Acreage 2025 points to smaller soybean and corn areas, but weather and conditions remain good in the US

Acreage 2025: soybean and corn areas reduced, while wheat area increased

The USDA's expected "Acreage" report for the 2025/26 US crop, released on June 30, focused the market's attention, but had little impact on the direction of soybean, corn and wheat futures contracts traded in Chicago.

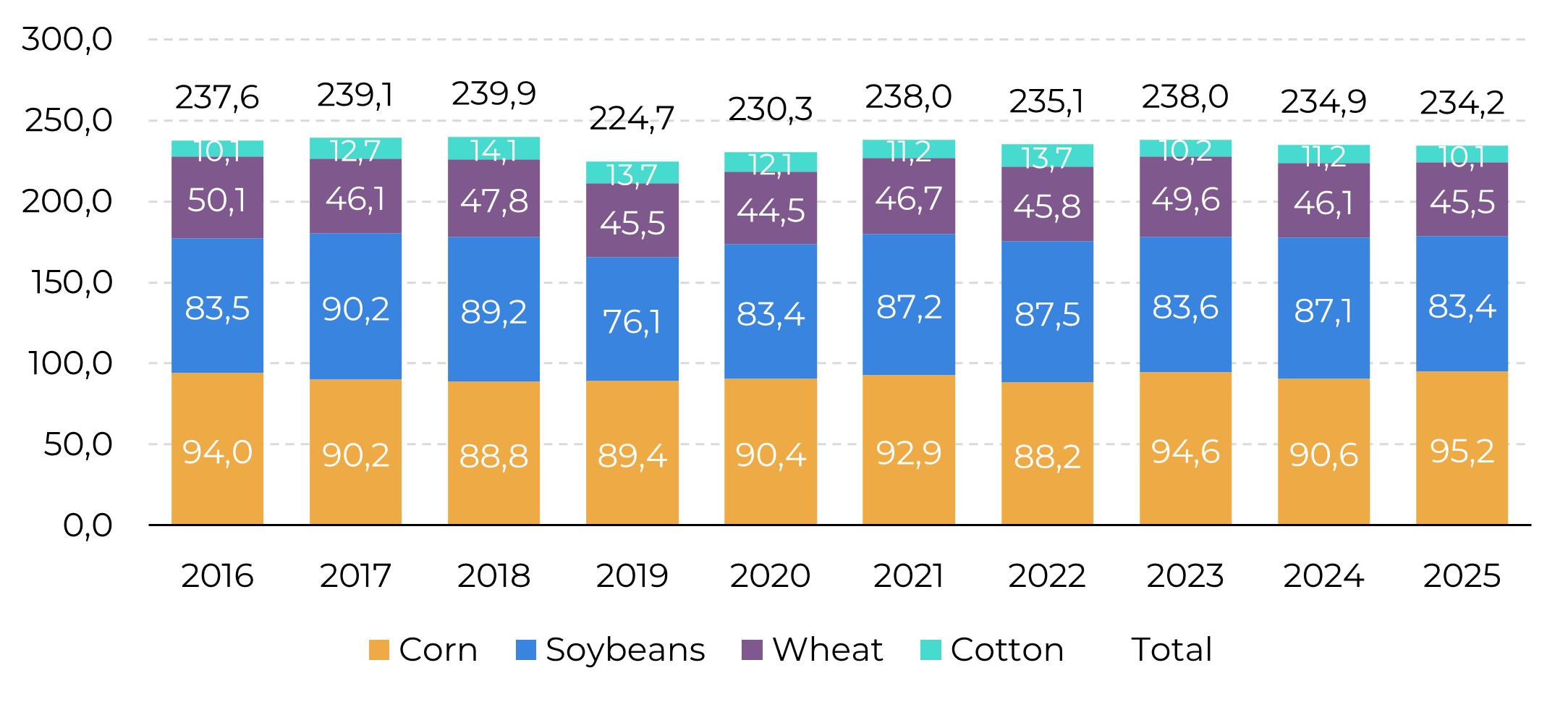

US Acreage 2025 - in million acres

Source: Reuters, Hedgepoint

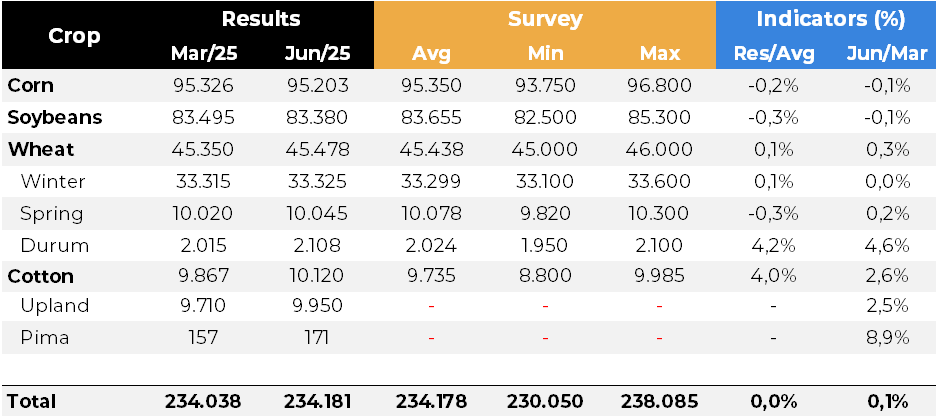

US Acreage 2025 vs March vs Market Expectations - in million acres

Source: Reuters, Hedgepoint

On the corn side, the average market expectation pointed to an area of 95.350 million acres, slightly higher than the March report (95.326 million acres). However, the USDA indicated an area of 95.203 million acres, down regarding March. Even with a different bias than expected, there were no major impacts in Chicago, as the production potential should still point to a record crop in the 2025/26 season.

US Crop Conditions: the index improves for corn and remains stable for soybeans

US Crop Conditions: the index improves for corn and remains stable for soybeans

The USDA's weekly crop conditions update for the 2025/26 season indicated a significant improvement in the corn indices and stability in the soybean indices in the last week of June, drawing the market's attention.

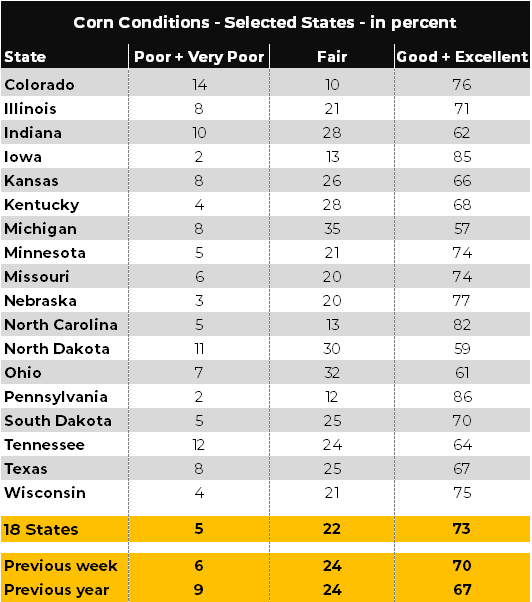

US Corn - Crop Conditions - as of June 29 - in %

Source: USDA, Hedgepoint

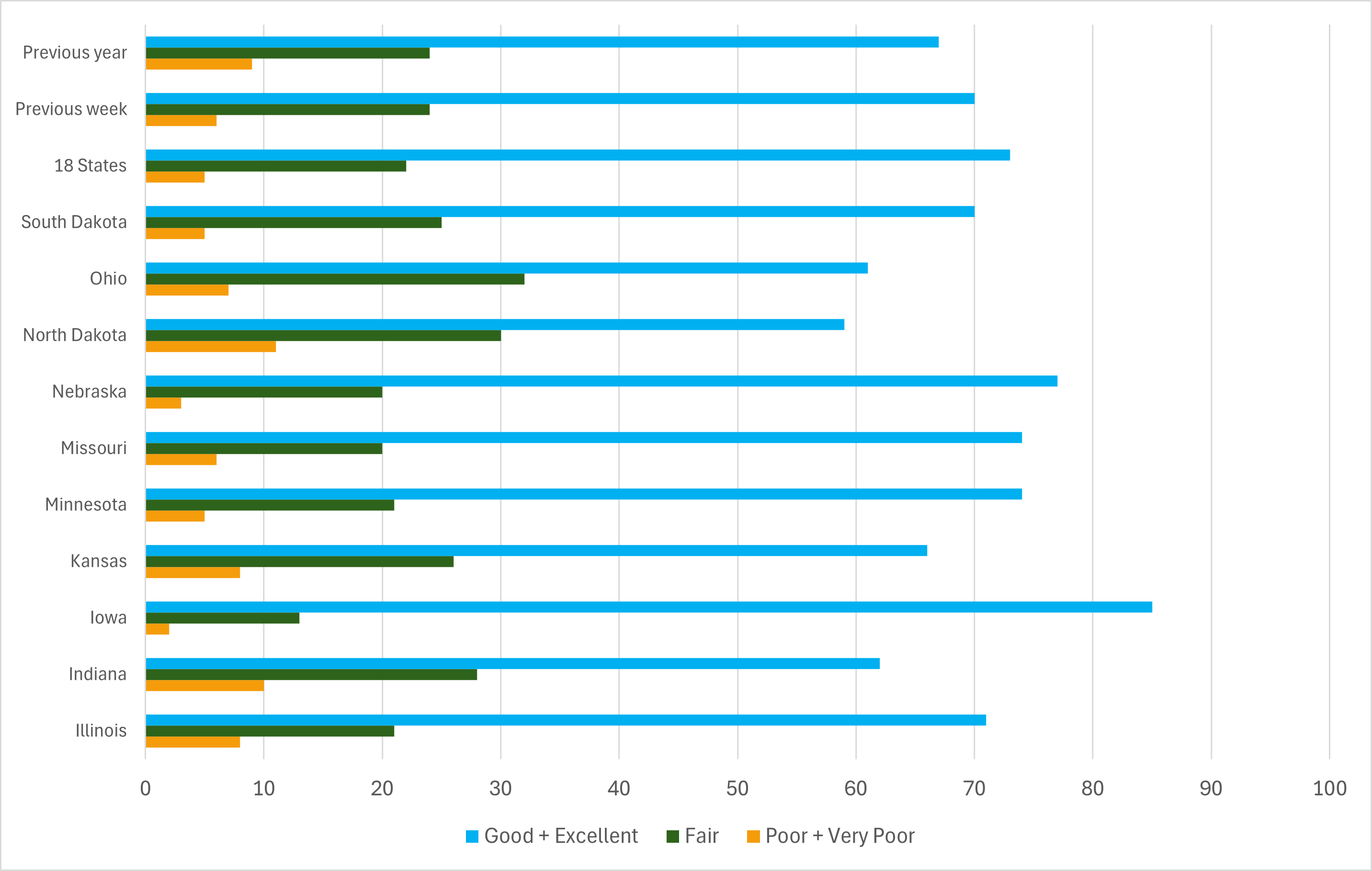

US Corn Conditions - Top 10 Key States and US - as of June 29 - in %

Source: USDA, Hedgepoint

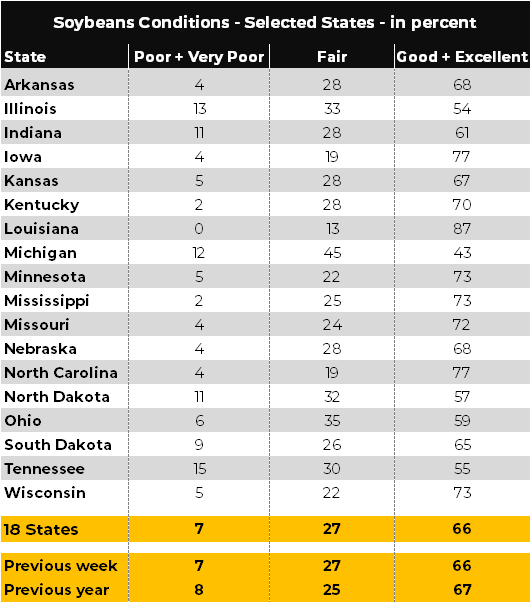

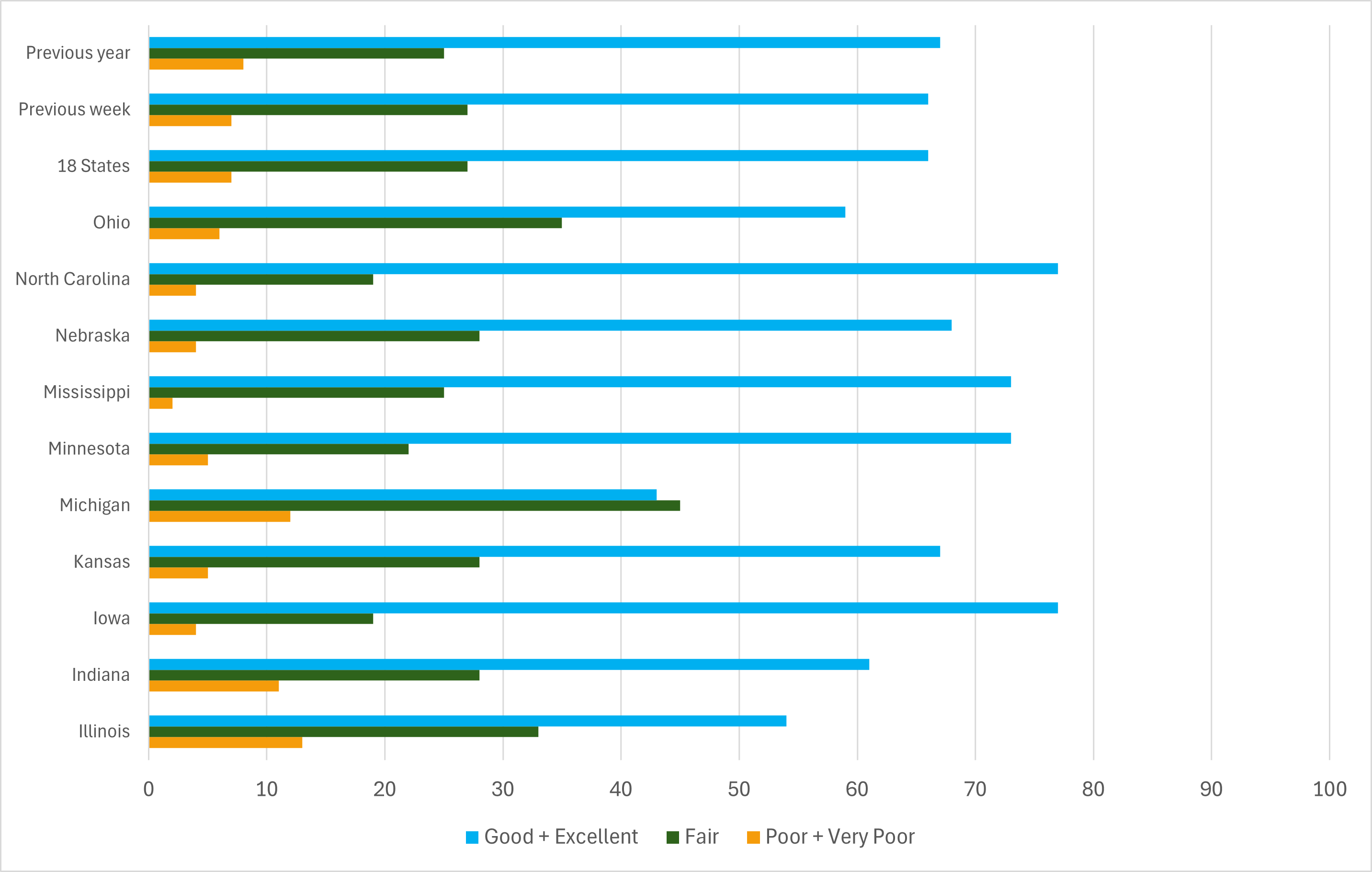

Regarding soybeans, the USDA indicated that 66% of US crops were in good or excellent condition. In the previous week, the percentage was also 66%, while in the same period last year the percentage was 67%. It's noteworthy that while corn saw an improvement, soybean rates remained unchanged. At the moment, current levels indicate a crop without major problems, but with room for reductions in the production potential currently estimated by the USDA.

US Soybeans - Crop Conditions - as of June 29 - in %

Source: USDA, Hedgepoint

US Soybeans Conditions - Top 10 Key States and US - as of June 29 - in %

Source: USDA, Hedgepoint

Weather: regularity and positive forecasts for the next two weeks

Weather: regularity and positive forecasts for the next two weeks

The weather situation continues to be considered very positive in the North American producing belt, providing a favorable environment for crop development.

Weather Map - Accumulated Precipitation - June 29 to July 5 - in mm

Source: NOAA

The forecast maps now point to a period of significant humidity throughout the producing belt between July 6 and 12, which should once again bring a good environment for crops.

Weather Map - Accumulated Precipitation Forecast - July 6 to 12 - in mm

Source: NOAA

Weather Map - Accumulated Precipitation Forecast - July 13 to 19 - in mm

Source: NOAA

Written by Luiz F. Roque

Luiz.Roque@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.