Mostly, a demand game!

"The strength of the short-term bullish trend will depend on demand pace and crop development conditions in the Brazilian Center-South. If the latter deteriorate, trade flows could turn completely bullish."

Mostly, a demand game!

- The current macro framework is not supportive of the commodity complex.

- Risks such as the devaluation of emerging market currencies, higher refinery stocks, and a weaker Chinese economy could pressure demand, lowering FOB premiums.

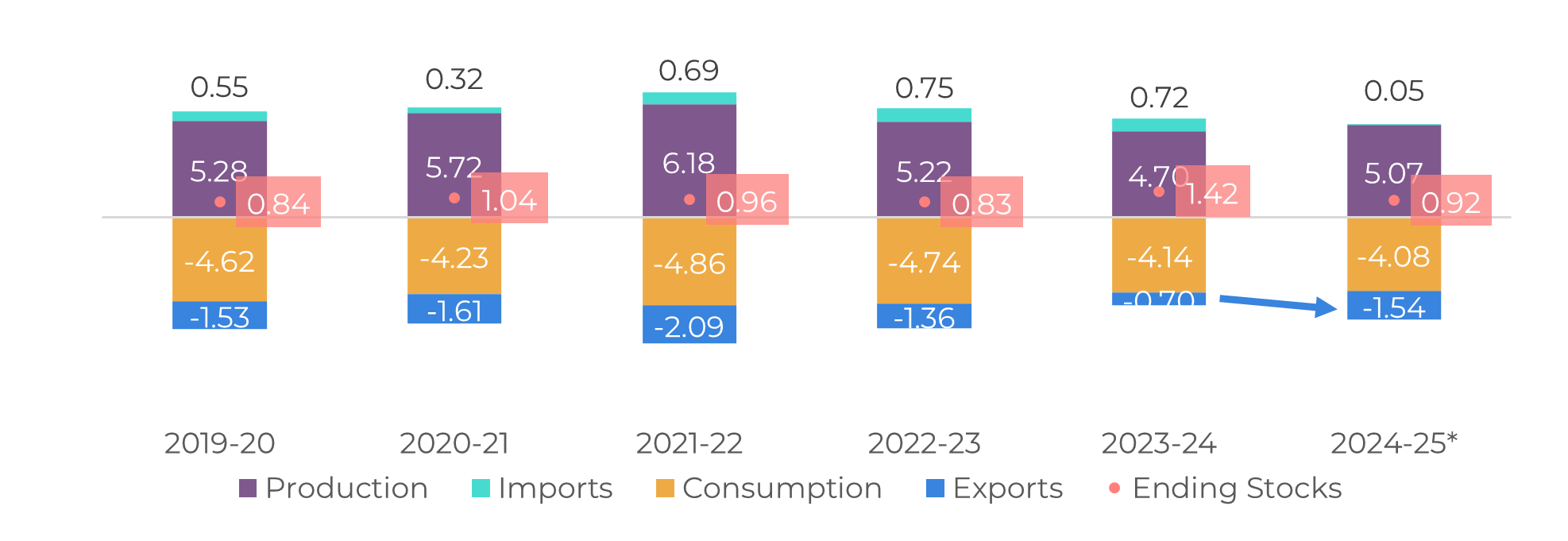

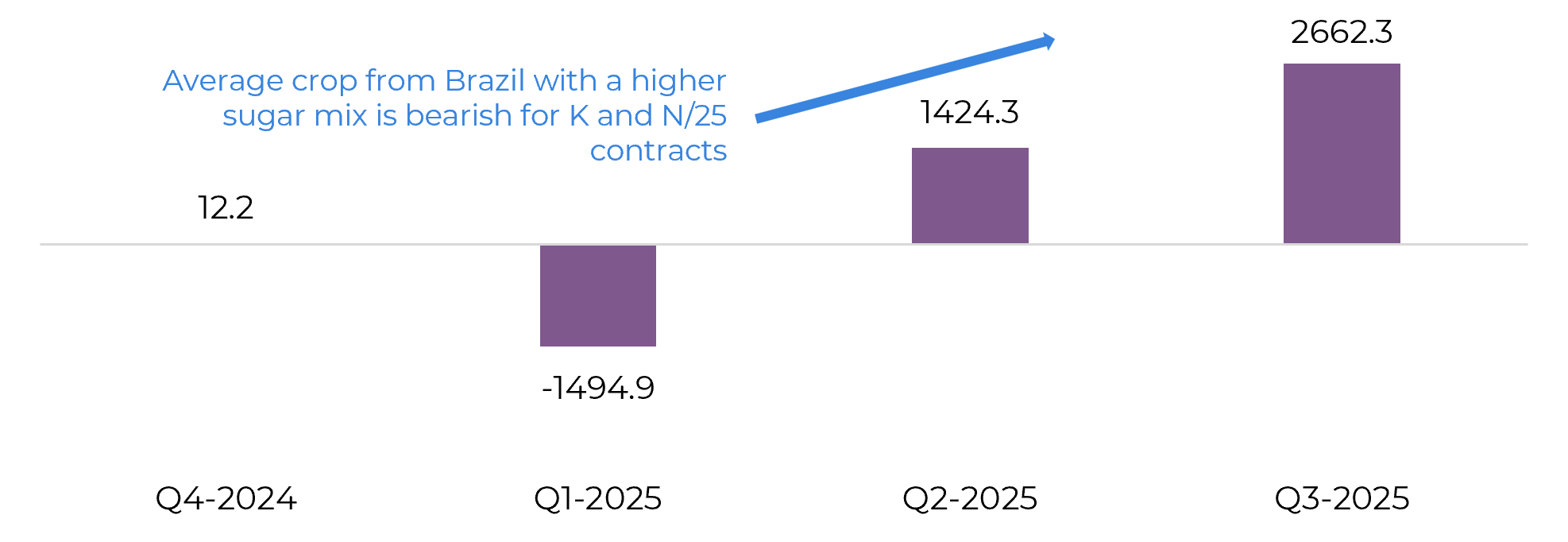

- Fundamentals seem stable, but availability tightness might not be as severe as expected in Q4/24. Mexico's season has started optimistically, and Brazil continues to push through, with a higher deficit predicted in Q1/25.

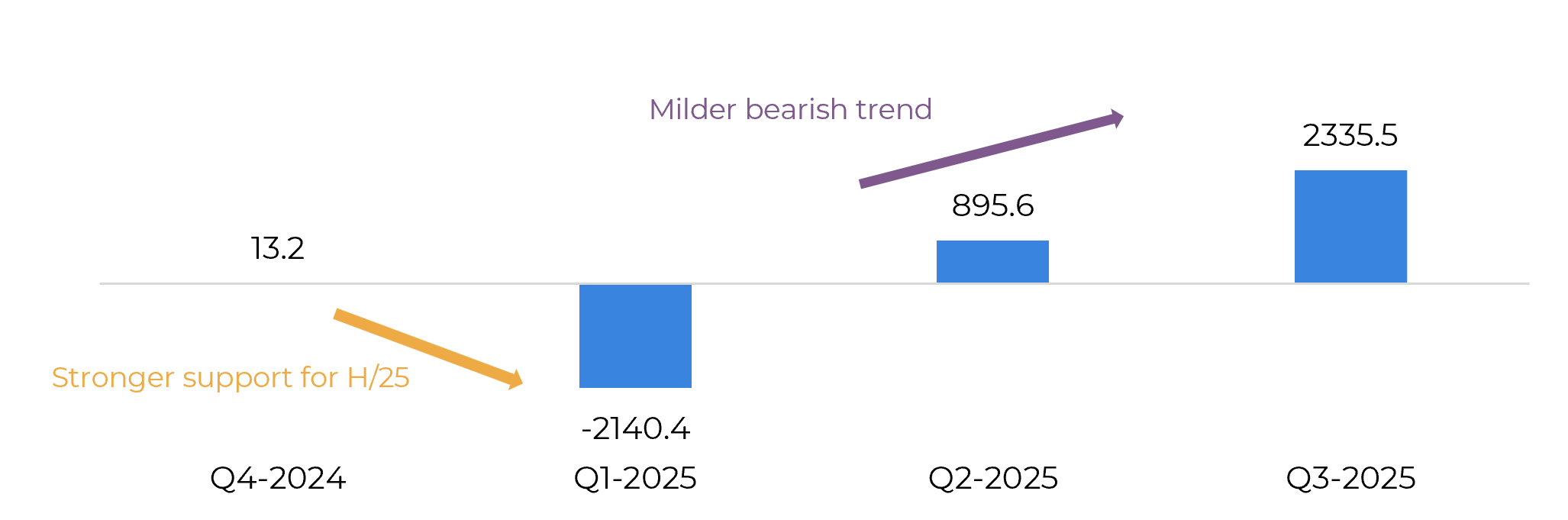

- Q1/25 trade flows could tighten if India's production falls short, widening the supply-demand imbalance and potentially driving higher prices.

- The strength of the short-term bullish trend will depend on demand pace and crop development conditions in the Brazilian Center-South. If the latter deteriorates, trade flows could turn completely bullish.

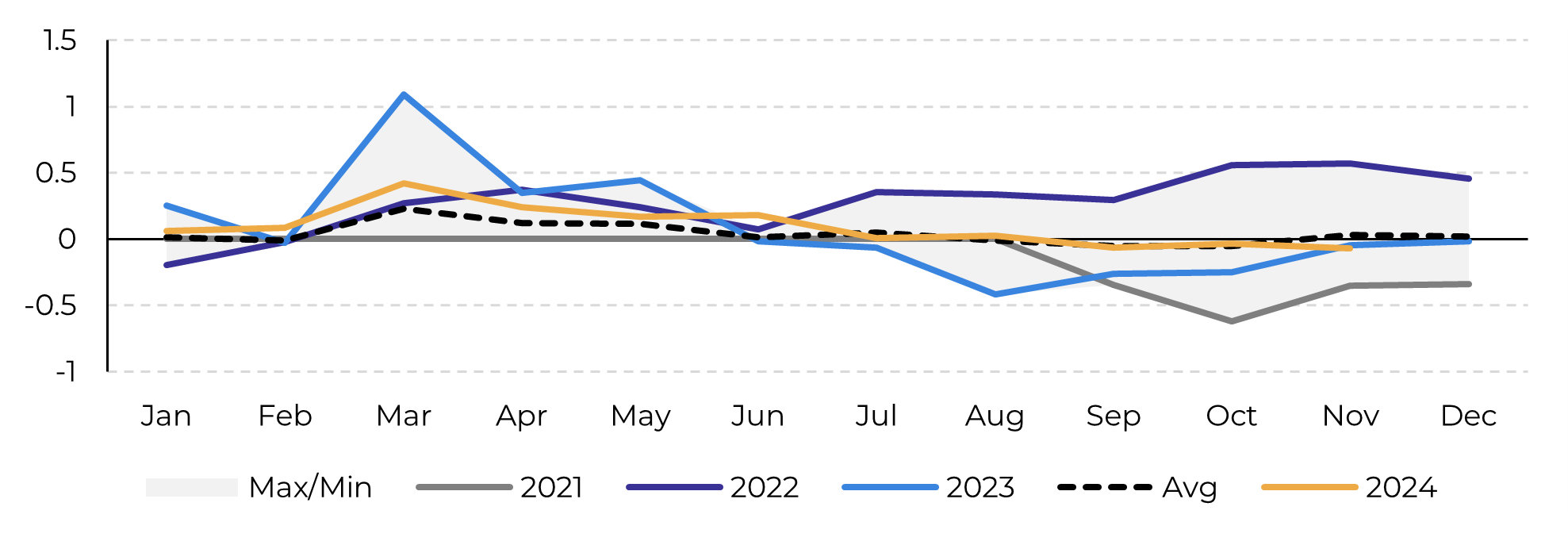

As discussed in previous reports, the overall macro framework is not supportive for the commodity complex. Specifically for sugar, following Trump's election, the stronger dollar and weaker Brazilian real, driven by anticipated fiscal policy changes in Brazil, created a favorable environment for Center-South’s exports, which capped sugar gains. Risks such as the devaluation of emerging market currencies, reducing their purchasing power, and a weaker Chinese economy have also added pressure to the demand side, lowering FOB premiums.

Image 1: Raw Sugar Monthly Santos FOB Premium (USc/lb)

Source: Source: Refinitiv, Hedgepoint

Image 2: Sugar Balance - Mexico (Mt Oct-Sep)

Source: Conadesuca, Greenpool, Hedgepoint - obs. export data combines exports and IMMEX

Image 3: Base Case | Total trade flows (‘000t tq)

Source: GreenPool Hedgepoint

Image 4: No India | Total trade flows (‘000t tq)

Source: GreenPool Hedgepoint

Another factor that could drive higher prices is the deterioration of crop development conditions in the Brazilian Center-South for the 25/26 season. If rains become scarce again, or if by February there are concerns about cane quality and the ability to achieve a higher sugar mix, demand will have no alternative, and trade flows could turn completely bullish.

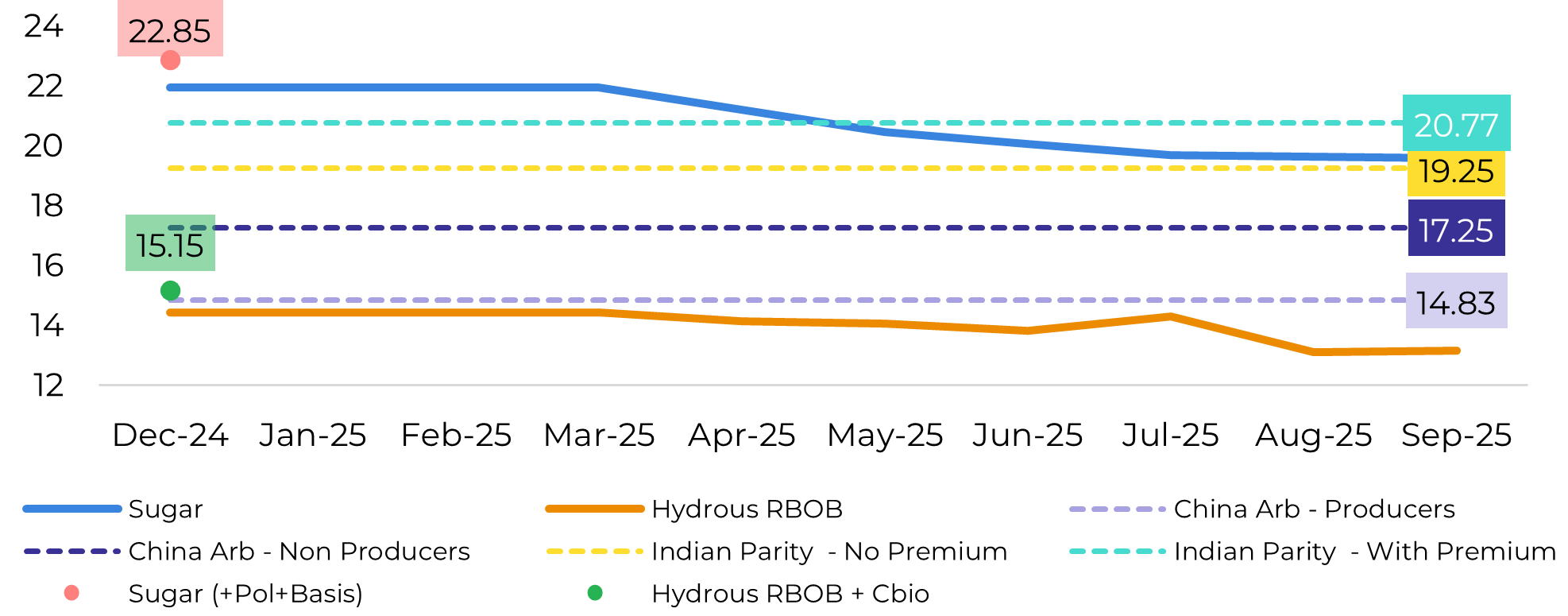

Image 5: Sugar market key paritites (c/lb)

Source: Bloomberg, Refinitiv, Hedgepoint

In Summary

Q1/25 trade flows could tighten if India's production falls short of our expectations. The supply-demand imbalance is expected to widen, potentially driving higher prices. This trend can be exceptionally strong if crop conditions in the Brazilian Center-South deteriorate. Otherwise, demand pace will be the key monitoring variable when it comes to price action during the Brazilian offseason.

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.