A lot discussed, little changed

"Raw sugar prices are struggling to break the 20c/lb level, needing significant bullish news for a decisive upward move, as last week's weakness in the energy sector and market bets on a smaller rate cut (25 bps) than initially projected may be overshadowing bullish developments. While prices saw a modest rise due to a correction in the U.S. dollar, India's potential export ban did not have the anticipated impact, with sugar losing its gains and finishing the week lower than 19c/lb. The market seems skeptical, while Brazil is flooding the market with sugar with its fast-paced crop, allowing traders to sit and wait."

A lot discussed, little changed

- Raw sugar prices are struggling to surpass the 20c/lb level and may need significant bullish news for a decisive upward movement.

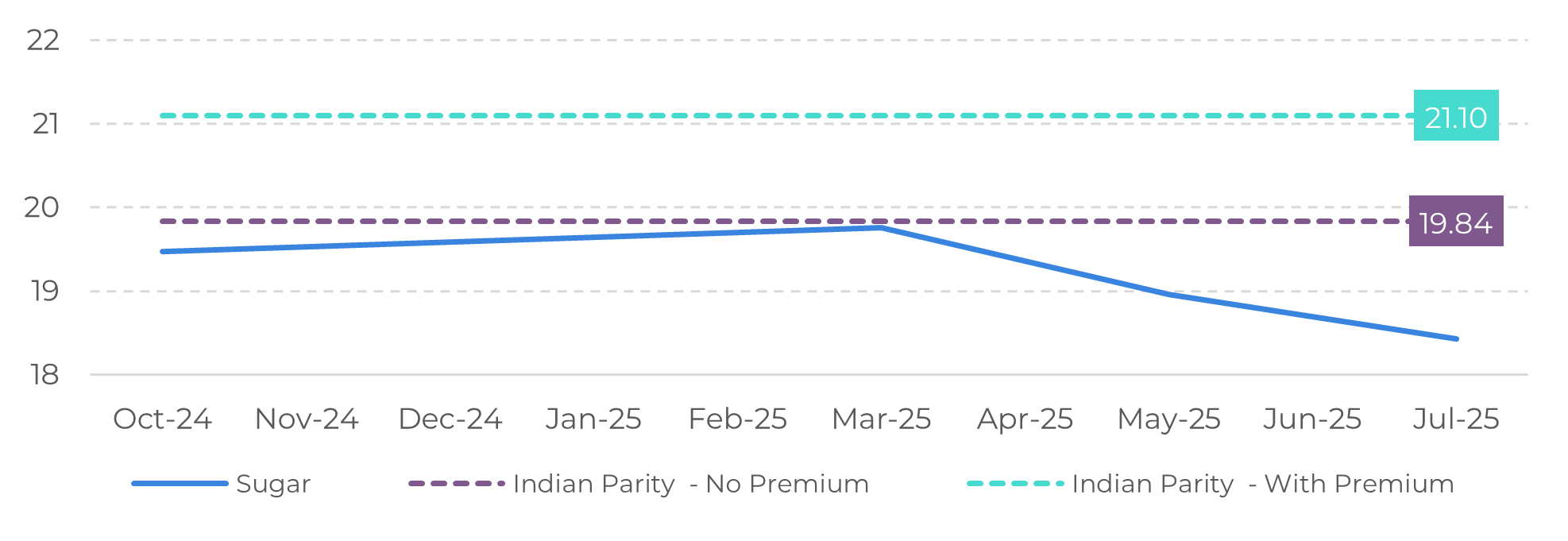

- India's potential export ban has raised questions about its sugar export intentions, as the government prioritizes achieving a 20% ethanol blending target by 2025/26, though the market remains cautiously optimistic about possible exports.

- To enable exports, prices would likely need to exceed 20c/lb, with mills potentially demanding a premium, driving raws to breach 21c/lb, which could pressure the government to allow exports if production exceeds estimates.

- Brazil's production has been impacted by drought, affecting cane quality and sugar mix expectations, while the country keeps a strong export pace reaching 3.9Mt in August, providing short-term comfort to the market.

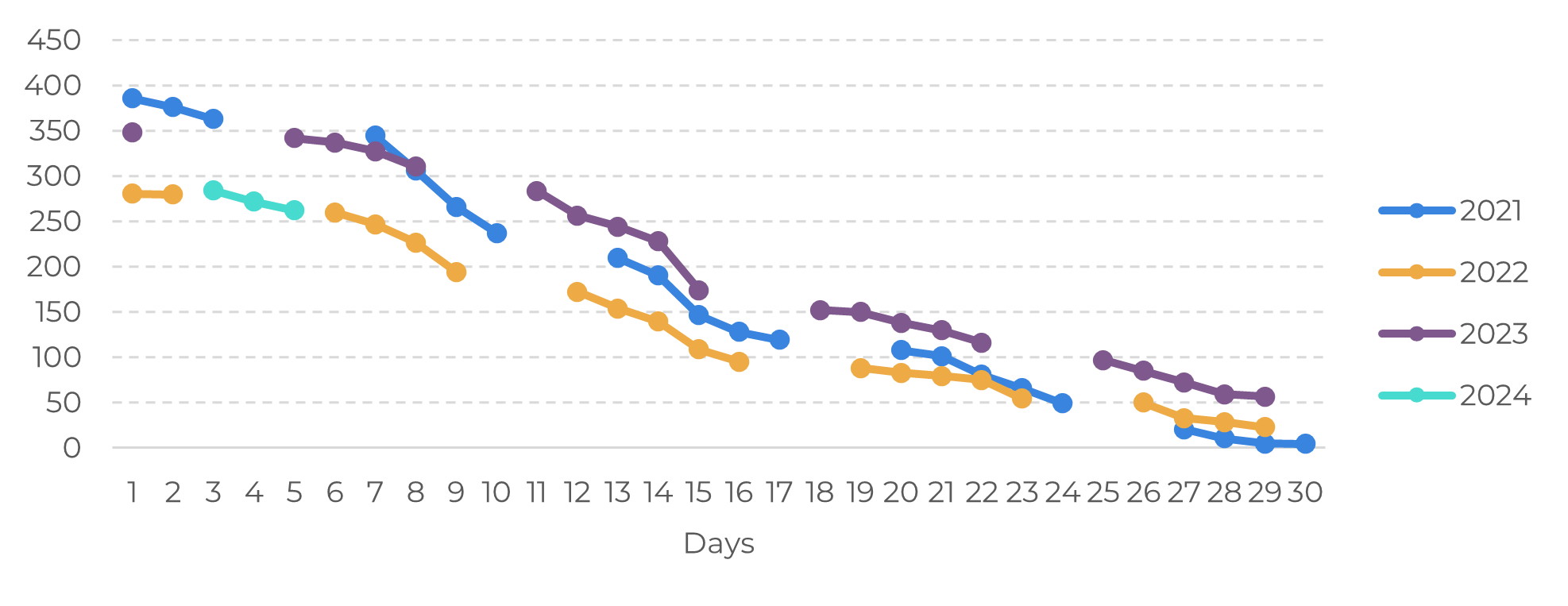

- As October's expiry approaches, declining open interest may lead to movement in spreads, as funds start their position rolling.

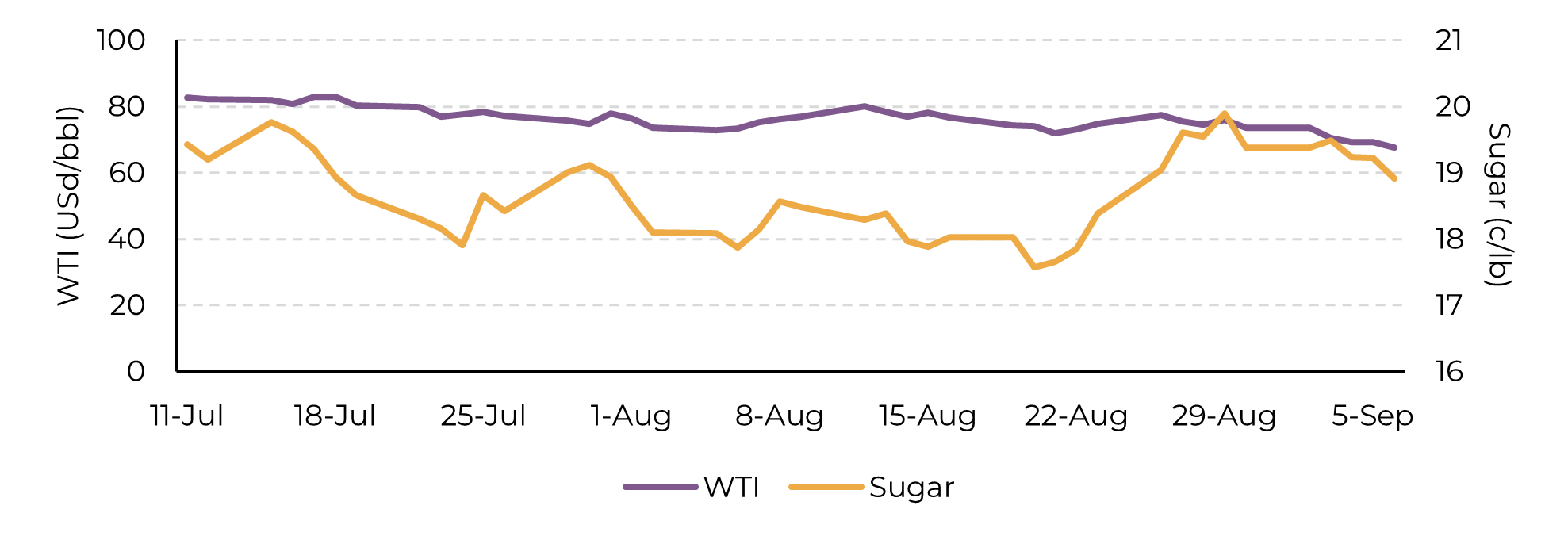

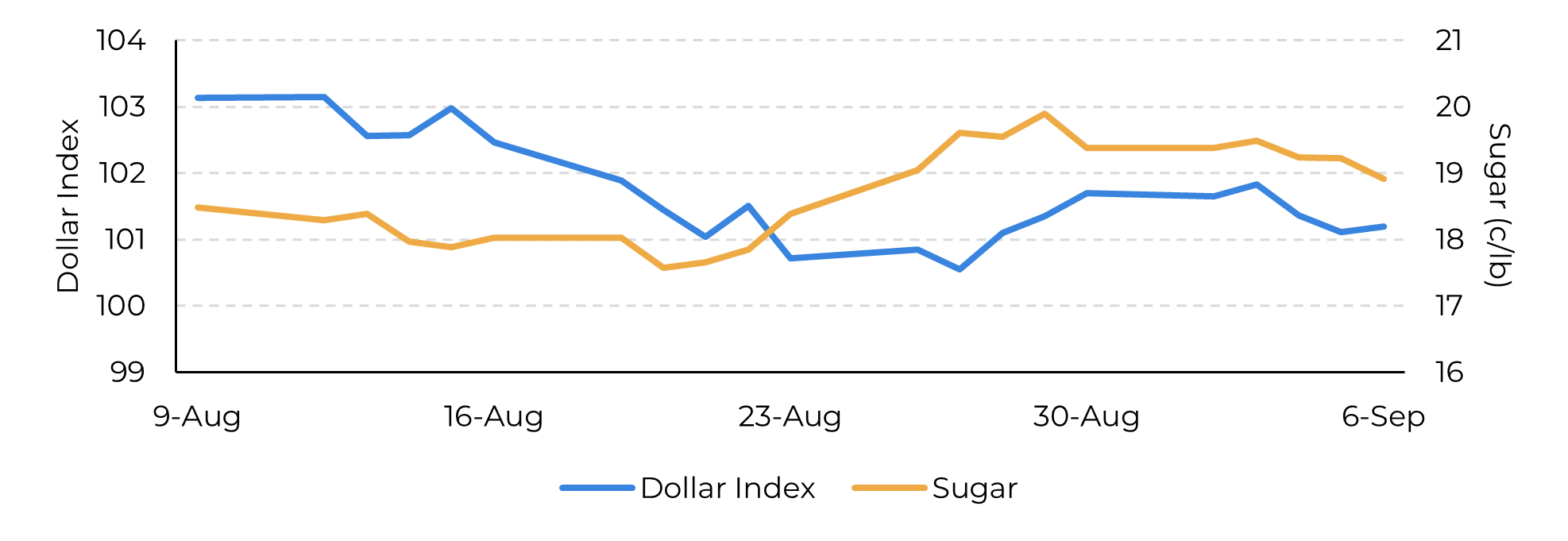

Raw sugar prices struggles to break through the 20c/lb level, likely needing more substantial bullish news to make a definitive move upward. Last week, weakness in the energy sector and broader macroeconomic concerns overshadowed some of the bullish signals that emerged. While prices did see a modest rise following the U.S. dollar's correction on Friday, which was triggered by weaker-than-expected U.S. employment data for August and a stabilization in expectations for interest rate cuts, other news, such as India's sugar export ban, did not have the market-moving impact that some anticipated, with raws ending the week at a lower tone.

As the world's second-largest sugar producer, behind only Brazil’s Center-South region, India has reignited one of the market's central questions: will it export sugar? The government has indicated its intention to prohibit exports, prioritizing the goal of achieving a 20% ethanol blending target by 2025/26. However, market consensus suggests that global trade flows will likely need India’s participation, especially after Brazil’s production was impacted by recent droughts.

Image 1:Sugar vs. WTI: A resilient commodity

Source: Refinitiv, Hedgepoint

Image 2: Dollar correction and sugar prices

Source: Refinitiv, Hedgepoint

Image 3: Indian export parity

Source: Bloomberg, Hedgepoint

Image 4: Open Interest behaviour through September (Thousand)

Source: Refinitiv, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.