Brazilian crop keeps getting smaller

"About 400 thousand hectares of cane were affected by fires in Center-South Brazil, lowering quality and increasing costs. Our estimates for the region’s sugar mix estimate was reduced from 49.1% to 48.6%, and cane harvest expectations were downgraded from 614 Mt to 610 Mt, leading to a lower sugar production of 39.6 Mt, a 700 kt decline from our previous number. This reduction should tighten trade flows and is already affecting market positioning. "

Brazilian crop keeps getting smaller

- A year ago, Brazil's Center-South crop was expected to have much higher sugar output, but this year’s fires and adverse weather have led to continued lowering expectations.

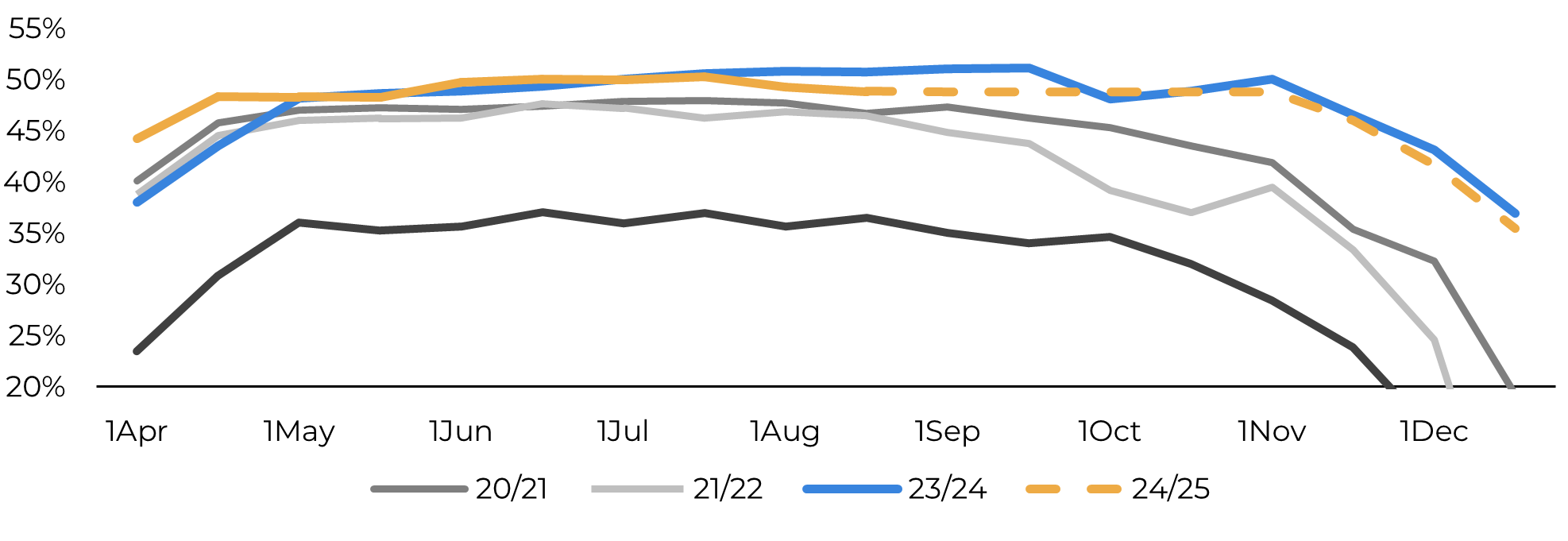

- Hedgepoint’s sugar mix estimate has been revised down from 49.1% to 48.6%, a significant drop from initial forecasts of around 52%.

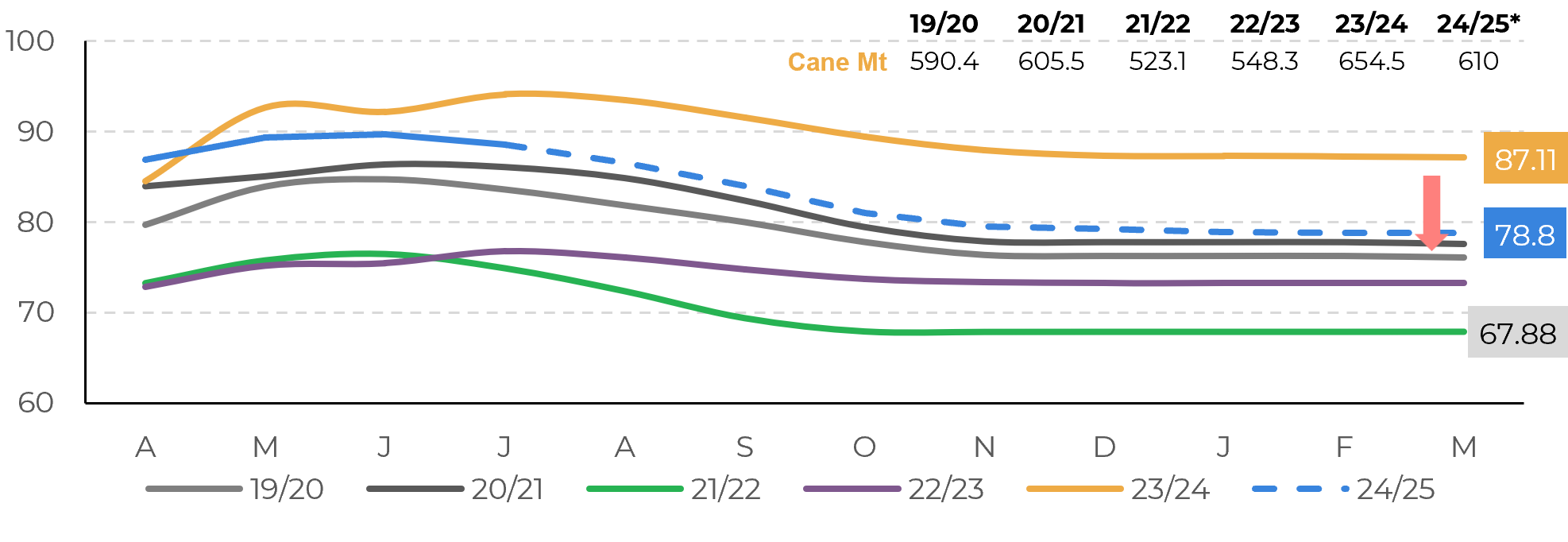

- Total Cane Harvest (TCH) expectations were downgraded from an 8.9% correction to 9.5%, lowering cane estimates from 614 Mt to 610 Mt.

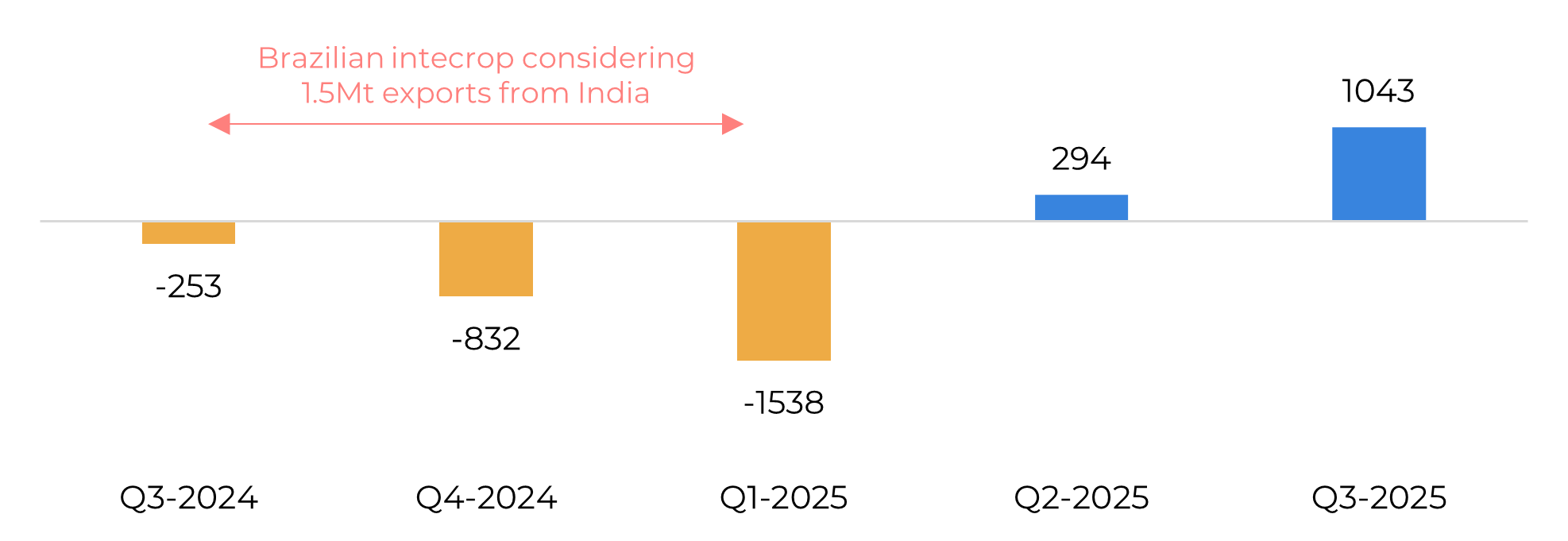

- Sugar production estimates have decreased from 40.3 Mt to 39.6 Mt, resulting in fewer exports and tighter trade flows.

- A 1.3 Mt deficit is projected from Q3 2024 to Q3 2025, primarily during the Brazilian intercrop, with potential price support above Indian export parity.

About a year ago, the headline of this report told a different story. At that time, the progress of the Brazilian Center-South crop indicated a much higher output than originally expected. However, this year, fires and adverse weather conditions have forced us, along with many other market analysts, to repeatedly lower our expectations. Similarly, the Northern Hemisphere also tell a different tale than last year, acting more on the bearish side, many countries are set to a partial recovery. In this report, we will discuss some of the key changes to our estimates.

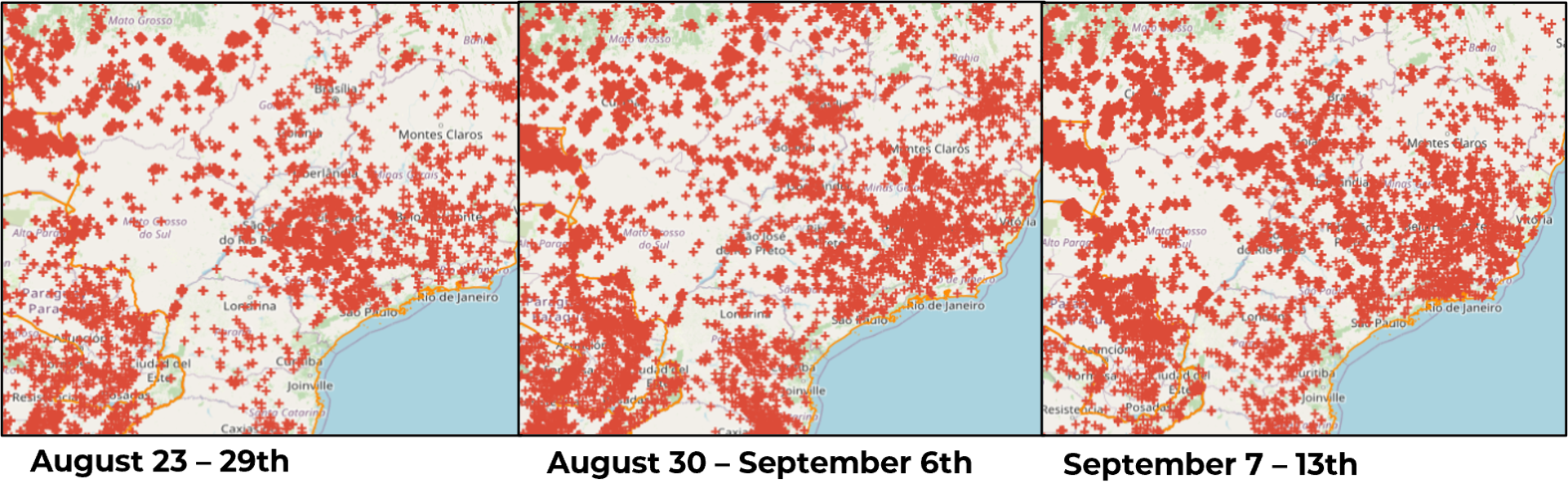

Talking about CS, CTC estimates that about 400 thousand hectares were affected by recent fires, of which 60% were older cane, and 40% of total affected area were "ready to harvest", thus its effects will be mostly felt by the mix. The major impact is a decline in raw material quality and purity, affecting efficiency and productivity, requiring more treatments like fertilizers and pesticides, which drive up costs. This trend is boosted by the fact that fires compromise harvest optimization.

Image 1: Center-South’s fire focus

Source: INPE, reference satellite – AQUA (afternoon)

Image 2: Sugar mix per fortnight (%)

Source: Unica, Hedgepoint

Image 3: Cummulative TCH (t/ha)

Source: Unica, CTC, Hedgepoint

Image 4: Total trade flows (‘000t tq)

Source: GreenPool, Hedgepoint

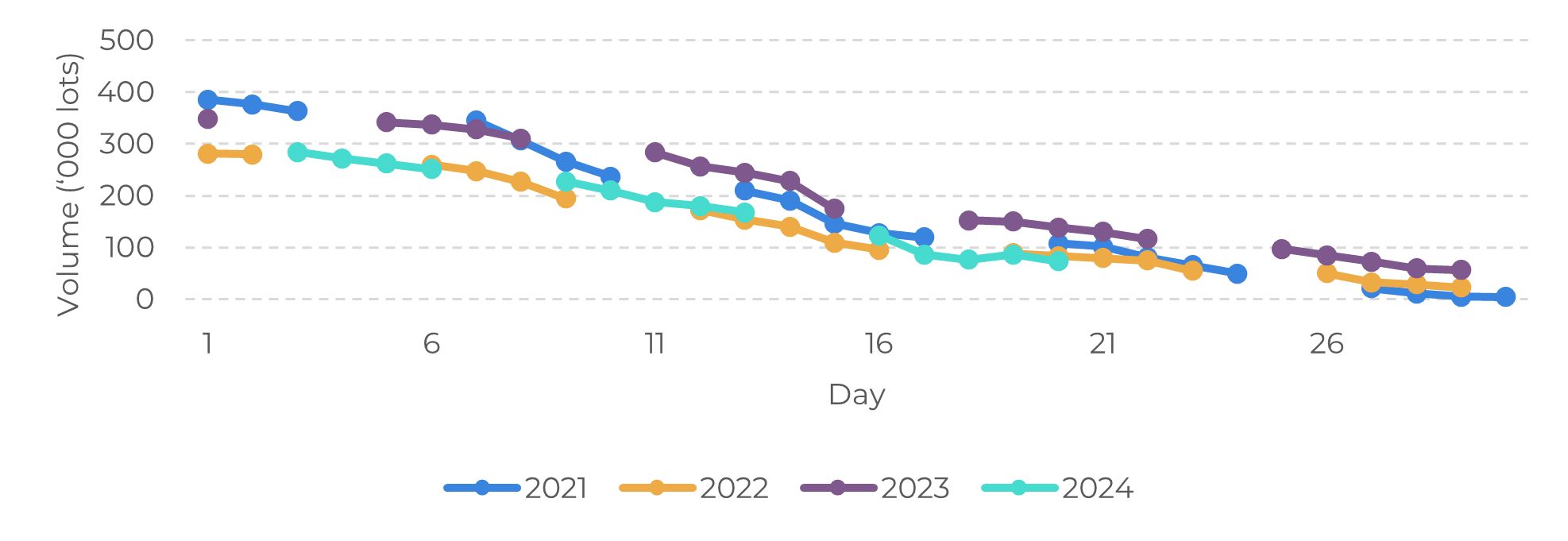

Image 5: Open Interest behaviour through September (‘000 lots)

Source: Refinitiv, Hedgepoint

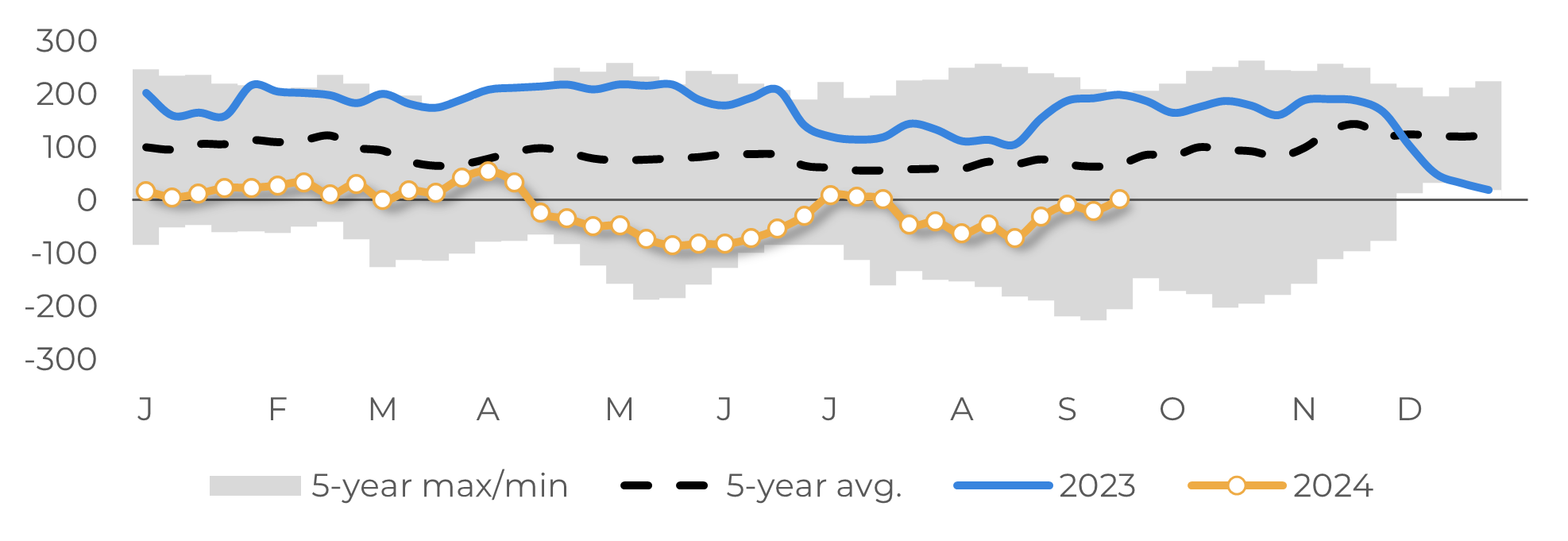

Image62: Spec positioning (‘000 lots)

Source: CFTC, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

thais.italiani@hedgepointglobal.com