Jun 30

/

Ignacio Espinola

Palm Oil Market Outlook: Key Drivers and Emerging Risks for 2025–2026

Back to main blog page

* Indonesia's biodiesel policy and bad weather cut palm oil supply.

* India's tax cuts boost palm oil imports.

* Middle East tensions and oil prices affect palm oil demand.

* EU rules may limit palm oil trade and could raise costs.

Palm Oil Market Outlook: Key Drivers and Emerging Risks for 2025–2026

In early 2025, palm oil prices experienced a notable surge, primarily driven by Indonesia’s B40 biodiesel mandate. This policy has significantly increased domestic consumption of palm oil, tightening export availability from one of the world’s largest producers. In parallel, Malaysia—alongside Indonesia, the two countries accounting for roughly 85% of global palm oil supply—has faced adverse weather conditions, which have negatively impacted yields and overall production volumes.

On the demand side, India’s recent return to the palm oil import market represents a significant development. The Indian government has cut import taxes on vegetable oils to replenish domestic inventories, a move expected to support strong near-term demand and sustain global consumption levels.

Policy Shifts and Geopolitical Risks Reshape Global Dynamics

The global palm oil market is entering a period of heightened volatility, driven by the convergence of shifting biofuel policies and escalating geopolitical tensions. While long-term demand fundamentals remain strong, recent developments are reshaping trade flows, tightening supplies, and introducing greater uncertainty into market outlooks.

Geopolitical Tensions and Crude Oil Volatility

Geopolitical instability, particularly the ongoing conflict between Israel and Iran, has injected new volatility into global commodity markets, especially crude oil. Initially, fears of supply disruptions pushed crude prices to around $73 per barrel. However, in an unexpected reversal, prices quickly dropped to $65 per barrel—an 11% decline in just one week.

This rapid swing carries direct implications for palm oil, particularly given its significant use in biodiesel production. Lower crude oil prices reduce the competitiveness of palm-based biodiesel, potentially capping further gains in palm oil prices. The trajectory of the Israel-Iran conflict remains a crucial factor, with any escalation or resolution likely to affect energy and vegetable oil markets alike.

Biofuel Policies Reinforce Structural Demand

Amid these geopolitical shifts, biofuel policies continue to provide structural support for plant-based oil demand. In the United States, the Environmental Protection Agency (EPA) recently announced an 8% increase in the Renewable Fuel Standard (RFS) target for 2026, raising the overall mandate to 24 billion gallons. A notable part of this increase comes from higher biomass-based diesel requirements, which will reinforce long-term demand for oils such as soybean oil—and, indirectly, palm oil.

Although palm oil is not explicitly included in the U.S. program, it may benefit through substitution effects as biofuel producers adjust their feedstock blends in response to market and regulatory changes.

In Southeast Asia, Indonesia is considering expanding its domestic biodiesel program further, with B50 or even B60 blending mandates potentially being introduced as early as 2026. A move to B50 could raise domestic palm oil consumption by an additional 1 to 2 million metric tons annually, further tightening export availability and intensifying competition among major importing countries such as India and China.

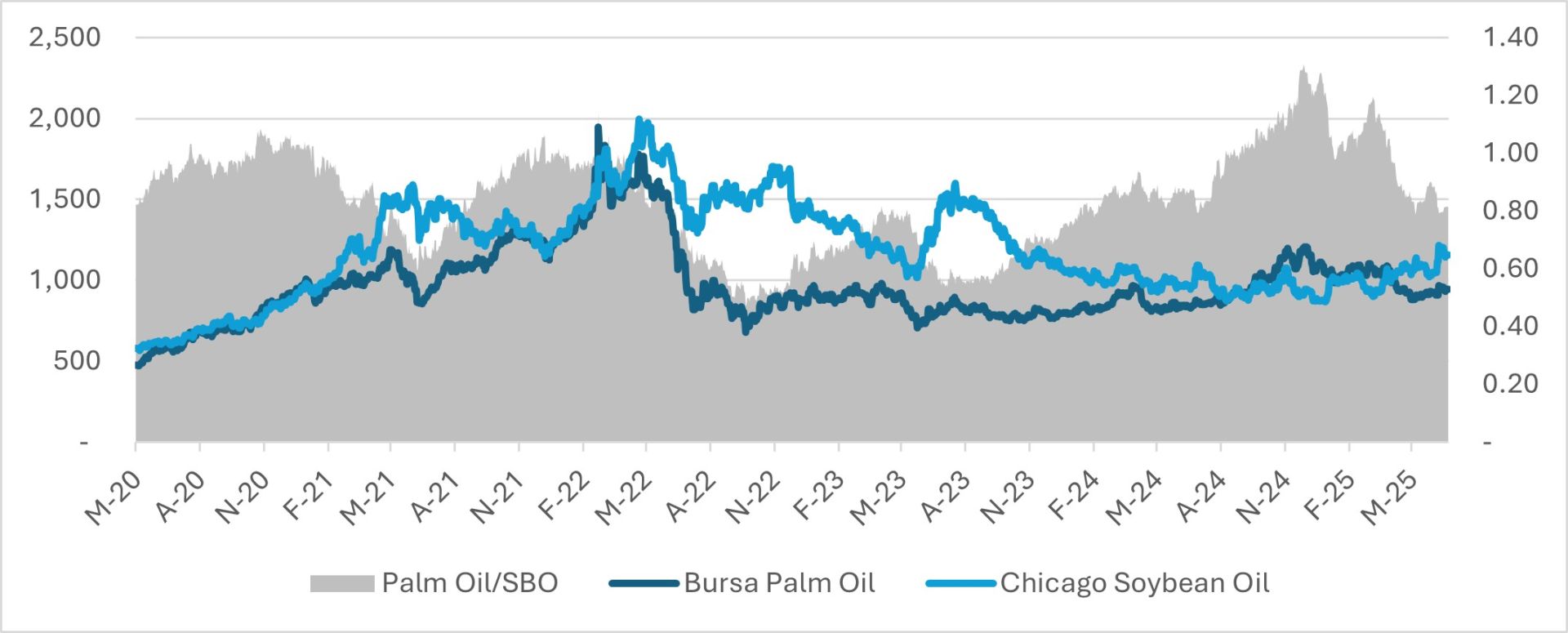

Soybean vs Corn prices ratio - CBOT

Soybean vs Corn prices ratio - CBOT

Source: Reuters, Hedgepoint

Geopolitical and Regulatory Risks Complicate the Outlook

Beyond energy markets and biofuel policy, the palm oil sector is also grappling with a range of structural regulatory challenges. The European Union’s Deforestation Regulation (EUDR) is expected to significantly reshape trade flows by mandating full traceability and zero-deforestation sourcing for imported commodities, including palm oil. This regulation could increase compliance costs and limit access to the European market for producers unable to meet the new sustainability standards.

Meanwhile, continued geopolitical uncertainty—notably in the Middle East—adds further unpredictability. As seen in the Israel-Iran conflict, such instability can rapidly impact energy prices, freight costs, and broader commodity correlations, all of which have downstream effects on the palm oil market.

Conclusion: Navigating a Complex Market Landscape

As the market looks ahead to the second half of 2025 and into 2026, palm oil sits at the intersection of multiple powerful forces. On one hand, robust biofuel mandates in major economies point to a structurally strong demand environment. On the other, tightening regulations and persistent geopolitical risk present formidable challenges.

To navigate this complex landscape, market participants—from traders and producers to policymakers—will need to monitor both energy policy shifts and geopolitical developments closely. With supply constrained by weather, policy, and sustainability standards, and demand influenced by both food and fuel sectors, the global palm oil market remains delicately balanced.

Written by Ignacio Espinola

ignacio.espinola@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Reviewed by Luiz F. Roque

Luiz.Roque@hedgepointglobal.com

Luiz.Roque@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products.

Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information.

The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions.

Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.

Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).

Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.

“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint.

Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.