Macro vs Fundamentals

"After an extremely sluggish week for the sugar market, the expiry of white sugar contracts came to the rescue, reminding the market of the current bullish fundamentals."

Macro vs Fundamentals

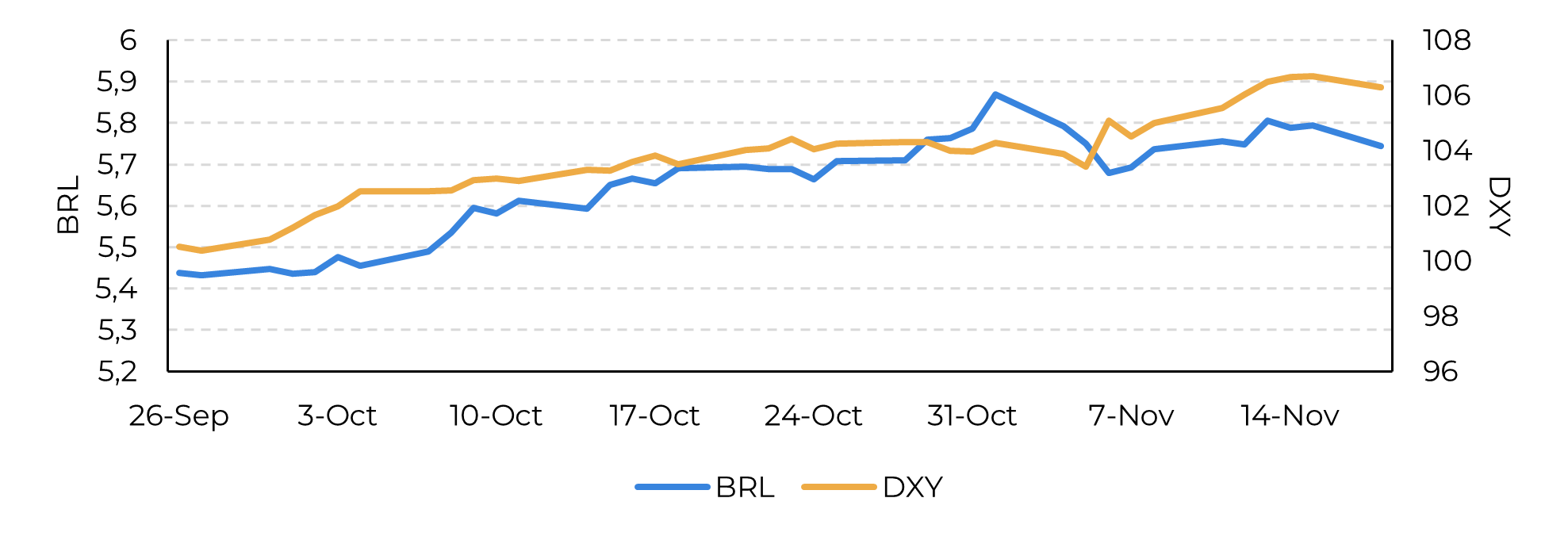

- Raw sugar prices saw a sharp correction last week, influenced by macroeconomic trends like a stronger dollar and a weaker Brazilian real.

- The over 2% price drop seen last Monday was partly due to rains in Brazil's Center-South region and Unica’s report anticipation.

- Concerns about increased cane availability in the Center-South region led to a loss of market momentum, but estimates for sugar production remain unchanged at 39.7 million tons for 24/25.

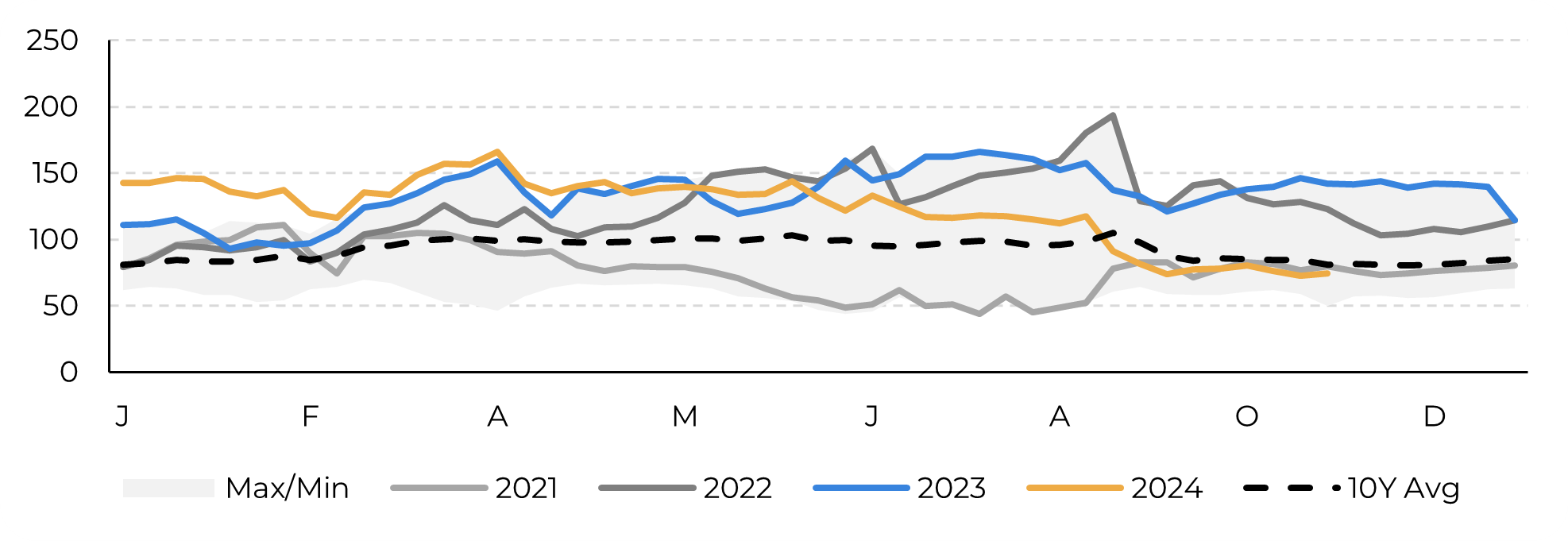

- Increased white sugar availability from Europe, Thailand, Central America, and India has affected the white premium and demand for raw sugar, keeping prices under pressure.

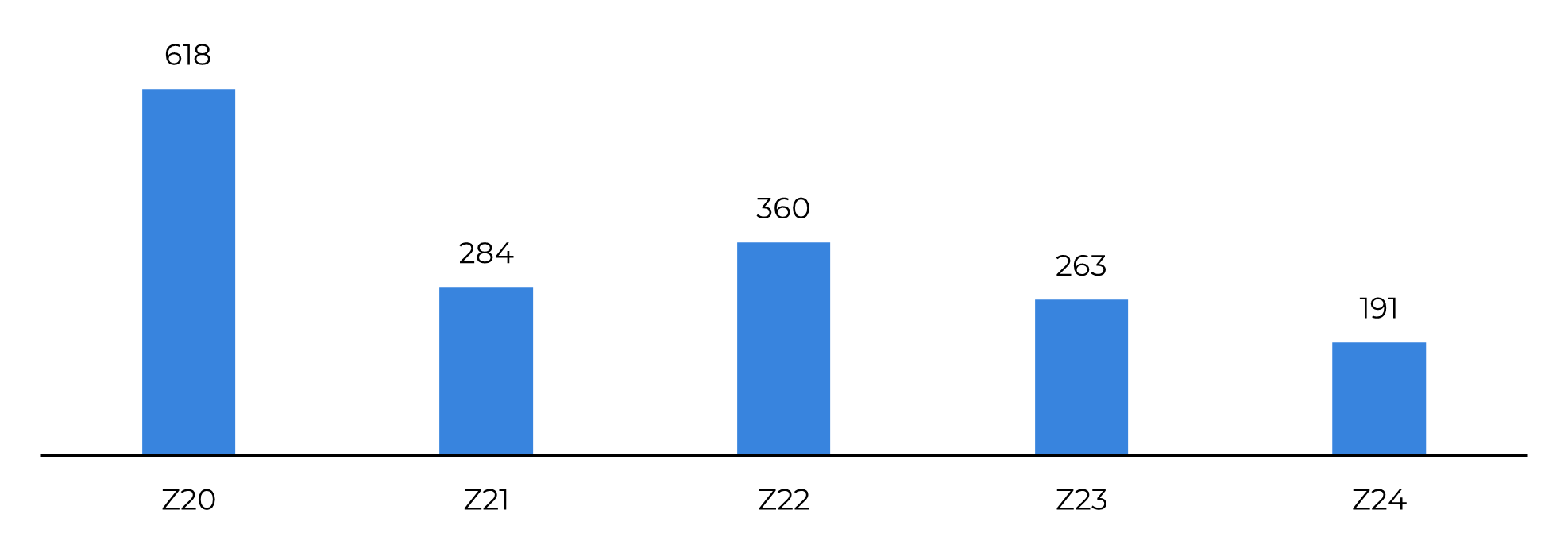

- By the end of the week, however, whites’ delivery added a bullish tone, with raw sugar showing a strong recovery in the first trading session of this week.

Last week started with a sharp correction to raw sugar prices. One might argue that sugar prices have been shaped by broader macroeconomic trends, such as a stronger dollar following Trump’s election and a weaker Brazilian real amid anticipated fiscal policy changes in Brazil. However, these factors alone don't fully explain last Monday’s price drop. While the long-awaited rains across Brazil's Center-South region played a role, the over 2% decline suggests that traders were already pricing in UNICA’s results, which revealed a higher-than-expected crushing volume.

Concerns have emerged that the Center-South region might have more cane availability than previously estimated, leading to a loss of momentum in the market. Nevertheless, we chose to keep our estimates unchanged, as many mills are wrapping up operations, and our forecast for crushing was already more optimistic than the average. With an estimated 610 million tons of cane and a slight reduction in the sugar mix from 48.2% to 48.1%, sugar production could still reach 39.7 million tons in 24/25. Although this is a strong result despite weather challenges, sugar remains supported by bullish fundamentals due to limited short-term availability from major producers, but this support is not as strong as one could expect.

The main reason behind sugar’s difficulty in breaching the 22 c/lb level could be explained by the demand side.

Image 1: Stronger Dollar and Weak Brazilian Real: A Recipe for Bearish Sugar Prices

Source: Source: Refinitiv, Hedgepoint

Image 2: Weekly White Premium Seasonality (10 years - Usd/t)

Source: Refinitiv, Hedgepoint

Image 3: Raw Sugar Monthly Santos FOB Premium (USc/lb)

Source: Refinitiv, Hedgepoint

Image 4: White Sugar Delivery | December Contracts (‘000 t)

Source: GreenPool, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.