Prices are on fire

"Market sentiment is shifting, with short-term support – especially after the fires in Brazilian Center South – but no return to last December's price highs. Trade flows remain more comfortable than what was priced in the previous year"

Prices are on fire

- Market sentiment is shifting, with short-term support – especially after the fires in Brazilian Center South – but no return to last December's price highs. Trade flows remain more comfortable than what was priced in the previous year.

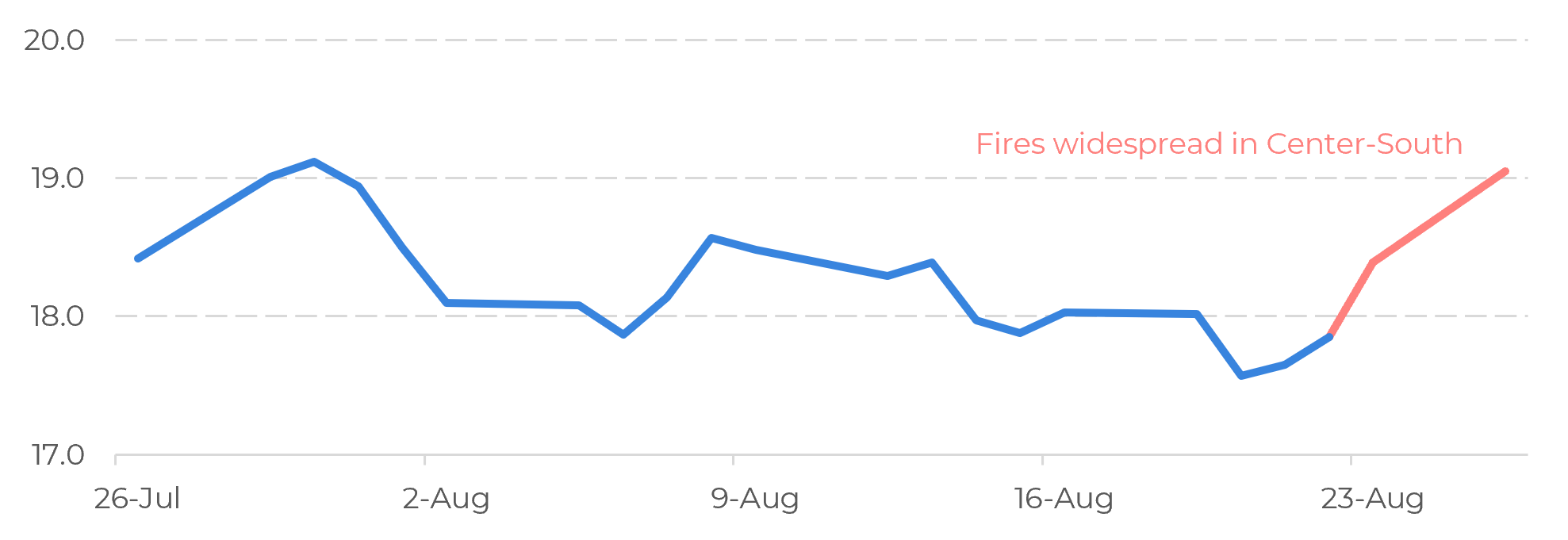

- Speculative positioning and Conab’s optimistic view were some of the reasons behind last week’s weakness. The fact that market is still waiting for TCH and crushing pace to show some correction also contributed to prices testing the 17.5c/lb floor.

- However, talks of a sudden death were boosted by fires reported across the Center-South region, accelerating price-recovery back to 19 c/lb.

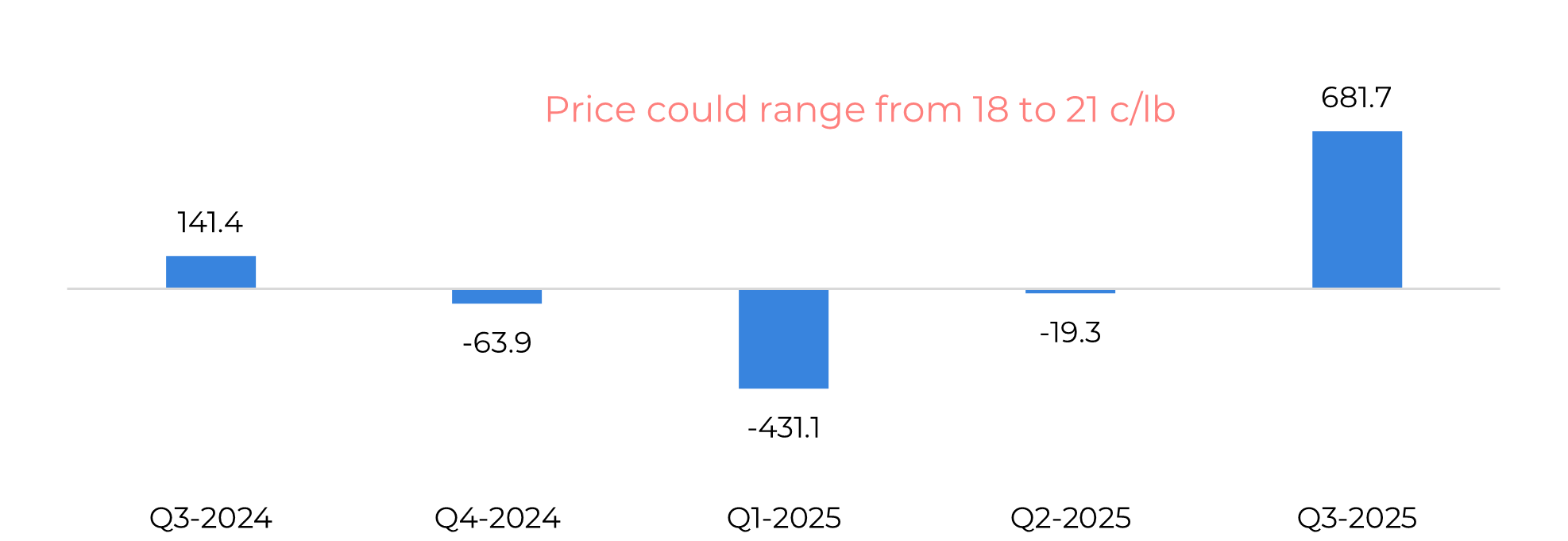

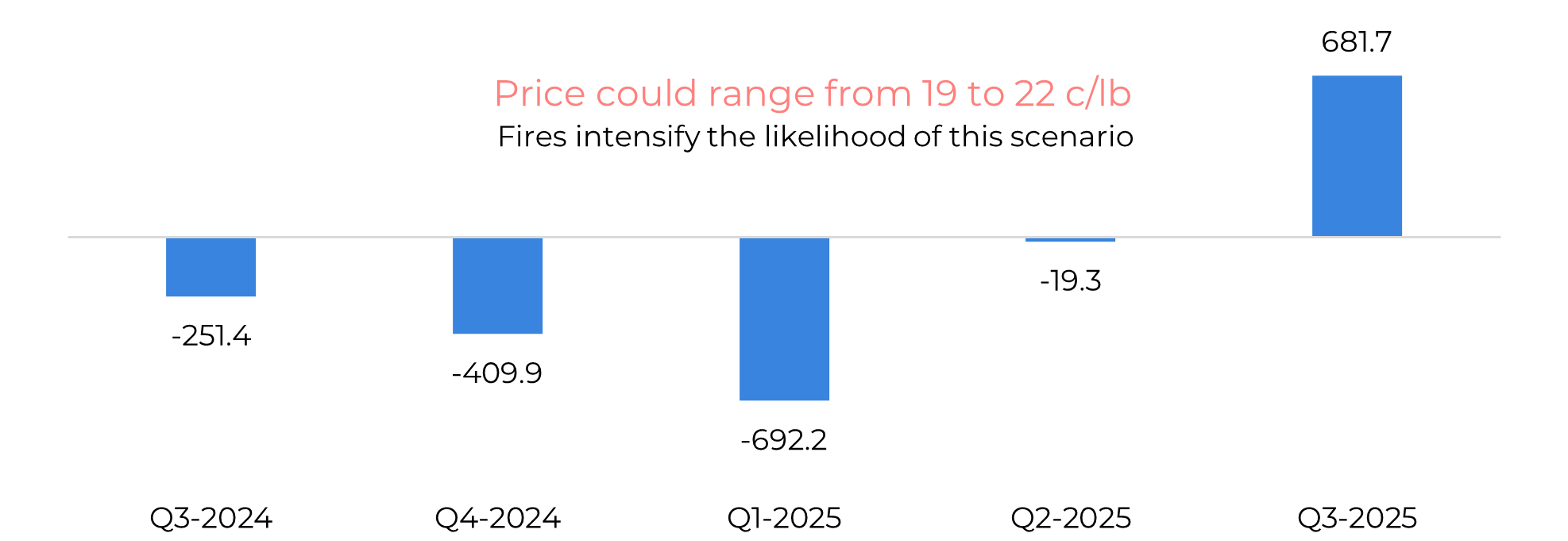

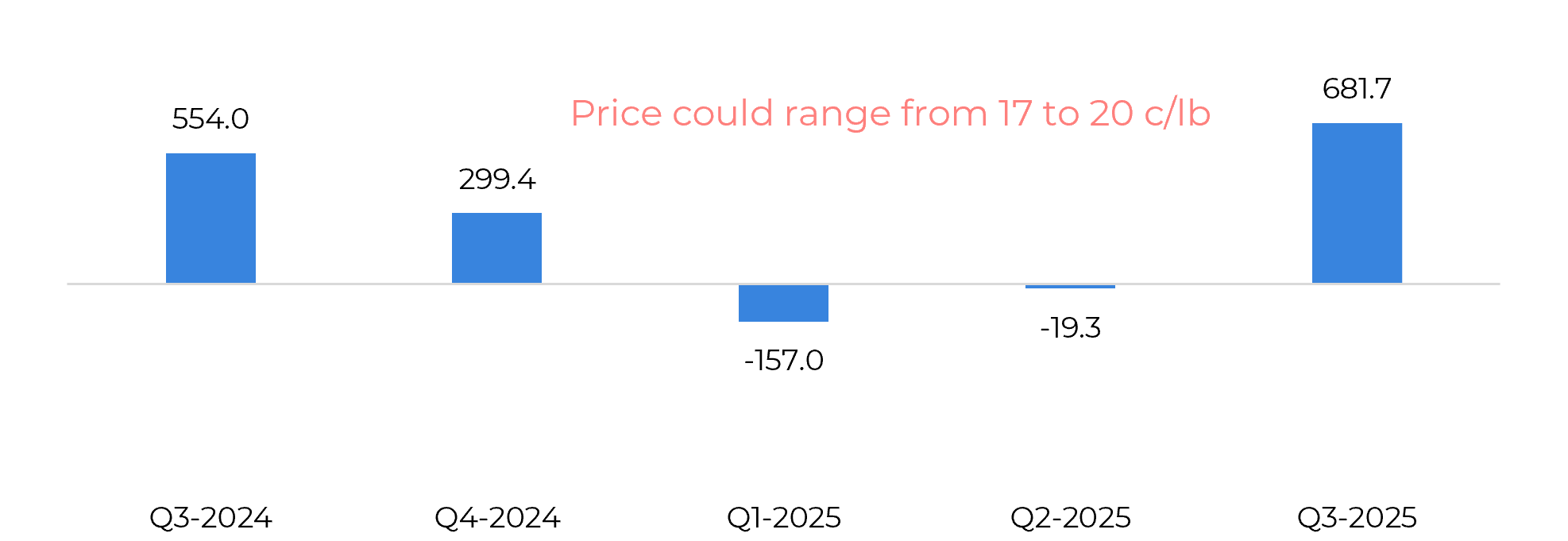

- In this report we analyze some scenarios and take a change at pointing out some possible price range during the intercrop.

- An important assumption is considering a slight increase to cane volumes in 25/26, justified by preliminary positive weather forecasts.

Market sentiment appears to be shifting. While fundamentals don’t indicate a tightness similar to 2023, the sweetener market framework is becoming increasingly supportive in the short term. However, prices are unlikely to return to the highs seen last December.

Firstly, speculative positioning had been comfortably on the short side until mid-last week, at least. Despite increasing discussions around a potential "sudden death" in Brazil's Center-South, current data shows the region’s resilience. Although strong TCH (tonnes of cane per hectare) and rapid harvesting are expected to start correcting soon, final figures are still anticipated to be higher than in 2021/22, the last year of sudden death. As a result, the fundamentals weren’t strong enough to trigger position shifts and price recovery, especially given the favorable weather conditions for cane and beet development in the Northern Hemisphere.

Image 1: Raw sugar prices monthly behaviour (c/lb)

Source: Refinitiv

Image 2: Total trade flows | Base case: 614Mt of cane (Mt tq)

Source: GreenPool, Hedgepoint

Image 3: Total trade flows | Bullish case: 600Mt of cane (Mt tq)

Source: GreenPool, Hedgepoint

Image 4: Total trade flows | Bearish case: 630Mt of cane (Mt tq)

Source: GreenPool, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.