A week focused on macro and few changes in sugar

"Recent rainfall in Center-South Brazil could disrupt the current crushing but supports 2025/26 crop development, benefiting sugar's H/K spreads. Sugar prices were somewhat stable last week, though with some fluctuations, as the period was largely influenced by macroeconomic events."

A week focused on macro and few changes in sugar

- Recent rainfall in Center-South Brazil could disrupt the current crushing but supports 2025/26 crop development, benefiting sugar's H/K spreads.

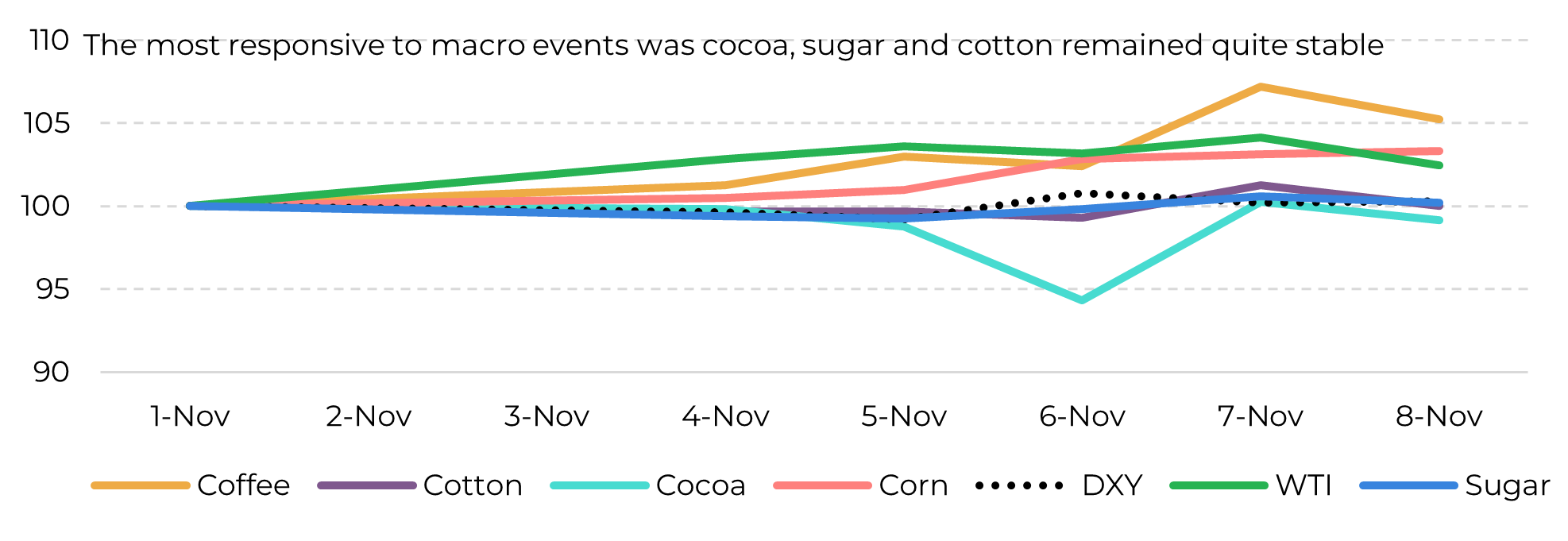

- Despite macroeconomic volatility, sugar prices remained somewhat stable during last week, with short-term supply concerns and seasonal factors offering support.

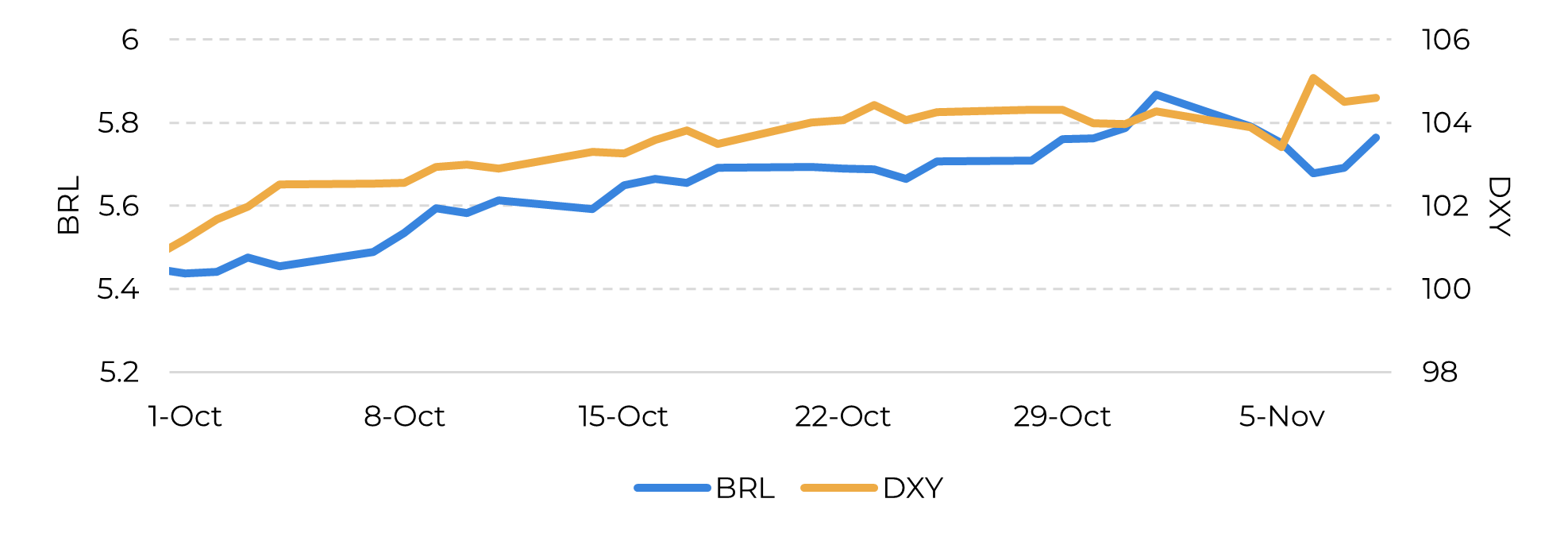

- Trump’s election strengthened U.S. Treasury yields and the dollar, raising risk-aversion and potentially pressuring global commodity demand in the long term if an inflationary agenda is indeed pursued.

- The potential reintroduction of U.S. tariffs and China’s recession risks could reduce China’s demand for commodities, including sugar.

- The Fed cut rates by 0.25%, while Brazil’s Central Bank hiked by 0.50%, reflecting different economic priorities. The interest differential might benefit the BRL's strengthening, possibly supporting sugar prices – of course, depending on fundamentals.

- Nevertheless, while we wait to see how macro unravels, sugar fundamentals remained stable amid last week’s macro shifts.

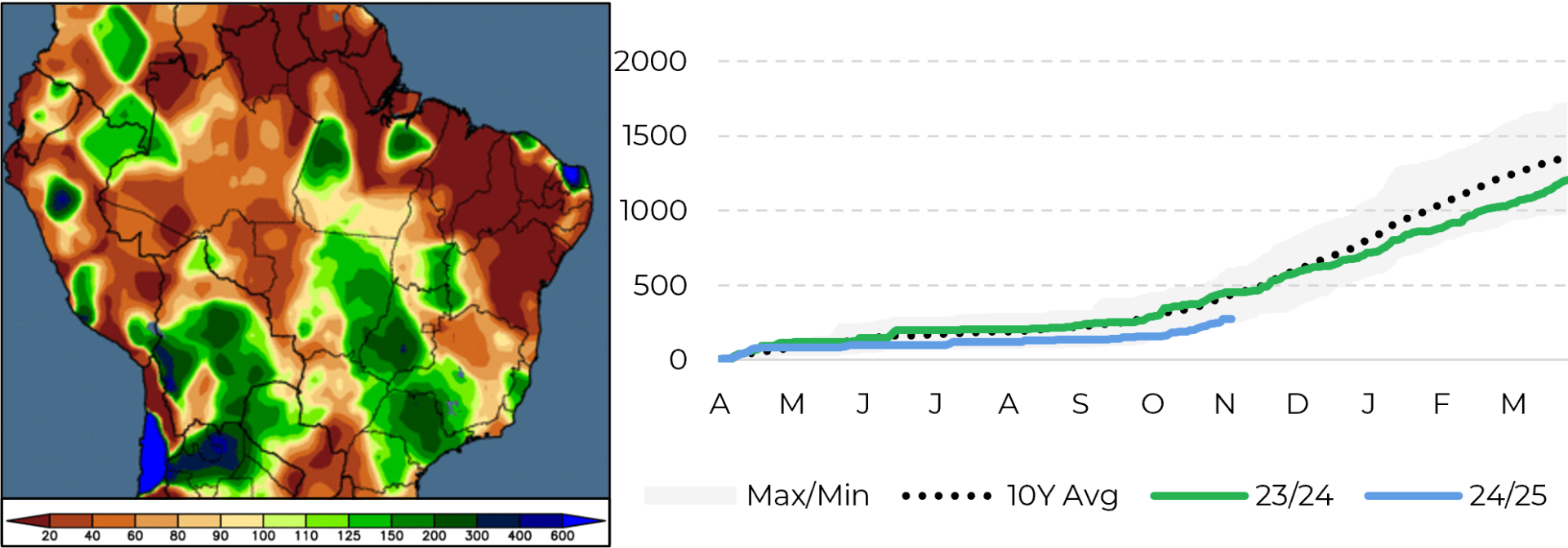

The main focus in the sugar market has been the long-awaited arrival of rains in the Brazilian Center-South. While higher precipitation may shorten the current season by disrupting crushing, it could be beneficial for the development of the 25/26 crop. Consequently, recent rainfall is expected to support the H/K spreads. As a result, sugar prices were somewhat stable last week, though with some fluctuations, as the period was largely influenced by macroeconomic events.

Image 1: 14-days precipitation anomaly ending Nov 6 (mm | left) and estimated cummulative precipitation in cane areas in Center-South (mm | right).

Source: Agweather, Bloomberg, Hedgepoint

Image 2: Busy week on the macro front: BRL x DXY

Source: Refinitiv, Hedgepoint

Image 3: Macro week impact on key commodities (Nov 1st =100)

Source: Refinitiv, Hedgepoint

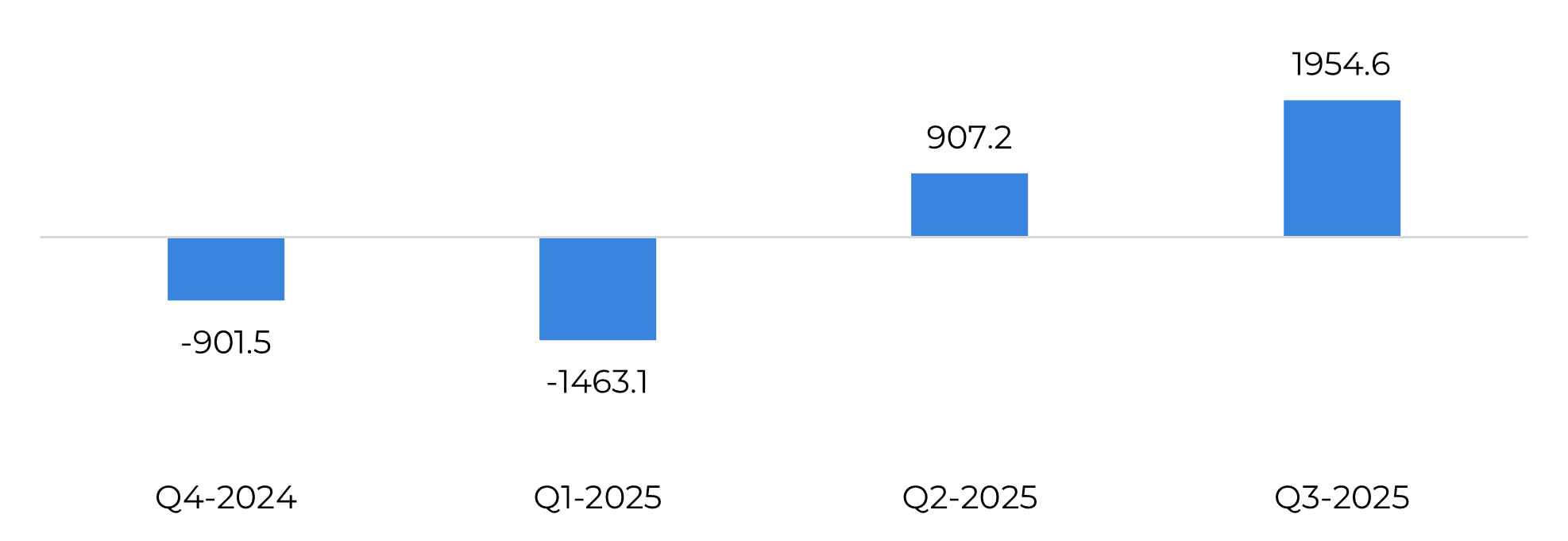

Image 4: Sugar global trade flows (‘000t tq)

Source: GreenPool, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.