Funds react to market sentiment switch

"Brazil’s Center-South sugarcane crop continues to face dry, hot conditions, raising fire risks and reducing sugar quality. While long-term forecasts show potential rainfall relief in October and November, the damage has already lowered the sugar mix, with projections suggesting further declines. This has caught the attention of funds, contributing to a rally in sugar prices, with October reaching a seven-month high. However, optimism around India’s 2024/25 crop and improved EU sugar beet yields have tempered the rally, especially in white sugar, which has seen less bullish movement due to stronger production outlooks in key regions. "

Funds react to market sentiment switch

- Brazil’s Center-South region faces ongoing dry and hot conditions, increasing fire risks and worsening sugarcane quality, though rainfall may improve by October-November.

- UNICA's report shows slightly higher cane crushing but lower sugar mix due to fire damage, reducing the season's sugar output and potentially widening the Q3 2024 to Q1 2025 deficit.

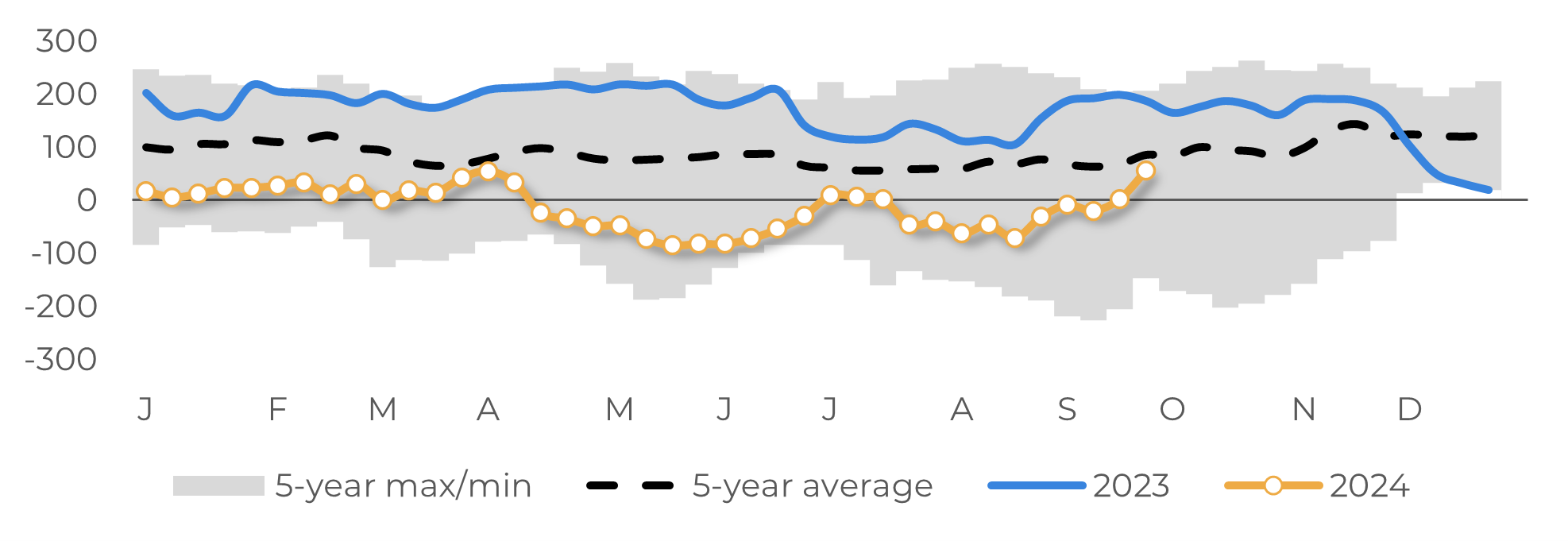

- The deteriorating Brazilian crop has drawn attention from funds, driving October sugar prices to a seven-month high of 23.42 c/lb, aided by a supportive macroeconomic environment and the expiry approach.

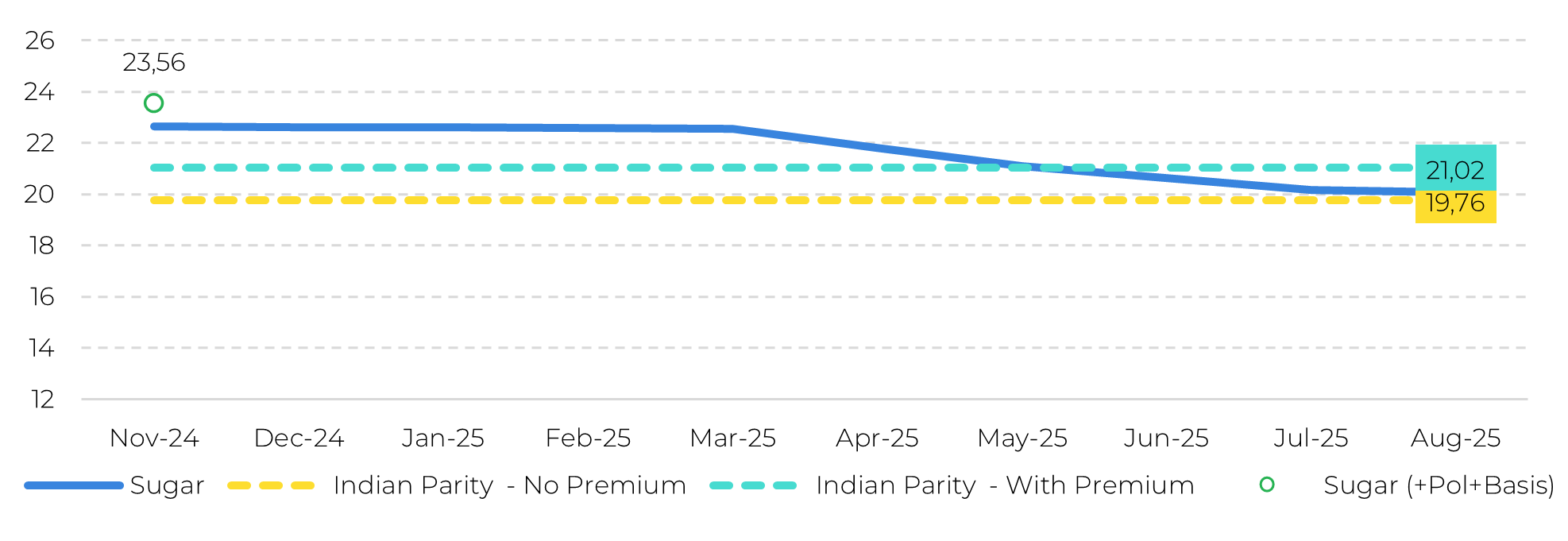

- Optimism about India’s 2024/25 crop from its government officials tempered the rally, as March-May-July 2025 contracts are trading at a premium over Indian export parity.

- White sugar prices have lagged behind raw sugar’s rise, as Europe and India’s recovery in sugar production eases pressure on the white sugar market.

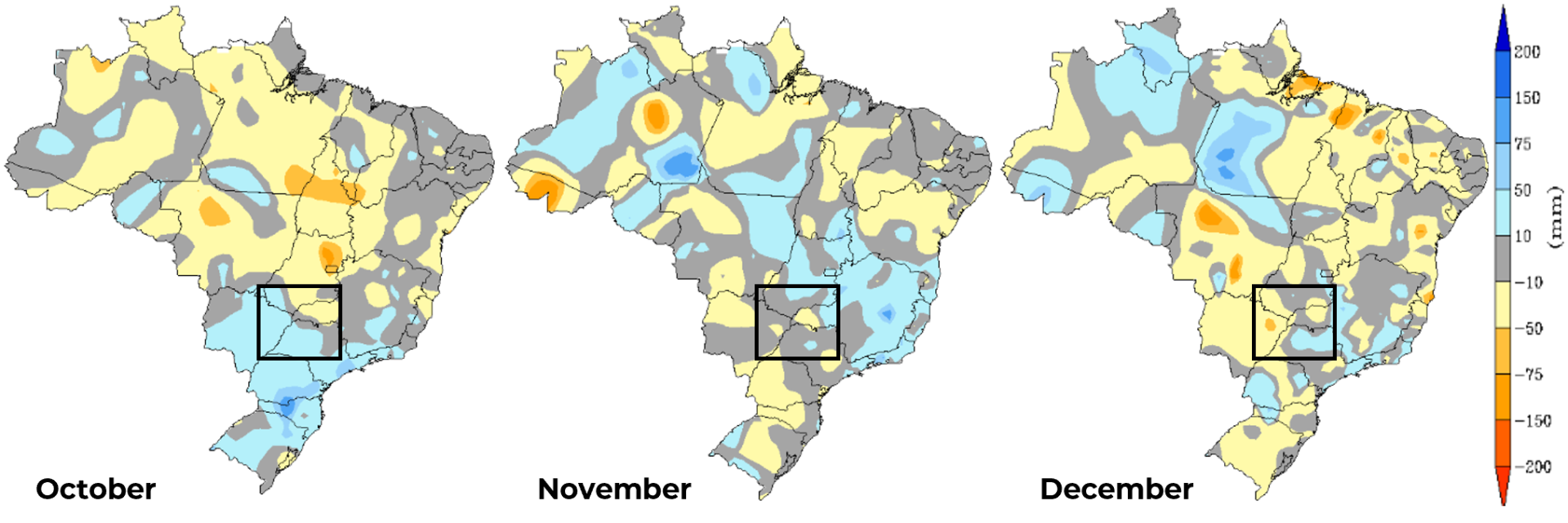

The main focus of the sugar market continues to be the weather in the Centre-South region of Brazil. Dry and hot conditions are expected to persist in most areas over the coming week, raising the risk of fires and potentially worsening the state of cane. However, there's a glimmer of hope: long-term forecasts indicate some improvement in rainfall for October and November, which could bring relief, at least regarding fires.

Unica released its September first fortnight report, bringing slightly higher cane crushing, higher TRS but reduced mix, confirming the fact that fire have indeed contributed to the lingering trend of lower purity, quality and efficiency. According to Unica’s director, reducing sugar’s concentration is 11% higher compared to last season, inducing a lower sugar mix. Updating our dataset accordingly resulted in a drop in the season's end index value to 48.47% from 48.6%, indicating that it could approach 48.3% if there's no recovery in the next four fortnights. Every 1 percentage point drop to the sugar mix would result in, approximately 80-100kt less sugar, and thus 80-100kt more of deficit between Q3-24 and Q1-25.

Image 1: Long term precipitation anomaly forecast (mm)

Source: Inmet

Image 2: Non-Comercial (Specs) net positioning (‘000 lots)

Source: CFTC

Image 3: Indian Export Parity (c/lb)

Source: Boomberg, Hedgepoint

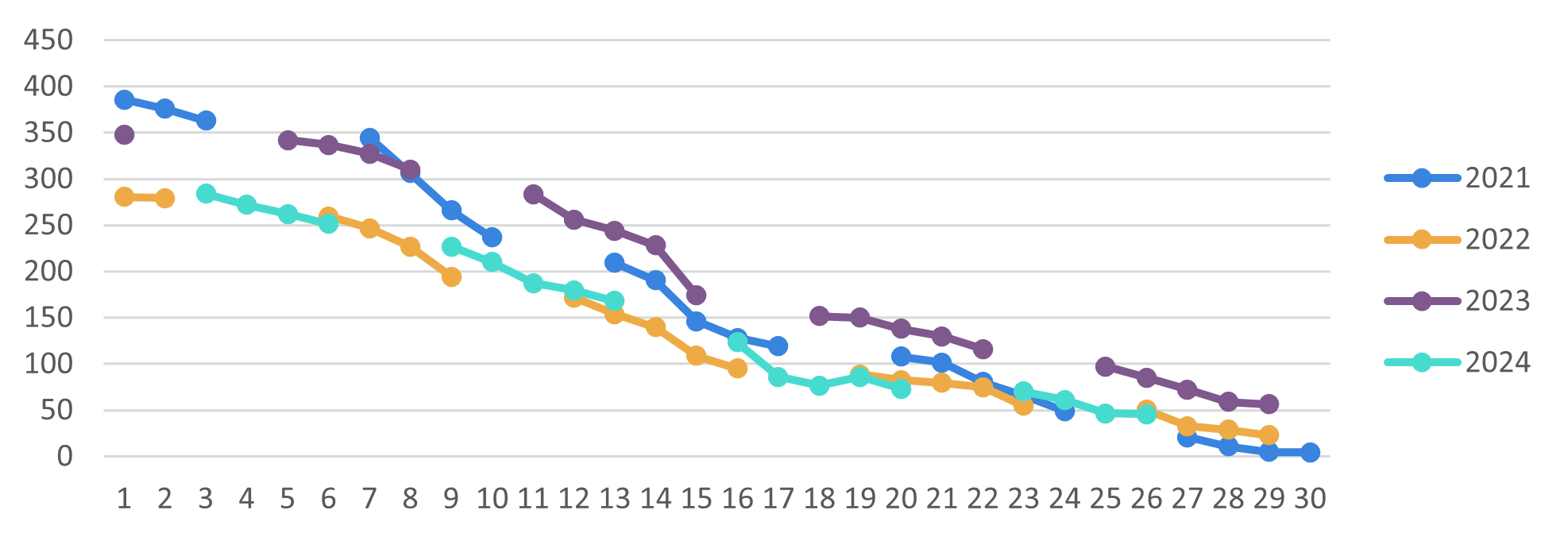

Image 4: Open Interest behavior in September

Source: Refinitiv

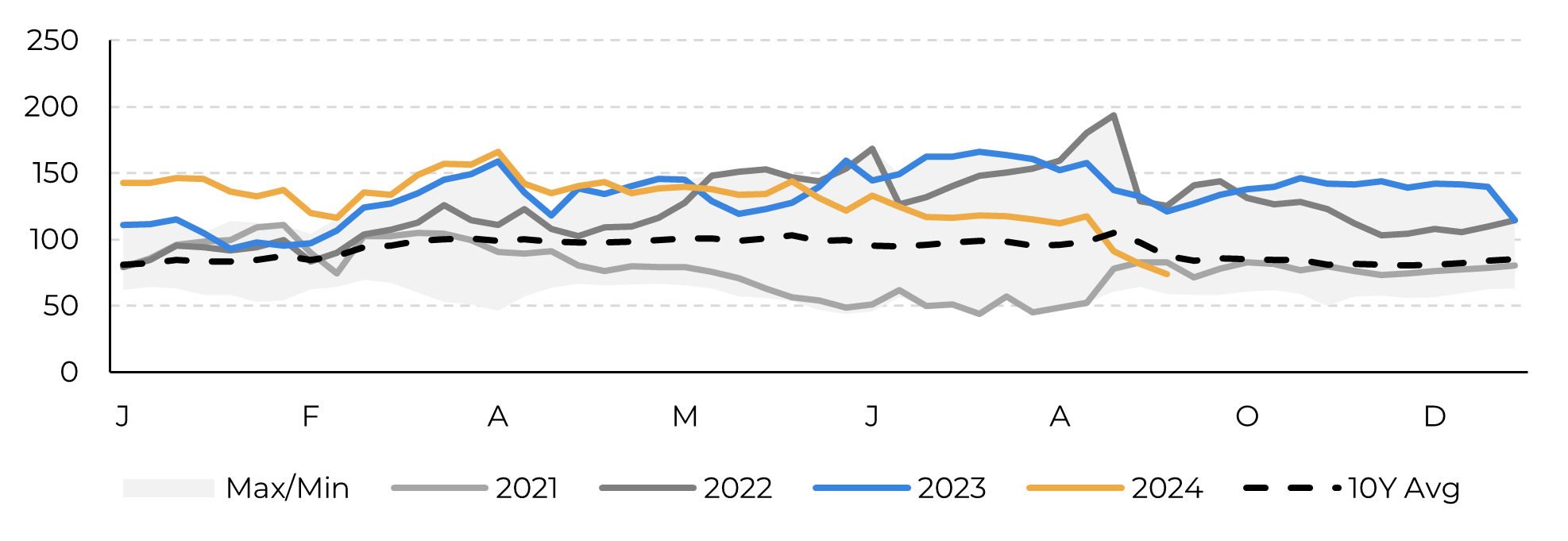

Image 5: White Premium Weekly Seasonality (Usd/t)

Source: Refinitiv, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com