Sugar and Ethanol Monthly Report - 2023 12 28

S&D and Trade Flow

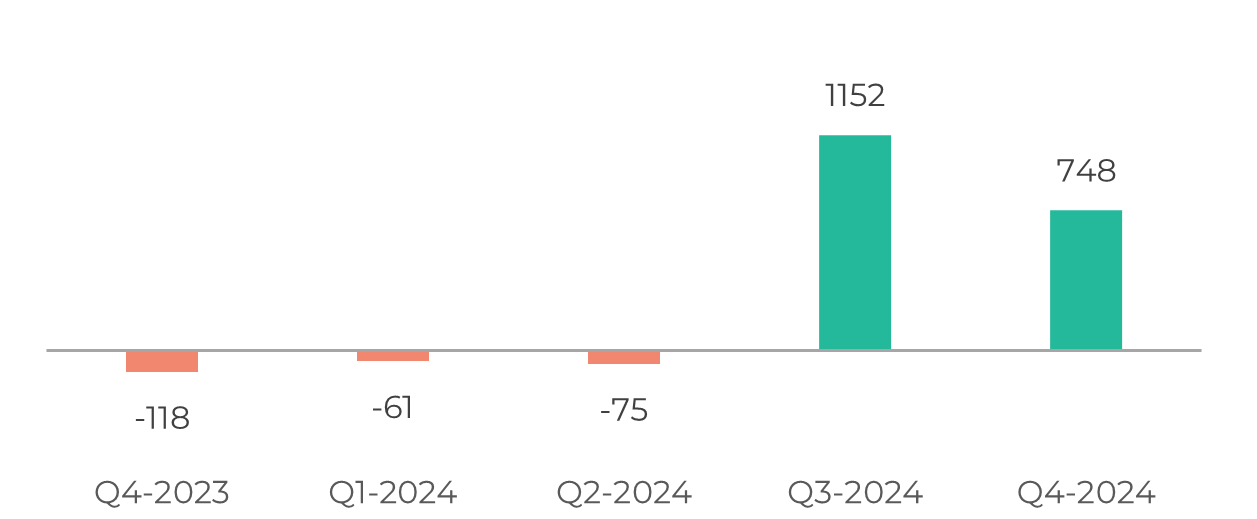

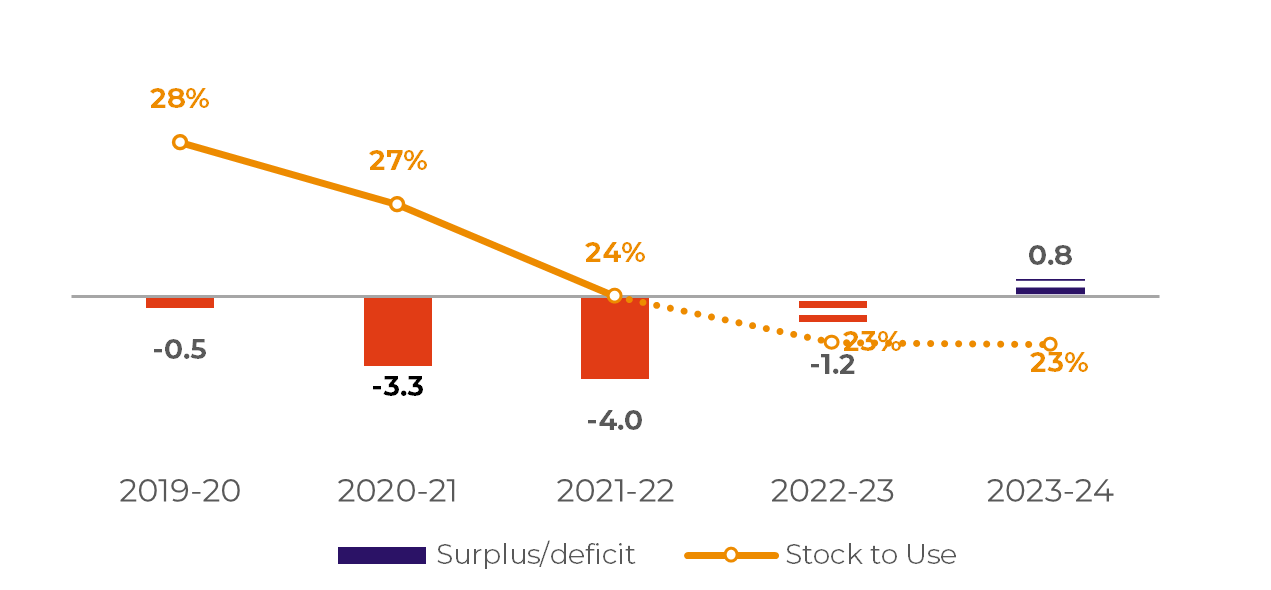

As a result, the trade flows' deficit doesn't seem as deep as once expected, being easily settled through import seasonality, especially as market expect another year of excelent results in Center-South during 24/25.

Of course, weather will remain a source of volatility, as recent hot weather can impact cane's development in Brasil. However, the conversion to an ENSO-neutral condition in mid-2024 also allows some optimism regarding the Northern Hemisphere's 24/25 season - yes, it is too soon to peg.

Still, it seems like we are walking away from catastrophy. Higher future availability complies with an inverted curve, while higher availability from Brazil induces a small carry between October24 and March25.

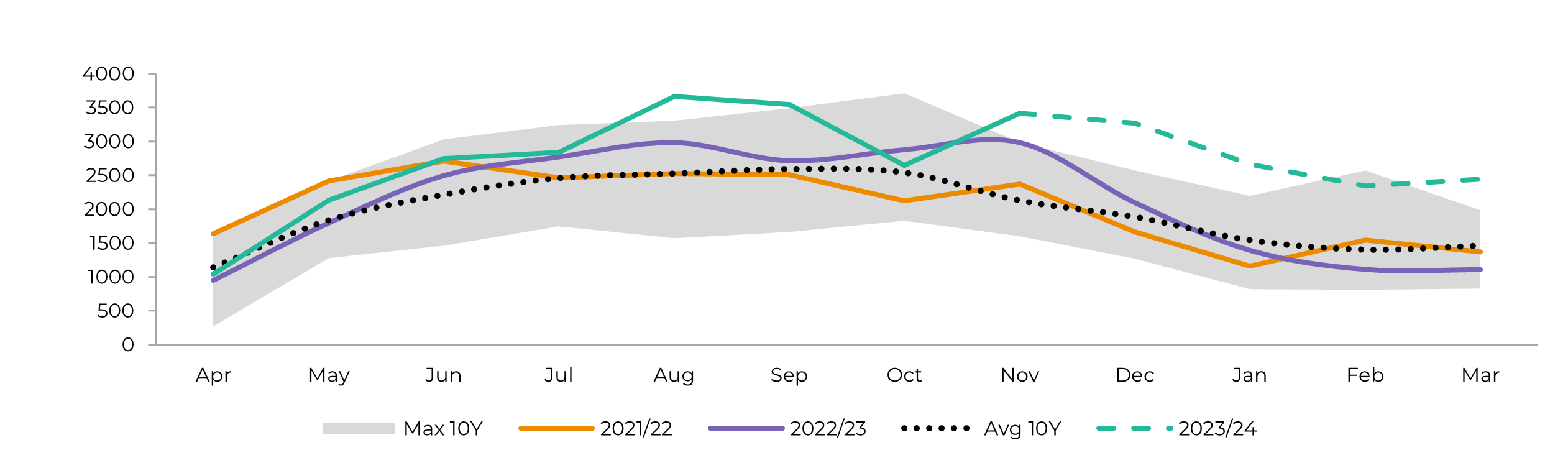

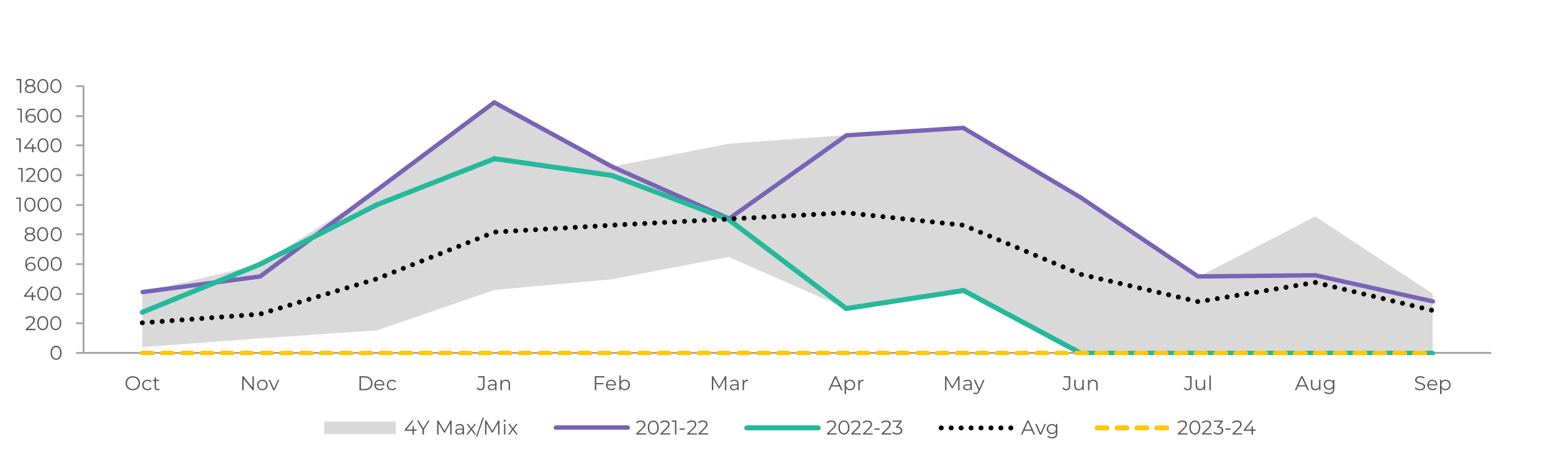

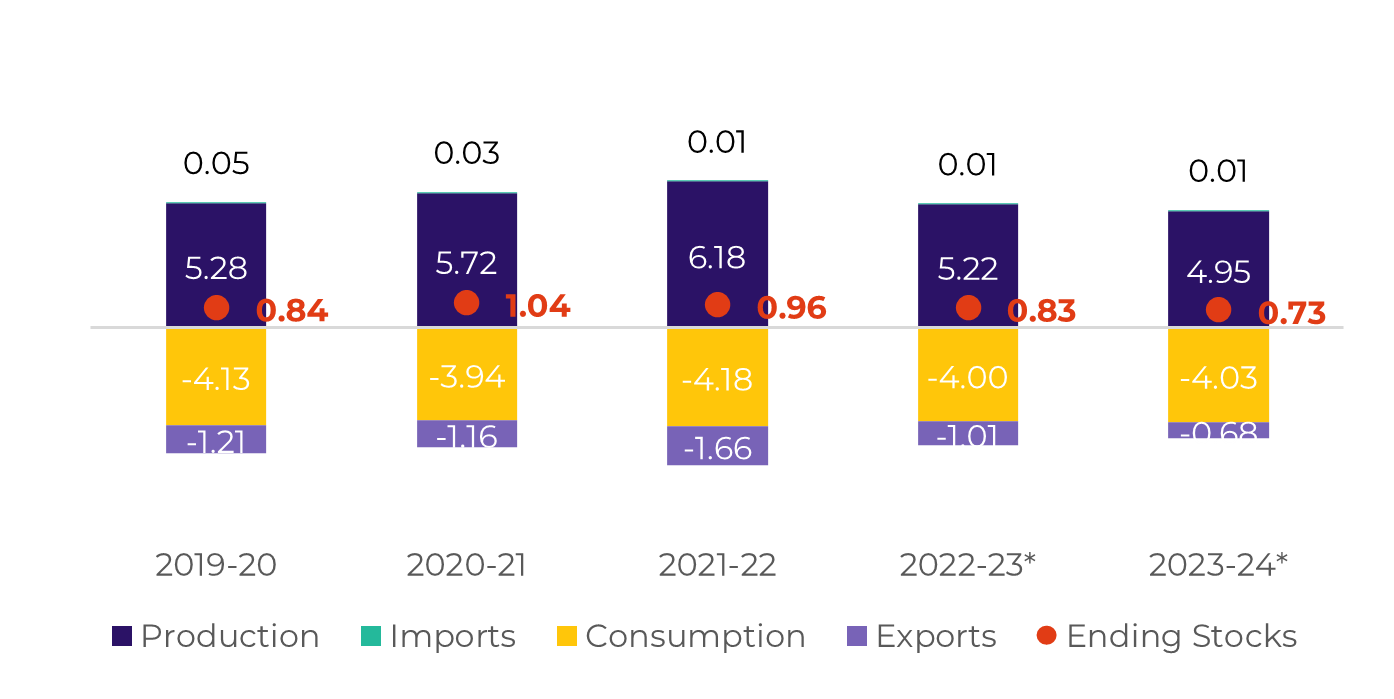

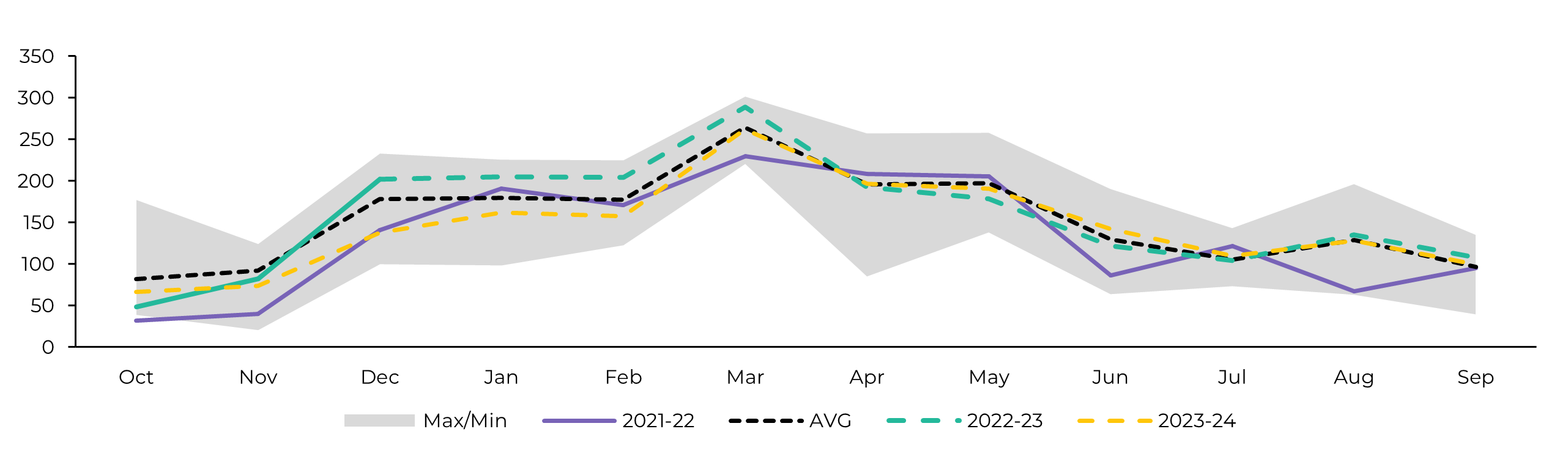

Image 1: Total Trade Flow ('000t)

Source: hEDGEpoint

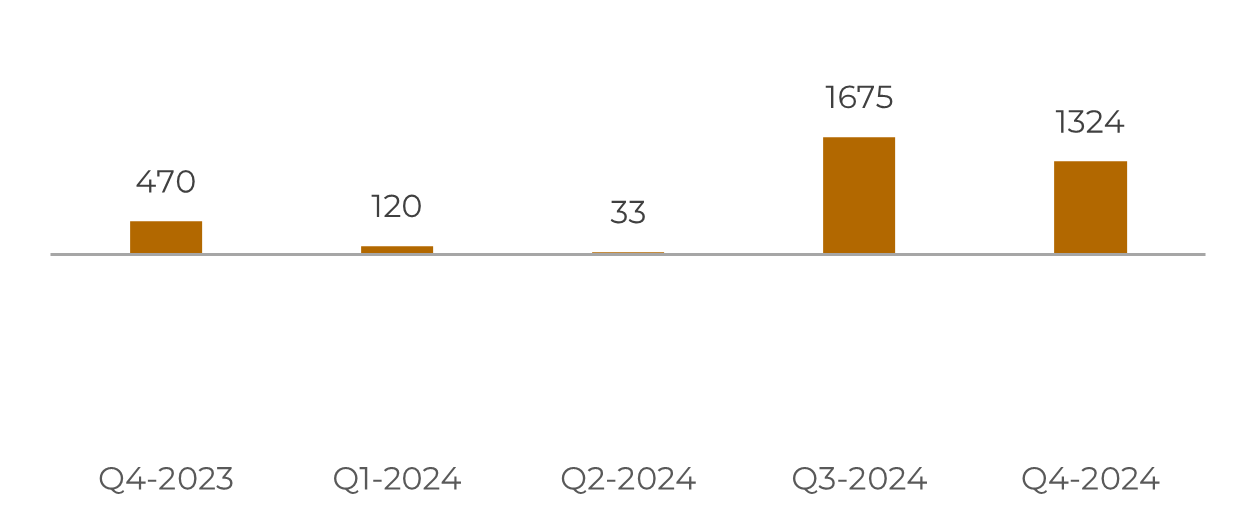

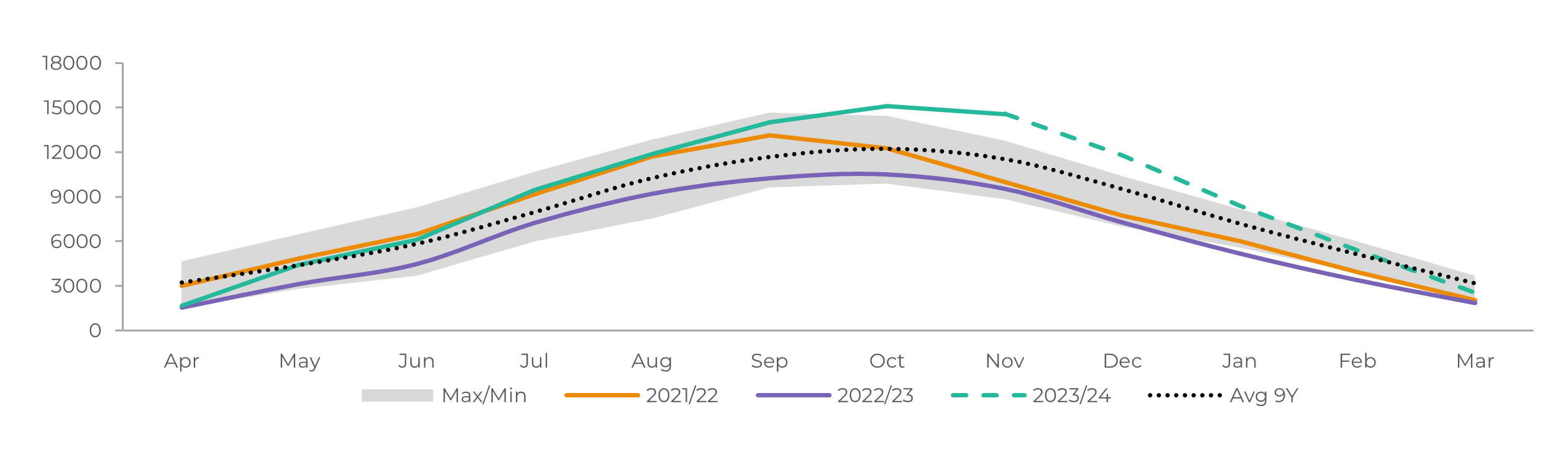

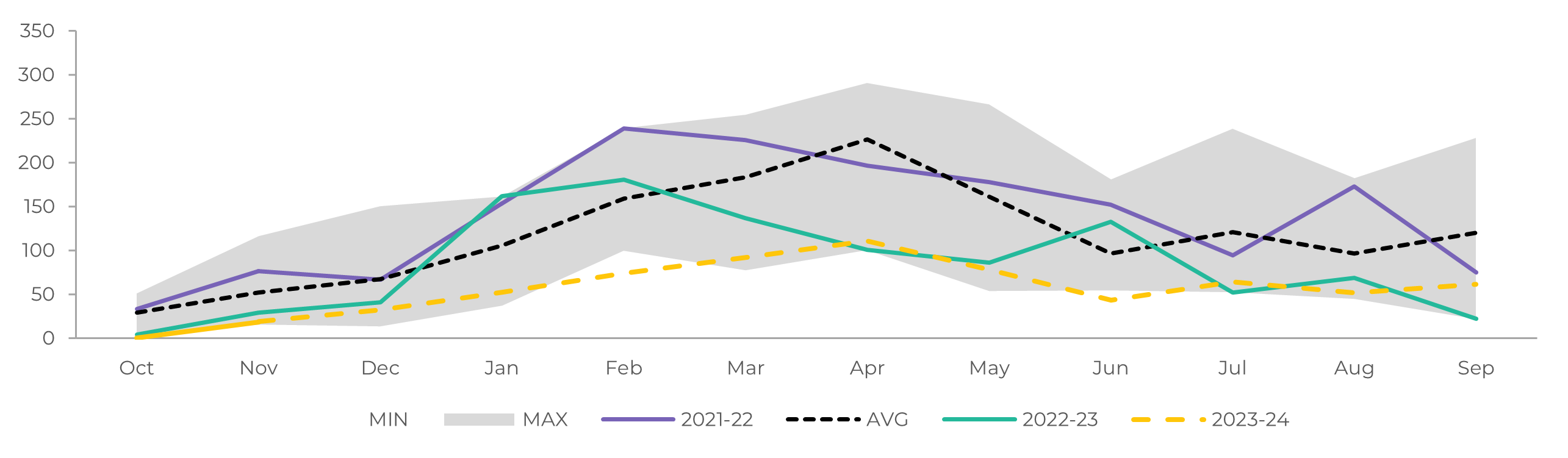

Image 2: Raw's Trade Flow ('000t)

Source: hEDGEpoint

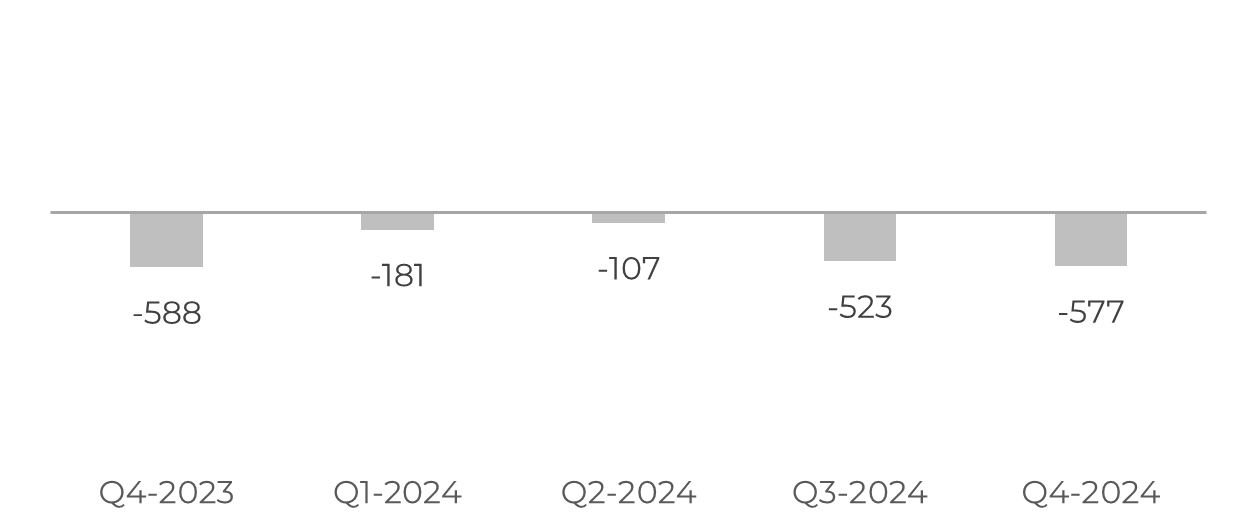

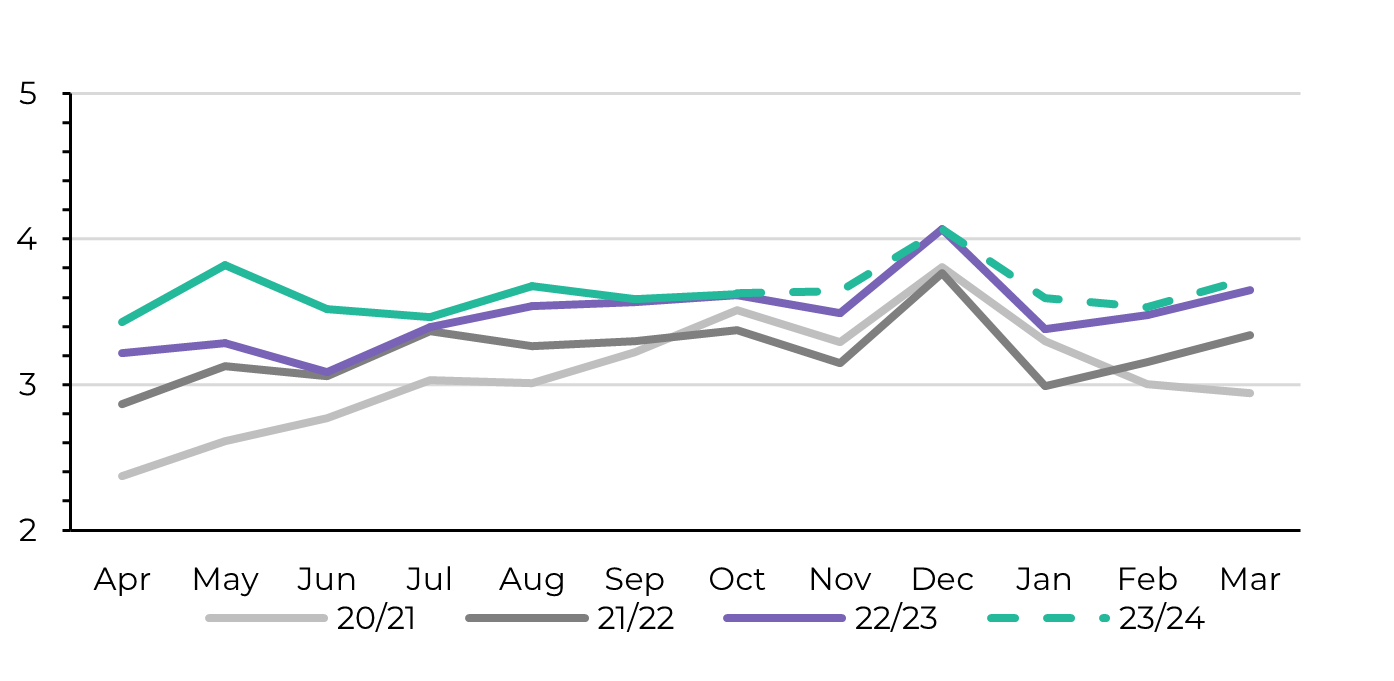

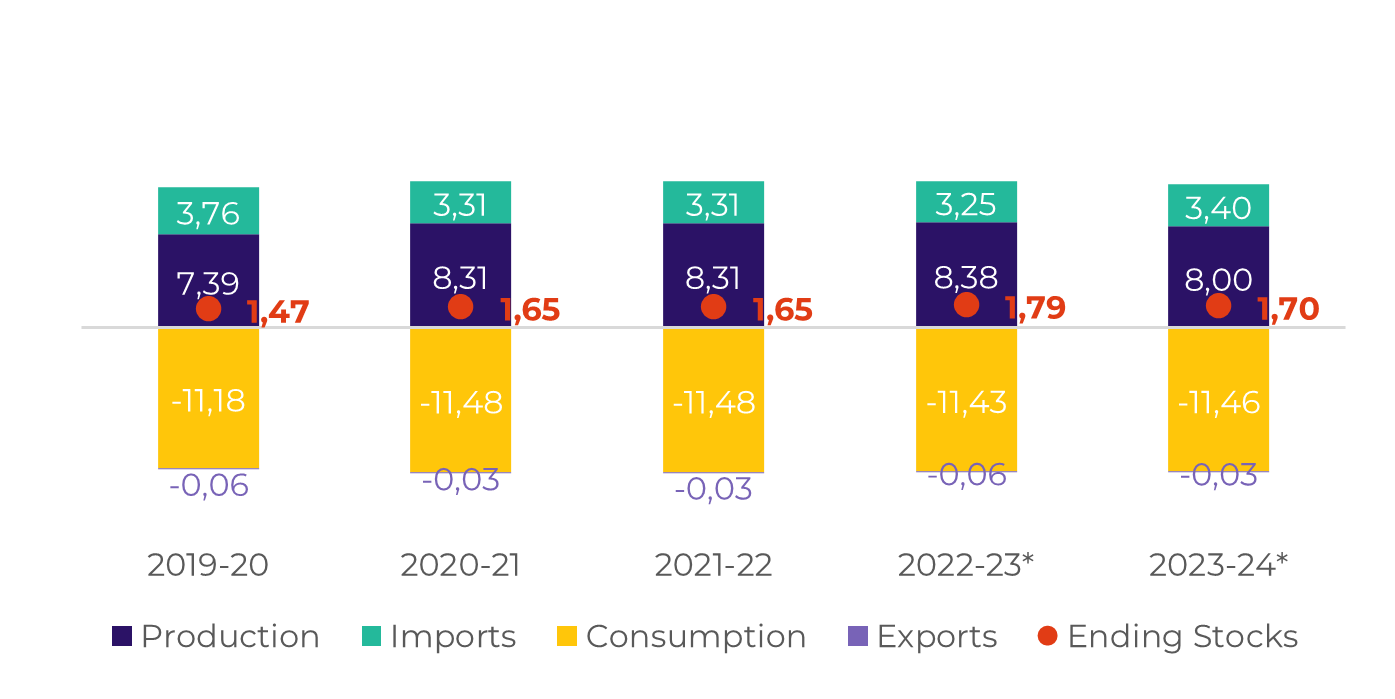

Image 3: White's Trade Flow ('000t)

Source: hEDGEpoint

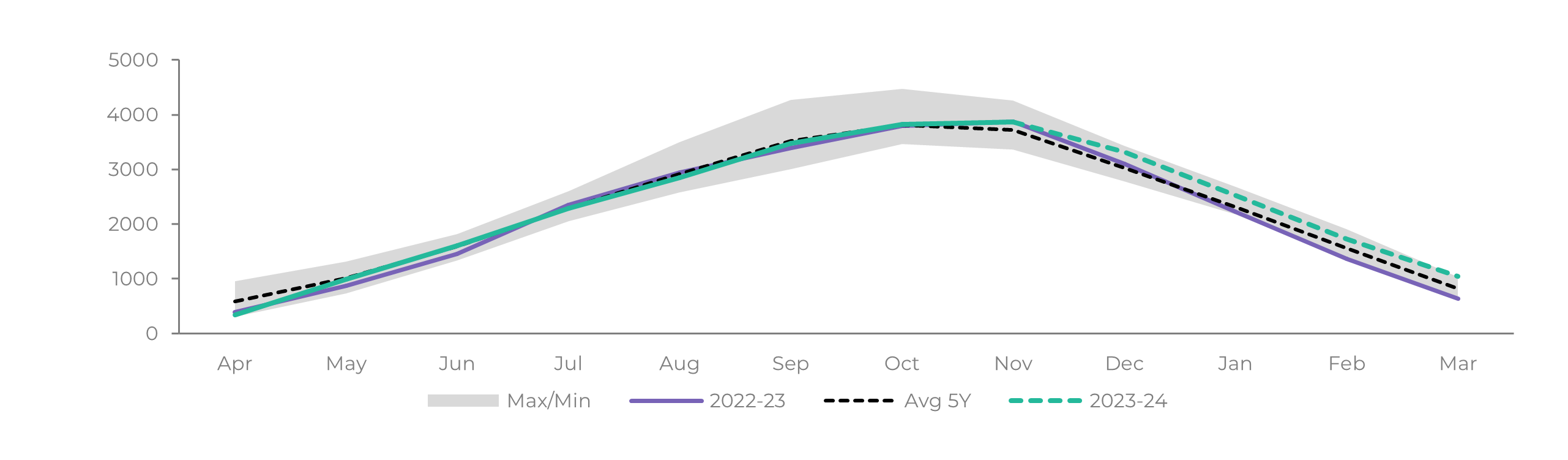

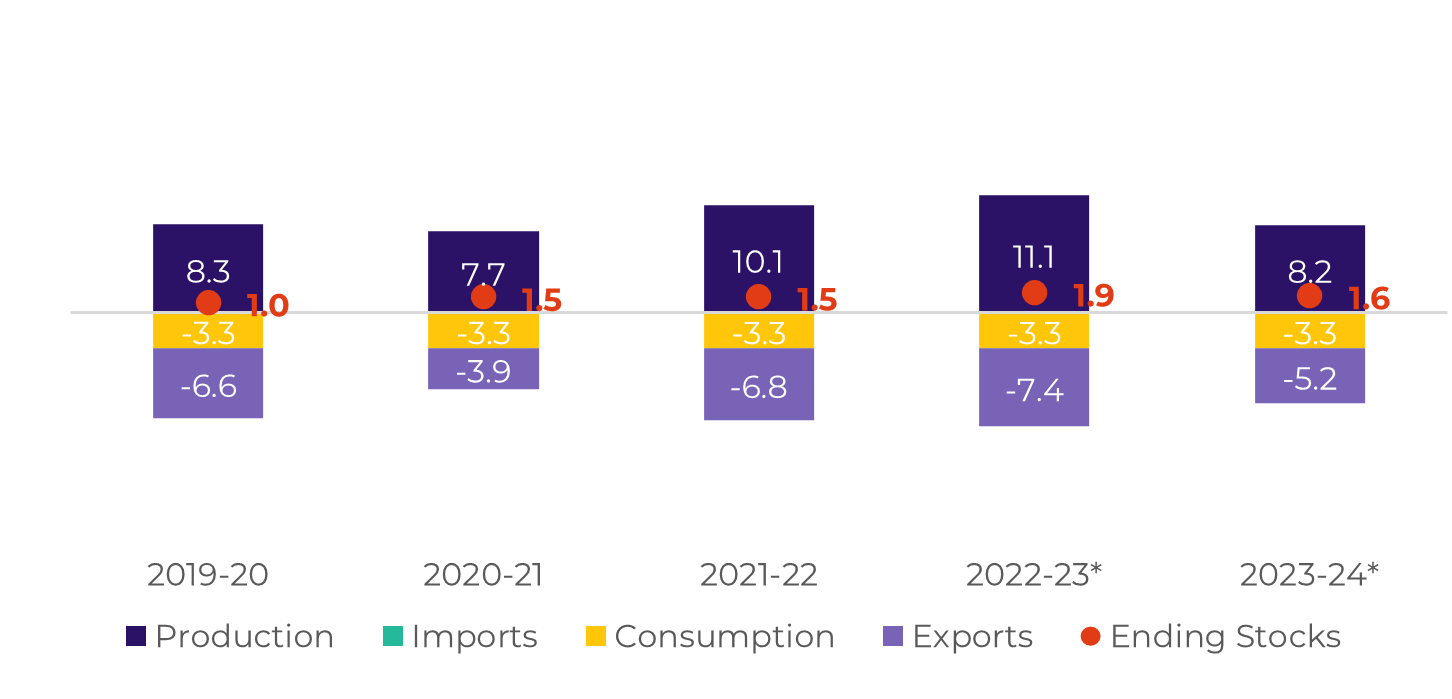

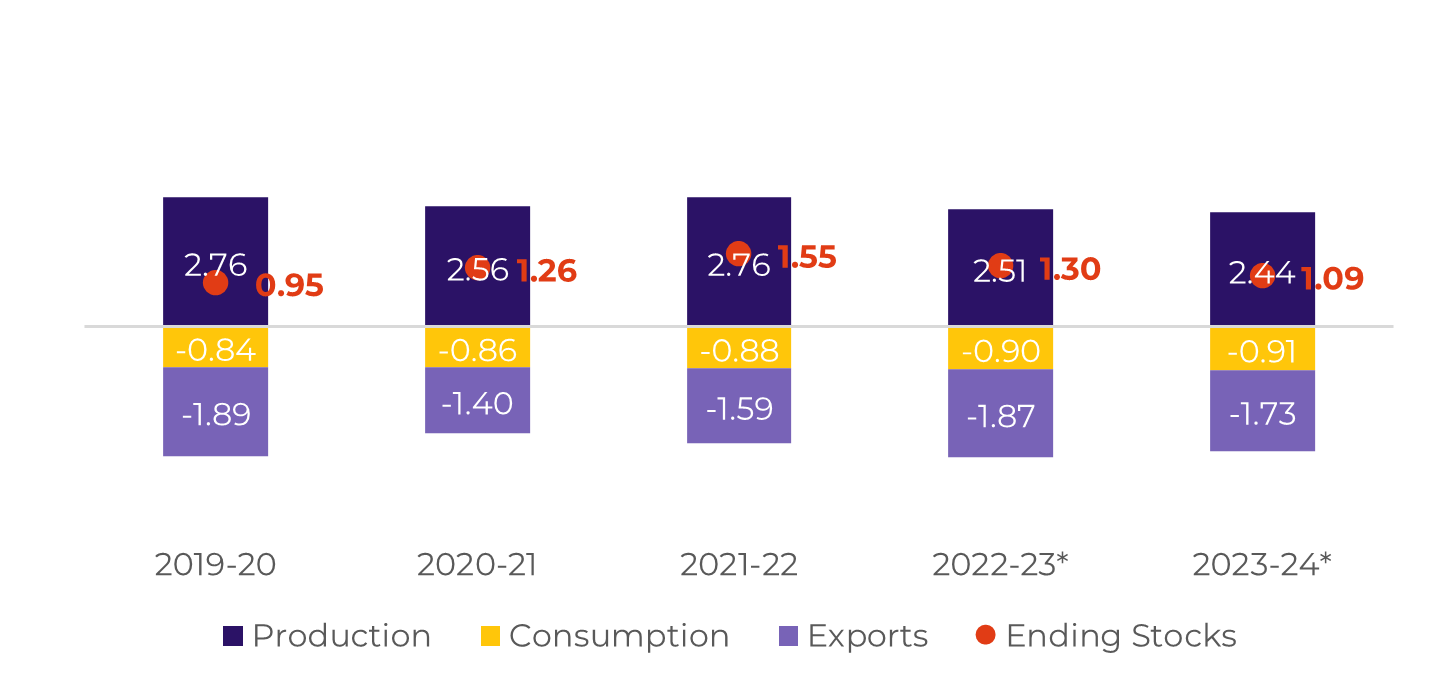

Image 4: Global Supply and Demand Balance (MT RV oct-sep)

Source: hEDGEpoint

Brazil CS

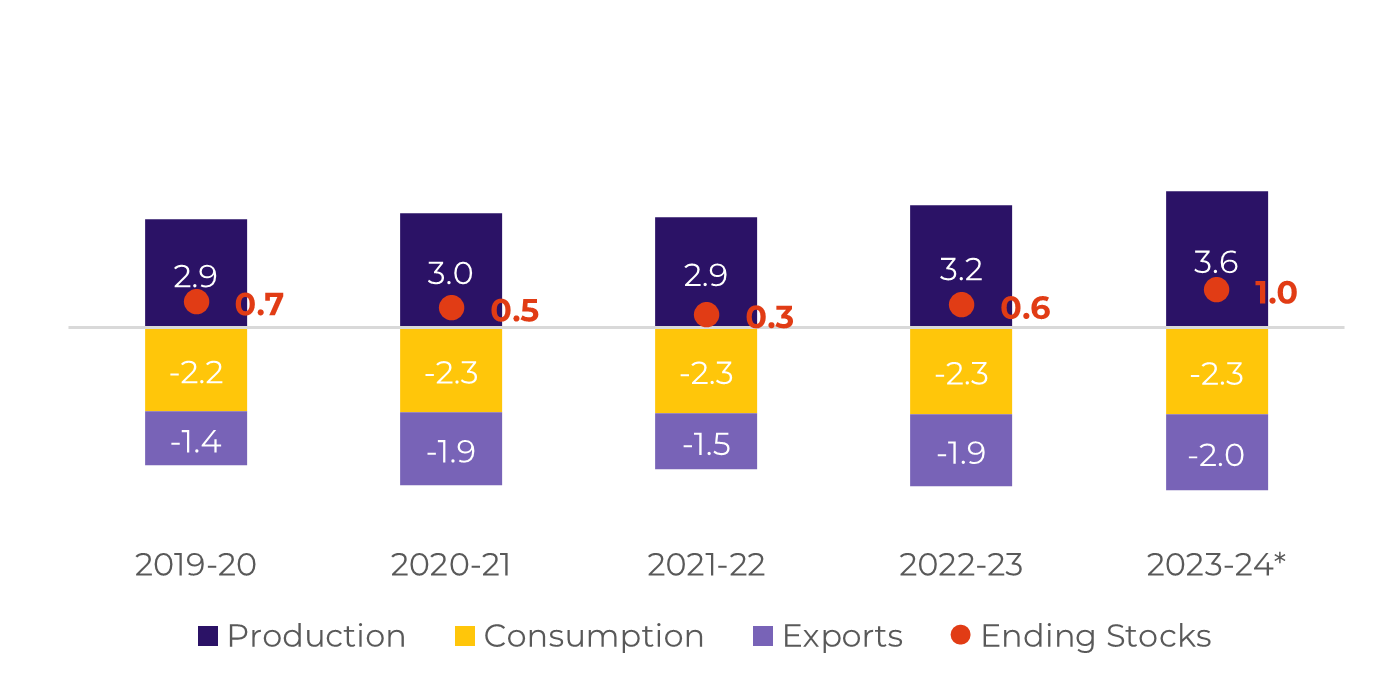

Image 5: Sugar Balance - Brazil CS (Apr-Mar Mt)

Source: Unica, MAPA, SECEX, hEDGEpoint

Of course, weather plays an important role in cane crushing and development, and watching it closely became a must, especially given the recent high temperatures.

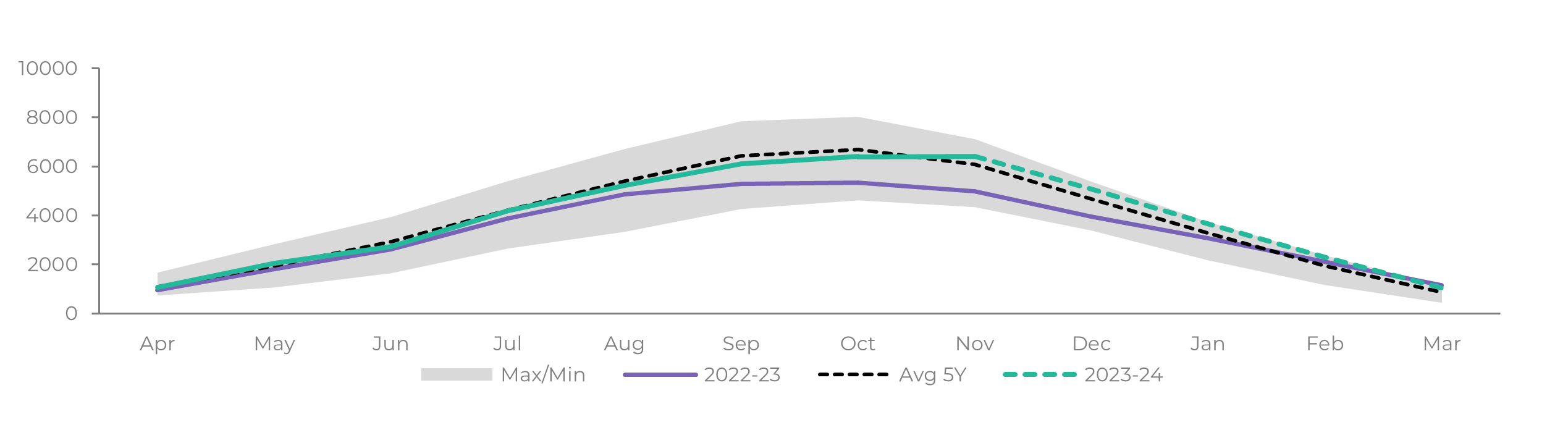

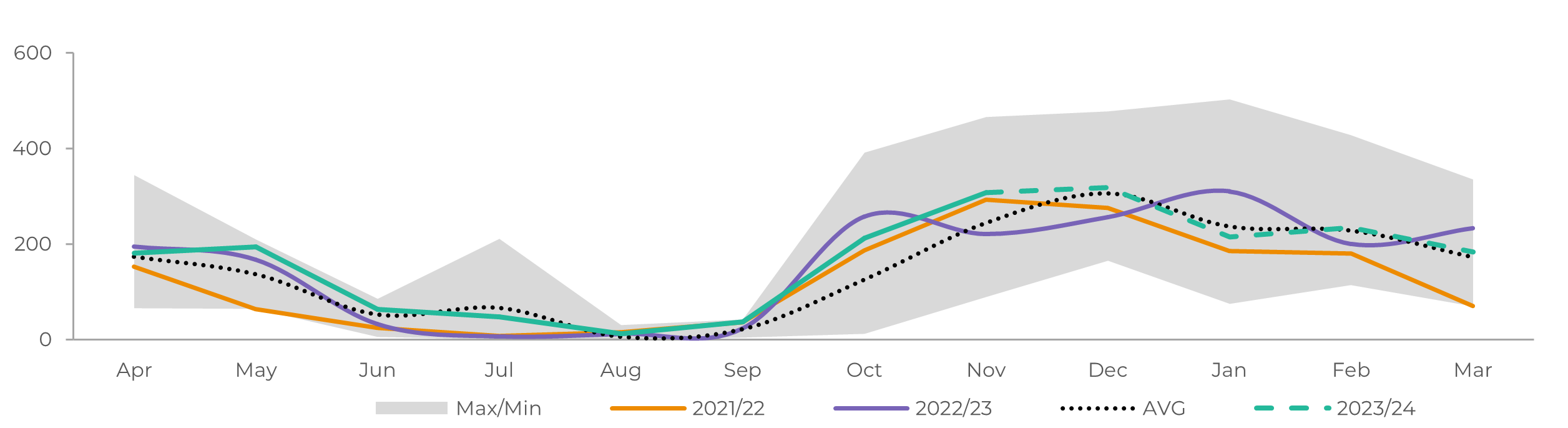

Image 6: Total Exports - Brazil CS ('000t)

Image 7: Total Stocks - Brazil CS ('000t)

Source: SECEX, Williams, hEDGEpoint

Source: Unica,MAPA, SECEX, Williams, hEDGEpoint

Brazil CS Ethanol

Image 8: Otto Cycle - Brazil CS (M m³)

Source: ANP, Bloomberg, hEDGEpoint

Image 9: Anhydrous Ending Stocks - Brazil CS ('000 m³)

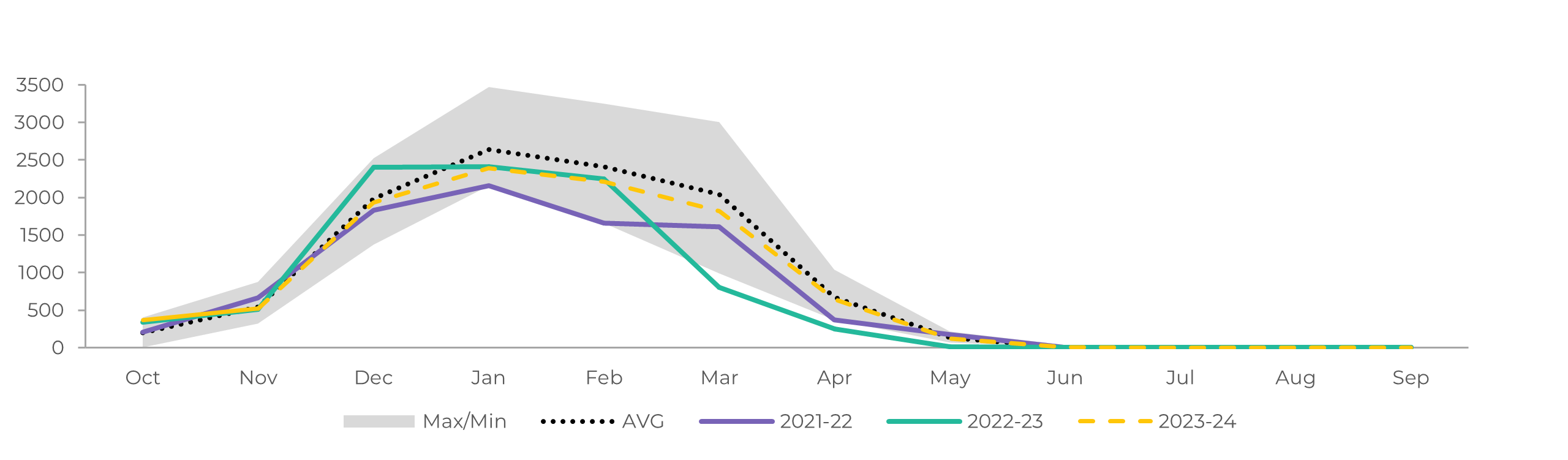

Image 10: Hydrous Ending Stocks - Brazil CS ('000 m³)

Source: Unica, MAPA, ANP, SECEX, hEDGEpoint

Source: Unica, MAPA, ANP, SECEX, hEDGEpoint

Brazil NNE

Image 11: Sugar Balance - Brazil NNE (Apr-Mar Mt)

Source: MAPA, SECEX, hEDGEpoint

Image 12: Total Exports - Brazil NNE ('000t)

Source: SECEX, hEDGEpoint

India

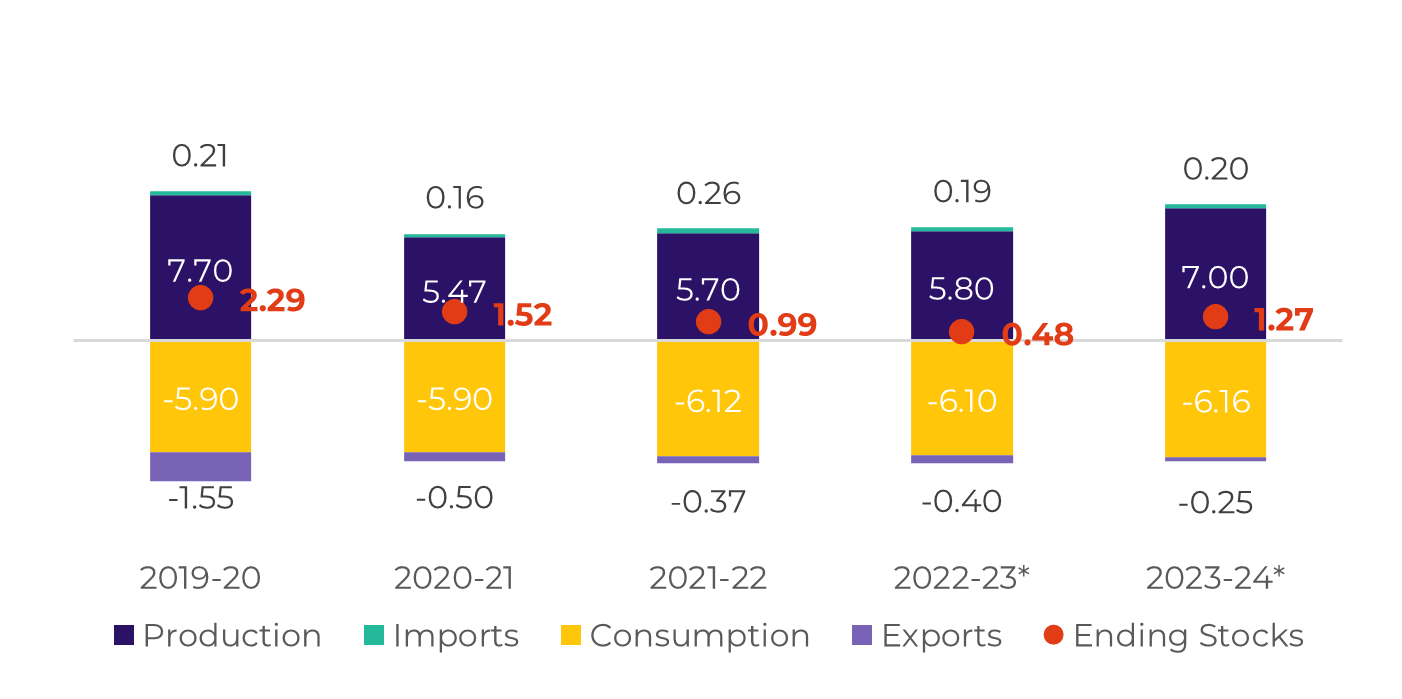

Image 13: Sugar Balance - India (Oct-Sep Mt)

Source: ISMA,AISTA, hEDGEpoint

Image 14: Total Domestic Exports - India ('000t w/o tolling)

Source: ISMA,AISTA, hEDGEpoint

Thailand

Image 15: Sugar Balance - Thailand (Dec-Nov Mt)

Source: Thai Sgar Millers, Sugarzone, hEDGEpoint

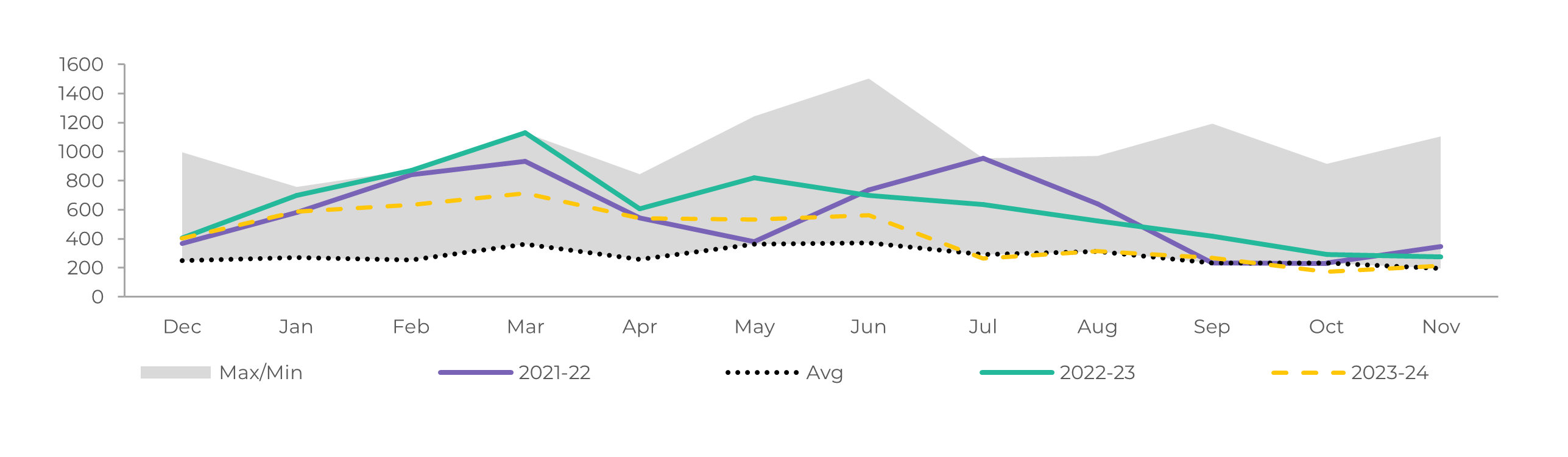

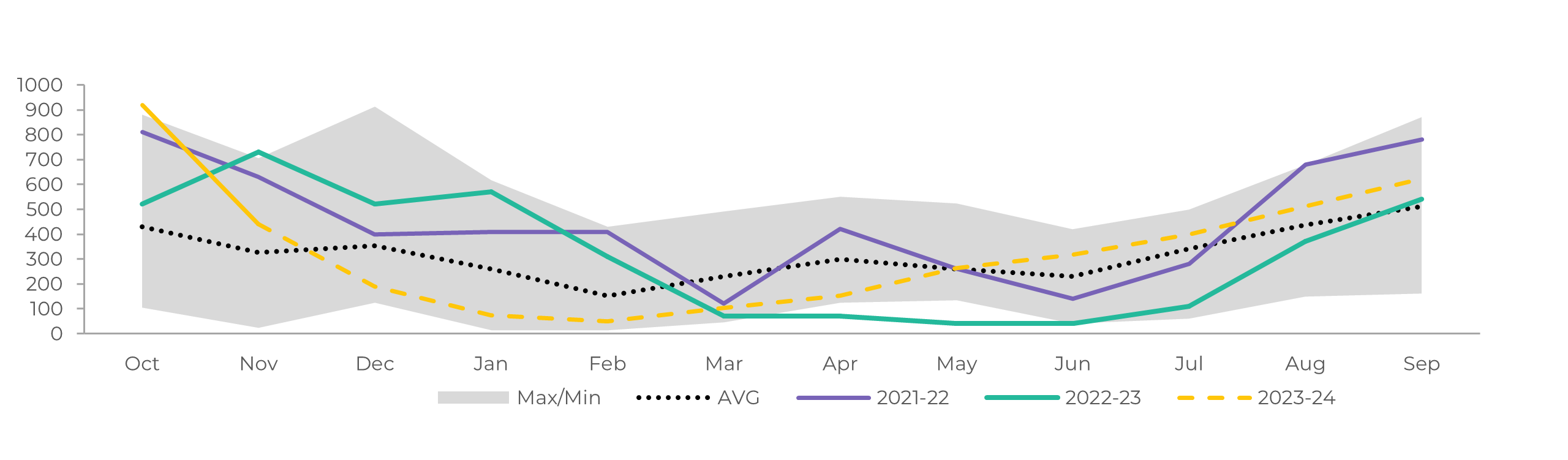

Image 16: Total Exports - Thailand ('000t)

Source: Thai Sgar Millers, hEDGEpoint

EU 27+UK

Image 17: Sugar Balance - EU 27+UK (Oct-Sep Mt)

Source: EC, Greenpool, hEDGEpoint

The extent of its impact is still unclear, especially given the recent weather improvement, but could mean a reduction in the next revision.

Mexico

Image 18: Sugar Balance - Mexico (Oct-Sep Mt)

Source: Conadesuca, Greenpool, hEDGEpoint

Image 19: Total Exports - Mexico ('000t)

Source: Conadesuca, Greenpool, hEDGEpoint

USA

Image 20: Sugar Balance - US (Oct-Sep Mt)

Source: USDA, hEDGEpoint

The volume was distributed among some countries. For instance, Brazil NNE received an aditional 53kt, Autralia 30kt and Guatemala 17kt.

Guatemala

Image 21: Sugar Balance - Guatemala (Oct-Sep Mt)

Source: Cengicaña, Sieca, Azucar.gt,Greenpool, hEDGEpoint

Image 22: Total Exports - Guatemala ('000t)

Source: Sieca

Russia

Image 24: Sugar Balance - Russia (Mt Sep-Aug)

Source: Ikar, Sugar.ru, Greenpool, hEDGEpoint

China

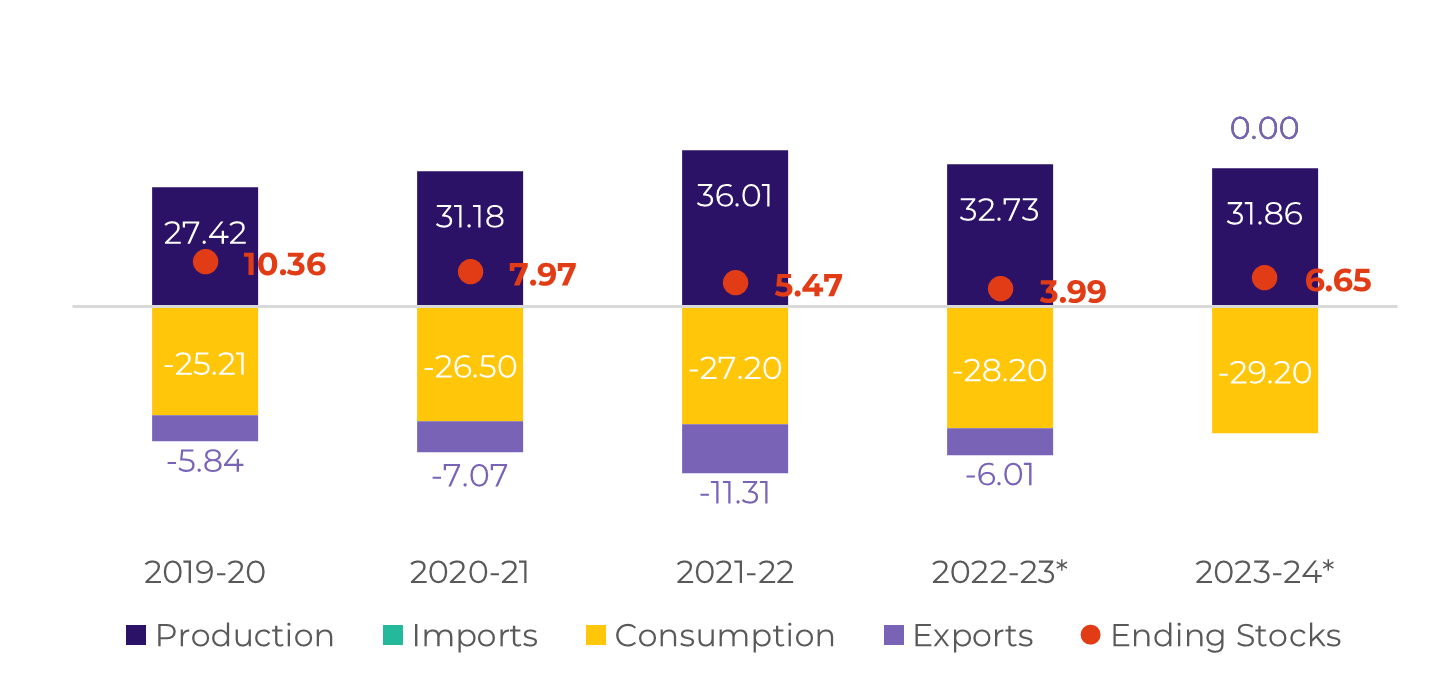

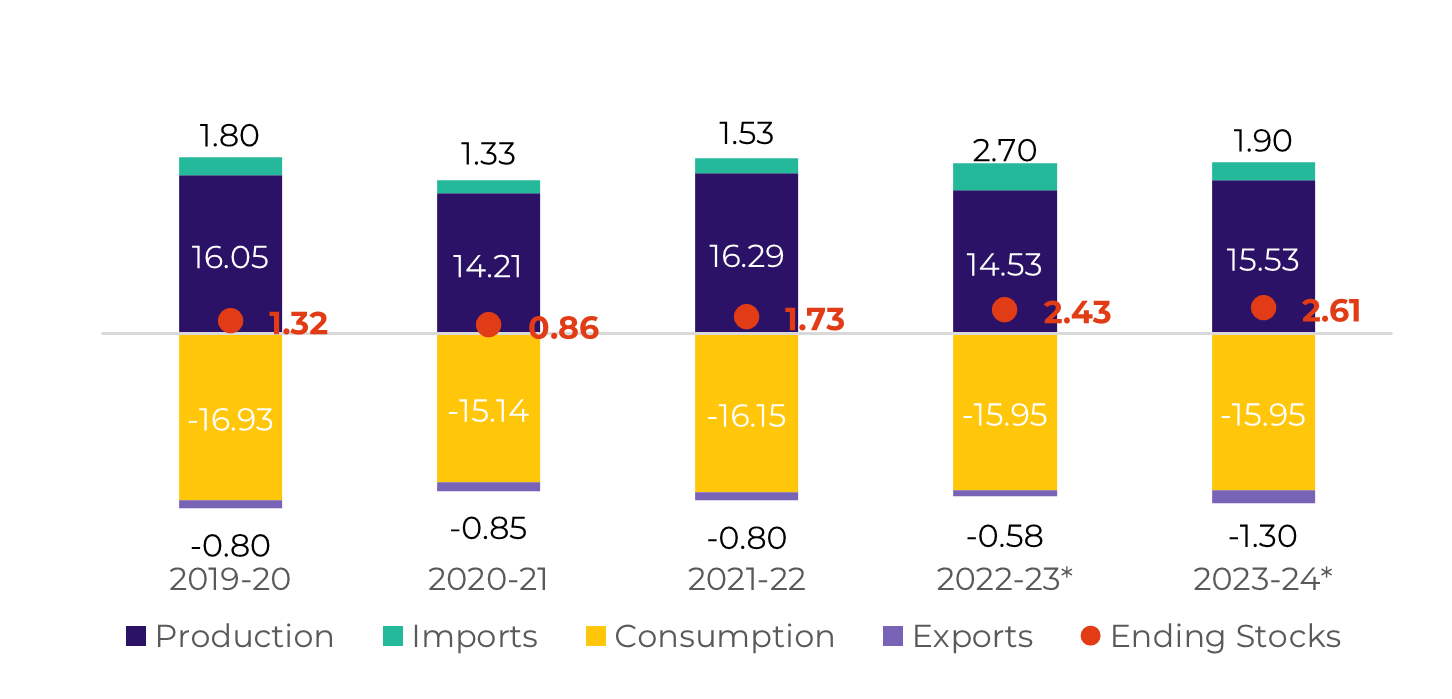

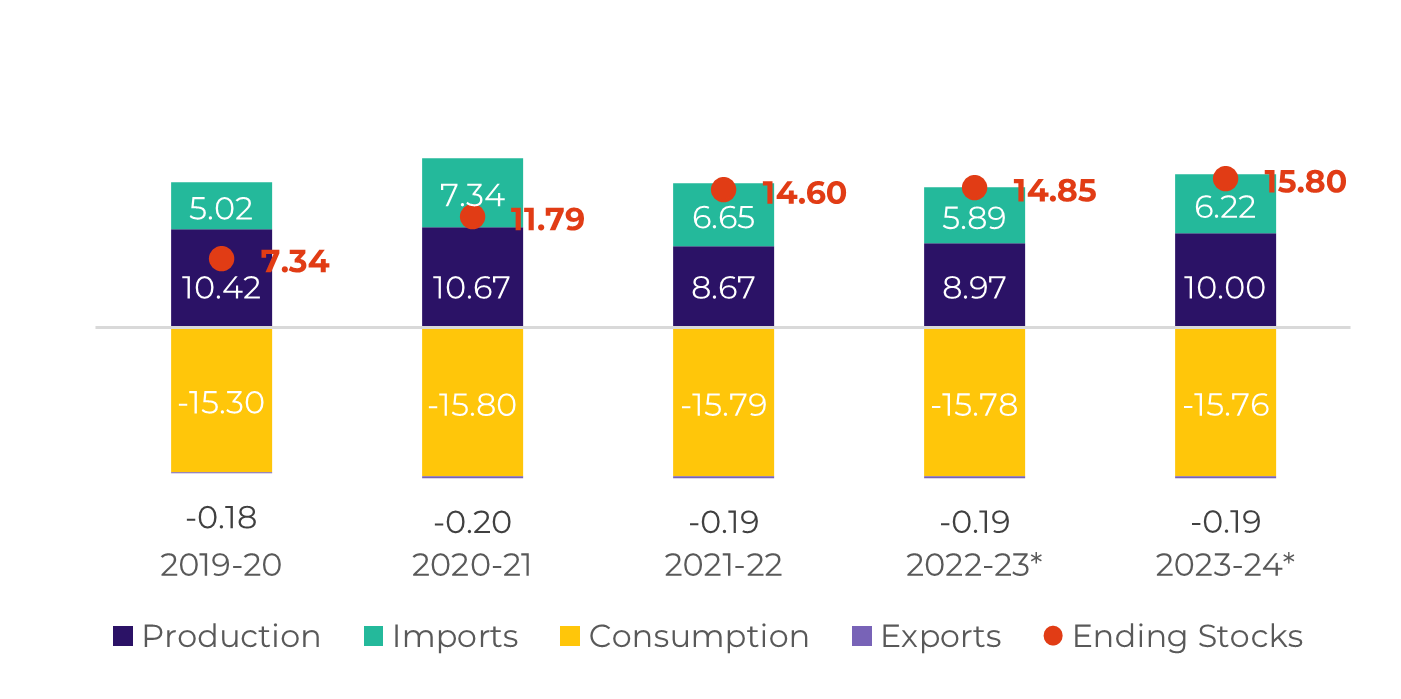

Image 25: Sugar Balance - China (Oct-Sep Mt)

Source: GSMN, CSA, Refinitiv, Greenpool, hEDGEpoint

Obs: stocks also account for bonded warehouses volume and imports include syrup and smuggling estimates

Image 26: Total Imports - China ('000t - exc. syrup and smuggling)

Image 27: Total Production - China ('000t)

Source: GSMM, hEDGEpoint

Source: CSA, Refinitiv, Greenpool, hEDGEpoint

Weekly Report — Sugar and Ethanol

livea.coda@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Sugar and Ethanol Desk

murilo.mello@hedgepointglobal.com

vipul.bhandari@hedgepointglobal.com

gabriel.oliveira@hedgepointglobal.com

etori.veronezi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.