The bearish trader might take the wheel

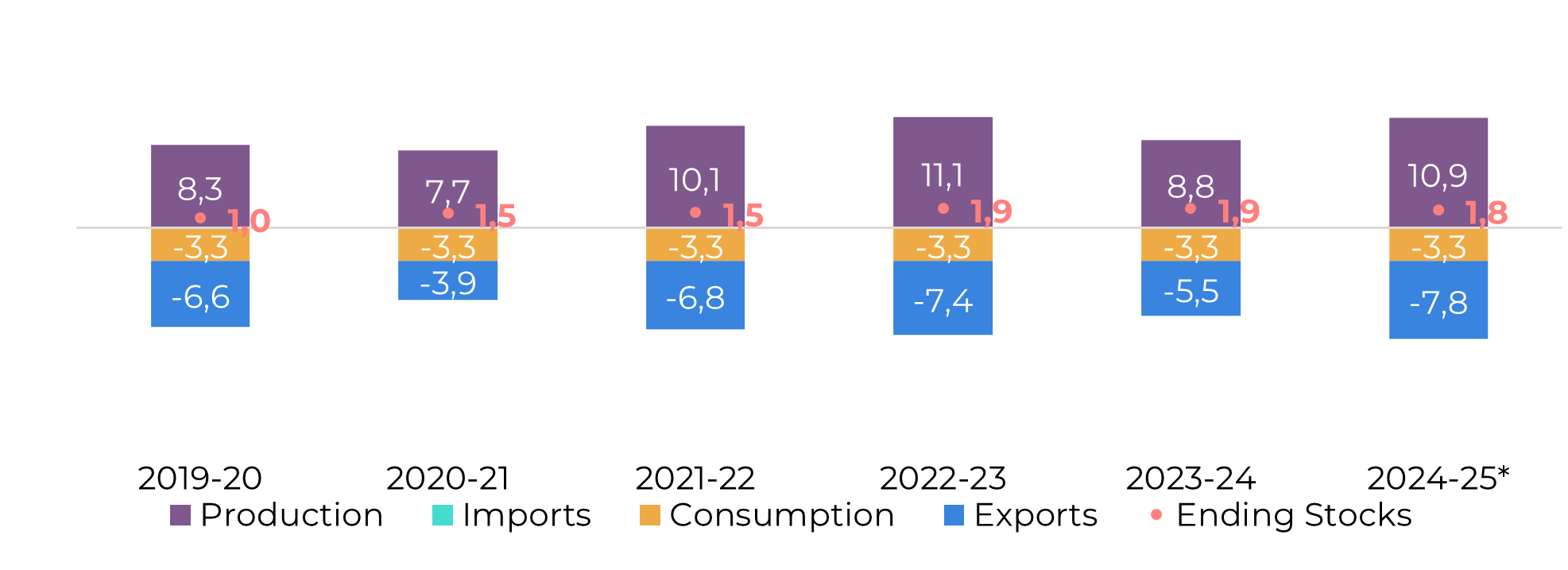

"Last week, sugar prices corrected due to various factors. Thailand began its crushing season on December 6th, producing 193kt of sugar in the first 7 days, with improved yields. However, on December 10th, the Chinese Agricultural Products Standards Office (AGDA) suspended imports of syrup, sugar blends, and sugar pre-mix powders from Thailand due to sanitary concerns."

The bearish trader might take the wheel

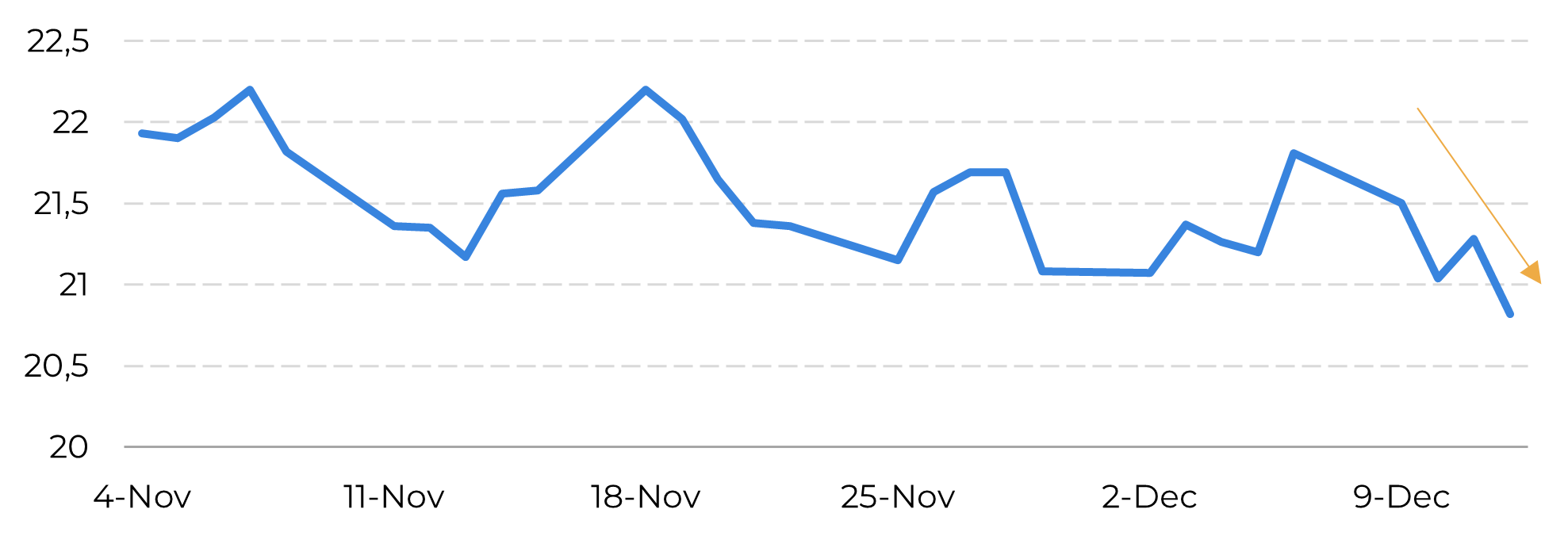

- Sugar prices corrected last week due to various factors, including Thailand's improved sugar yields and production pace.

- On December 10th, the Chinese Agricultural Products Standards Office (AGDA) suspended imports of syrup, sugar blends, and sugar pre-mix powders from Thailand due to sanitary concerns.

- This suspension means about 1Mt of Thailand's sugar exports will need to find new markets.

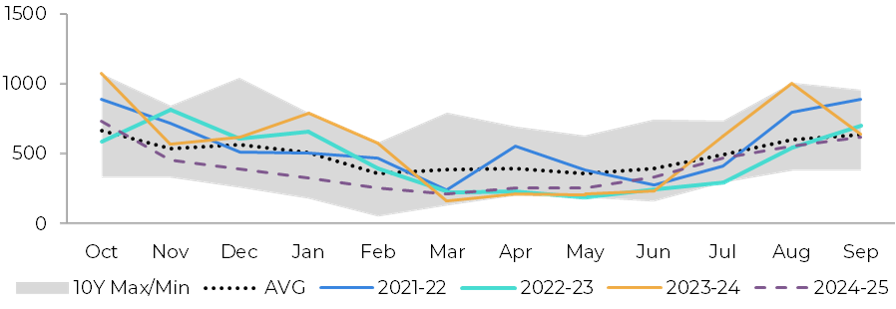

- China's harvest is showing exceptional results, reducing its need for imports, with a 53% increase in production by the end of November.

- Indonesia is taking steps to become food self-sufficient by 2027, including a ban on sugar imports for consumption starting in 2025, while maintaining raw sugar imports at 3.4Mt.

Sugar prices corrected last week, driven by some interesting news. While key suppliers like India, as discussed in the previous report (link), saw their harvests pick up pace, others have just started showing healthy results. Thailand began its crushing on December 6th. In the first 7 days, the country produced 193kt of sugar from 2.7Mt of cane, which is 0.1% more than the first week of the 23/24 season. Yields have already improved from 64.8 kg of sugar per ton of cane last year to 70.8 kg/t this season. However, the most interesting news from that region isn't just about the good harvest pace.

Image 1:Raw sugar prices (Usc/lb)

Source: Refinitiv, Hedgepoint

Image 2: Sugar Balance - Thailand (Mt Dec-Nov)

Source: Thai Sugar Millers, Sugarzone, Hedgepoint

Image 3: Total Imports - China ('000t - inc. Syrup and smuggling)

Source: CSA, Refinitiv, Green Pool, GSMM, Hedgepoint

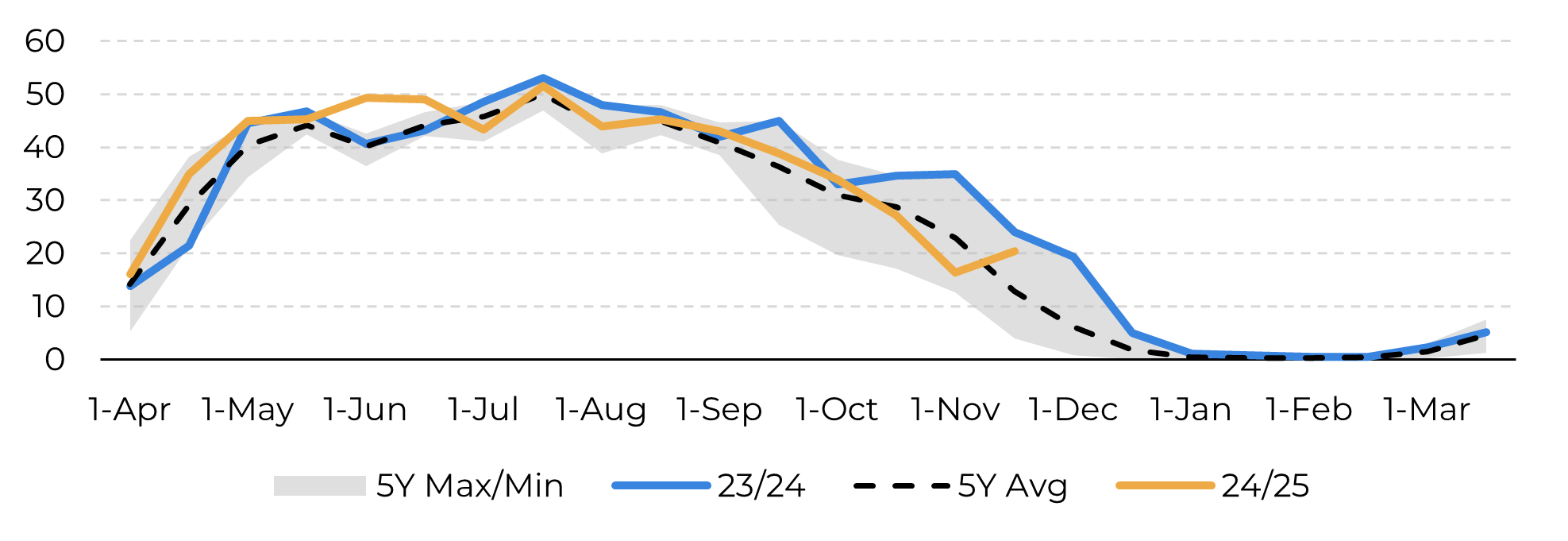

Image 4: Bi-weekly sugarcane harvested at Center-South mills (M ton)

Source: UNICA, Hedgepoint

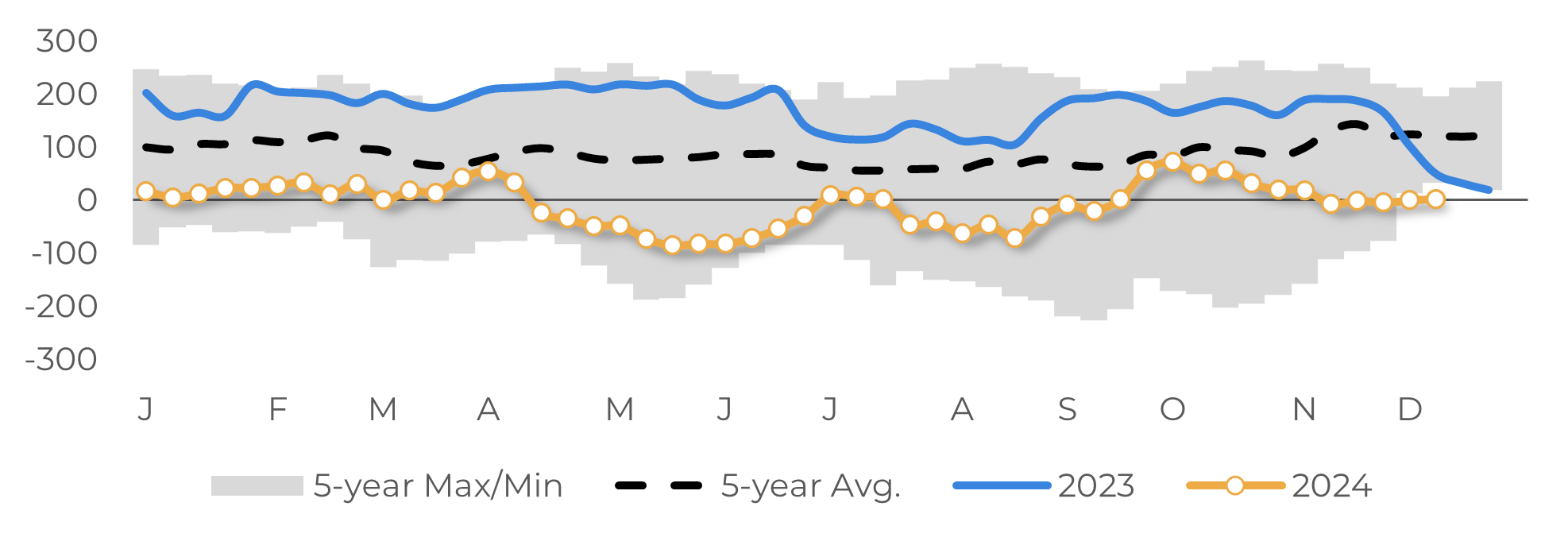

Image 4: Speculative net position (Thousand lots)

Source: CFTC, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.