Supportive Scenario: macro, weather and delivery

"As the raw sugar contract approaches expiry, it may experience a short-term boost as funds roll over their positions. This strength, however, is not solely driven by technical factors; fundamentals also play a role. The latest UNICA report revealed a lower-than-expected sugar mix, while the Center-South region continues to suffer from drought conditions. The strong white sugar delivery could pressure the white premium, particularly if India's export parity for the quality remains favorable."

Supportive Scenario: macro, weather and delivery

- The sugar market started last week slowly, with participants waiting for the UNICA report, while drought in Center-South Brazil supported prices.

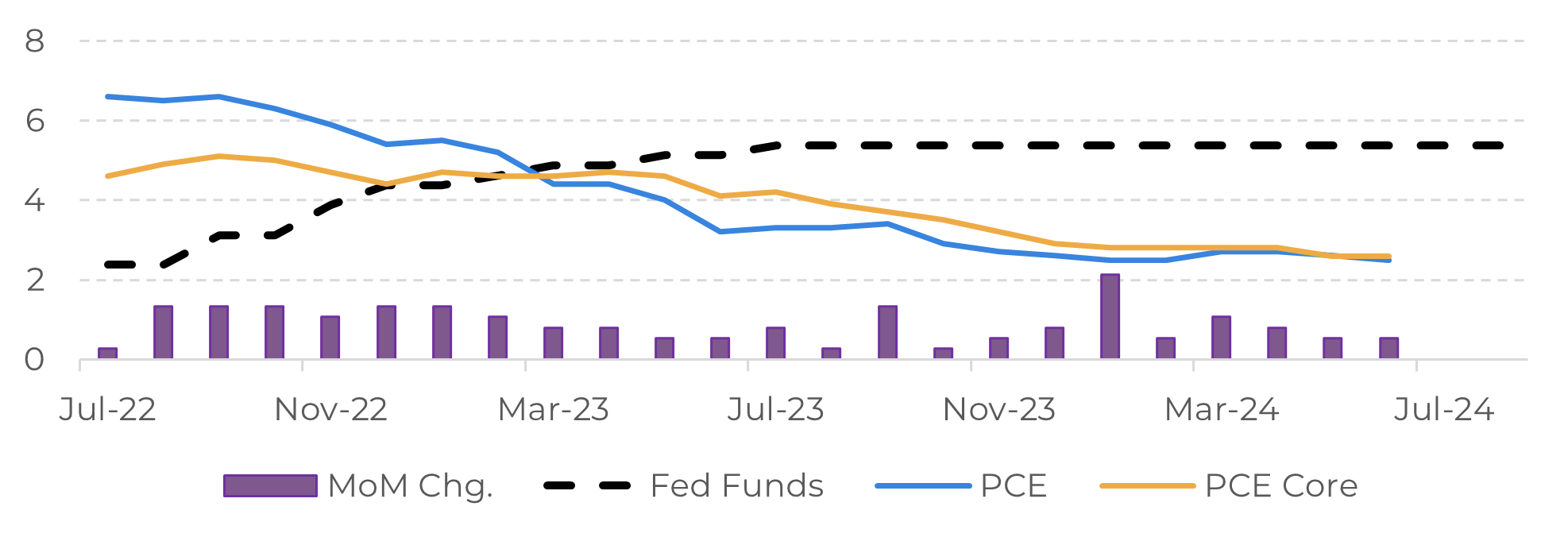

- Macroeconomic factors turned more bullish midweek as U.S. inflation dropped, helping raw sugar prices rise.

- The UNICA report revealed a lower-than-expected sugar mix (48.85%), contrary to forecasts of over 49%.

- Brazil's Senate approved the "Combustíveis do Futuro" bill, raising future biofuel blend mandates, possibly boosting demand for ethanol.

- Despite bullish biofuel developments, sugar prices still rely on Indian export parity, with global trade engagement expected at 20-21 c/lb.

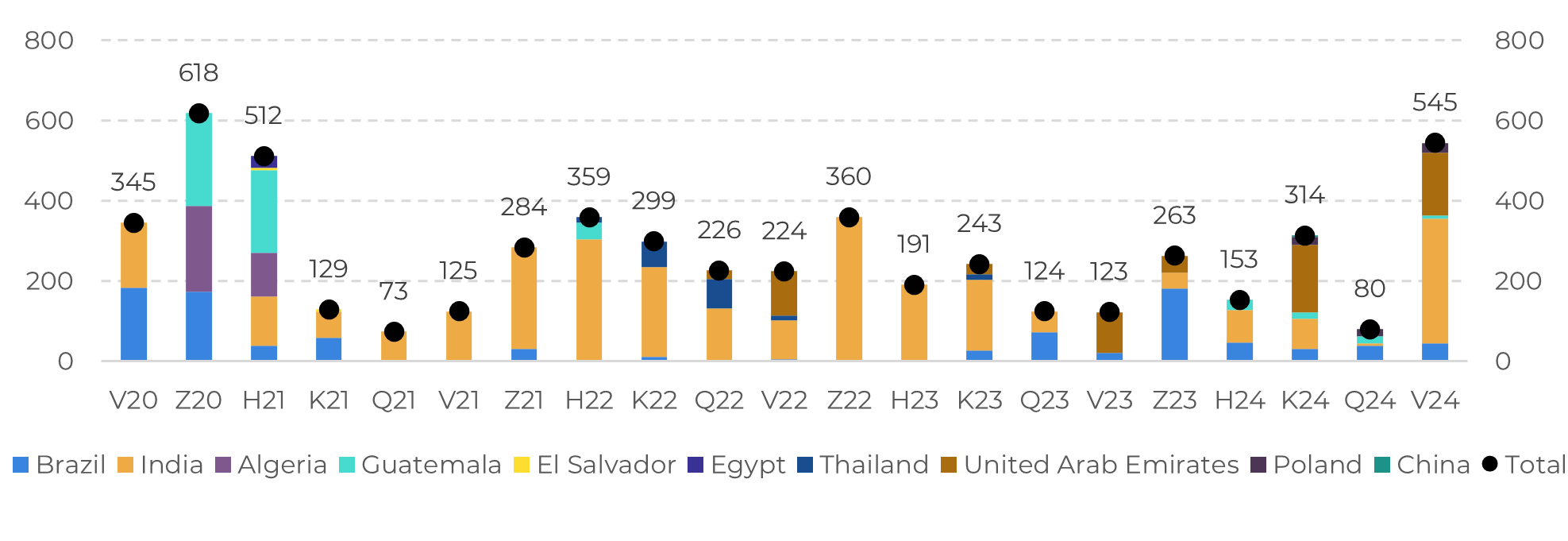

- White’s delivery was healthy, reflecting both a high white premium and an open white sugar Indian parity – a proxy for the tolling profit.

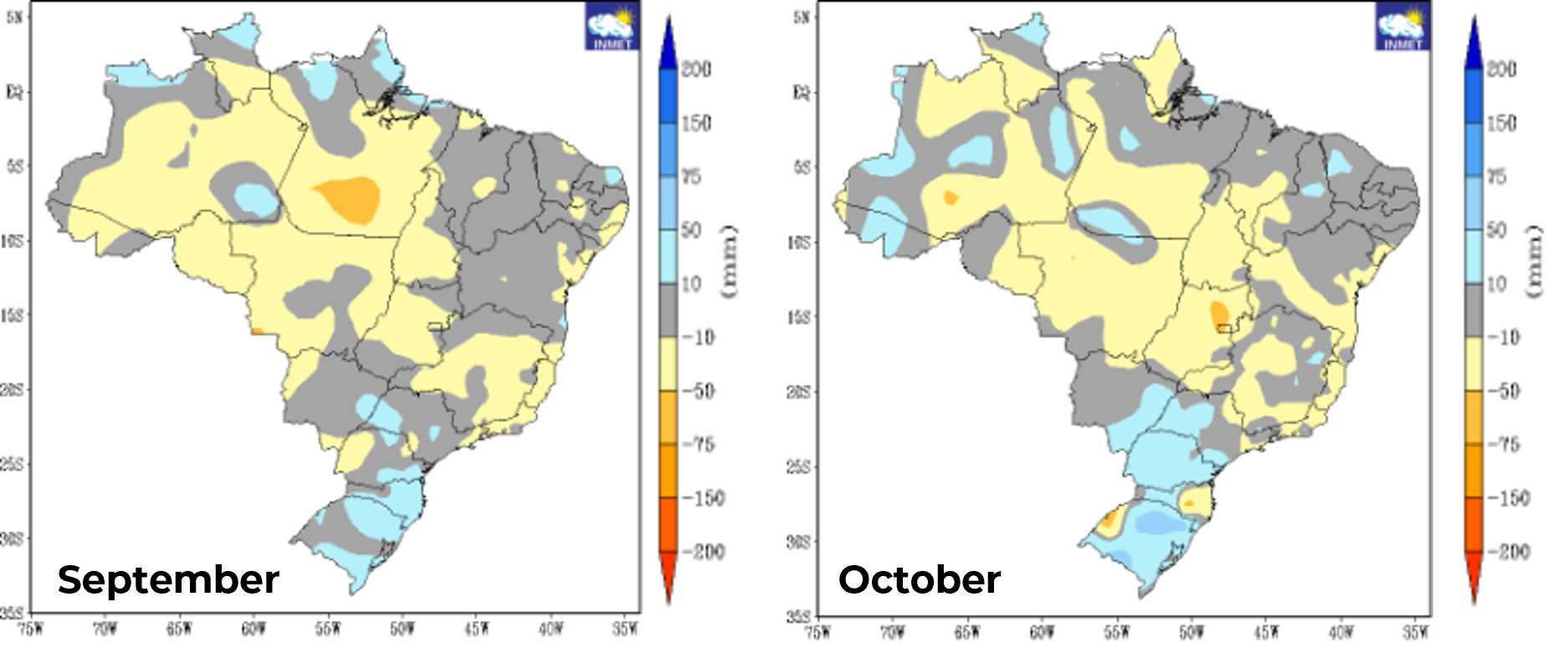

The market started slowly last week, with most participants cautiously awaiting the release of the UNICA report. Meanwhile, the overall environment continued to show signs of weakness, as the energy complex struggled to maintain its gains. Despite this, sugar remained somewhat insulated, supported by the ongoing drought in Center-South Brazil. During the first half of September, the region has experienced hot and dry conditions, with no relief in sight. Low relative humidity and high temperatures in key sugarcane-producing areas have sparked concerns about an increasing number of field fires.

Image 1: Brazilian precipitation anomaly (mm)

Source: INMET

Image 2: US – PCE Index (%)

Source: Bureau of Labor Statistics, Refinitiv

Image 3: White contract delivery (‘000t)

Source: Refinitiv, Hedgepoint

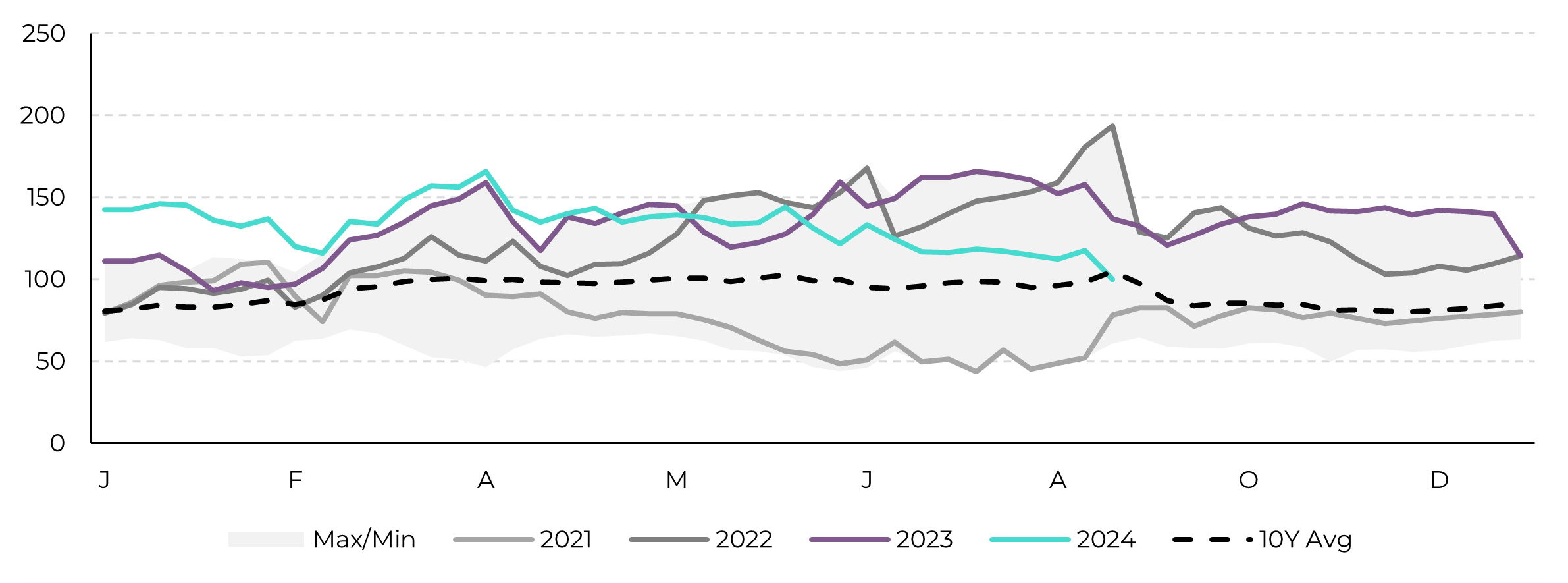

Image 4: White premium 10Y weekly seasonality (USd/t)

Source: Refinitiv, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.