Sweet deals and sour quotas: the EU-Mercosul saga

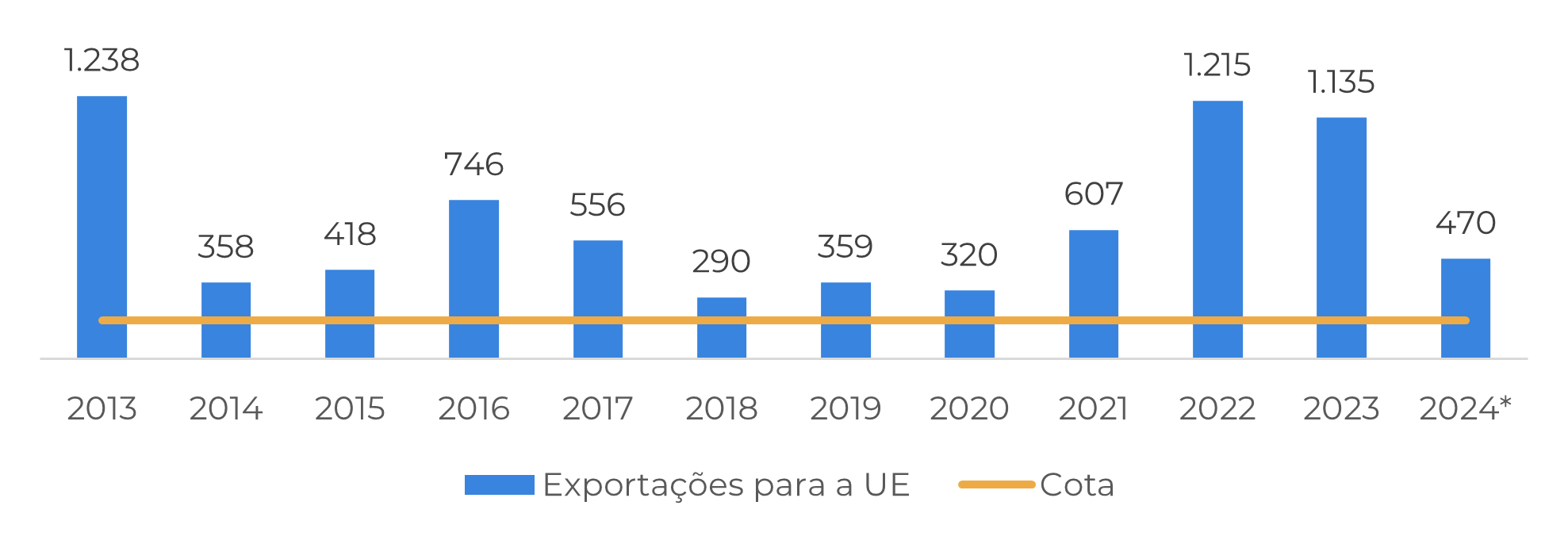

"During the past week, market players discussed the EU-Mercosul agreement, formalized on December 6, which proposes zero tariffs for certain products but limits imports of sensitive agricultural products like sugar. The sugar quota of 180kt is not a significant change, as the EU has consistently imported beyond this quota from Brazil."

Sweet deals and sour quotas: the EU-Mercosul saga

- The EU-Mercosul agreement, formalized on December 6, proposes zero tariffs for certain products but limits imports of sensitive agricultural products like sugar.

- The sugar quota of 180kt is not a significant change, as the EU has consistently imported beyond this quota from Brazil.

- India's sugar production is gaining momentum after a late start, with both cane volume and sugar production reduced by 34% compared to last year.

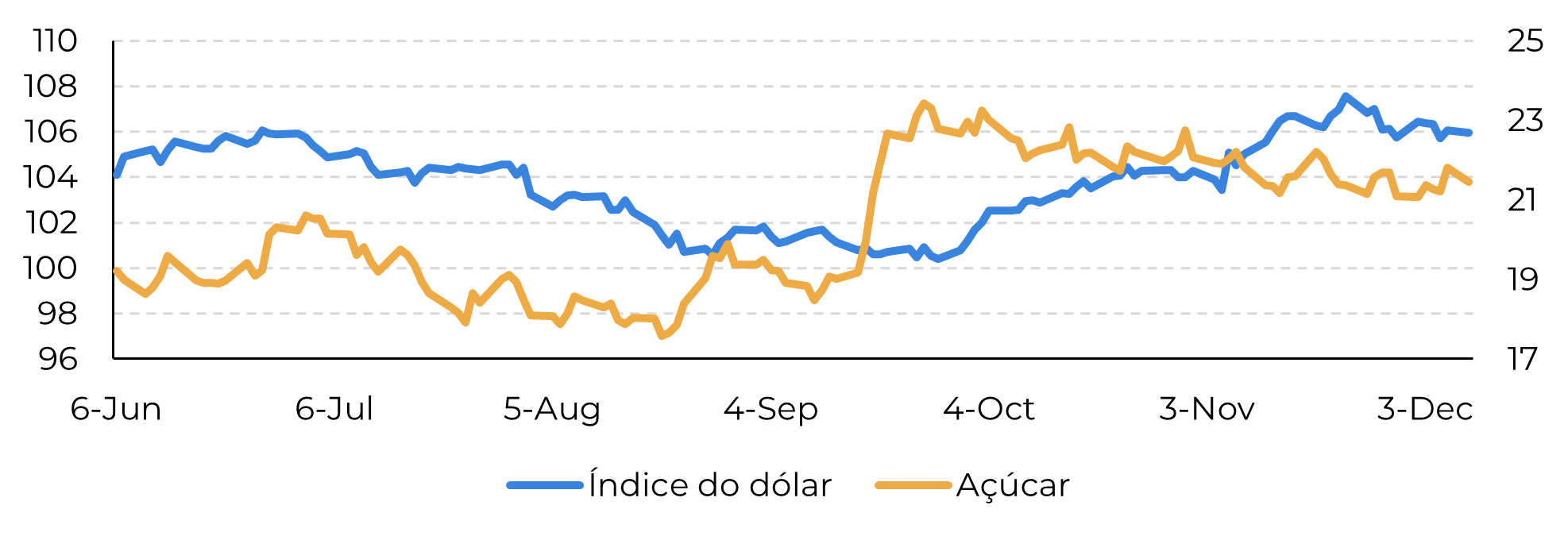

- The market anticipates a 25 basis points interest rate cut by the Fed, while Brazil's Central Bank is expected to tighten monetary policy with a 75 basis points hike.

- The Brazilian CS offseason may lead to a market availability shortage in Q1/25, potentially resulting in a bullish trend if demand increases.

During the past week, a significant discussion among market players centered around the agreement between the European Union and Mercosul, formalized on December 6, though it still requires further approvals. This deal proposes zero tariffs for the import of certain products from Mercosul countries into the EU. While coffee and fruits are included in the deal, it limits imports of sensitive agricultural products, such as beef, ethanol, pork, honey, sugar, and poultry.

For sugar, the proposal establishes a zero-tariff quota of 180kt for the bloc, not a significant change. Any imports outside it will be subject to the current tariffs. To recap, the current system follows a preferential tariff structure, meaning that different tariffs are applied depending on the sugar's origin. For instance, if the EU imports raw sugar for refining from CXL quota countries, which include Australia, Brazil, Cuba, and India, the tariff is 98 EUR per tonne. If the import is from Least Developed Countries (LDC), the Balkans, or African, Caribbean, and Pacific (ACP) countries, there is no applicable tariff – unless it is for the direct consumption of brown sugar. For any direct consumption import, the tariff is 419 EUR per tonne, and if raw sugar is imported outside the quota system for refining, a tariff of 339 EUR per tonne will be charged.

The quota of 180kt for the entire bloc does not represent a significant change from what was previously established. In fact, the EU has consistently imported sugar from Brazil beyond the quota on an annual basis. According to SECEX data, an average of 600kt of sugar enters the bloc from Brazil each year. Of this amount, approximately 390kt comes from the Center-South region, and 540kt is raw sugar. Therefore, the need for imports is the determining factor: if the EU requires sugar, they will import it outside the quota system as they have done in the past. However, with this year's favorable prospects and increased availability from Ukraine, the share of the European market occupied by Brazil – the main representative of Mercosul in terms of sugar – might be lower. As a matter of fact, we approach 2024 end and Brazilian exports to the EU is lagging about 40%, but it is still above the proposed quota at 400kt. As a result, we don't expect the deal between the two blocs to affect sugar prices or market’s dynamic.

Image 1: Brazilian exports into the EU (‘000t)

Source: Secex | *volume until November 2024

Compared to last year, when 433 mills were operating, 51Mt of cane were crushed and 4.23Mt of sugar were produced, the variation still seems to be driven by the late start. Both cane volume and sugar production reduced by 34%, compared to 40% in the first 15 days. We still need to monitor it closely.

Image 2: India’s 24/25 season pace

Source: ChiniMandi | NFCSF

Image 3: The dollar index is still supported, sugar not so much

Source: Refinitiv, Hedgepoint

Image 4: Only Coffee and Cocoa remain with a strong bullish trend

Source: Refinitiv, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.