Sugar and Ethanol Monthly Report - 2023 11 27

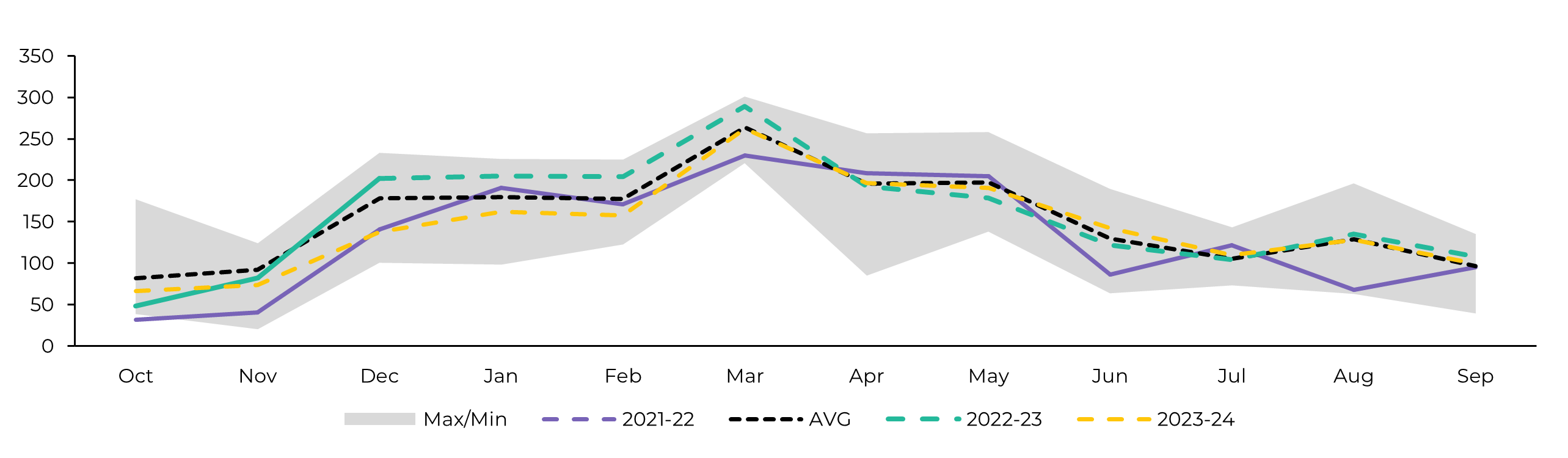

S&D and Trade Flow

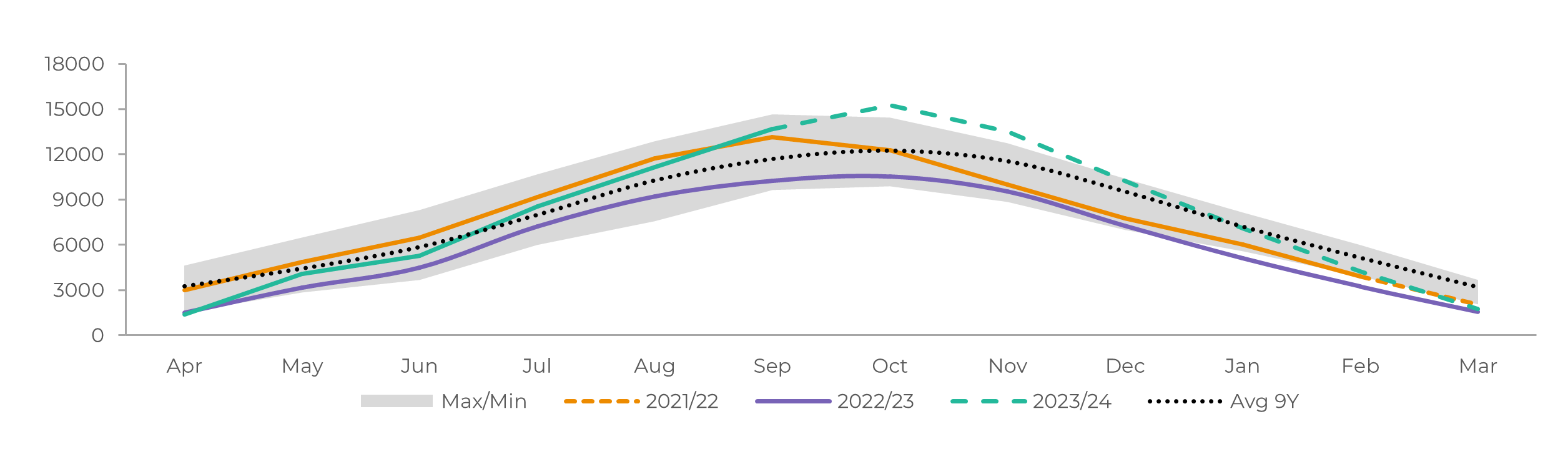

However, Brazilian sugar is expected to keep flowing during Q4, with mills maximizing their sweetener production and working fast to crush as much cane as possible.

Port congestion given a rainier-than-average October has induced recent gains, but dryness is coming. March contract is set to find support in market tightness during Q4/23 and Q1/24.

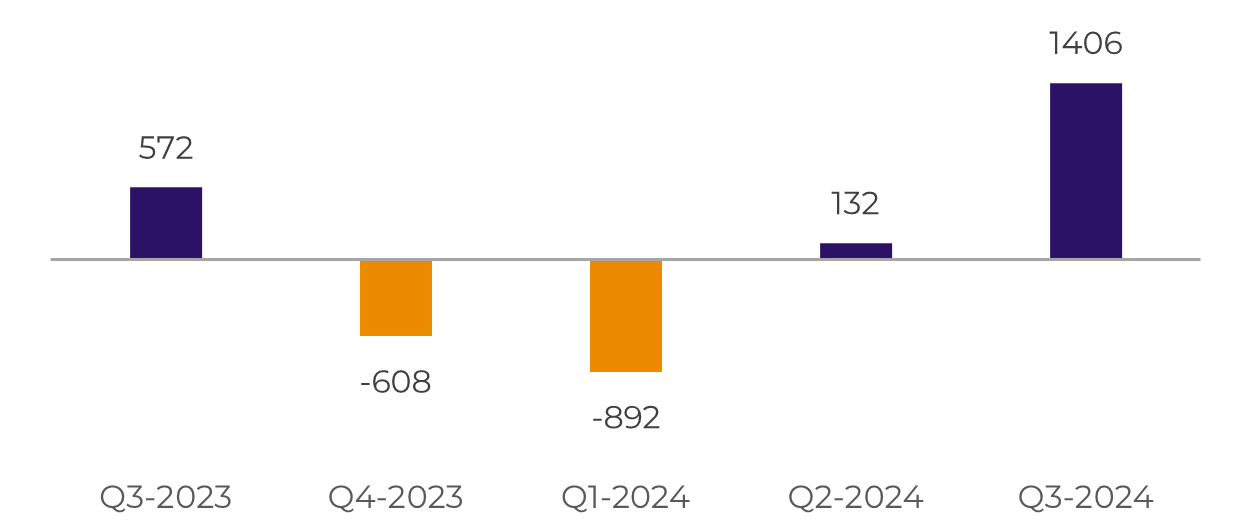

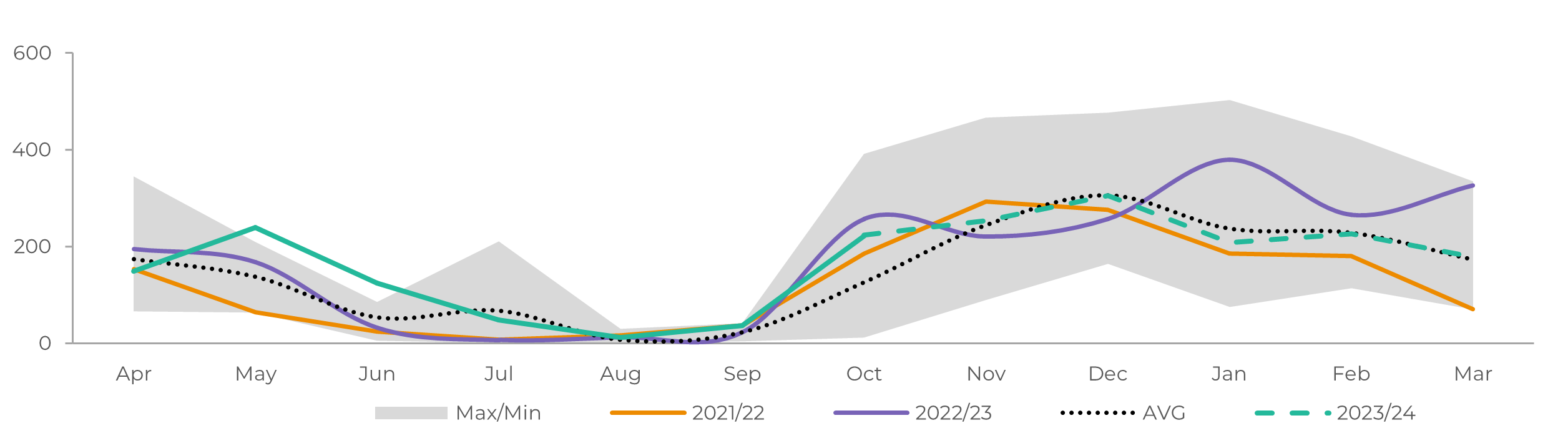

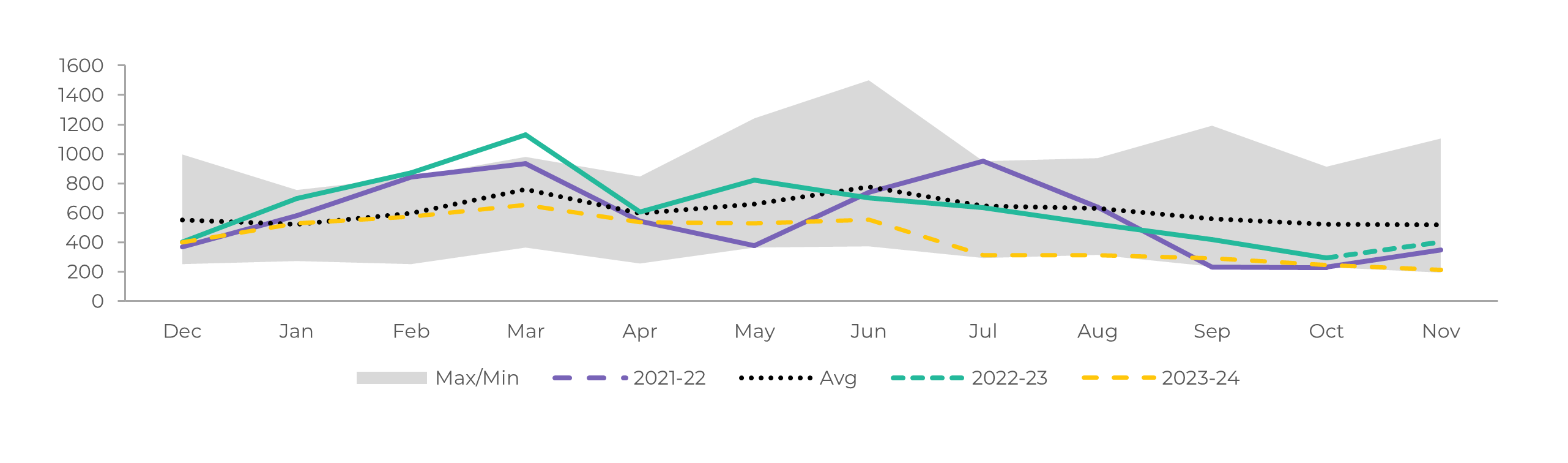

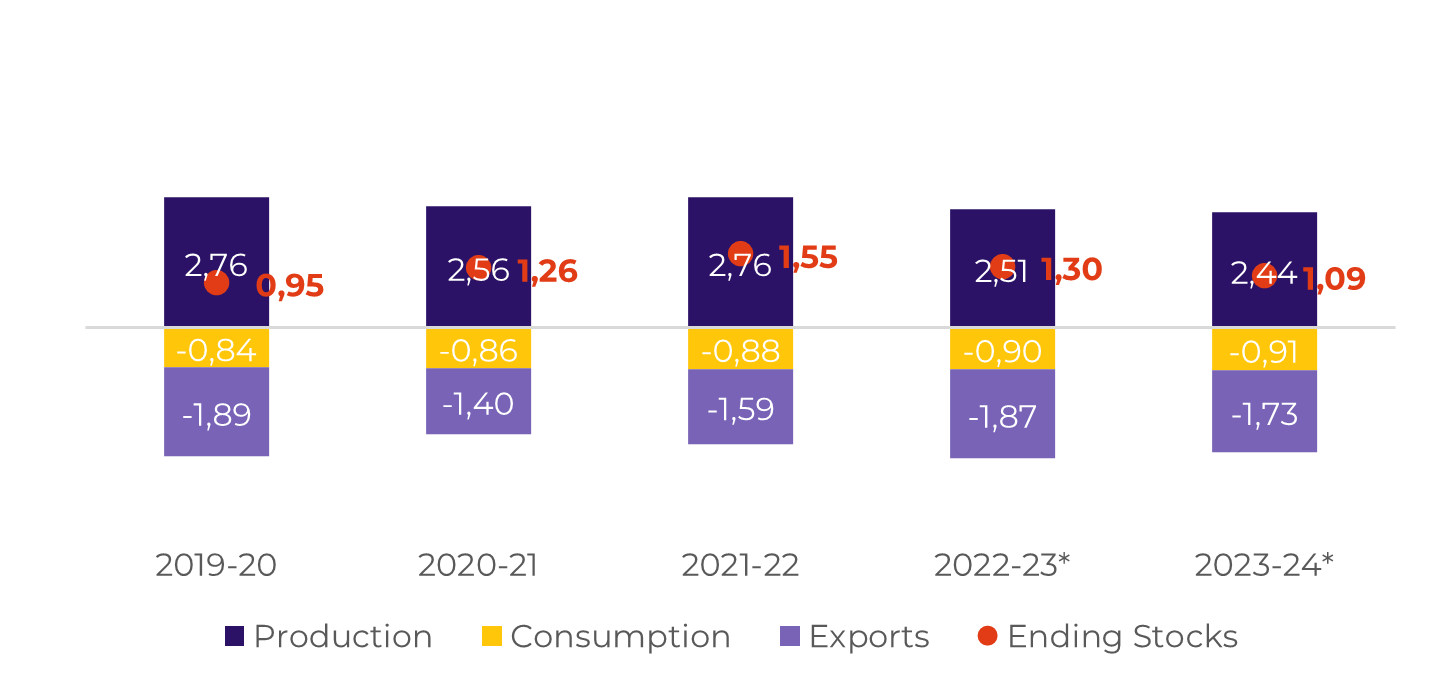

Image 1: Total Trade Flow ('000t)

Source: hEDGEpoint

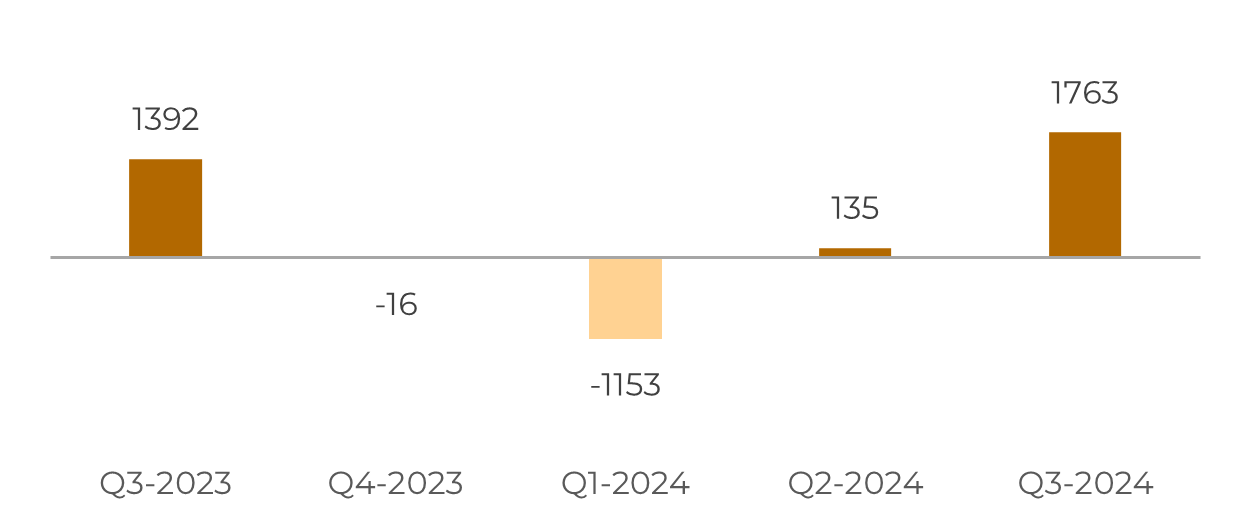

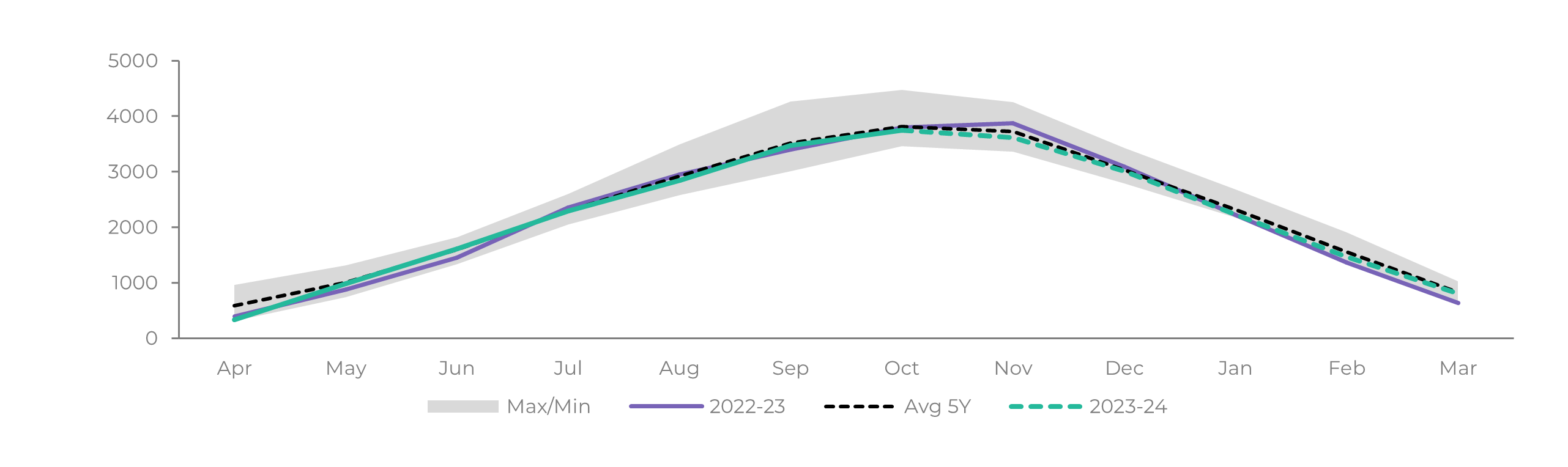

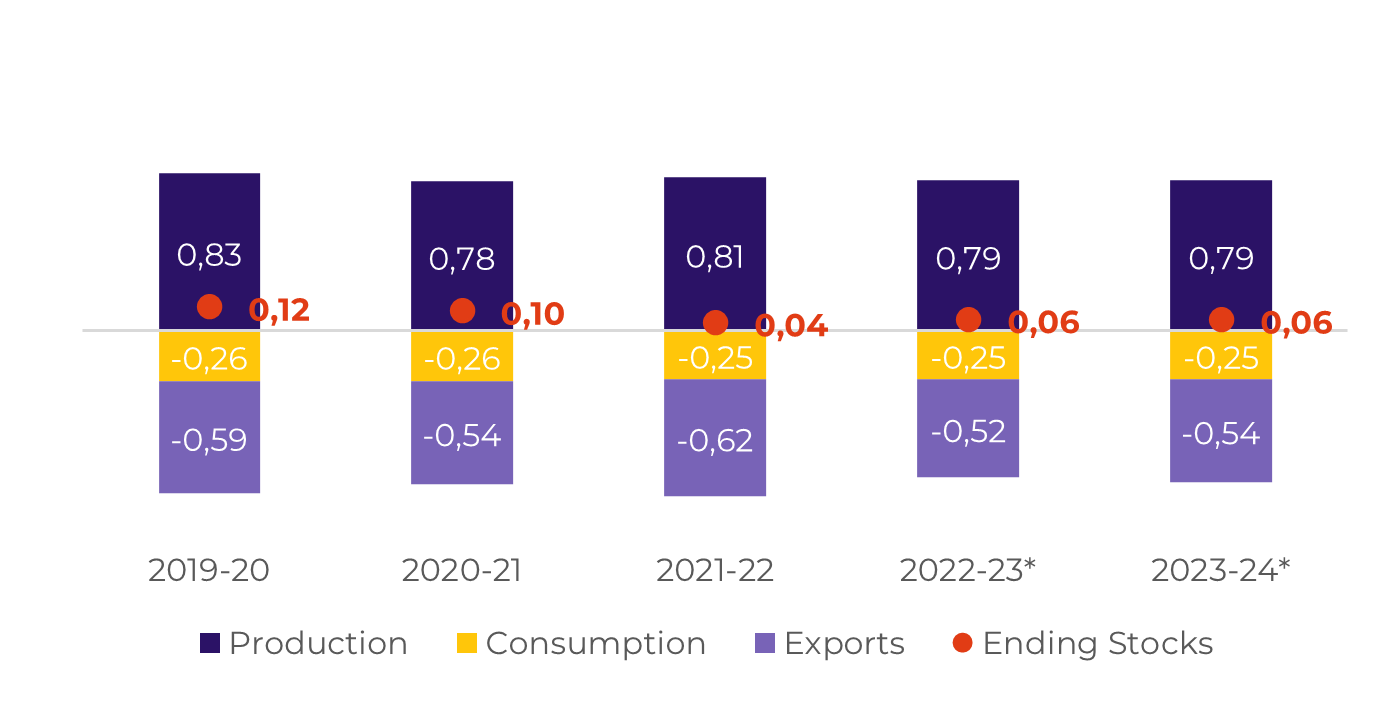

Image 2: Raw's Trade Flow ('000t)

Source: hEDGEpoint

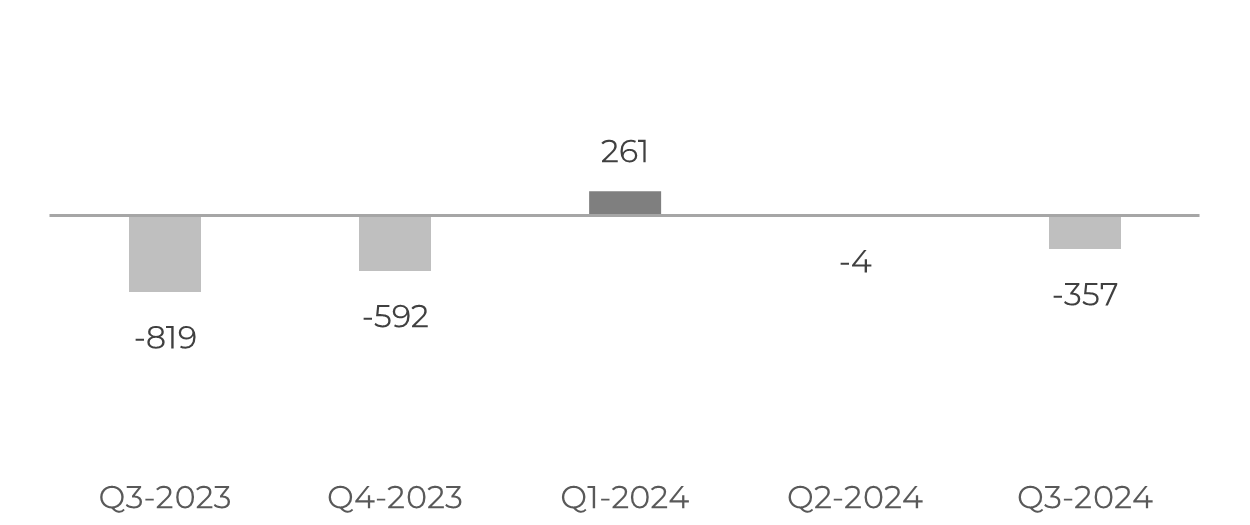

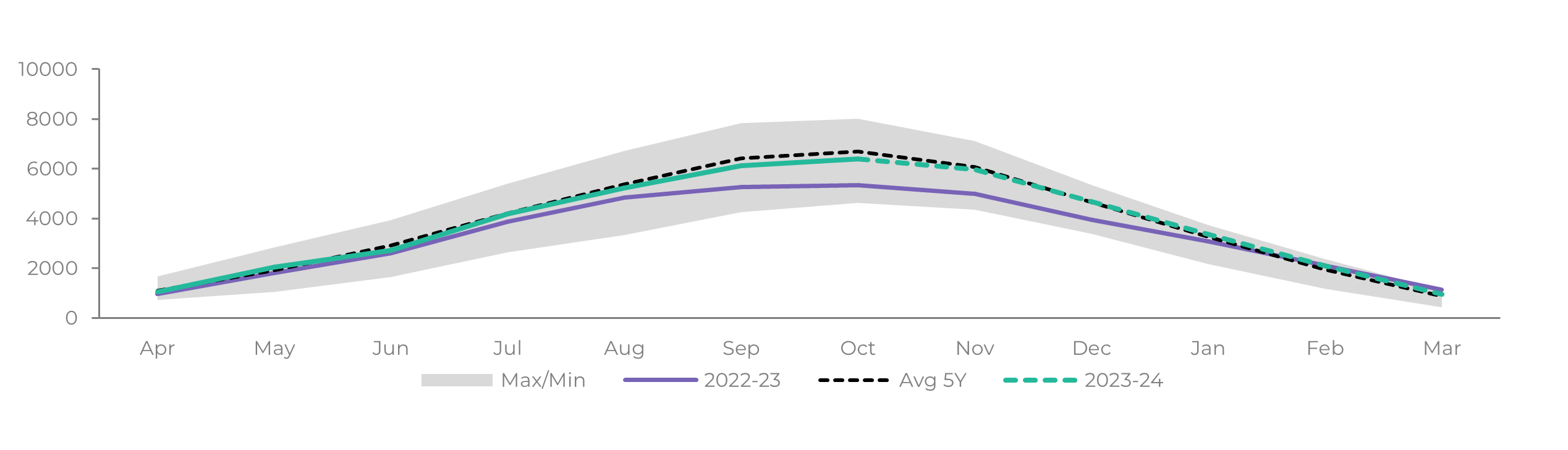

Image 3: White's Trade Flow ('000t)

Source: hEDGEpoint

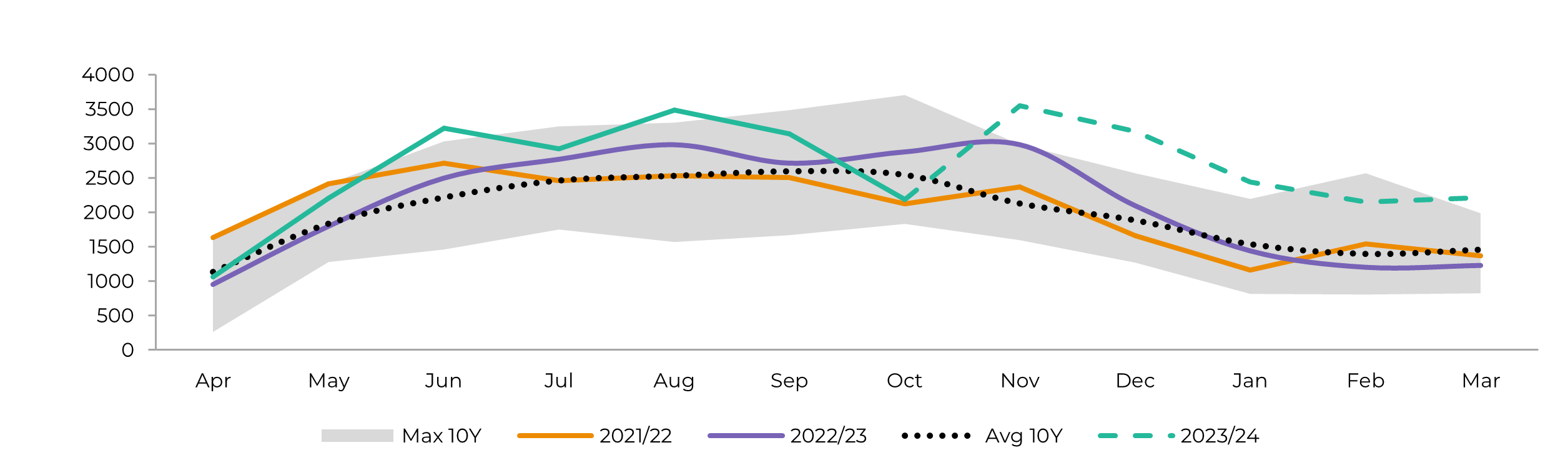

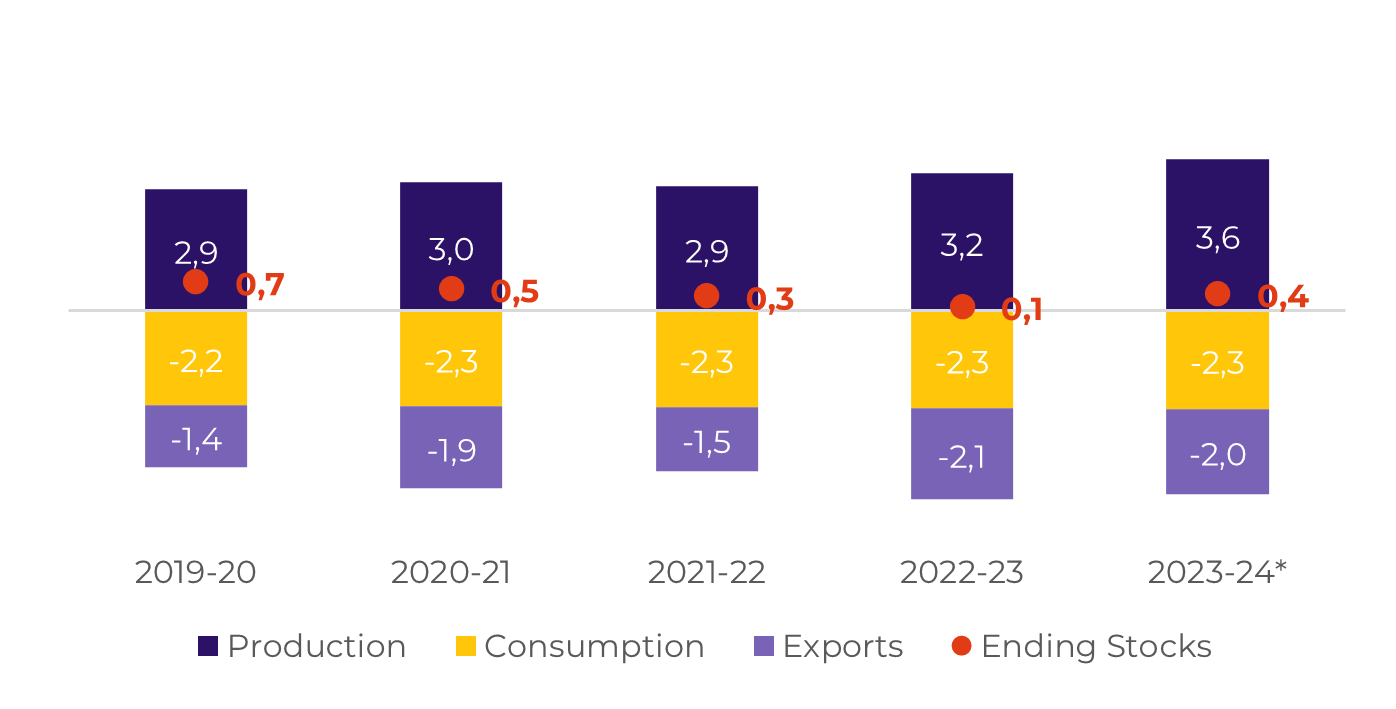

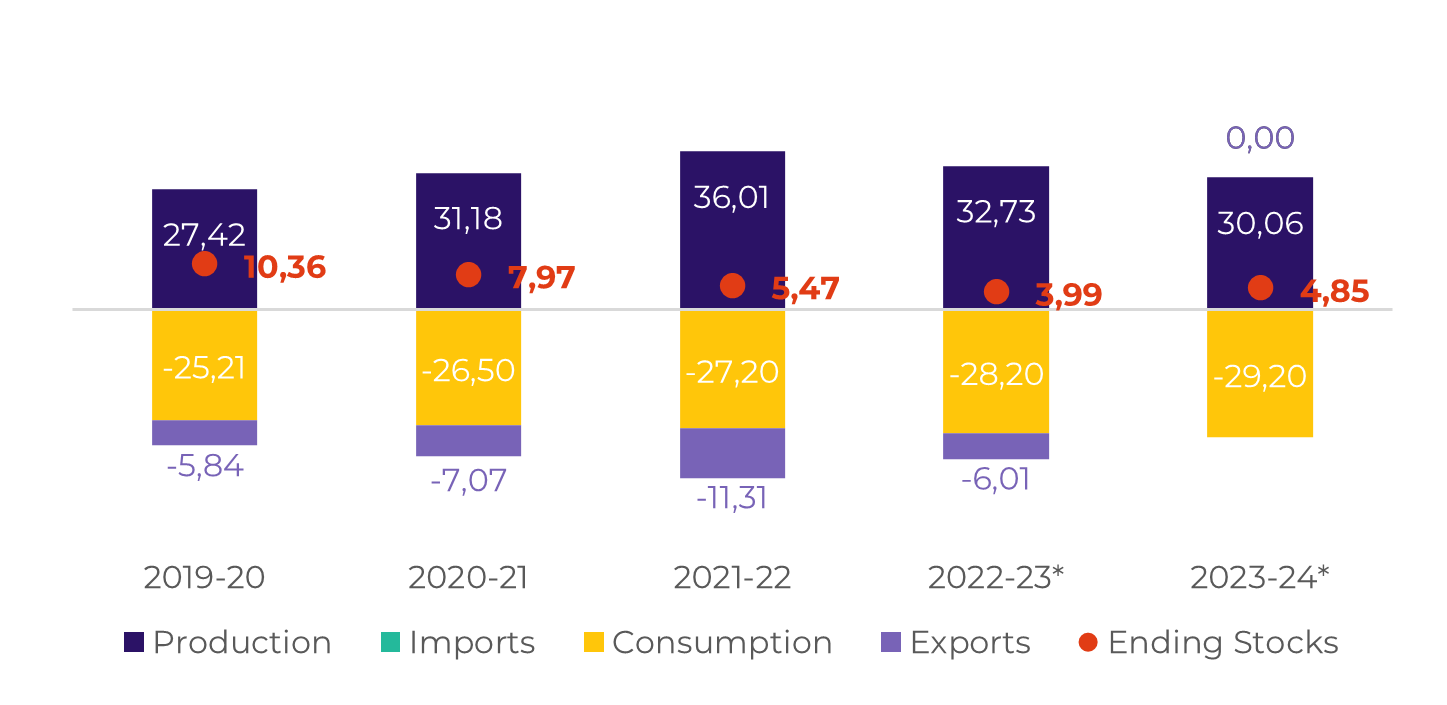

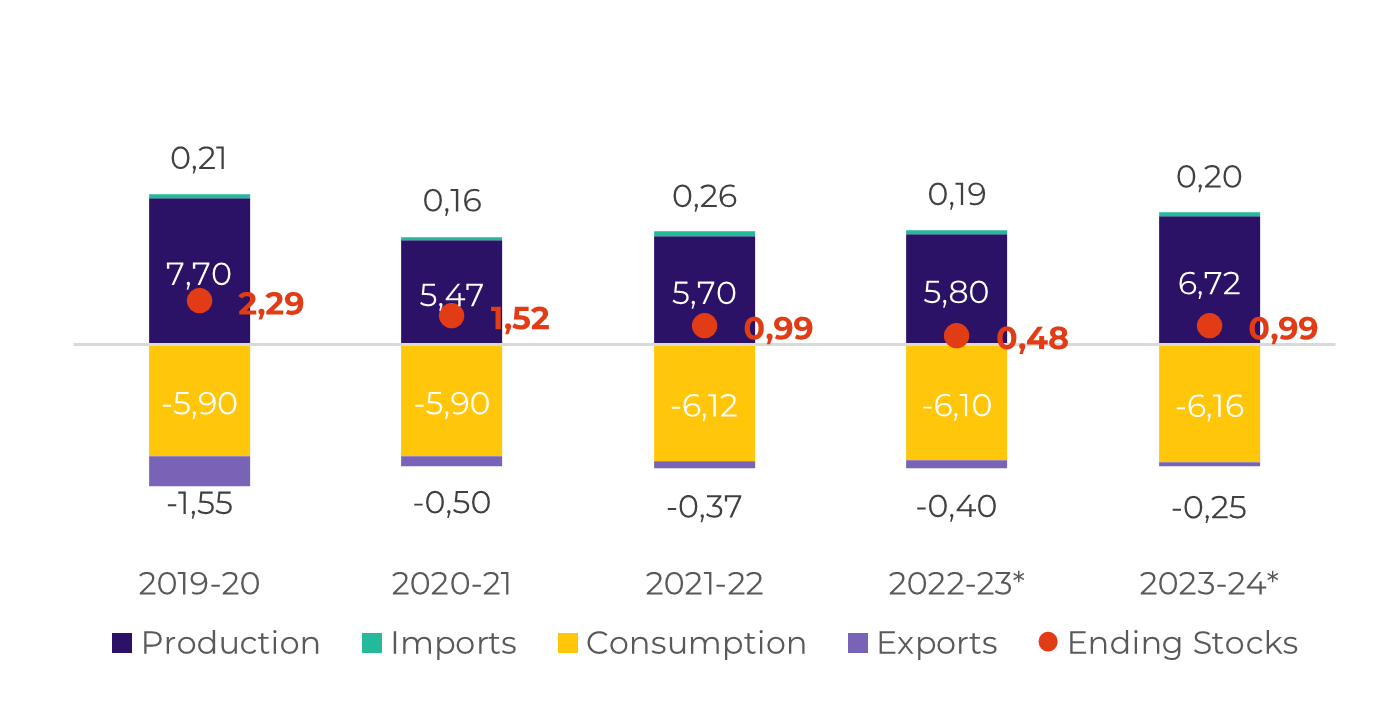

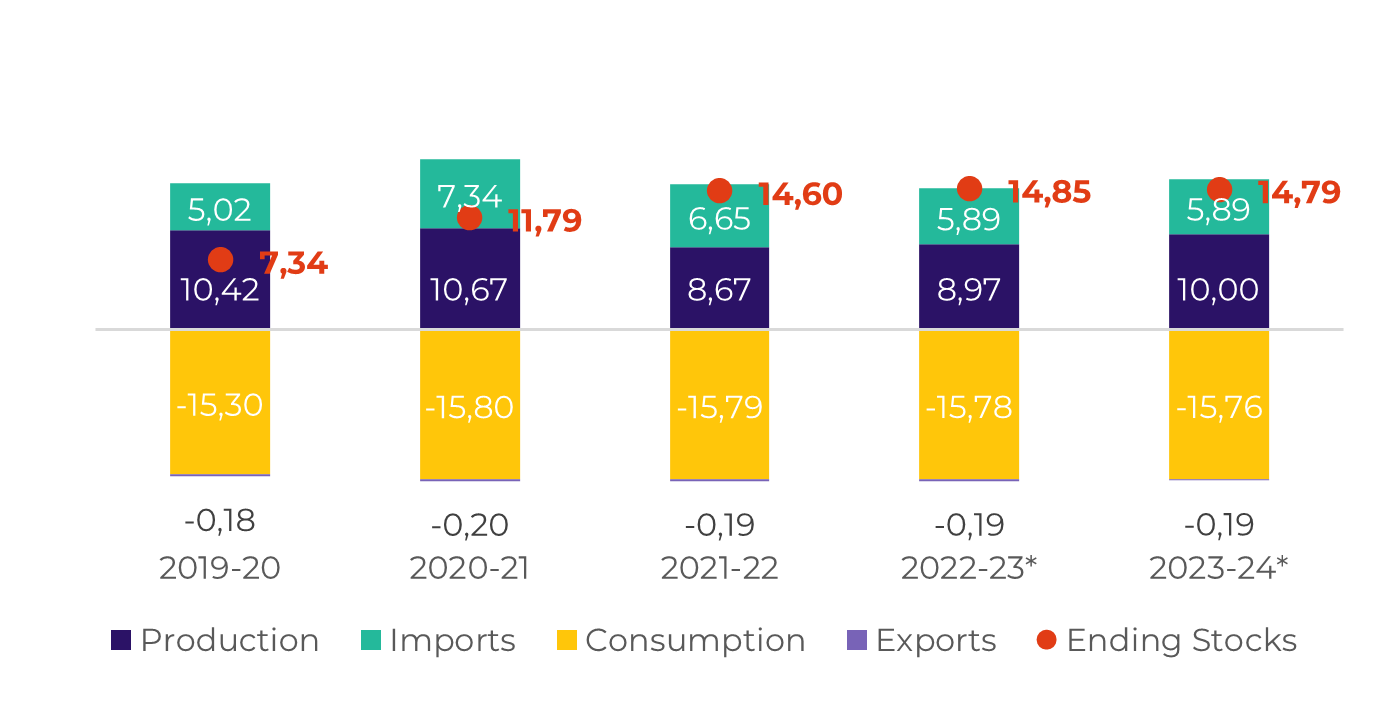

Image 4: Global Supply and Demand Balance (MT RV oct-sep)

Source: hEDGEpoint

Brazil CS

Image 5: Sugar Balance - Brazil CS (Apr-Mar Mt)

Source: Unica, MAPA, SECEX, hEDGEpoint

Although some models predict lower rains during Brazil's summer, prospects for 24/25 cane developments are good. The country could produce over 42Mt of sugar next season, especially considering recent investments in crystalization and the maitenance of a high sugar mix.

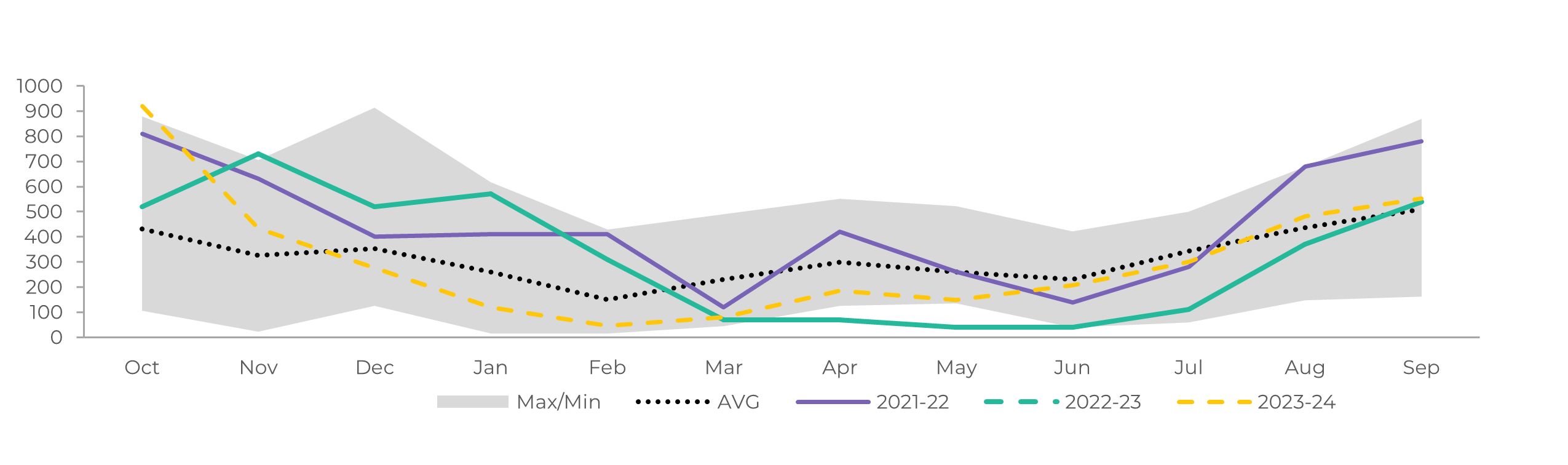

Image 6: Total Exports - Brazil CS ('000t)

Image 7: Total Stocks - Brazil CS ('000t)

Source: SECEX, Williams, hEDGEpoint

Source: Unica,MAPA, SECEX, Williams, hEDGEpoint

Brazil CS Ethanol

Image 8: Otto Cycle - Brazil CS (M m³)

Source: ANP, Bloomberg, hEDGEpoint

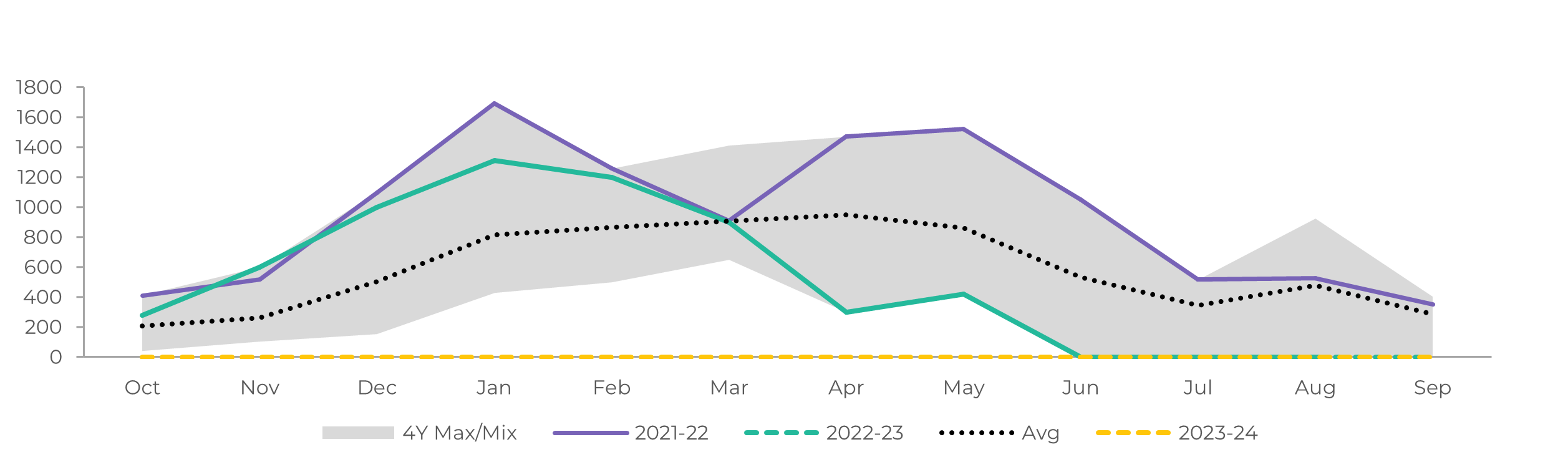

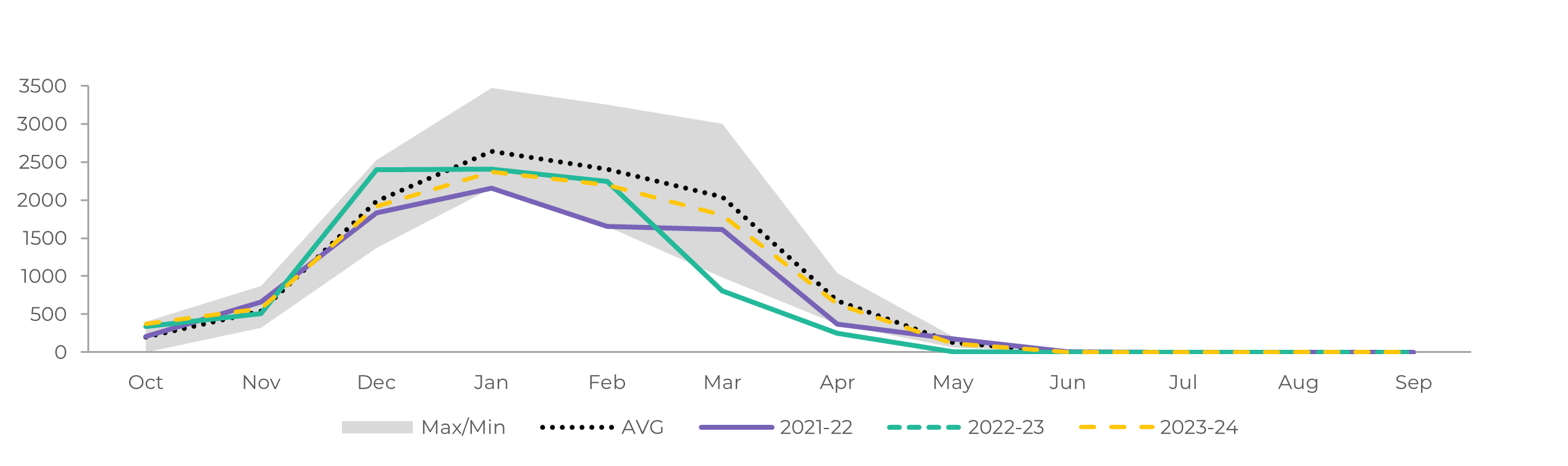

Image 9: Anhydrous Ending Stocks - Brazil CS ('000 m³)

Image 10: Hydrous Ending Stocks - Brazil CS ('000 m³)

Source: Unica, MAPA, ANP, SECEX, hEDGEpoint

Source: Unica, MAPA, ANP, SECEX, hEDGEpoint

Brazil NNE

Image 11: Sugar Balance - Brazil NNE (Apr-Mar Mt)

Source: MAPA, SECEX, hEDGEpoint

Image 12: Total Exports - Brazil NNE ('000t)

Source: SECEX, hEDGEpoint

India

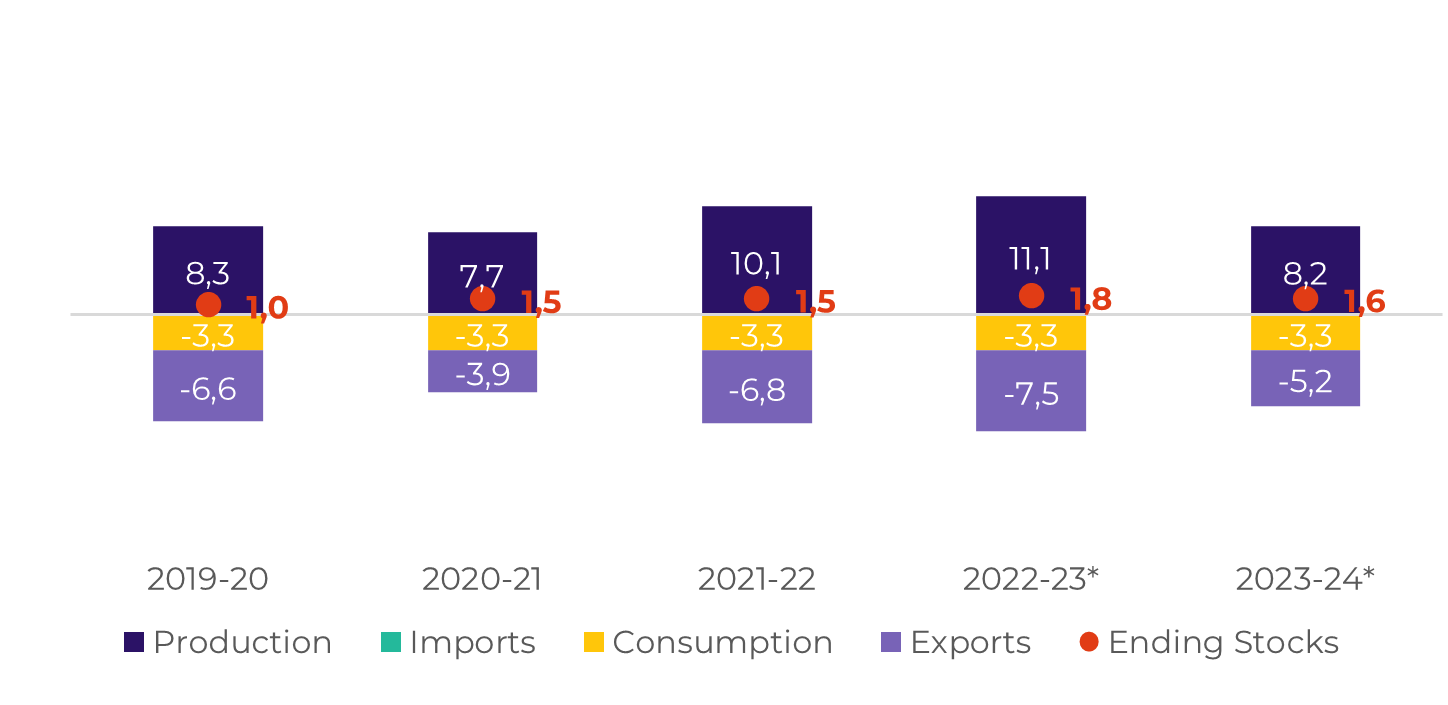

Image 13: Sugar Balance - India (Oct-Sep Mt)

Source: ISMA,AISTA, hEDGEpoint

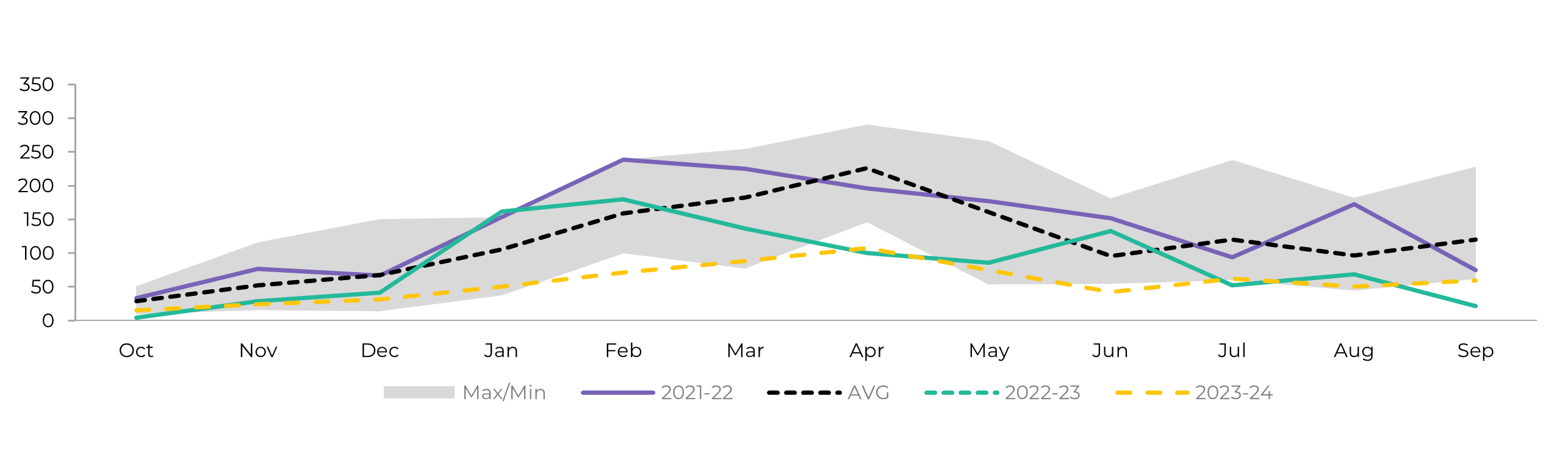

Image 14: Total Domestic Exports - India ('000t w/o tolling)

Source: ISMA,AISTA, hEDGEpoint

Thailand

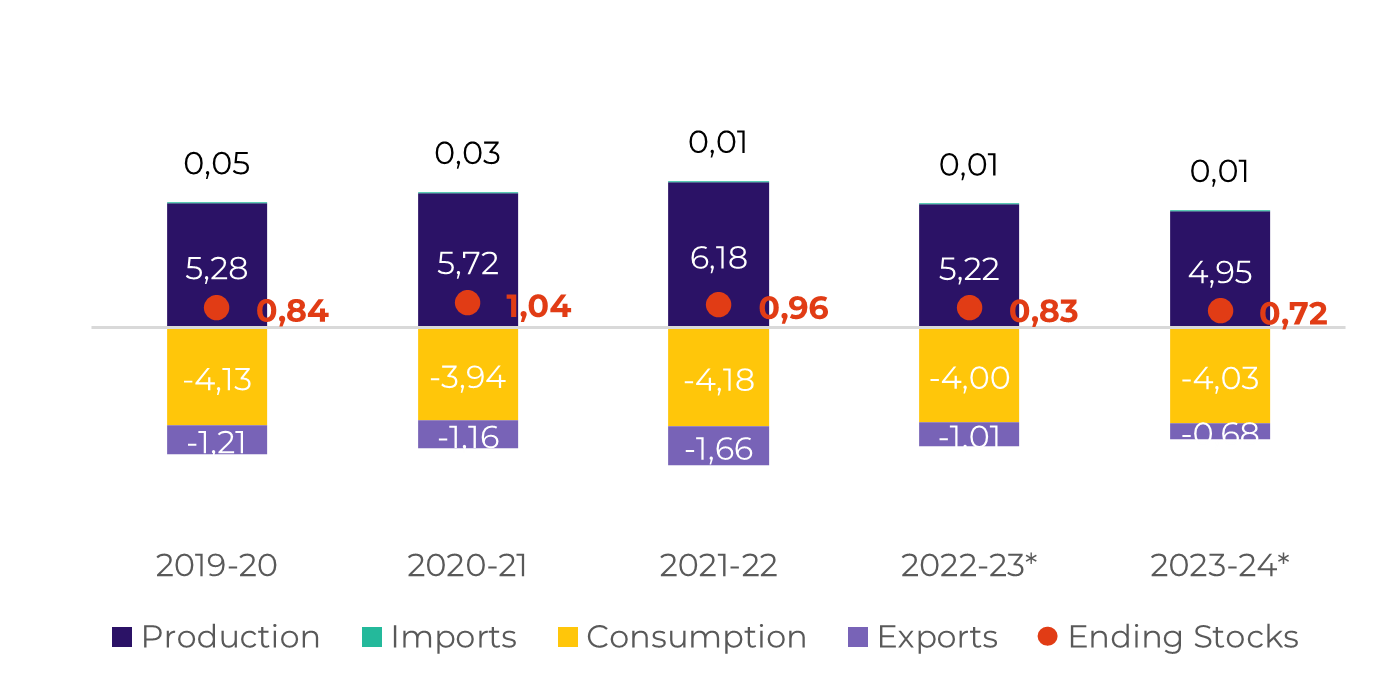

Image 15: Sugar Balance - Thailand (Dec-Nov Mt)

Source: Thai Sgar Millers, Sugarzone, hEDGEpoint

Image 16: Total Exports - Thailand ('000t)

Source: Thai Sgar Millers, hEDGEpoint

EU 27+UK

Image 17: Sugar Balance - EU 27+UK (Oct-Sep Mt)

Source: EC, Greenpool, hEDGEpoint

Mexico

Image 18: Sugar Balance - Mexico (Oct-Sep Mt)

Source: Conadesuca, Greenpool, hEDGEpoint

Image 19: Total Exports - Mexico ('000t)

Source: Conadesuca, Greenpool, hEDGEpoint

USA

Image 20: Sugar Balance - US (Oct-Sep Mt)

Source: USDA, hEDGEpoint

Guatemala

Image 21: Sugar Balance - Guatemala (Oct-Sep Mt)

Source: Cengicaña, Sieca, Azucar.gt,Greenpool, hEDGEpoint

Image 22: Total Exports - Guatemala ('000t)

Source: Sieca

El Salvador

Image 23: Sugar Balance - El Salvador (Oct-Sep Mt)

Source: Consaa, Sieca, Greenpool, hEDGEpoint

Russia

Image 24:

Source: Ikar, Sugar.ru, Greenpool, hEDGEpoint

Of these figures, around 6.55Mt would be produced directly from beet while 220-250kt from syrup and molasses. We revised our numbers up considering the conservative end of estimates.

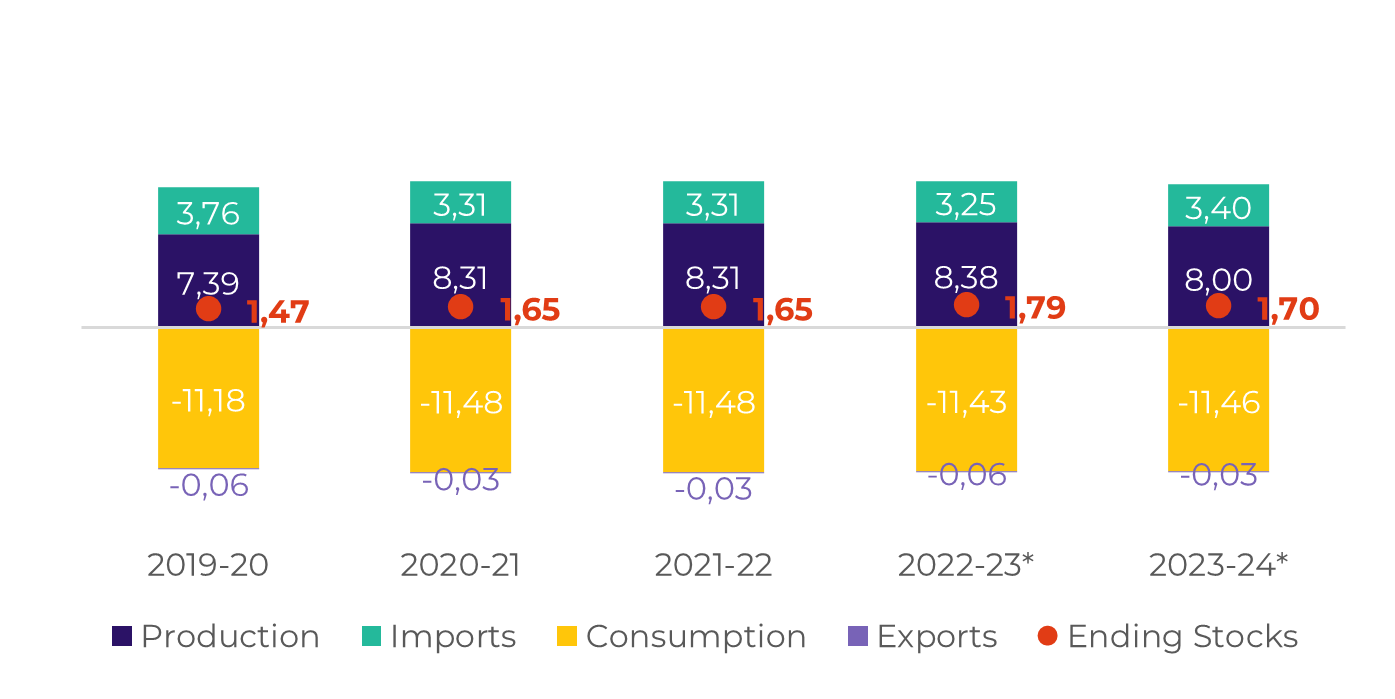

China

Image 25: Sugar Balance - China (Oct-Sep Mt)

Source: GSMN, CSA, Refinitiv, Greenpool, hEDGEpoint

Obs: stocks also account for bonded warehouses volume and imports include syrup and smuggling estimates

Image 27:

Source: GSMM, hEDGEpoint

Source: CSA, Refinitiv, Greenpool, hEDGEpoint

Weekly Report — Sugar and Ethanol

livea.coda@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Sugar and Ethanol Desk

murilo.mello@hedgepointglobal.com

etori.veronezi@hedgepointglobal.com

gabriel.oliveira@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.