Market Update - Soybeans - 2025 04 25

Trade war and Brazilian soybean exports

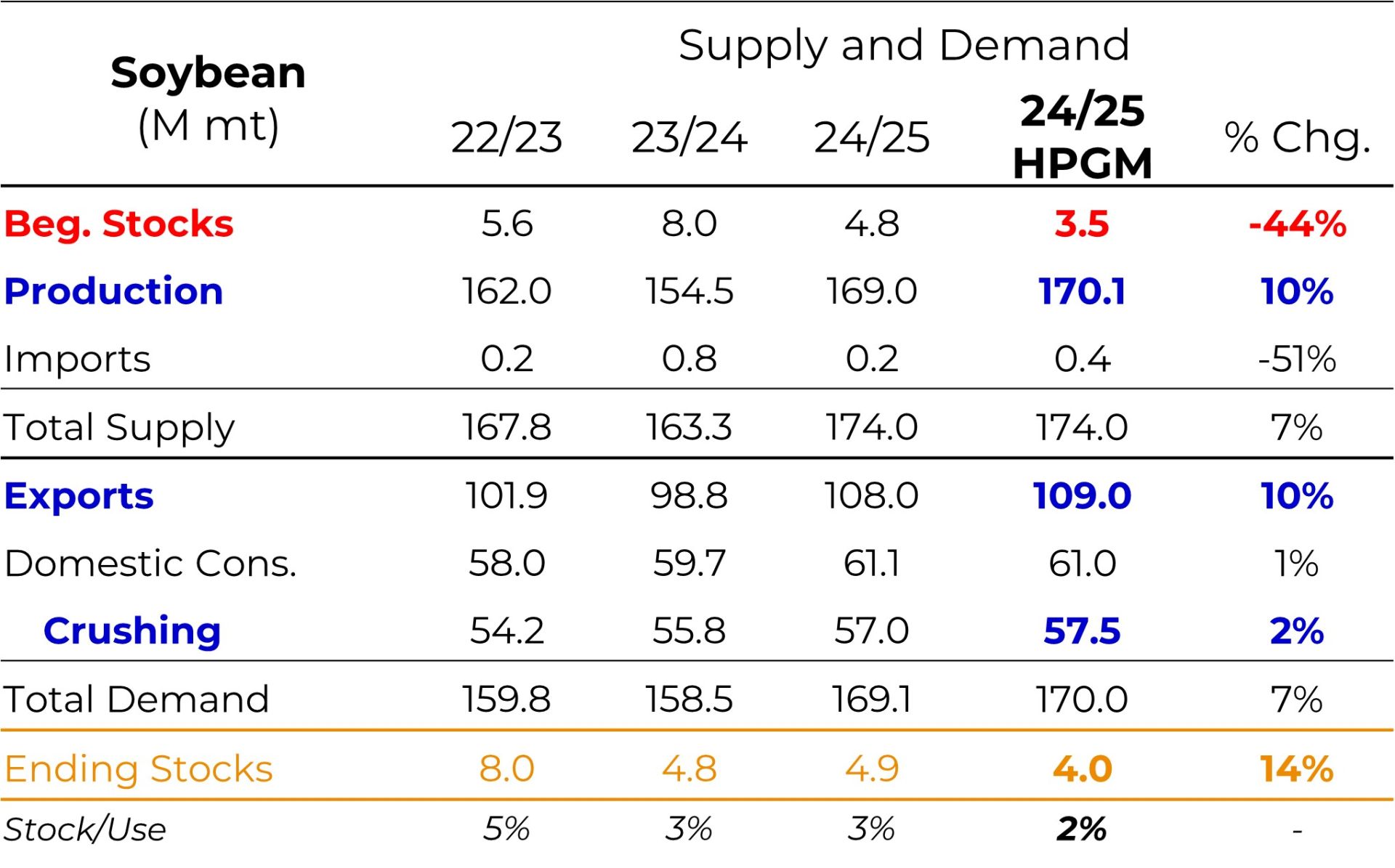

Estimate for Brazil's soybean exports raised to 109 million tons

Our new update to Brazil's soybean supply and demand picture points to an increase in the export estimate for the 2024/25 season. The new figure indicates a potential export of 109 million tons, an increase of 2 million tons regarding the previous estimate (107 million tons).

The new estimate already takes into account a probable increase in Chinese demand for Brazilian soybeans in the current "trade war" scenario, where Chinese tariffs on US products - in response to US tariffs on Chinese products - should bring an important reduction to Chinese purchases of soybeans from the United States in the coming months. Currently, China imposes an import tariff of 125% on all US products, while the US is working with a tariff of 145% on practically all Chinese products (with a few exceptions).

We understand that the Chinese tariff makes new purchases of soybeans from the United States unfeasible, since the final price paid by Chinese importers tends to be more than double the price paid in other origins, such as Brazil. As a result, as long as there is no robust trade agreement between the world's two largest economies, we shouldn't see any new ships with US soybeans being sent to China. At the same time, there are still some doubts regarding purchases that have already been made and have not yet been delivered to China. Will these purchases be subject to tariffs? Will they be canceled?

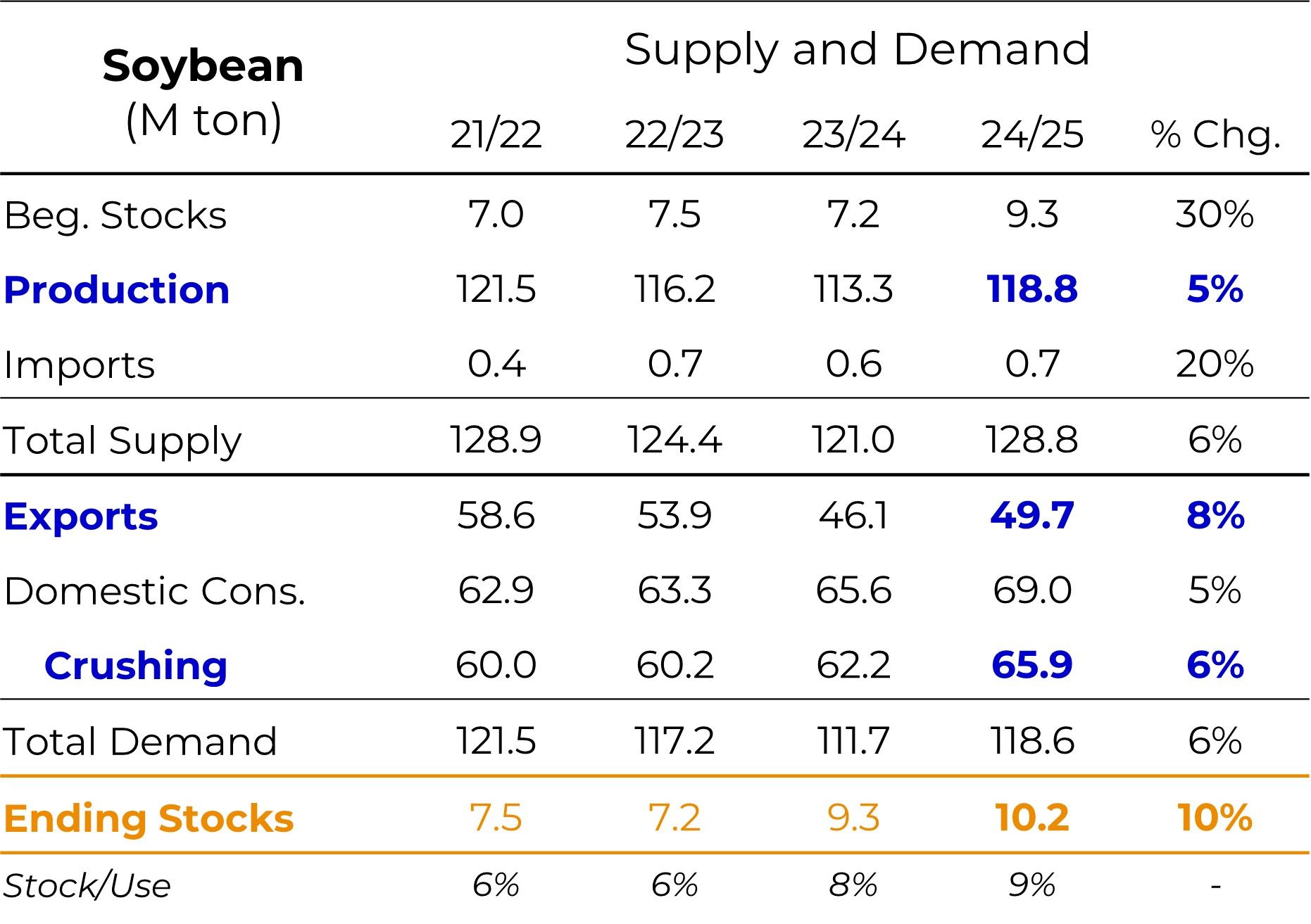

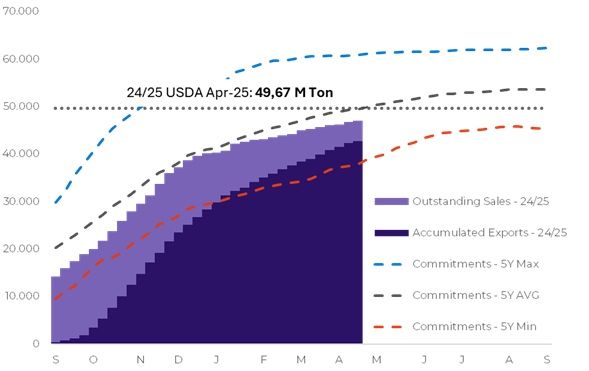

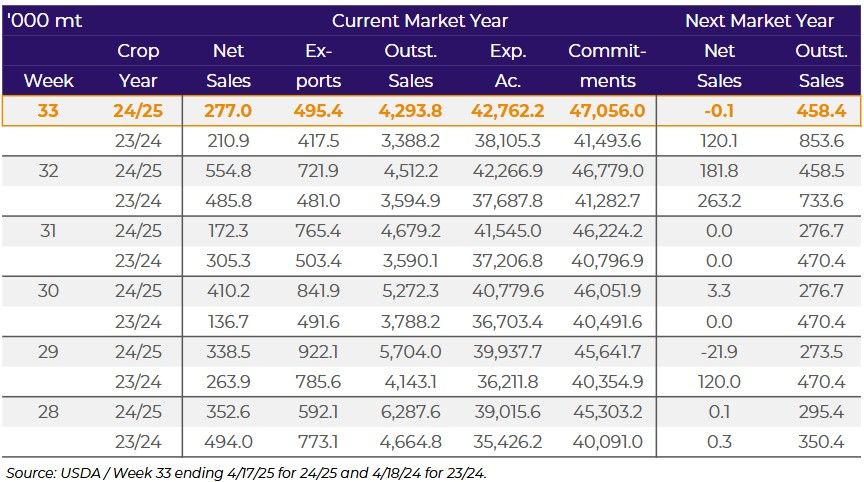

It's important to remember that the USDA's current estimate points to US soybean exports of 49.7 million tons (total, for all countries) in the 2024/25 season. To date, US soybean export records stand at 47.1 million tons for the 2024/25 season. In other words, approximately 2.6 million tons of new sales are missing to reach the USDA's estimate. In addition, of the total already registered, 4.3 million tons have not yet been delivered to their destinations, which include countries that are also imposing retaliatory tariffs on the US. Of this volume already registered, approximately 200,000 tons are for China, or approximately 4.6%. Given this, we can say that a large part of the sales already registered and not delivered, as well as pending sales, are at risk, with possible cancellations taking place in the coming weeks. If they do occur, these cancellations could lead to a reduction in the USDA's export estimate, which could result in an increase in stocks in the US and possible negative pressure in Chicago. The next USDA supply and demand report will be released on May 12, and possible adjustments could already be seen.

USA - Supply and Demand (M Ton)

Source: USDA, Hedgepoint

Soybeans - USA - Export Sales - Current Crop (thousand tons)

Source: USDA, Hedgepoint

Soybeans - USA - Export Sales - Current Crop (thousand tons)

Source: USDA, Hedgepoint

In this context, Brazilian soybeans are likely to benefit greatly in the coming months, with Chinese purchases becoming even more concentrated in the world's largest soybean producing and exporting country. In addition, if other countries don't reach an agreement with the US either, additional demands could be included in the equation. But the question is: how far can Brazilian soybean exports go?

Brazil - Supply and Demand - USDA x Hedgepoint (M Ton)

Source: USDA, Hedgepoint

Soybean - Brazil - Export Line-up - Year-to-date (M ton)

Source: Safras, Hedgepoint

Market Intelligence - Grains & Oilseeds

Luiz.Roque@hedgepointglobal.com

Thais.Italiani@hedgepointglobal.com