Crop Forecast: Sugar Center-South

"Sugar production estimates reduced from 40.8 Mt to 40.3 Mt for 24/25, contributing to a tight supply during CS’s intercrop, supporting the sweetener."

Crop Forecast: Sugar Center-South

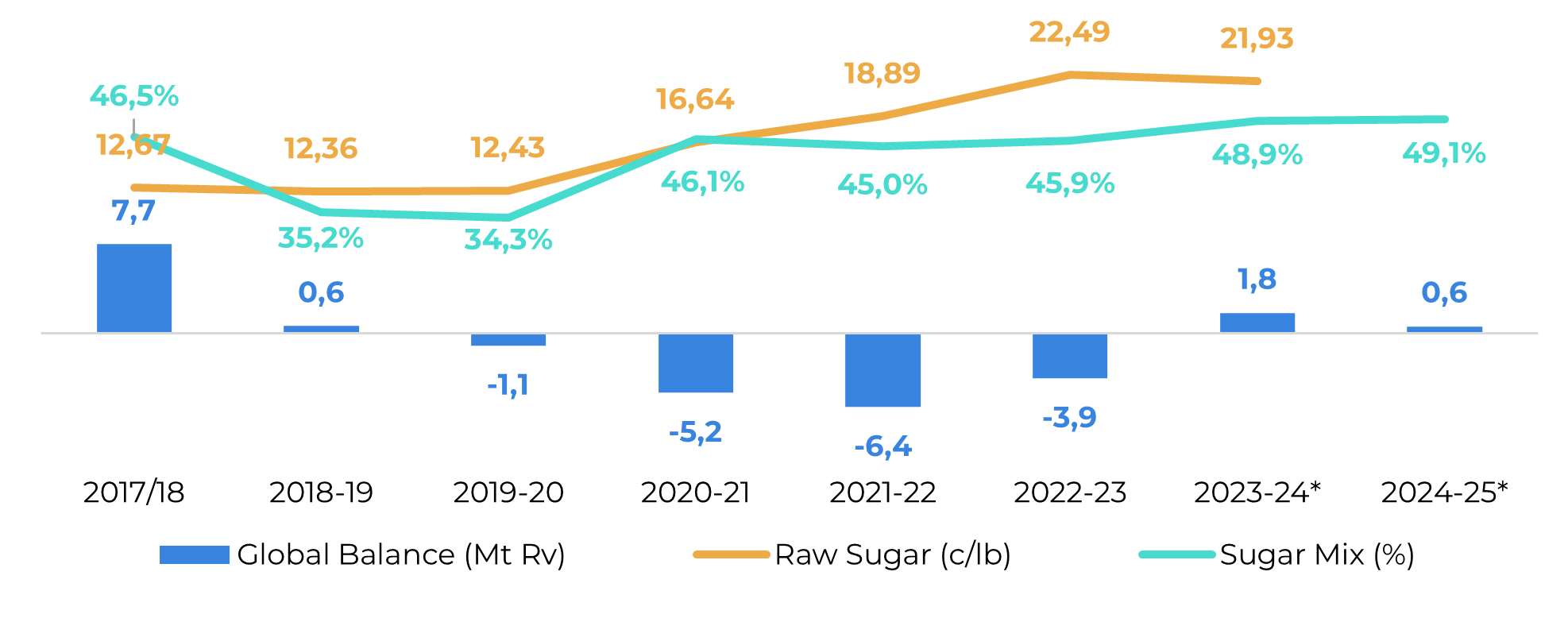

- Center-South mills have struggled to direct over 50% of available raw material into sugar production, resulting in a revised sugar mix down to 49.13%. Total Recoverable Sugar (TRS) is anticipated to end the season higher than originally expected, at 140kg/t. However, reducing sugar (RS) concentration should remain an issue.

- Sugar production estimates reduced from 40.8 Mt to 40.3 Mt for 24/25, contributing to a tight supply during CS’s intercrop, supporting the sweetener.

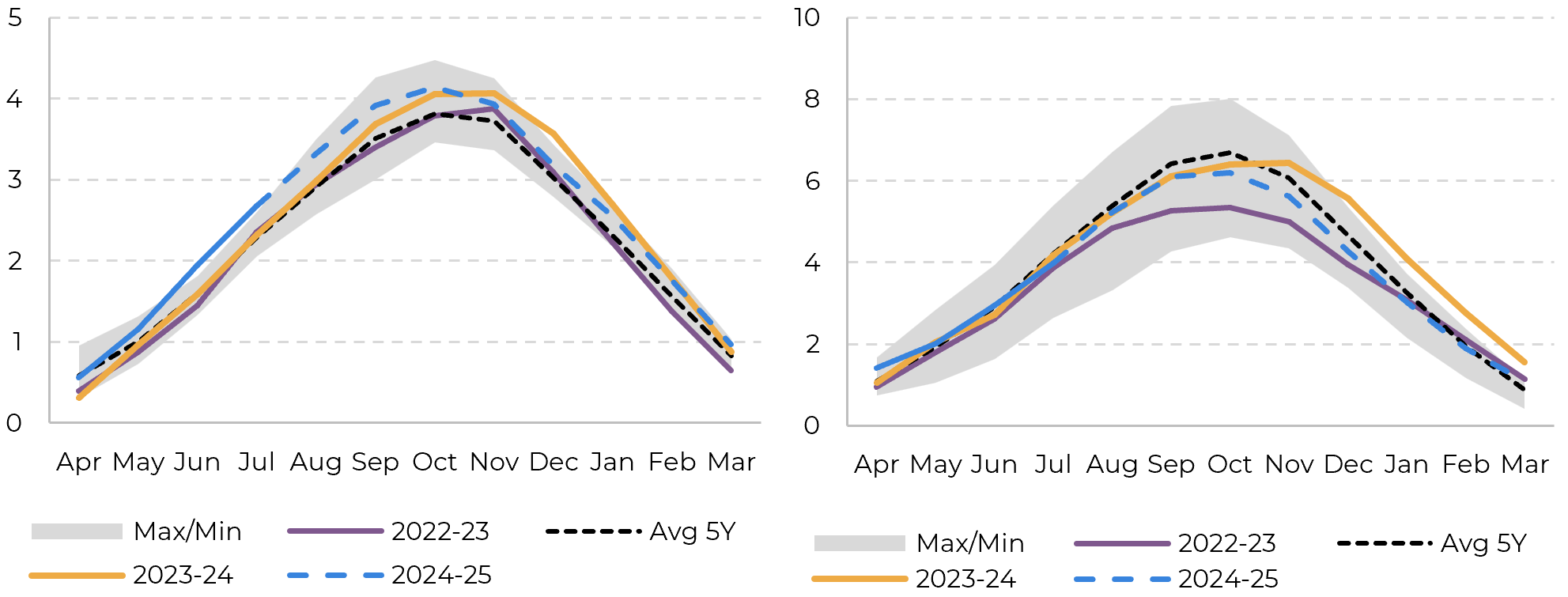

- Meanwhile domestic biofuel prices are expected to struggle due to increased ethanol production, resulting in a more comfortable-than-usual ethanol availability during the Brazilian summer.

- The 2025 sugar contracts are likely to enter a bullish trend as CS’s intercrop period approaches, with sugar prices expected to range between 20 to 24, influenced by market fundamentals and potential global sugar availability revisions. Ethanol may have peaked at 16 cents, considering Cbios.

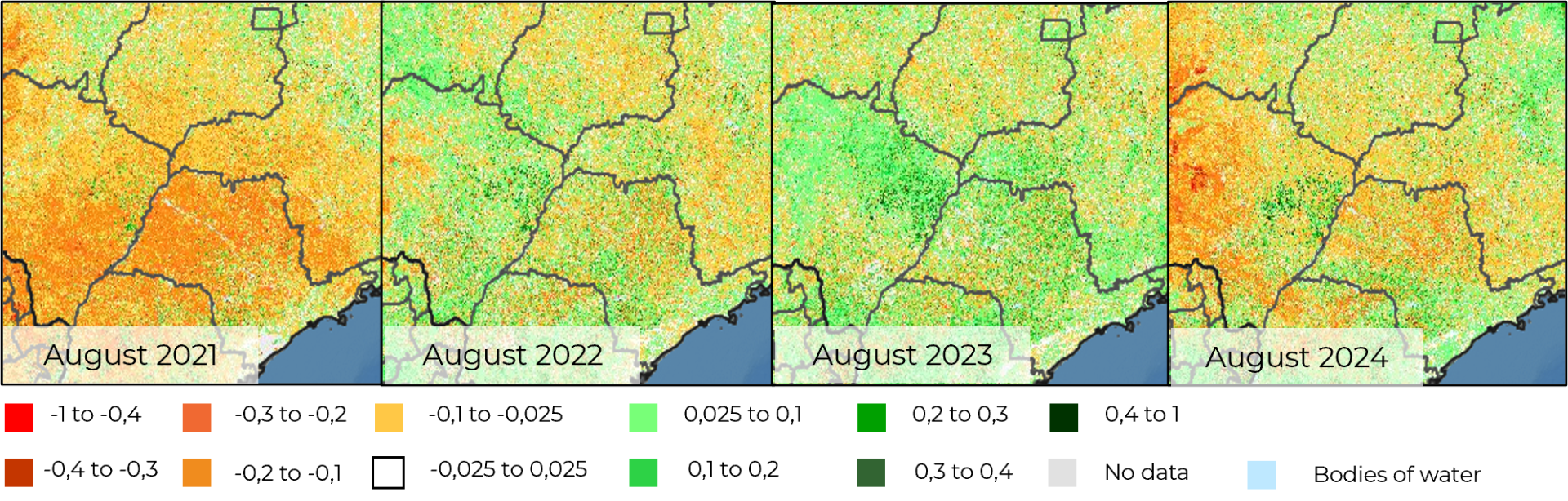

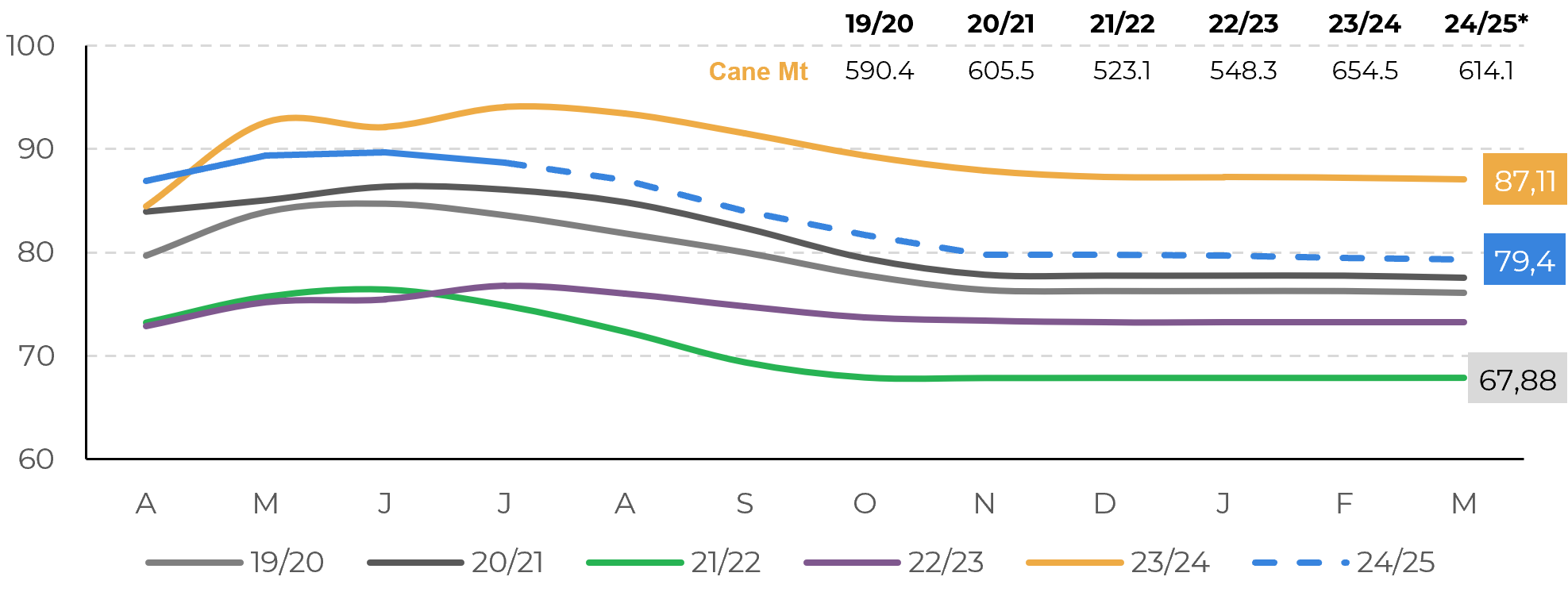

As discussed in previous reports, we have revised our estimates for Center-South’s total cane availability down from 620Mt to 614Mt (link). We understand that this may still be seen as optimistic by many analysts and that there is indeed some downward pressure, especially after the recent fires. However, Total Cane per Hectare (TCH) has shown considerable resilience. Even assuming a similar correction to cumulative TCH compared to 21/22, the last "sudden-death" year, it is important to recall that the Normalized Difference Vegetation Index (NDVI) indicates a better outlook. Therefore, the only revisions made after the latest Unica report were to the sugar mix and cane quality, measured by the Total Recoverable Sugar (TRS).

The fact that mills were only able to direct 49.27% of the available raw material into sugar production during the first half of August, compared to 50.82% in the same period of 23/24, confirms the challenge of reaching above 50% by the end of the season. Considering the already evident cane quality issues, driven by the higher concentration of Reducing Sugars (RS), which are less favorable for sugar production, along with the impact of recent fires, we have revised our sugar mix down to 49.13%.

Image 1:NDVI Anomaly evolutiuon from 2021 to 2024

Source: USDA| GADAS - Modis AQUA 8 Day NDVI Anomaly, Hedgepoint

Image 2: Cummulative TCH (t/ha)

Source: Unica, CTC, Hedgepoint

Image 3: Anhydrous (left) and hydrous (right) stocks – Brazil CS (M m³)

Source: Unica, MAPA, ANP, SECEX, Hedgepoint

Image 4: Sugar mix vs global S&D and prices (% | Mt | c/lb)

Source: GreenPool, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.