Starting the year with a bearish tone

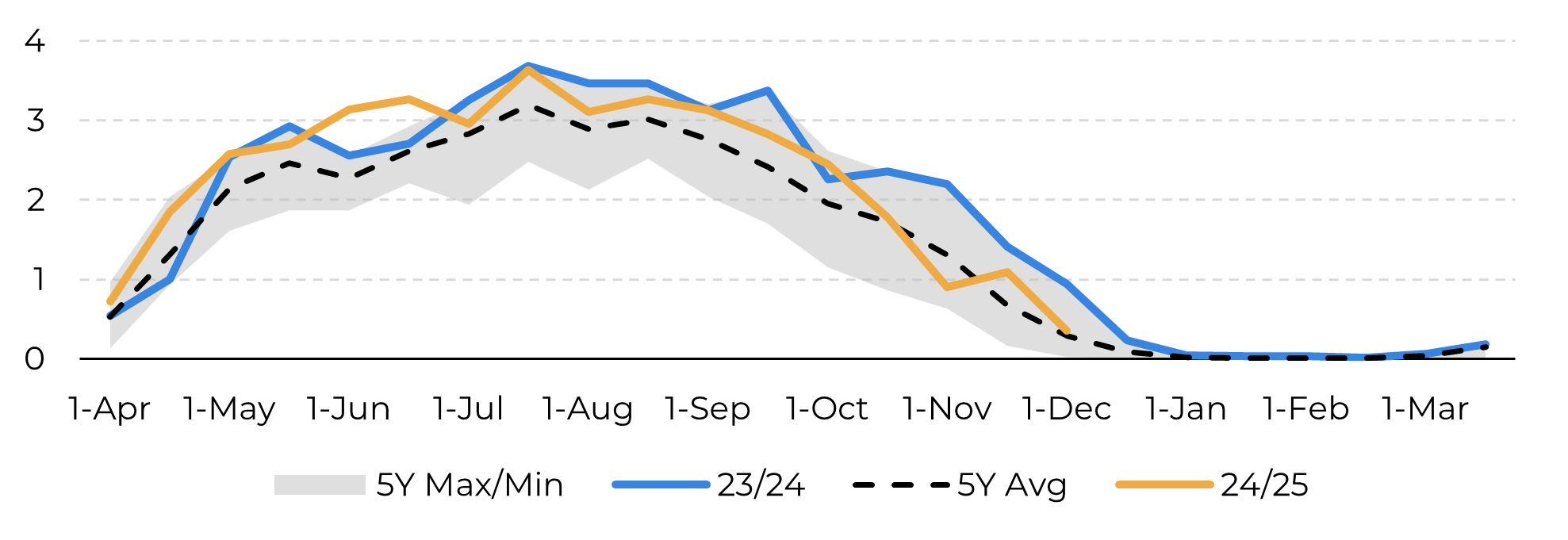

"In the final months of 2024, sugar prices fell to 19 cents per pound and faced difficulties in recovering. The Brazilian Center-South region exceeded expectations with nearly 603 million tons of crushed cane by early December, potentially reaching 620 million tons and nearly 40 million tons of sugar for the 2024/25 season."

Starting the year with a bearish tone

- In the last months of 2024, prices dropped to 19 c/lb, struggling to recover.

- The Brazilian Center-South region achieved nearly 603Mt by December’s first fortnight, surpassing estimates, and indicating that the region could reach close to 620Mt of cane and nearly 40Mt of sugar still in 24/25.

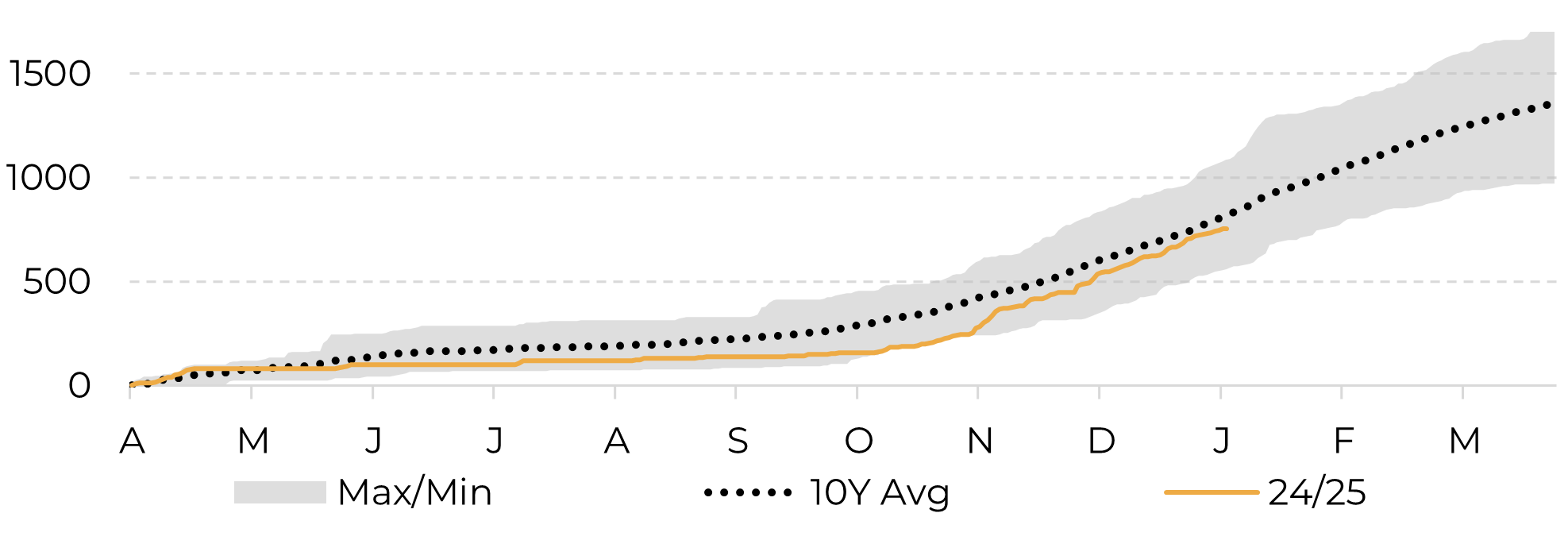

- Favorable summer rainfall has led to optimistic expectations for the 25/26 season, creating a bearish outlook for sweetener prices.

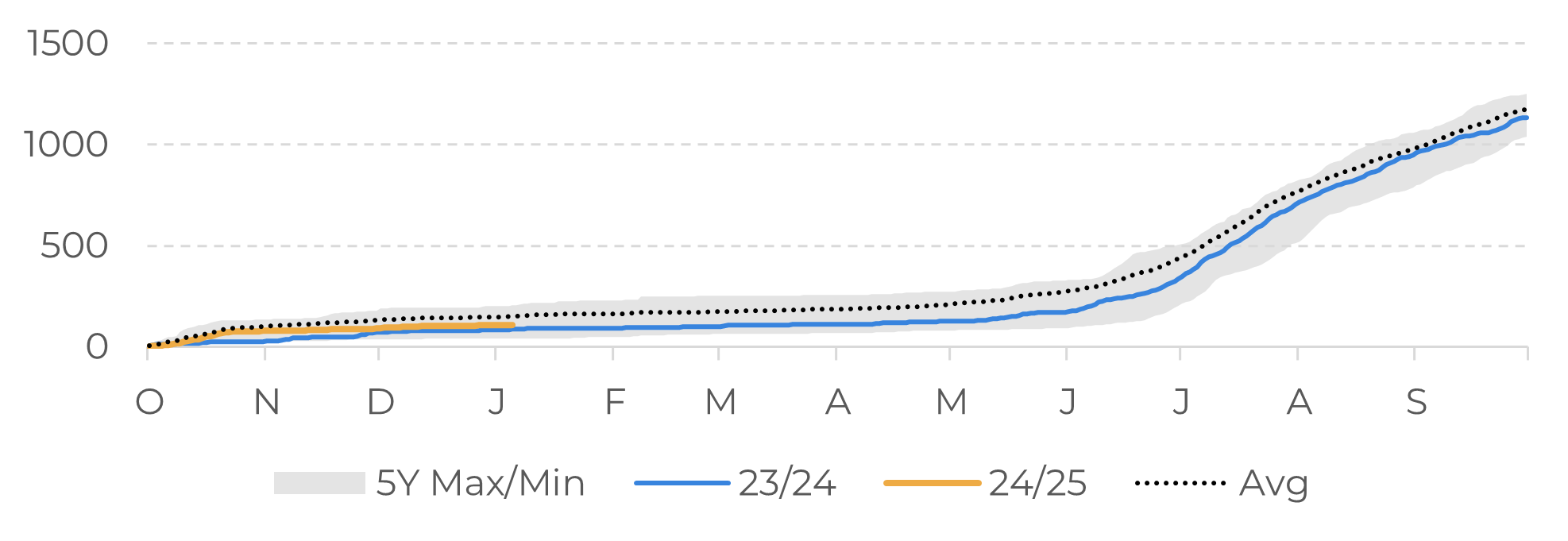

- India's sugar production is lagging by 17.8% due to a delayed start, but December crushing was almost the same as the previous year.

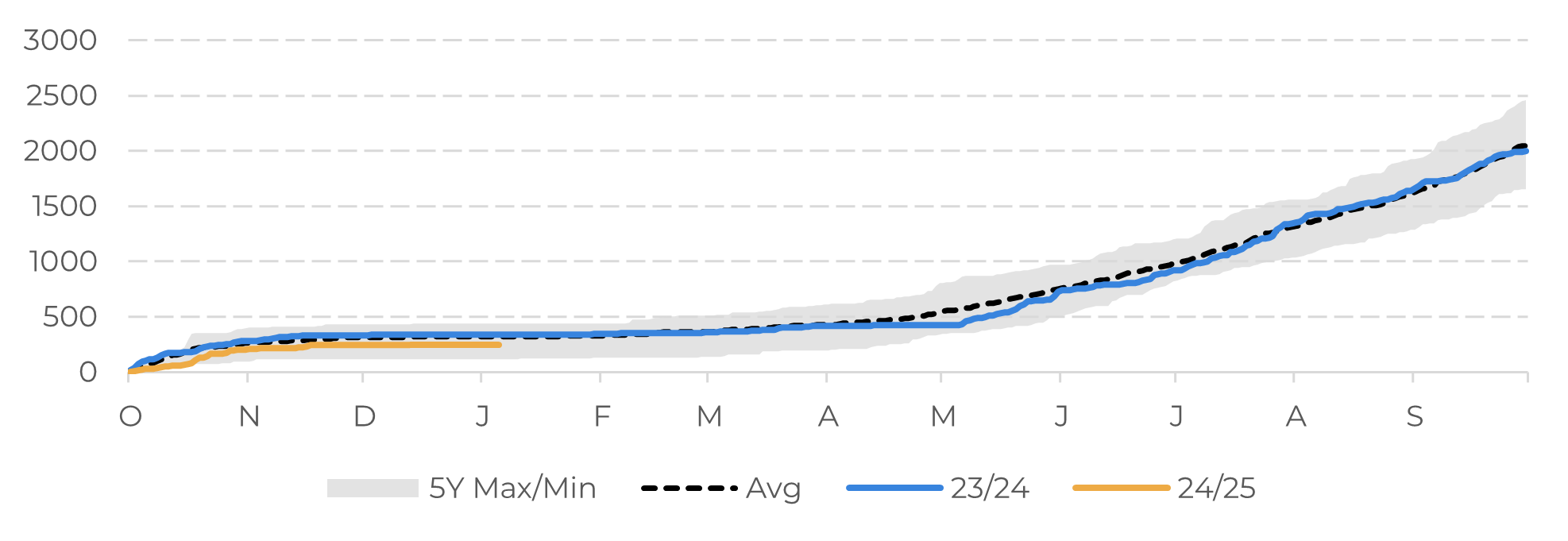

- Central America has delayed crop starts, with Guatemala and El Salvador's production falling behind 23/24 results, adding some support to prices, especially of whites. However, Europe’s good results so far can hinder white premium reactions.

The last two weeks of 2024 were marked by the end-of-year festivities and low activity in the sugar market. The price trend has remained relatively stable, following the pattern observed over the last three months of the year. Surprisingly good results from the Brazilian Center-South region, despite a year marked by drought and fires, have increased the already bearish expectations for the period, especially with a predicted recovery in the Northern Hemisphere. As a result, prices dropped to the 19c/lb level and have struggled to recover significantly.

The latest Unica report revealed that the Center-South region has already achieved nearly 603Mt, surpassing many analysts' estimates for the entire year. You may recall that we revised our figures down to about 610Mt around August. However, since November, the idea of a sudden-death, and even a poor crop has been more than dismissed. We now believe that with an average offseason crushing, the region can still reach close to 620Mt of cane and nearly 40Mt of sugar in 24/25. These results, combined with favorable summer rainfall so far, have led to more optimistic expectations for the 25/26 season. In other words, this has created a bearish outlook for sweetener prices.

Image 1: Bi-weekly sugar production at Center-South mills (M ton)

Source: Unica, Hedgepoint

Image 2: Cumulative Rainfall Estimated for Center-South Cane Regions (mm)

Source: Refinitiv, Hedgepoint

Regarding the Northern Hemisphere, despite India's weaker results so far, which suggest lower availability than currently expected by us, it's important to remember that the country delayed its start by at least two weeks due to rains and end-of-year festivities such as Diwali. As of now, sugar production is lagging by 17.8%, or about 1.7Mt. However, note that crushing during December was almost the same, reaching 6.72Mt in 2024, compared to 6.88Mt the previous year. The main difference lies in November, when production was 1.5Mt lower, which could be easily justified by the delay: fewer weeks, less product! However, although we might keep or numbers on the higher range (closer to 31Mt), this trend is worth monitoring, especially given undeniable factors such as higher disease incidence and reportedly reduced area for the season, especially in a context of favourable weather for crushing activities.

Image 3: Cumulative Rainfall Estimated for India’s Key Cane Regions (mm)

Source: Refinitiv, Hedgepoint

Image 4: Cumulative Rainfall Estimated for Thailand Northeast Region (mm)

Source: Refinitiv, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.