Highlights amid market slowdown

"The devalued Real incentivizes sugar exports and may lead to inflationary trends in the domestic market, with the crystal index expected to remain supported.

"

Highlights amid market slowdown

- During the last week of November, sugar prices slowed down due to minimal changes in fundamentals and the Thanksgiving holiday, which closed US markets.

- Conab's third estimate for the Brazilian 24/25 crop suggests lower production due to decreased yield, especially in the Center-South region.

- The latest Unica report signals the start of the offseason, with cane volume and sugar production falling behind the 23/24 results, indicating tighter availability.

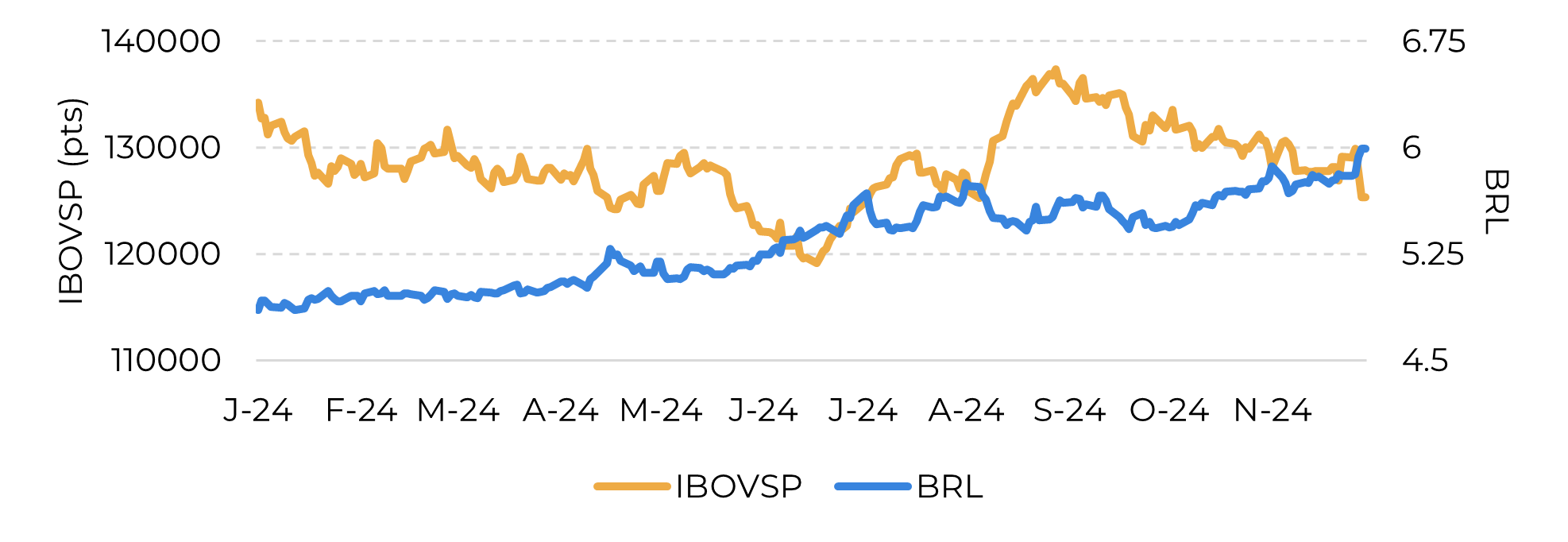

- The macroeconomic framework, particularly the strong dollar index and Brazil's weaker Real, sets a bearish tone to the commodity market.

- The devalued Real incentivizes sugar exports and may lead to inflationary trends in the domestic market, with the crystal index expected to remain supported.

During the last week of November, sugar prices experienced a slowdown. This was not only due to minimal changes in fundamentals but also because of Thanksgiving, which led to the closure of US markets. However, there are three highlights worth monitoring:

1. Conab released its third estimate regarding Brazilian Center-South 24/25 crop.

2. Unica report signalizes the offseason start.

3. BRL faces a stronger devaluation trend.

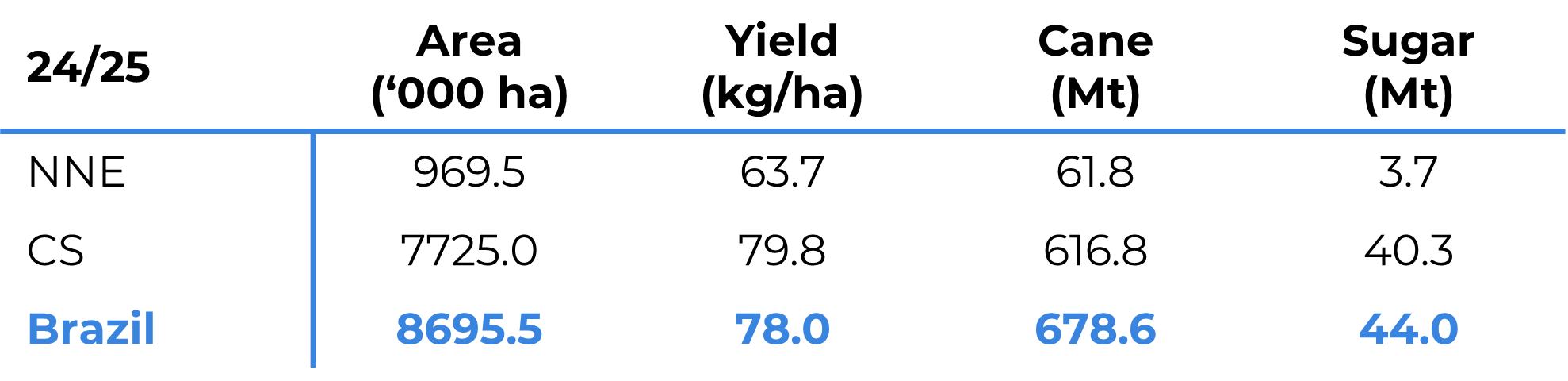

Regarding the first point, the agency did not report any news. Production in the country is expected to be lower, with about 4.8% less cane and a 4.3% increase in the harvesting area. This suggests that the decrease in output is solely due to lower yield, which Conab estimates at 78 kg/ha, or 8.8% lower than in 23/24 for the entire country. This reduction is attributed to a combination of lower precipitation and higher temperatures in the Center-South region, which accounts for 91% of total cane production.

Image 1: Conab’s estimates for 24/25 cane crop

Source: Conab

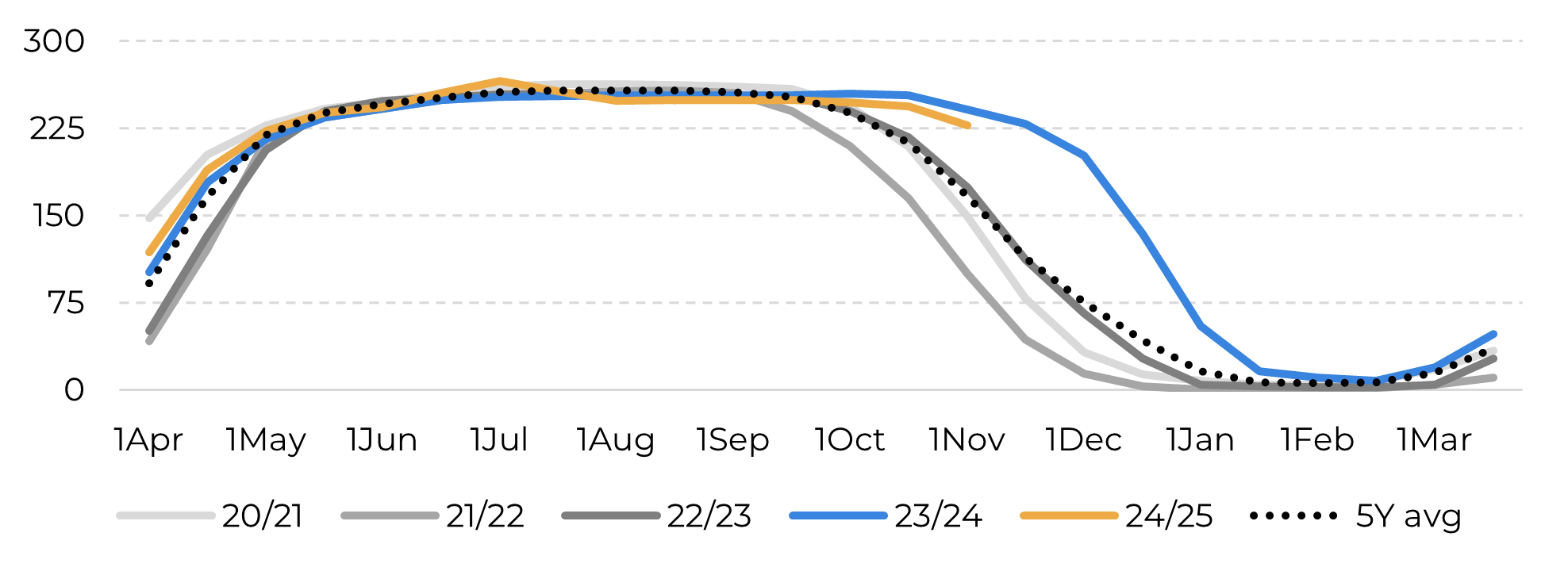

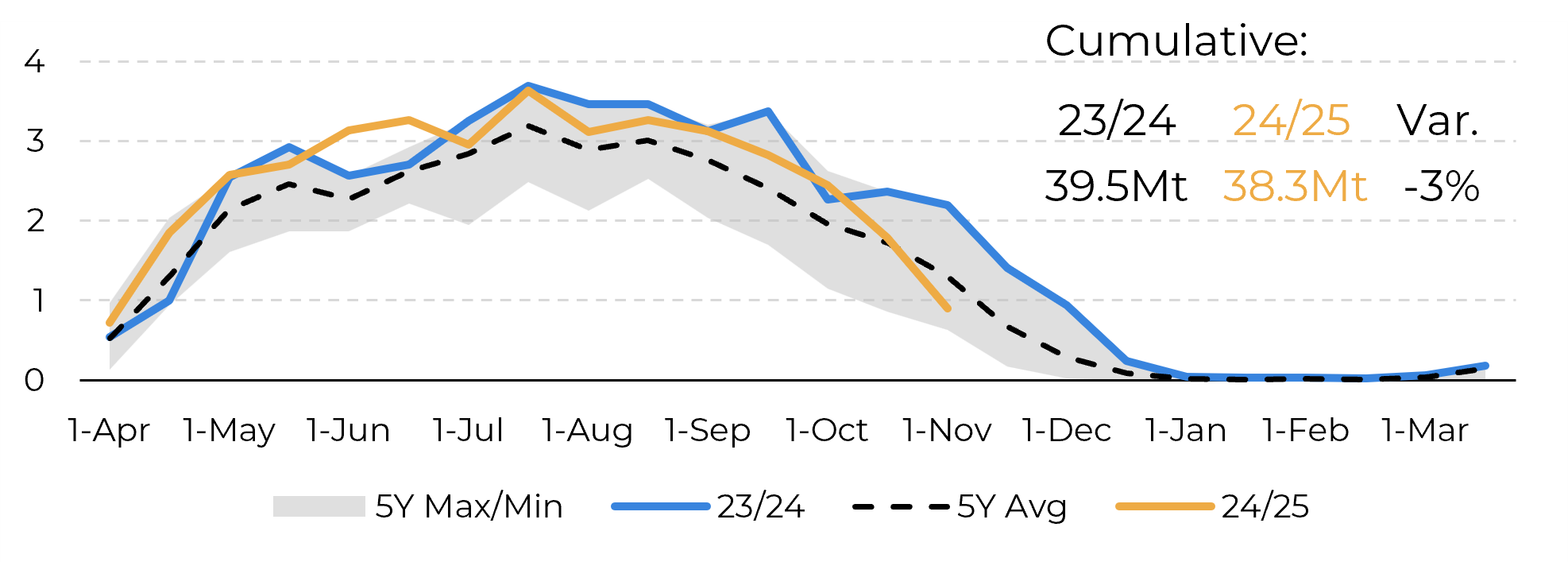

As for the latest Unica report, it seems to have had the opposite effect. With slightly less cane being crushed than the market expected and a surprisingly lower sugar mix and Total Recoverable Sugar (TRS), the first fortnight of November signaled the beginning of the offseason, setting a more bullish tone. While this is far from a sudden-death, as discussed during the mid-crop period, cane volume and sugar production have started to fall behind the 23/24 results, indicating that we are entering a period of tighter availability.

Image 2: Operating mills per fortnight (nº mills)

Source: Unica, Hedgepoint

Image 3: Sugar production per fortnight in Center-South

Source: Unica, Hedgepoint

Image 4: Brazilian fiscal policy weakened Real

Source: Refinitiv, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

victor.arduin@hedgepointglobal.com