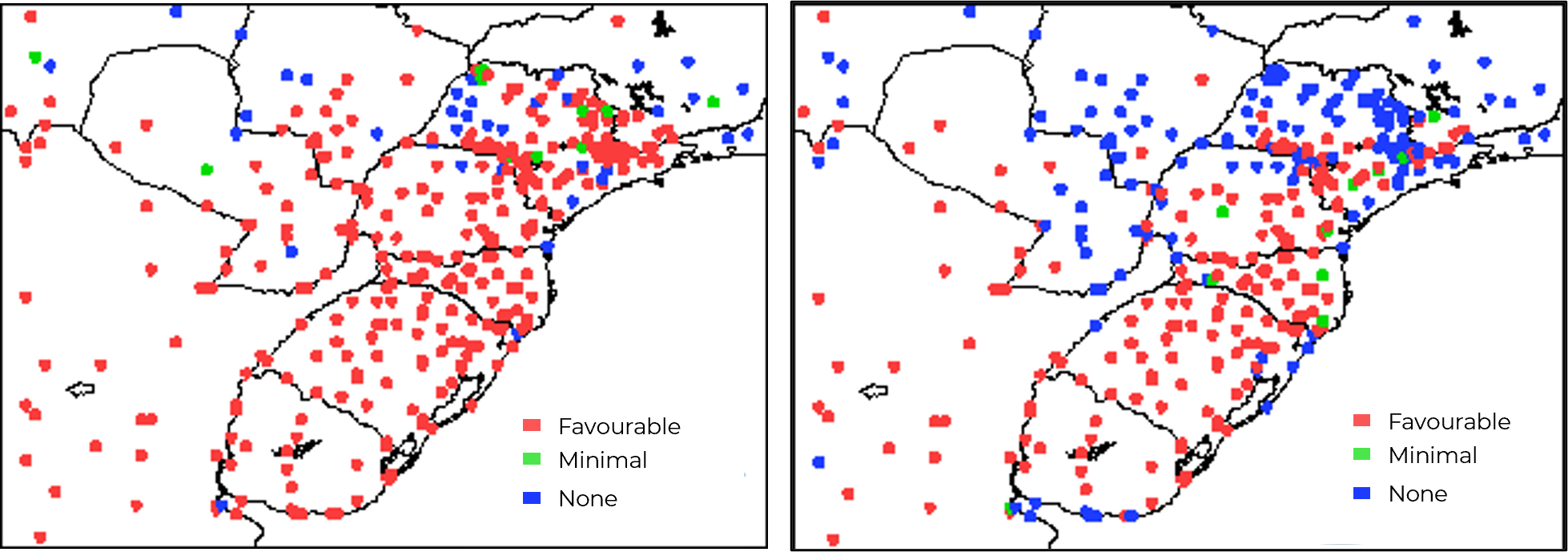

- Key factors to watch include potential Chinese sugar purchases and concerns about fires and frosts in Brazil’s Center-South region, which could affect future crop yields.

- India's continued export restrictions adds to the support side, while positive beet yields in Russia contribute to the market's current dynamics, suggesting a potential surplus if favorable weather continues.

The recent slowness in the sugar market has caused a noticeable decline in traders’ interest, especially compared to June figures, when volume breached 100k. In this context, it was only natural for sugar to be affected by the broader adverse macroeconomic developments over the past two weeks. The release of poor U.S. jobs data for July by the Bureau of Labor Statistics indicated a slowing economy, which triggered increased selling pressure in U.S. and other major equity markets, driving bond prices higher and lowering some borrowing rates. Most traders now expect the Federal Reserve to cut interest rates by at least 25 basis points in its September meeting. Although the dollar's decline would typically support commodities, as seen in the grains market, sugar fundamentals remain weak. Additionally, with Brazil being its key supplier, the ongoing devaluation of the BRL remains a significant bearish factor. Therefore, other markets such as Coffee, Cocoa and Grains offer a more thrilling experience.

Nevertheless, as the days went by, some of these macro trend corrected. After touching 5.88, the BRL moved back to 5.65 BRL/USD. Meanwhile, the Dolar index also showed some recovery, easing the selloff and allowing commodities to move back to their fundamentally-driven trading levels.

Image 1: Sugar didn’t respond to US currency moves

Source: Refinitiv

Image 2: Total Imports - China ('000t - exc. Syrup and smuggling)

Source: GSMN, CSA, Refinitiv, Greenpool, hEDGEpoint.

Image 3: Frost risk on the dawn of August 13 (left) and 14 (right) in CS Brazil

Source: CPTEC, INPE

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.